Does Everyone Get A Star Rebate Check A In 2016 the law changed regarding the STAR exemption Instead of applying to your assessor for the exemption you ll now register with New York State for the STAR credit If you re eligible you ll receive a STAR credit in the form of a check The credit may be more beneficial to eligible homeowners because it may provide a greater benefit than the

Most of the 2 5 million eligible homeowners would have received checks this summer but some checks are still on their way the taxation department noted this week To get the tax rebate check Surviving spouses may be eligible to retain the Enhanced STAR benefit See Surviving spouse eligibility Income 500 000 or less for the STAR credit 250 000 or less for the STAR exemption The income limit applies to the combined incomes of only the owners and owners spouses who reside at the property For 2024 benefits 98 700 or

Does Everyone Get A Star Rebate Check

Does Everyone Get A Star Rebate Check

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/mount-vernon-star-rebate-checks-2022-starrebate.jpg?w=1960&ssl=1

How Do I Know If I Get A STAR Rebate Check YouTube

https://i.ytimg.com/vi/S-5n0y0mo2M/maxresdefault.jpg

Menards Price Adjustment Rebate Form October 2022 RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/menards-price-adjustment-rebate-form-october-2022.jpg?resize=1536%2C1510&ssl=1

To find out when your school property taxes are due consult your city town village or school district If your STAR check hasn t shown up and your due date to pay your school property taxes has Enhanced STAR is an extra benefit for seniors age 65 and older with incomes up to 93 200 for the 2023 2024 school year It exempts the first 81 400 of the full value of a home from school

If you currently receive your STAR benefit as a reduction on your school tax bill the STAR exemption you may receive a greater benefit if you switch to the STAR credit to receive a check instead The value of the STAR credit savings may increase by as much as 2 each year but the value of the STAR exemption savings cannot increase The benefit is estimated to be a 293 tax reduction Enhanced STAR is for homeowners 65 and older whose total household income for all owners and residents spouses is 98 700 or less The benefit is estimated to be a 650 tax reduction In 2016 STAR was made available as an exemption or a credit You do not need to re register for

Download Does Everyone Get A Star Rebate Check

More picture related to Does Everyone Get A Star Rebate Check

Rebate Sign Stock Illustrations 6 692 Rebate Sign Stock Illustrations

https://thumbs.dreamstime.com/z/rebate-sign-stamp-rebate-sign-stamp-white-background-vector-illustration-141317066.jpg

Lowes Rebate Check Status Lowesrebate

https://i0.wp.com/www.lowesrebate.net/wp-content/uploads/2022/08/lowes-rebate-check-status.png

Is Everyone Getting A Rebate Check YouTube

https://i.ytimg.com/vi/NiF-qwKhynA/maxresdefault.jpg

The check goes to homeowners who are eligible for the usual STAR tax break and make less than 250 000 a year The average benefit in Upstate NY is 970 The program cost the state 2 2 billion Anyone earning between 250 000 and 500 000 a year will get a check for their STAR rebates rather than receiving the savings directly in their school tax bills So only those below the

There s an easy way to find out Open in Our App Get the best experience and stay connected to your community with our Spectrum News app Learn More How to check the status of your STAR property tax rebate By Susan Arbetter New York State PUBLISHED 2 55 PM ET Aug 29 2022 PUBLISHED 2 55 PM EDT Aug 29 2022 Select Delivery Schedule lookup below Choose the county you live in from the drop down menu Select your school district to view the information for your area Select your town or city The lookup shows the date we began or will begin to mail STAR credit and eligibility letters to your area Please allow five to ten business days for delivery

Nys Star Rebate Check 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/new-york-state-star-rebate-checks-latestrebate-63.jpg?w=2048&ssl=1

Menards Free After Rebate Items Thrifty Minnesota

https://thriftyminnesota.com/wp-content/uploads/2023/02/Menards-Ad-with-Free-After-Rebate-Items-scaled.jpg

https://www.tax.ny.gov/pit/property/star/star-qa.htm

A In 2016 the law changed regarding the STAR exemption Instead of applying to your assessor for the exemption you ll now register with New York State for the STAR credit If you re eligible you ll receive a STAR credit in the form of a check The credit may be more beneficial to eligible homeowners because it may provide a greater benefit than the

https://www.democratandchronicle.com/story/news/...

Most of the 2 5 million eligible homeowners would have received checks this summer but some checks are still on their way the taxation department noted this week To get the tax rebate check

STAR REBATE CHECK Homeowners In New York Would Receive 1 000 If

Nys Star Rebate Check 2023 RebateCheck

Nys Star Rebate Check 2023 Rebate2022

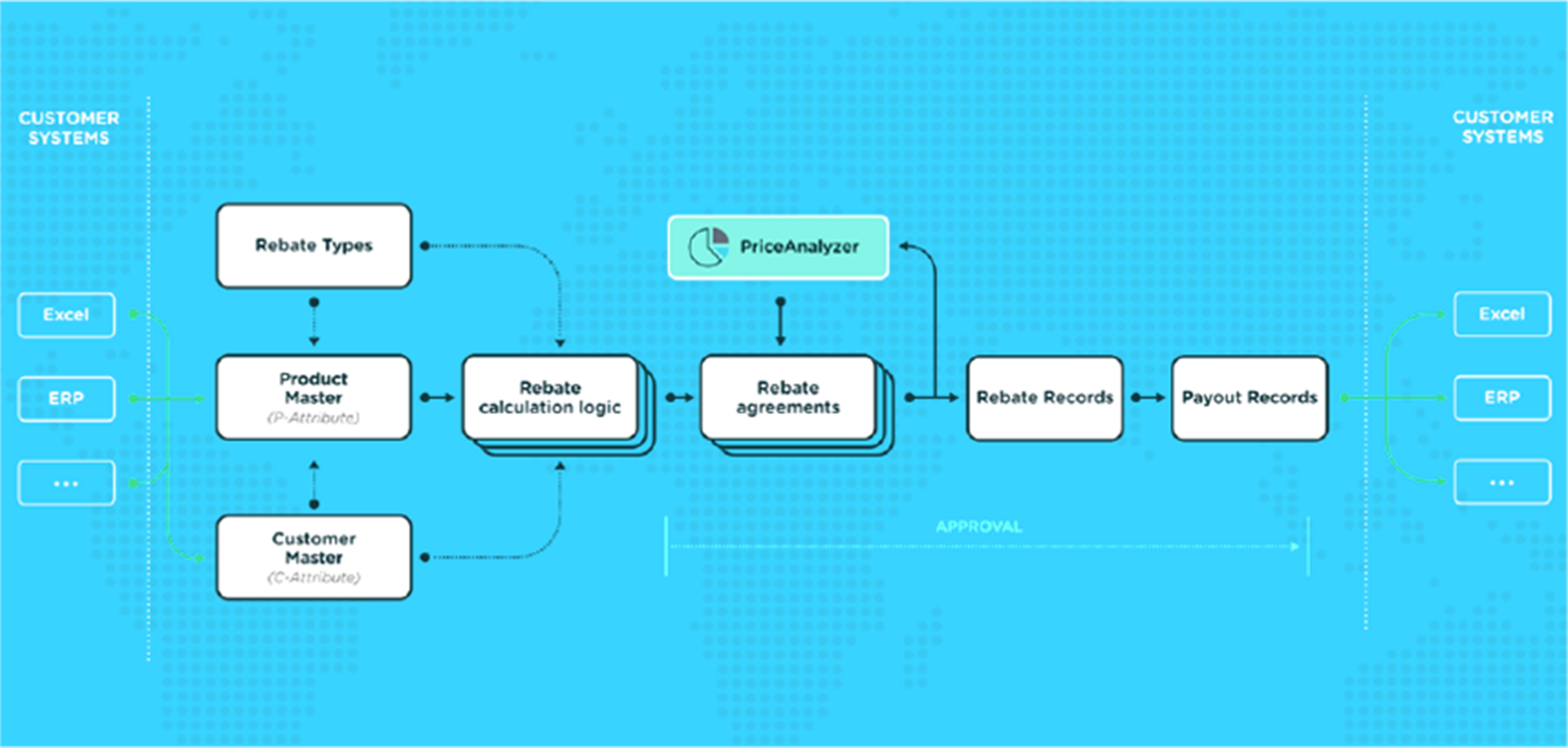

RebateManager Don t Get Stuck In Rebate Management Hell Pricefx

Rebate Check Update Almost All Have Been Sent

Did You Get Your STAR Rebate Check Yet Fingerlakes1

Did You Get Your STAR Rebate Check Yet Fingerlakes1

Did You Receive An MLR Rebate Check From Your Insurance Carrier BBG

New York s STAR Rebate Program Undergoes Changes

That Darned Rebate Check Dr Kenny Handelman

Does Everyone Get A Star Rebate Check - The new STAR tax rebate checks are landing in some homeowners mailboxes months earlier than Gov Kathy Hochul originally estimated putting them in voters hands just weeks before the June