Does Buying A House Get You A Tax Break You can get a tax break for buying a house through tax deductions and credits for a few expenses you pay every month but rules and limits apply and you must itemize

Types of Tax Breaks for Buying a House The IRS offers many tax breaks that can help offset the substantial costs of buying and owning a home What kind of tax breaks for buying a house do you get these days We found 13 deductions credits and other potential savings opportunities for homebuyers

Does Buying A House Get You A Tax Break

Does Buying A House Get You A Tax Break

https://bridgewellgroup.ca/wp-content/uploads/2018/04/Steps-to-Buying-a-Home-2.png

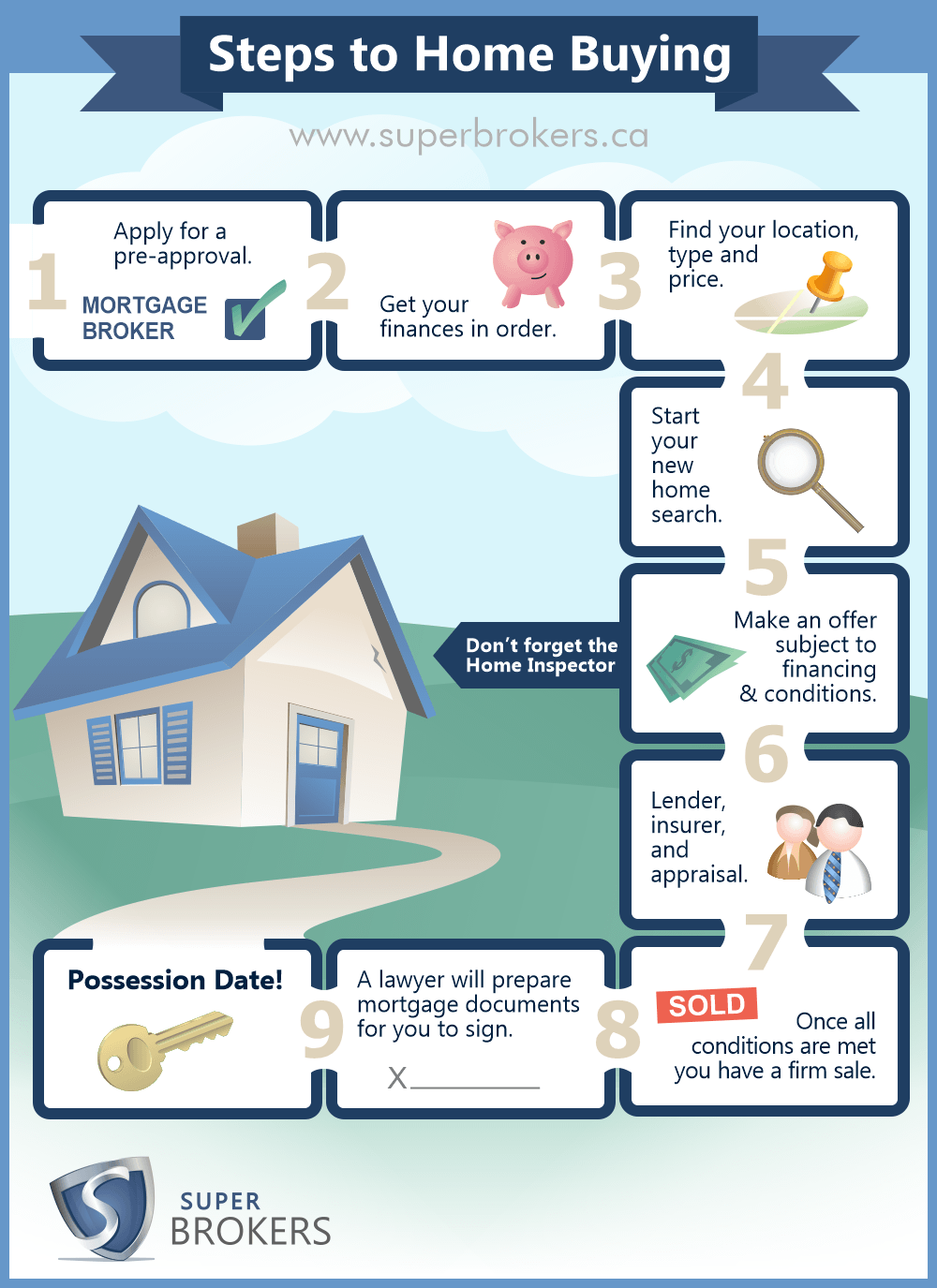

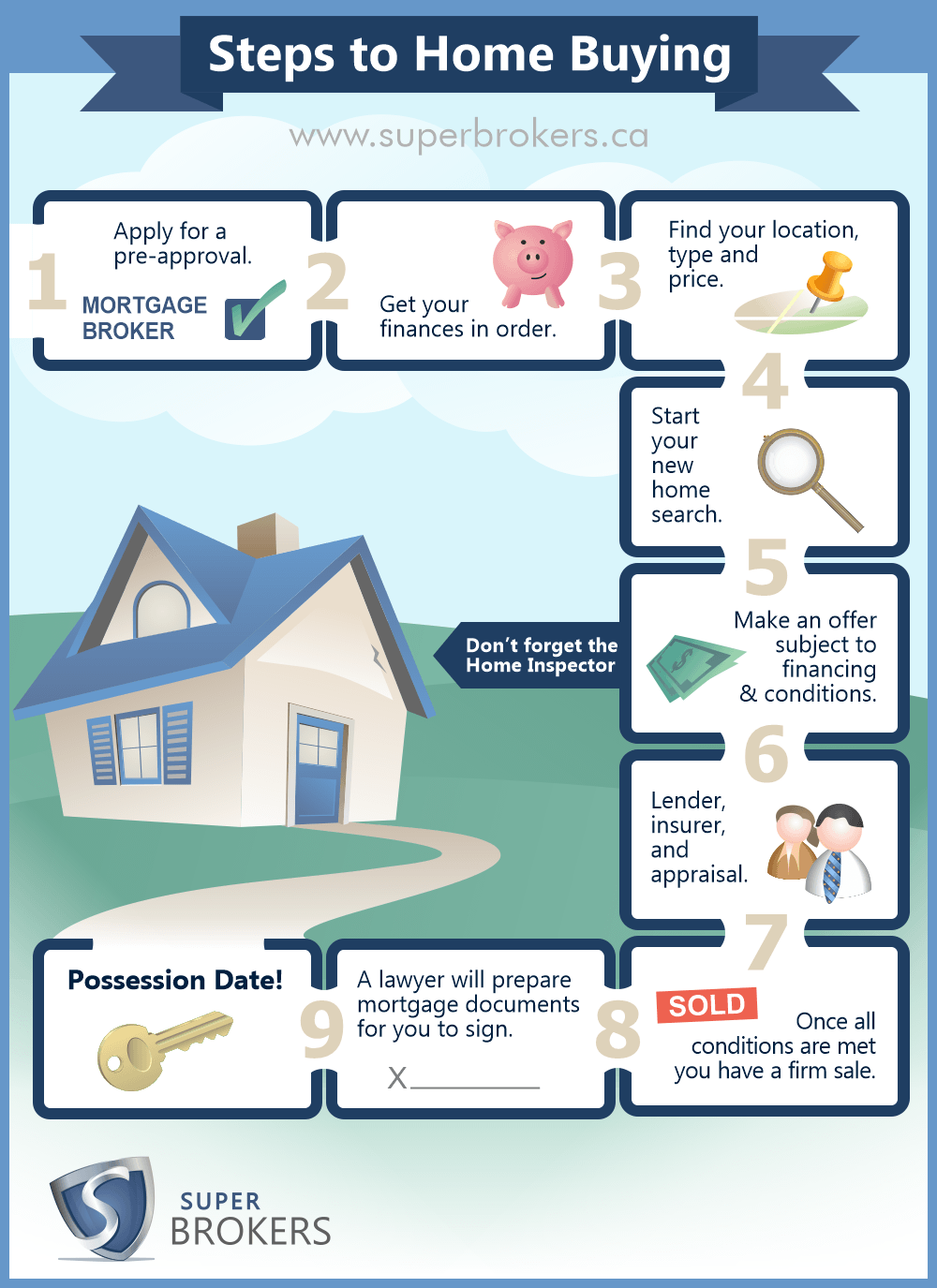

Nine Steps To Buying A House

https://activerain.com/image_store/uploads/agents/seaver42/files/Buying A Home.jpeg

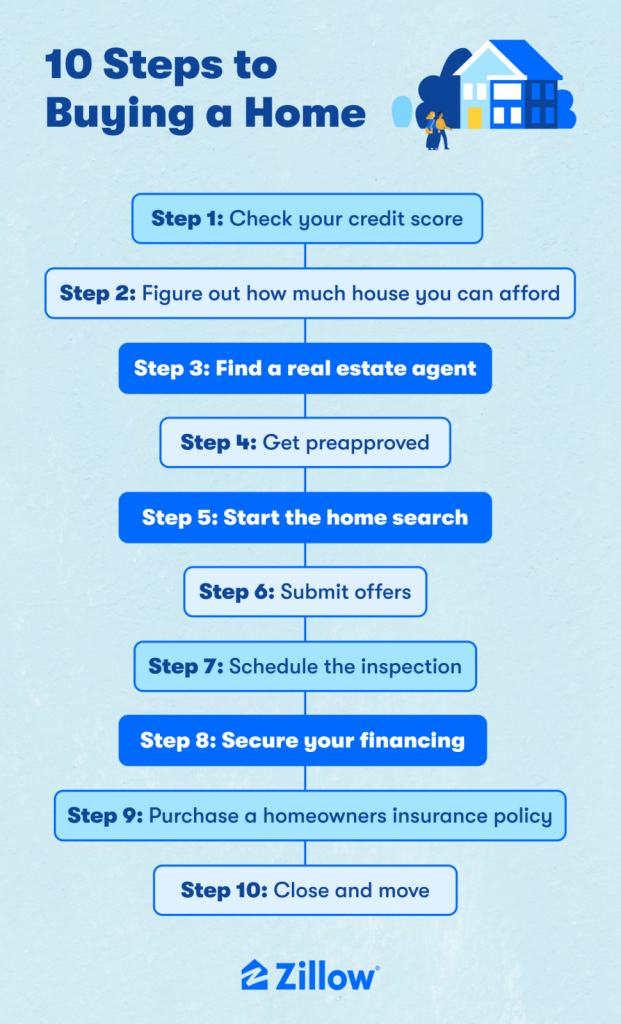

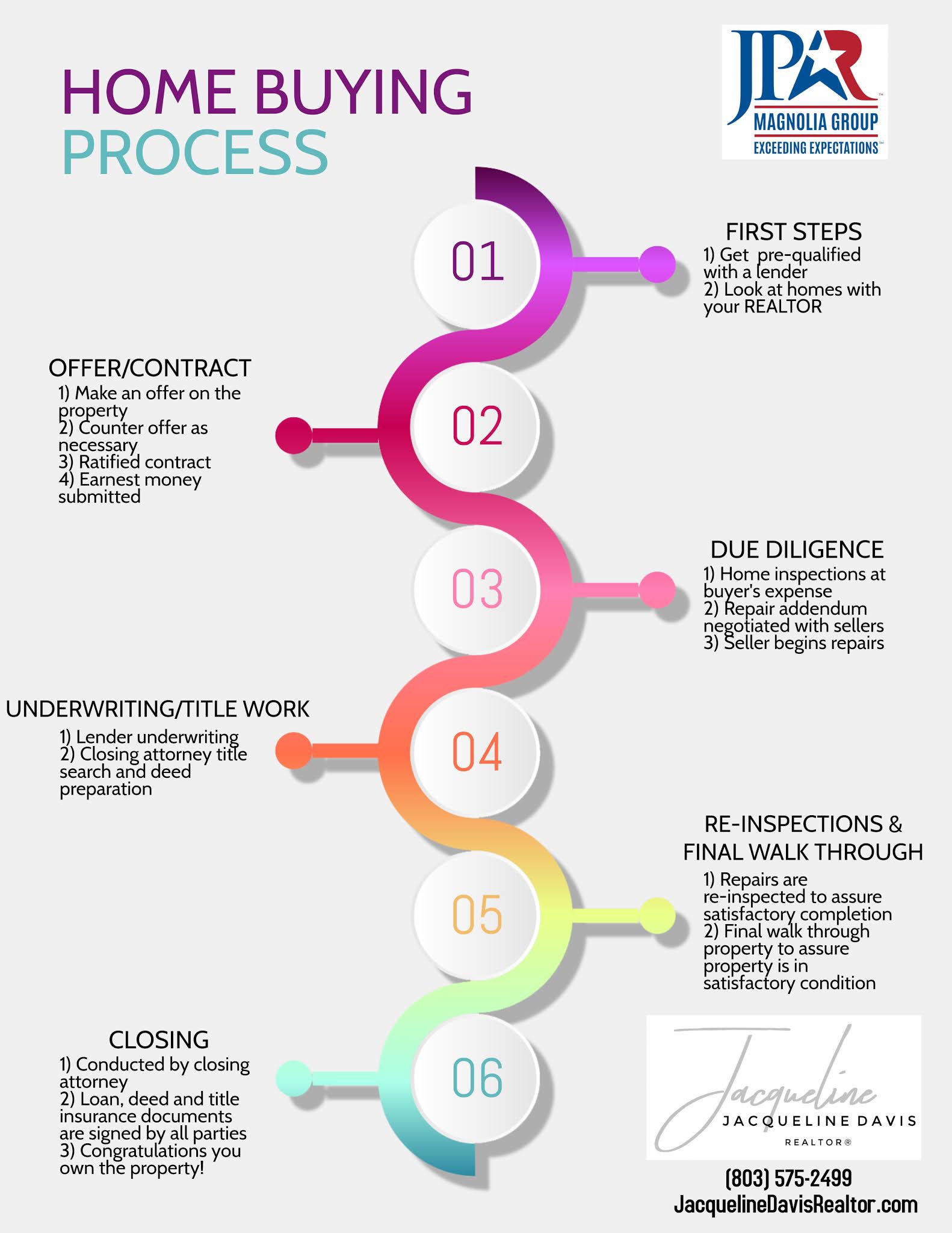

10 Steps To Buying A House Tara Davidson

https://wp-tid.zillowstatic.com/16/10-steps-to-buying-a-home-f13e67-621x1024.png

Key Takeaways The Internal Revenue Service IRS provides several tax breaks to make homeownership more affordable Common home related tax deductions include those for mortgage interest How you ll get a tax break for buying a house Potential tax savings can come in the form of deductions that reduce taxable income or tax credits that could reduce your tax liability on a dollar for dollar basis

For most people the biggest tax break from owning a home comes from deducting mortgage interest If you itemize you can deduct interest on up to 750 000 of debt 375 000 if married filing To encourage Americans to buy their first homes the government offers credits and tax breaks Here s the lowdown on who can qualify for each benefit

Download Does Buying A House Get You A Tax Break

More picture related to Does Buying A House Get You A Tax Break

How Long Does It Take To Buy A House

https://d3v5ezchayoty7.cloudfront.net/wp-content/uploads/2020/11/30090046/HomeBuying-Infographic-02b.jpg

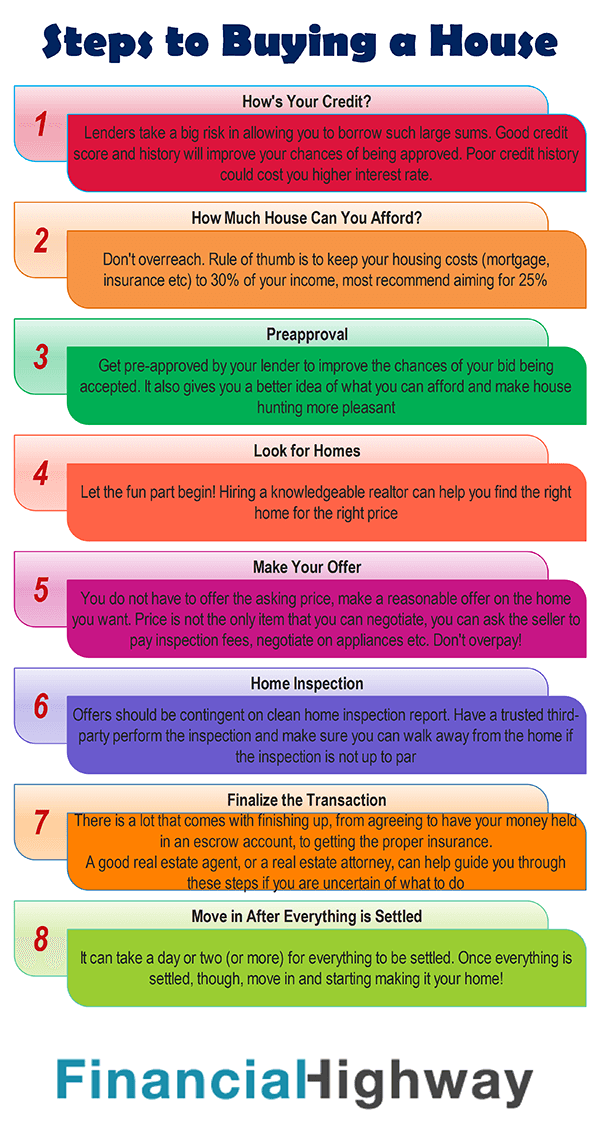

Steps To Buying A House

https://financialhighway.com/wp-content/uploads/2012/08/Steps-to-Buying-a-House.png

10 Basic Steps In Buying A House

https://assets.site-static.com/userFiles/1343/image/blog feb 28.png

Key Takeaways For tax years prior to 2018 you can deduct interest on up to 1 million of debt used to buy build or improve your home For tax years after 2017 the limit is reduced to 750 000 of debt for binding contracts or Here s a description of tax breaks that encourage homeownership including tax deductions tax credits the capital gains exclusion and other tax incentives

Property taxes You can get a tax break for paying property taxes but there s a limit You may deduct up to 10 000 5 000 if married and filing separately of property taxes Buying a home can help lower your tax bill in certain circumstances In fact tax breaks for homeownership are a primary motivation for many people to buy their own homes

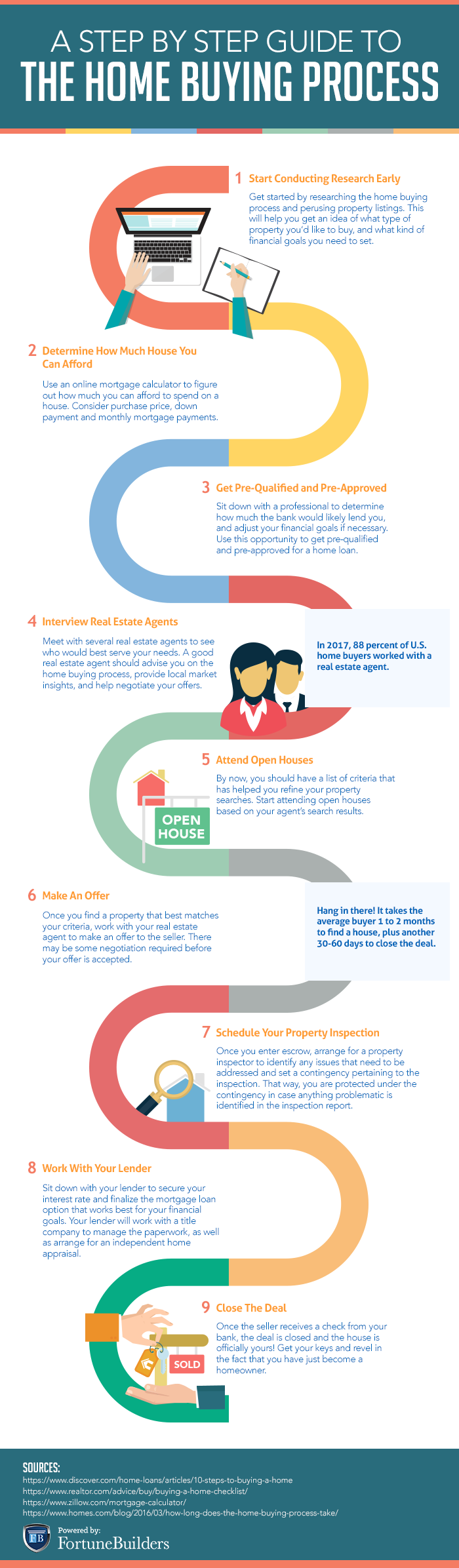

7 Steps To Buying A House infographic Move Engine

https://move-engine.com/wp-content/uploads/2018/09/7-steps-to-buying-a-house-infographic.png

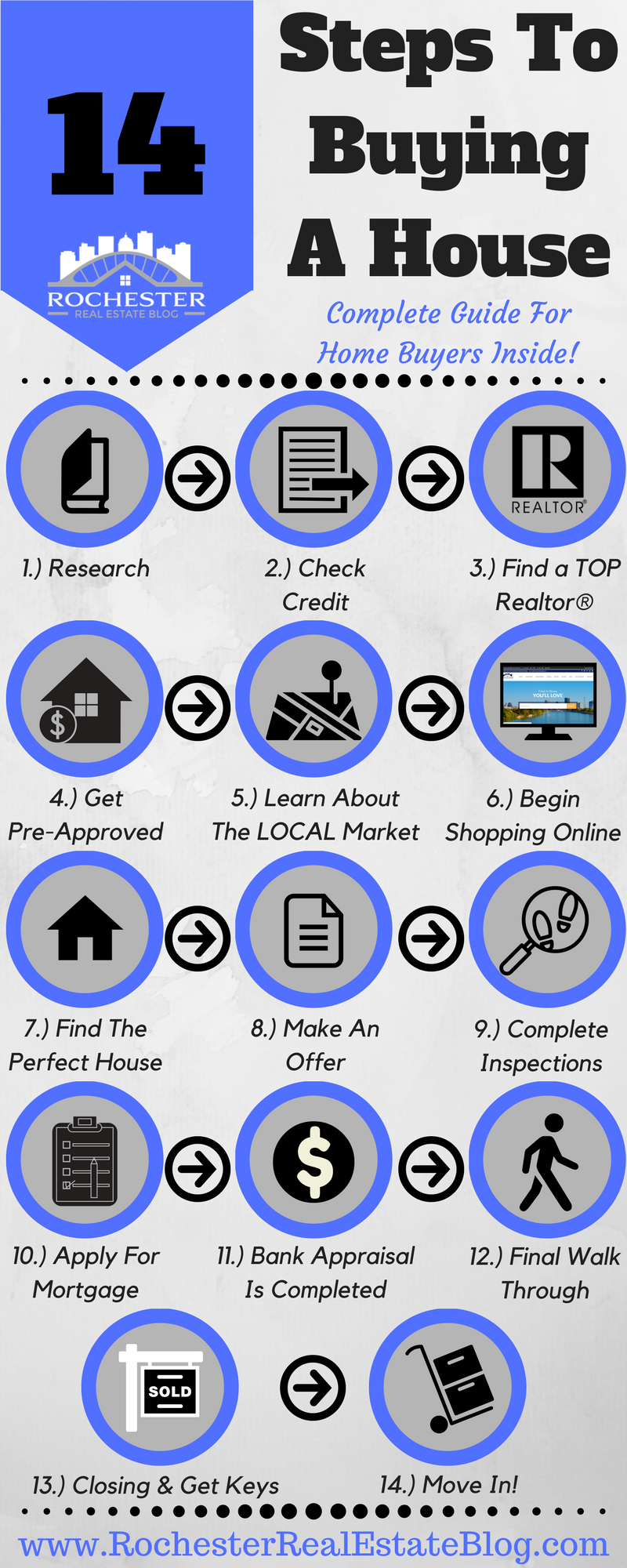

14 Steps To Buying A House A Complete Guide For Home Buyers

http://www.rochesterrealestateblog.com/wp-content/uploads/2017/01/14-Steps-To-Buying-A-House-A-Complete-Guide-For-Home-Buyers.png

https://www.thebalancemoney.com/do-y…

You can get a tax break for buying a house through tax deductions and credits for a few expenses you pay every month but rules and limits apply and you must itemize

https://www.forbes.com/advisor/mortga…

Types of Tax Breaks for Buying a House The IRS offers many tax breaks that can help offset the substantial costs of buying and owning a home

How Long Does It Take To Buy A House

7 Steps To Buying A House infographic Move Engine

The Triangle Home Buying Process The Jim Allen Group

How Does The Process Of Buying A House Work House Poster

HOW DOES THE HOME BUYING SELLING PROCESS WORK

Home Buying Process Super Brokers

Home Buying Process Super Brokers

Steps To Buying A Home In 2018 2019 Home Buying Better Homes And

The Home Buying Process

5 Green Home Upgrades That Also Buy You A Tax Break CBS News

Does Buying A House Get You A Tax Break - For most people itemizing their tax deductions this is where you ll find the biggest tax break for owning a home In 2021 if you re an individual taxpayer or a married couple filing