Does An Llc Pay Taxes In Texas There are several different types of taxes that an LLC operating in Texas may need to pay including franchise tax sales tax and employer related taxes such as Social Security Medicare taxes

If you have a Texas LLC you don t need to file an annual report Learn what state business employer and sales taxes your LLC might be responsible for By default a Texas LLC is taxed by the Internal Revenue Service IRS based on the number of Members the LLC has Then the Texas Comptroller honors this

Does An Llc Pay Taxes In Texas

Does An Llc Pay Taxes In Texas

https://www.newlywedsonabudget.com/wp-content/uploads/2019/10/unpaid-taxes-1170x780.jpg

What Taxes Does An LLC Pay

https://i0.wp.com/blog.4506-transcripts.com/wp-content/uploads/2020/04/what-taxes-does-an-llc-pay.jpeg?fit=1200%2C800&ssl=1

What Taxes Does An LLC Pay In Florida YouTube

https://i.ytimg.com/vi/-nFUlpGWka4/maxresdefault.jpg

Unlike many other states Texas doesn t require LLCs to file annual reports Texas imposes a franchise tax on most LLCs which is payable to the Texas Your Texas LLC is subject to state taxes federal taxes and possibly sales taxes State Taxes Texas doesn t have a state income tax but it does have an annual franchise tax due on May 15

Key Takeaways Texas doesn t have a business income tax but imposes a franchise tax on certain businesses Businesses with revenues under 2 47 million pay no tax Businesses LLCs are not inherently tax exempt in Texas as exemptions are based on a business s activities rather than its structure As an example some non profit activities may qualify for tax exemption in

Download Does An Llc Pay Taxes In Texas

More picture related to Does An Llc Pay Taxes In Texas

You Can Pay Your Taxes With Credit Card But Should You

https://www.gannett-cdn.com/-mm-/e6fc938b703a3aefb17e10ece8094955d629fbcd/c=0-167-3862-2349/local/-/media/2016/03/21/USATODAY/USATODAY/635941795874671933-ThinkstockPhotos-464263169.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Why Child Care Businesses Pay Taxes In Texas Icsid

https://www.icsid.org/wp-content/uploads/2021/11/why-child-care-businesses-pay-taxes-in-texas-.jpg

Wait I Have To Pay Taxes In June Most Freelancers Don t Pay

https://i.pinimg.com/originals/71/5a/79/715a7976f2dcefe8abe41abcca589808.png

How does a series limited liability company LLC report its activities for franchise tax A series LLC is treated as a single legal entity It pays one filing fee and registers as one A Texas LLC doesn t pay state income tax but instead has to file a Franchise Tax Report as mentioned above You ll have to pay a tax if your LLC s Total Revenue is over the No Tax Due Threshold of

Texas LLCs are taxed as pass through entities by default which means that the LLC itself doesn t pay income tax Instead the profits and losses of the LLC are passed on to the LLC owners called members and There is no annual Texas LLC registration fee Flexible tax treatment For federal tax purposes an LLC has choices as to how it will be taxed An LLC with only

How Does An LLC Pay Taxes LLC WISDOM

https://www.llcwisdom.com/wp-content/uploads/2020/05/llc-taxes-due-768x510.jpg

New York Limited Liability Companies FAQ Imke Ratschko New York Small

https://www.newyorksmallbusinesslaw.com/wp-content/uploads/2018/10/faq-3408300_1920-e1541014924325-1500x805.jpg

https://www.themosterlawfirm.com/2023/…

There are several different types of taxes that an LLC operating in Texas may need to pay including franchise tax sales tax and employer related taxes such as Social Security Medicare taxes

https://www.nolo.com/legal-encyclopedia/annual...

If you have a Texas LLC you don t need to file an annual report Learn what state business employer and sales taxes your LLC might be responsible for

Paying Taxes 101 What Is An IRS Audit

How Does An LLC Pay Taxes LLC WISDOM

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

How Often Does An LLC Pay Taxes Payroll Taxes Paying Taxes Income

How Does An LLC Pay Taxes In 2024

Franchise Tax Ohio How Business Tax Works In OH Create Your Own LLC

Franchise Tax Ohio How Business Tax Works In OH Create Your Own LLC

How To Not Pay Taxes YouTube

AICPA Says IRS Needs To Give Penalty Relief To Taxpayers Affected By

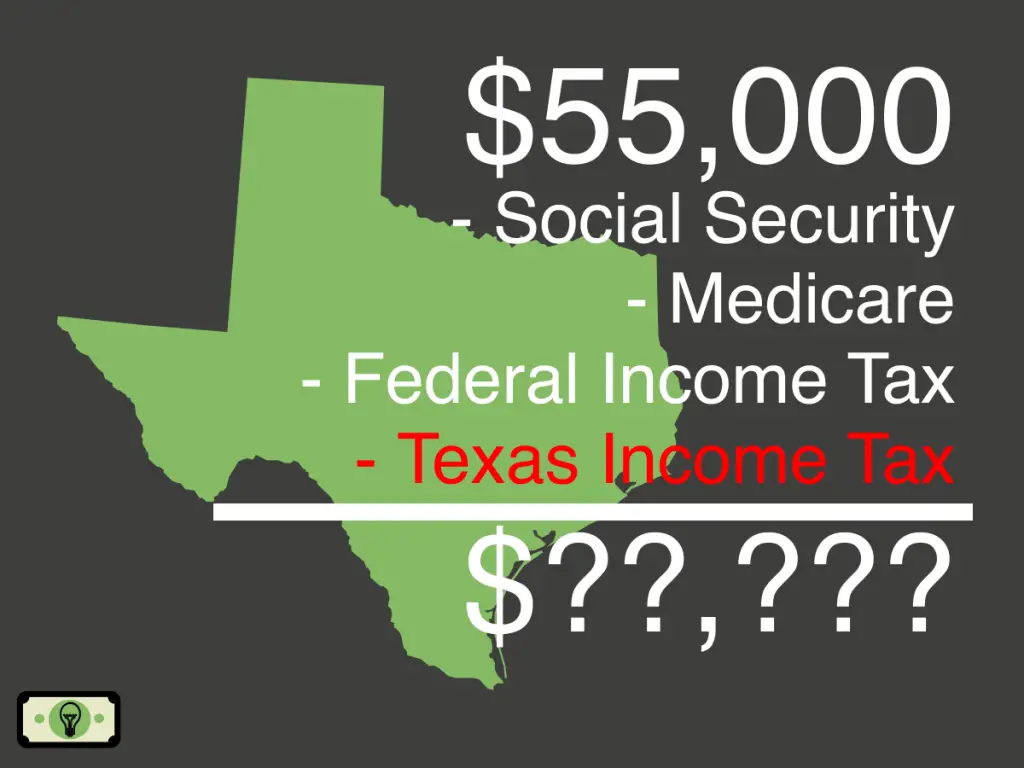

55K Salary After Taxes In Texas single 2013 Smart Personal Finance

Does An Llc Pay Taxes In Texas - LLCs are not inherently tax exempt in Texas as exemptions are based on a business s activities rather than its structure As an example some non profit activities may qualify for tax exemption in