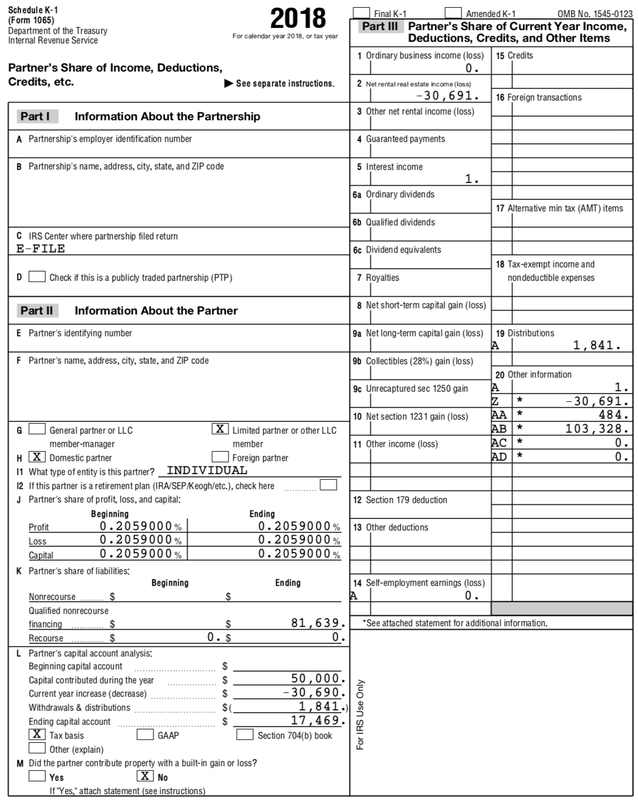

Does An Llc File A K1 A Schedule K 1 often simply called a K 1 is a tax document that is prepared annually by many limited liability companies LLC and other pass through entities including trusts estates and S

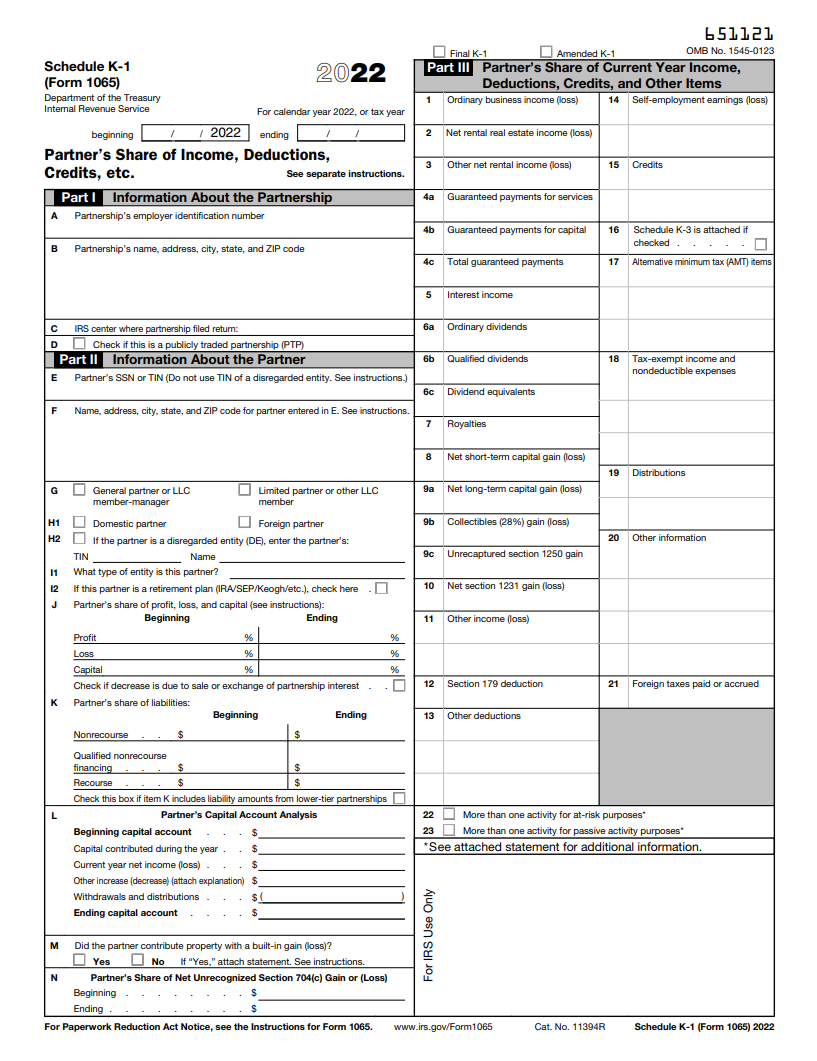

Don t file it with your tax return unless you re specifically required to do so See Code O under Box 15 later The partnership files a copy of Schedule K 1 Form 1065 with the According to the Internal Revenue Service IRS LLCs should issue Schedule K 1 each year However the decision to issue a K 1 or not largely depends on how your

Does An Llc File A K1

Does An Llc File A K1

https://www.mdtaxattorney.com/wp-content/uploads/2021/07/shutterstock_1987676312.jpg

Where Do I Mail My 2016 Tax Extension Form Gagasbh

https://www.patriotsoftware.com/wp-content/uploads/2018/11/filing-a-business-tax-return-1.png

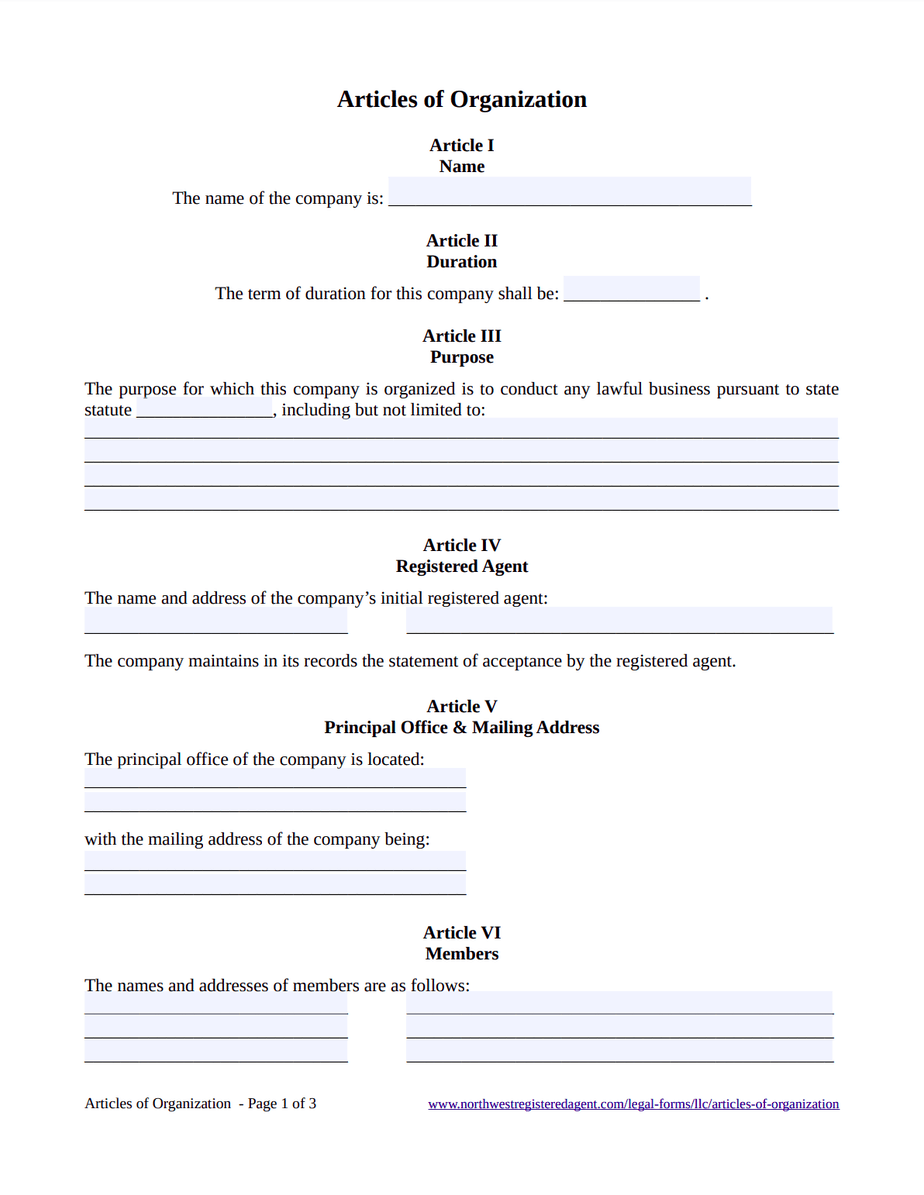

Articles Of Organization Utah Template

https://www.northwestregisteredagent.com/wp-content/uploads/2021/02/2021-02-15_14-06.png

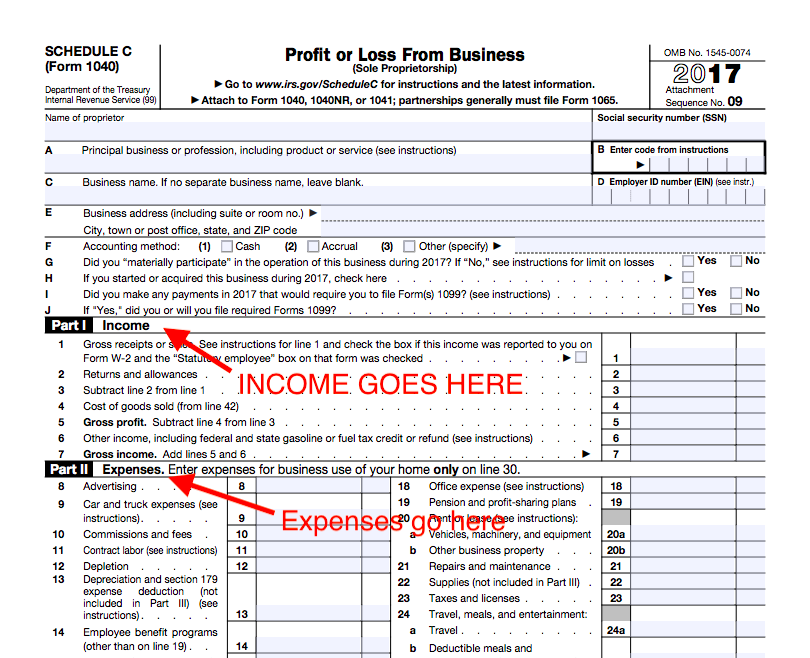

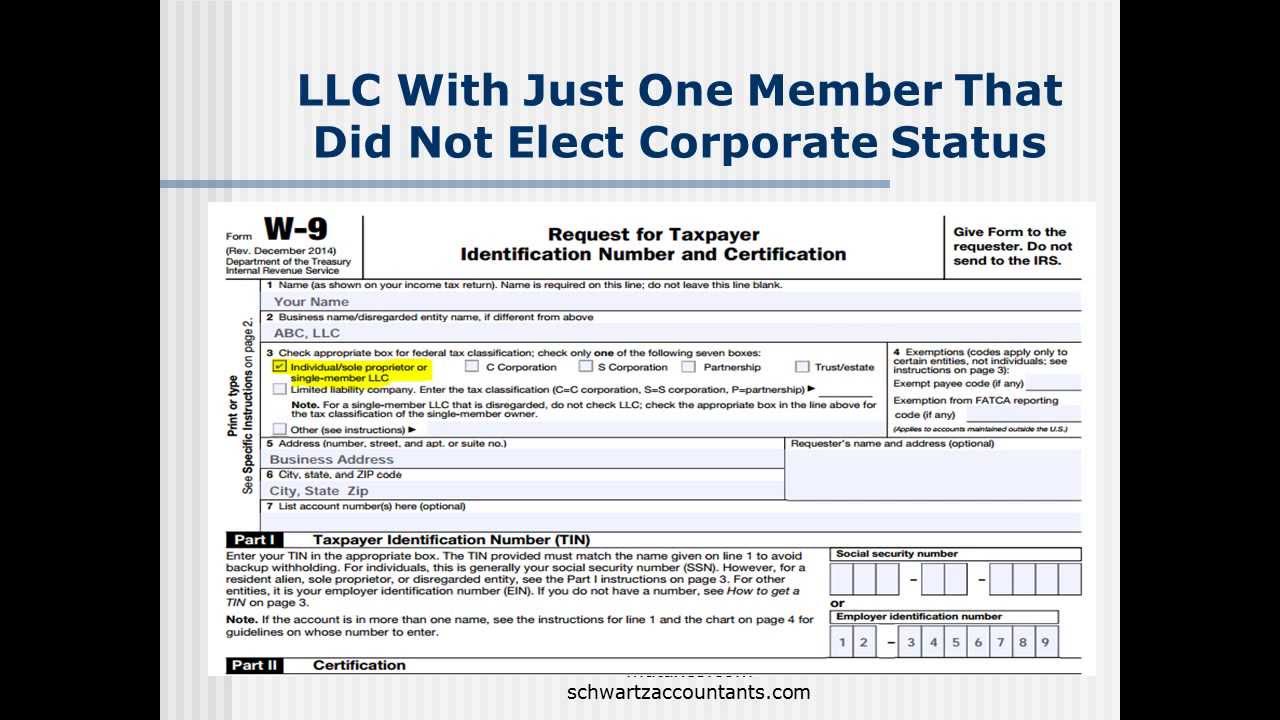

Not all LLCs will file K 1s The IRS may treat an LLC as a partnership a disregarded entity or a corporation This depends on the elections made by those within the LLC and the number of members Schedule K 1 is a federal tax document used to report the income losses and dividends for a business or financial entity s partners or an S corporation s shareholders The K 1 form is also

Schedule K 1 is a schedule of IRS Form 1065 U S Return of Partnership Income It s provided to partners in a business partnership to report their share of a partnership s profits losses deductions and credits to the IRS If you are an owner of a partnership LLC S corp or other entity that passes through taxes to its owners in most cases you will receive a K 1 form each year The K 1 is prepared by the entity to

Download Does An Llc File A K1

More picture related to Does An Llc File A K1

How To Give Your LLC A Name MyCompanyWorks

https://www.mycompanyworks.com/wp-content/uploads/2022/11/Give-Your-LLC-a-Name-1024x768.jpg

K1 Visa Archivos Morillo Suriel Abogados

https://morillosurielabogados.b-cdn.net/wp-content/uploads/2019/10/how-to-apply-for-a-k1-visa-1.jpg

2023 K1 Form Printable Forms Free Online

https://images.business.com/app/uploads/2022/03/23020936/K1-3.png

Schedule K 1 for LLCs and partnerships All partnerships and LLCs taxed as partnerships must provide each partner or LLC owner with a Schedule K 1 by March 15 each year However filing for an extension extends the If you ve ever invested in a business that uses one of several different types of legal structures such as partnership C corporation or LLC or if you re the beneficiary of a trust or an

Partners and shareholders of S corporations must file a Schedule K 1 to report income losses dividend receipts and capital gains The partnership Schedule K The K 1 tax form is a supplementary form that assists owners of small businesses in filing their personal taxes The form reports the income and other

K1 Tax Form For Dummies Mish Mosh Turned SIMPLE

https://vericrestprivatewealth.com/img/images/k1-005.webp

What Is K 1 Statement

https://assets0.biggerpockets.com/uploads/uploaded_images/normal_1553378243-K-1.png

https://carta.com/.../schedule-k-1-tax-form

A Schedule K 1 often simply called a K 1 is a tax document that is prepared annually by many limited liability companies LLC and other pass through entities including trusts estates and S

https://www.irs.gov/instructions/i1065sk1

Don t file it with your tax return unless you re specifically required to do so See Code O under Box 15 later The partnership files a copy of Schedule K 1 Form 1065 with the

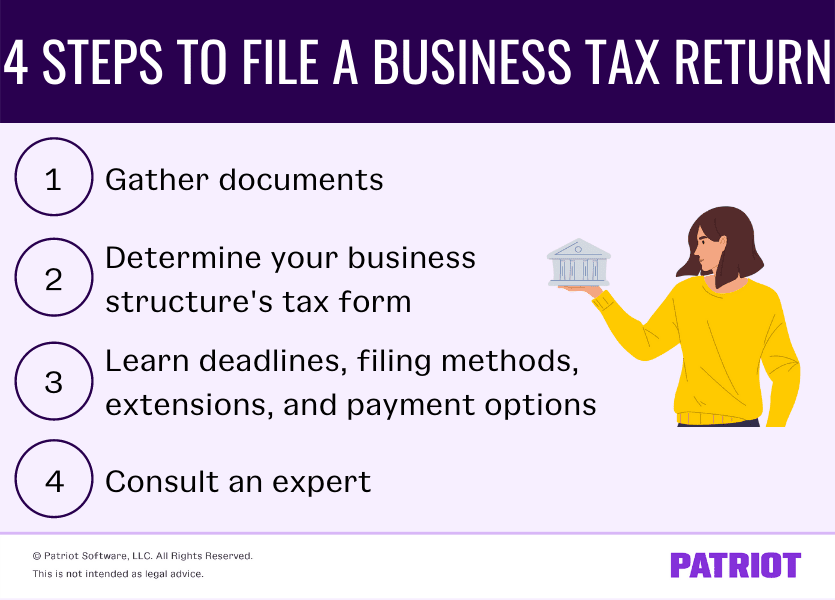

How To File LLC Taxes Legalzoom

K1 Tax Form For Dummies Mish Mosh Turned SIMPLE

K1 Tax Form Deadline 2023 Printable Forms Free Online

LLC Tax Filing What You Need To Know As A Solo Entrepreneur

What Is K 1 Statement

How To File For A K1 Visa with Pictures WikiHow

How To File For A K1 Visa with Pictures WikiHow

How To Fill Out A W9 For An Llc Partnership The Mumpreneur Show

K 1 Income And The Calculation Of Child Support Divorce New York

Free Louisiana LLC Operating Agreement Templates 2 PDF Word EForms

Does An Llc File A K1 - Not all LLCs will file K 1s The IRS may treat an LLC as a partnership a disregarded entity or a corporation This depends on the elections made by those within the LLC and the number of members