Does Borrowing From Banks Cost More Than Borrowing From The Market This paper investigates the pricing of bank loans relative to capital market debt The analysis relies on a novel sample of syndicated loans matched with bond spreads from the same rm on the same date After accounting for seniority banks earn an economically large premium relative to the market price of credit risk To quantify

Maintaining a high liquidity ratio can enable firms to borrow from the financial markets at low costs The equity and bond markets offer lower borrowing costs than formal banks Schwert 2020 finds that bank lenders earn a large premium relative to bondholders of 140 170 basis points suggesting that public bond markets are more competitive than private bank

Does Borrowing From Banks Cost More Than Borrowing From The Market

Does Borrowing From Banks Cost More Than Borrowing From The Market

https://onlinelibrary.wiley.com/cms/asset/28c63144-ede2-42a4-926d-1c2ed314073f/jofi.v75.2.cover.jpg?trick=1696792265643

Five Cheap Ways To Borrow Money

https://s3-us-west-1.amazonaws.com/cwdrcache/production/blog_resources/wp-content/uploads/2021/09/02104211/banner21.jpg

Borrowing FAQ Falmouth Public Library

https://www.falmouthpubliclibrary.org/wp-content/uploads/2016/01/10336500696_2787cbcc5d_k.jpg

This paper investigates the pricing of bank loans relative to capital market debt The analysis uses a novel sample of loans matched with bond spreads from the same firm on the same date After accounting for seniority lenders earn a large premium relative to the bond implied credit spread ABSTRACT This paper investigates the pricing of bank loans relative to capital market debt The analysis uses a novel sample of loans matched with bond spreads from the same firm on the same date

This paper investigates the pricing of bank loans relative to capital market debt The analysis uses a novel sample of loans matched with bond spreads from the same rm on the same Does Borrowing from Banks Cost More than Borrowing from the Market Michael Schwert Journal of Finance 2020 vol 75 issue 2 905 947 Abstract This paper investigates the pricing of bank loans relative to capital market debt The analysis uses a novel sample of loans matched with bond spreads from the same firm on the same date

Download Does Borrowing From Banks Cost More Than Borrowing From The Market

More picture related to Does Borrowing From Banks Cost More Than Borrowing From The Market

Advantages Disadvantages Of Borrowing Money From The Bank

https://www.24cashfinances.com/blog/wp-content/uploads/2021/08/borrowing-825x510.jpg

Borrowing Cost BORROWING COST Borrowing Costs Interest And Other

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8480c8d7f6a55f6ec6d5b0e244409777/thumb_1200_1553.png

What Does The Bible Say About Lending And Borrowing

https://media.swncdn.com/cms/CW/Finances/25364-lending-borrowing-money-shake-hands-debt-dollars-business-deal-wide.1200w.tn.jpg

Author s Michael Schwert 2020 Abstract This paper investigates the pricing of bank loans relative to capital market debt The analysis uses a novel sample of loans matched with bond spreads from the same firm on the same date This paper investigates the pricing of bank loans relative to capital market debt The analysis uses a novel sample of loans matched with bond spreads from the same firm on the same date After accounting for seniority lenders earn a large premium relative to the bond implied credit spread

[desc-10] [desc-11]

Why Do People Borrow Money What Are The Advantages And Disadvantages

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjOW4a_AGCIMcsEUB42JCpyWiw0WjOFB6_h8xj7qicpyfpdFPICoE-FYAo7Ef3zEGnkgVJ6IwxqUDqkJoc0yKs8pO6MZO2w4UQKPrPP5d6VBpaocVu7EZtLoOrcxhPwSpo8qJJ1BxaJwz5VbkRHkSzLKPNyNlwcb0xtS_DhhRV73CORuOwTGCMET4mJ8Q/s2250/pexels-photo-4968384.jpeg

Informed Investor Your Mortgage And The Banks

https://d339fvmg8h4kjw.cloudfront.net/images/_1200x630_crop_center-center_82_none/Your-Mortgage-And-The-Banks.jpeg?mtime=1634176114

https://rodneywhitecenter.wharton.upenn.edu › wp...

This paper investigates the pricing of bank loans relative to capital market debt The analysis relies on a novel sample of syndicated loans matched with bond spreads from the same rm on the same date After accounting for seniority banks earn an economically large premium relative to the market price of credit risk To quantify

https://www.researchgate.net › publication

Maintaining a high liquidity ratio can enable firms to borrow from the financial markets at low costs The equity and bond markets offer lower borrowing costs than formal banks

How Do Banks Determine How Much You Can Borrow JoanneKaleah

Why Do People Borrow Money What Are The Advantages And Disadvantages

BORROW Vs LEND What s The Difference Learn With Examples YouTube

Borrow And Steal

Borrowing Money When And How To Do It Right Hunter Lending Solutions

Article Good Reasons To Borrow Money

Article Good Reasons To Borrow Money

Should You Borrow More Money Than You Need Personal Finance Opinions

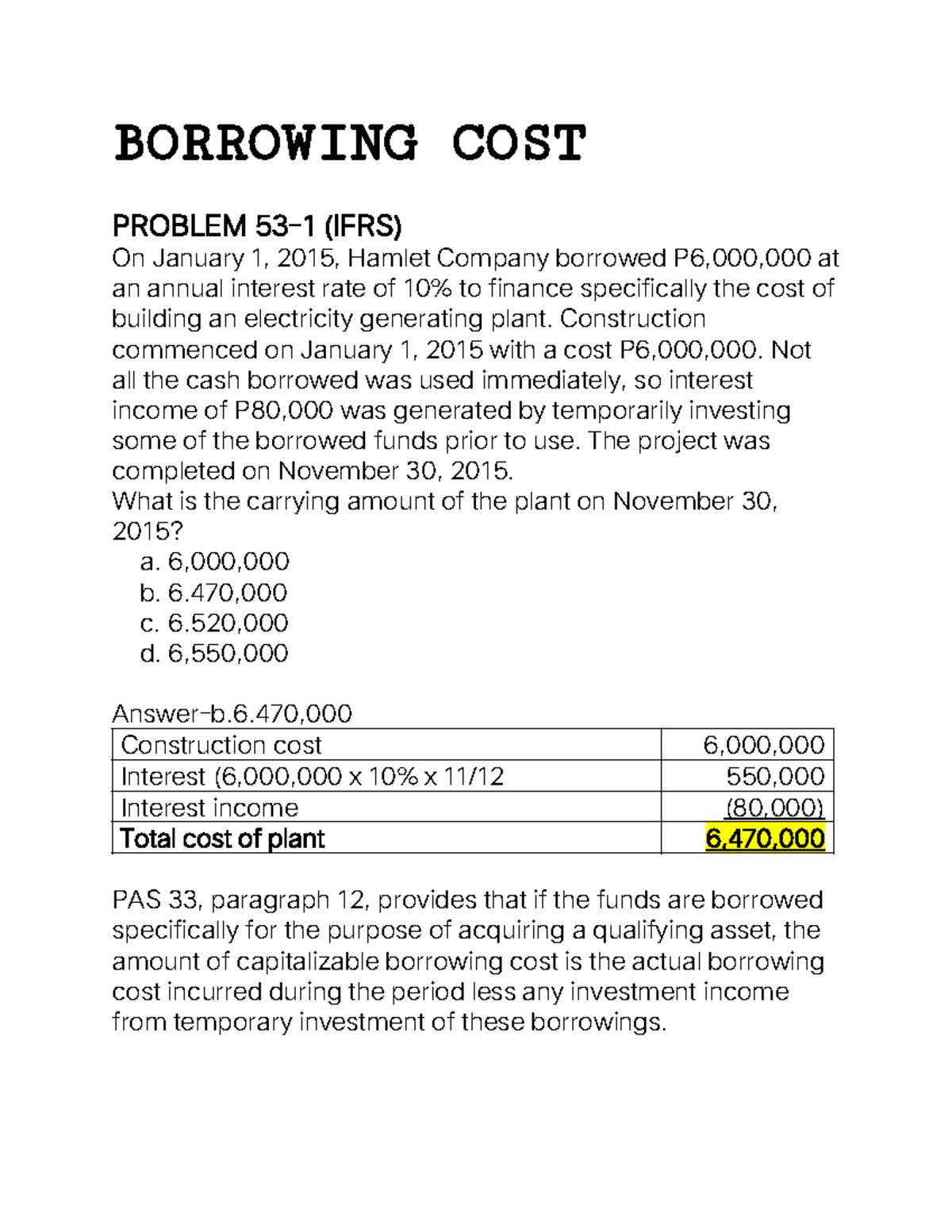

Borrowing Cost Problem Solutions B O R R O W I N G C O S T P R O B

Has Borrowing From The Bank Put Your Company In Debt Merchant

Does Borrowing From Banks Cost More Than Borrowing From The Market - ABSTRACT This paper investigates the pricing of bank loans relative to capital market debt The analysis uses a novel sample of loans matched with bond spreads from the same firm on the same date