Does California Have Homestead Tax Exemption The California Constitution provides a 7 000 reduction in the taxable value for a qualifying owner occupied home The home must have been the principal place of residence of the owner on

Homestead exemption protects a portion of your home equity from judgment creditors Learn the difference between automatic and declared homestead the a The recent legislation Assembly Bill 1885 significantly increased the California homestead exemption amounts In 2024 the exemption ranges from a minimum of 349 720 to a maximum of 699 426 based on county

Does California Have Homestead Tax Exemption

Does California Have Homestead Tax Exemption

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

Exemptions

https://www.willcountysoa.com/images/2010-tb-small.png

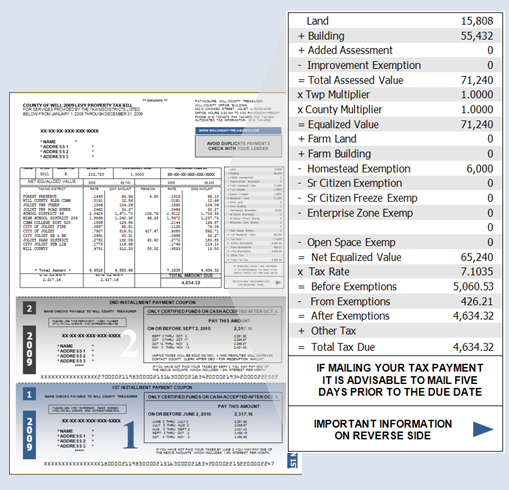

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

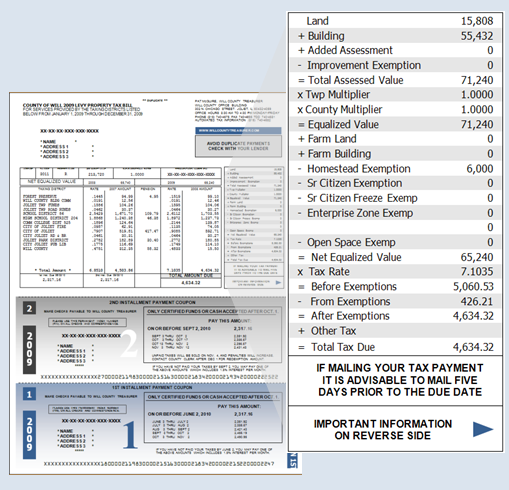

The Homeowners Exemption which allows a 7 000 exemption from property taxation is authorized by Article XIII section 3 subdivision k of the California Constitution and The following is provided as a resource to list types of property tax exemptions and general qualifying factors of each exemption however it is not possible to address all the unique

While the rules for homestead exemptions vary by state here in California we recently had an increase in the exemption limit thanks to California Assembly Bill 1885 back in 2020 bringing it up to between 300 000 and There are two kinds of homestead exemptions an automatic homestead and a declared homestead To be clear they both apply to your primary home not to commercial properties or to second homes For an

Download Does California Have Homestead Tax Exemption

More picture related to Does California Have Homestead Tax Exemption

Bill To Put Homestead Property Tax Exemption On Ballot Passes Second

https://floridapolitics.com/wp-content/uploads/2021/12/AdobeStock_188272315-1280x853.jpeg

California s New Homestead Exemption Law The Fullman Firm

https://www.fullmanfirm.com/wp-content/uploads/2021/01/understanding-californias-new-homestead-exemption-law.jpg

Bought A Home In Florida In 2021 File For Your Homestead Exemption By

https://sandbergteam.com/wp-content/uploads/2022/01/Homestead-Exemption-Header-2022-1024x630.png

The California homestead exemption in 2020 was 75 000 for a single homeowner with a maximum of 175 000 for homeowners who met specific family income and age requirements The new law eliminates many Texans can also claim an additional 3 000 exemption for certain county taxes In California however the exemption is much lower The first 7 000 of the value of the home is not taxed

California Assembly Bill AB1885 increases the homestead exemption to a minimum of 300 000 and a maximum of 600 000 depending on median county home prices The minimum homestead exemption in California is 300 000 and the maximum is 600 000 which are each adjusted annually on January 1st The actual homestead exemption

California Increases Homestead Exemption In New Legislation

https://imageio.forbes.com/specials-images/imageserve/5f663f05e9e0b9a862308108/0x0.jpg?format=jpg&width=1200

Filing For Homestead Exemption In Georgia

https://www.heathermurphygroup.com/wp-content/uploads/2023/03/HMG-Filing-for-Homestead-Exemption-in-Georgia.png

https://www.boe.ca.gov/proptaxes/homeowners_exemption.htm

The California Constitution provides a 7 000 reduction in the taxable value for a qualifying owner occupied home The home must have been the principal place of residence of the owner on

https://ceritypartners.com/insights/california...

Homestead exemption protects a portion of your home equity from judgment creditors Learn the difference between automatic and declared homestead the a

Credit Versus Exemption In Homestead Property Tax Relief ITR Foundation

California Increases Homestead Exemption In New Legislation

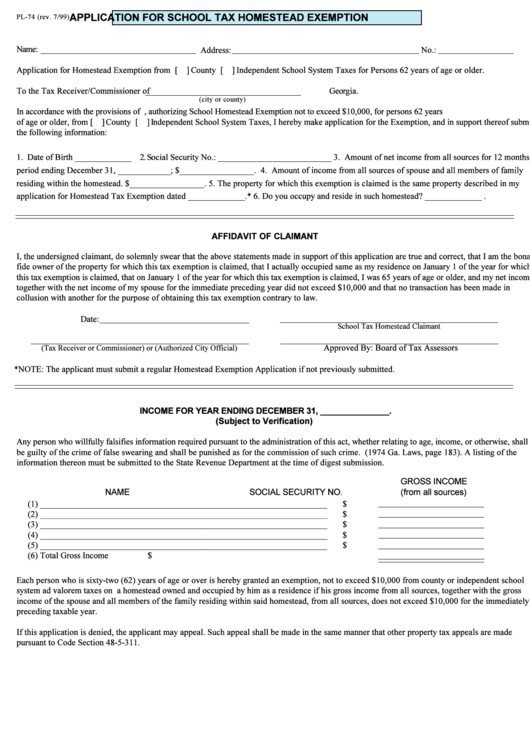

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

California Homestead Exemption Form Riverside County ExemptForm

Riverside County Homestead Exemption Form ExemptForm

York County Sc Residential Tax Forms Homestead Exemption CountyForms

York County Sc Residential Tax Forms Homestead Exemption CountyForms

Texas Homestead Tax Exemption

Homestead Exemption

Hays County Homestead Exemption Form 2023 ExemptForm

Does California Have Homestead Tax Exemption - If you re delving into California property tax matters it s important to delve into who qualifies for property tax exemption in California Read on to learn some of the ins and