Does Hawaii Tax State Pensions The good news is that public pension income is totally tax exempt in Hawaii The bad news is that all other forms of retirement income are taxed and are not eligible for any kind of deduction Hawaii entirely exempts some types of retirement income including Social Security retirement benefits and public pension income but fully taxes income

Hawaii does not tax qualifying distributions from Employer funded pension plan Federal civil service retirement Military pension State or county retirement system If you received distributions from a private employer pension plan and you made contributions to the pension plan your distribution is partially taxable Federal Income Tax Withholding 2024 W 4P Pension Tax Withholding Form FAQ Refer to tax withholding tables for approximate federal income taxes to be withheld Mailing Address ERS 211 Mailing Address Change To ensure receipt of 1099 R tax statement annual pension statement Holomua newsletters and ERS correspondence

Does Hawaii Tax State Pensions

Does Hawaii Tax State Pensions

https://files.taxfoundation.org/20230614105632/RSC-budget-republican-study-committee-tax-plan-2024.jpg

Capital Gains Tax Back In Washington Still Income Tax

https://taxfoundation.org/wp-content/uploads/2018/02/AdobeStock_83211482-e1529337149107.jpeg

Corporate Income Tax Rates Around The World 2014

https://taxfoundation.org/wp-content/uploads/2015/10/international1.jpg

Thus our tax laws allow employer funded pensions to escape tax while fully taxing 401 k plans IRAs and other retirement vehicles that are funded through the employees choices The Tax Review Commission slammed this distinction saying that there is no economic justification for this A No Section 88 91 of the Hawaii Revised Statutes requires that the ERS pay our retirees as individual primary account holders and not assigned to a trust account since it is not an individual The Internal Revenue Code IRC at Section 401 a 2 requires qualified governmental pension plans such as the ERS to make it impossible for

The ERS is a qualified defined benefit public pension plan covered under Section 401 a of the Internal Revenue Code It provides retirement disability survivor and other benefits to all eligible full time and part time However otherwise federally taxed pension amounts are exempt from Hawai i income taxes Similarly federally taxed social security benefits are exempt from Hawai i income taxes 5 BENEFITS TAX EXEMPTION IN HAWAI I 2001 2003 Tax Review Commission TRC

Download Does Hawaii Tax State Pensions

More picture related to Does Hawaii Tax State Pensions

Hawaii Federal Tax Id Number Search April Tax

https://www.khon2.com/wp-content/uploads/sites/8/2019/10/image003_1555639513429_83193399_ver1.0.png?w=900

60th Annual Hawaii Tax Institute Tuesday Plenary Sessions On Vimeo

https://i.vimeocdn.com/video/1749809096-2cbc4a7583ec67b6065d1316bda66f8f1c1002e1cb199dd54695fc65213a5435-d?f=webp

Debt Lessons From The States Investing In Public Employees While

https://gwbushcenter.imgix.net/wp-content/uploads/state-pensions-scaled-1-1.jpg

Pensions Partially taxed due to pension exclusion 401 k and IRA Distributions Taxable More States With the Highest Gas Taxes TIR 96 5 Taxation of Pensions Under the Hawaii Net Income Tax Law Deferred Compensation Arrangements Rollover IRAs Sub Accounts of Pension Plans Social Security and Railroad Retirement Act Benefits Limitation on Deductions for Contributions to a BENJAMIN J CAYETANO

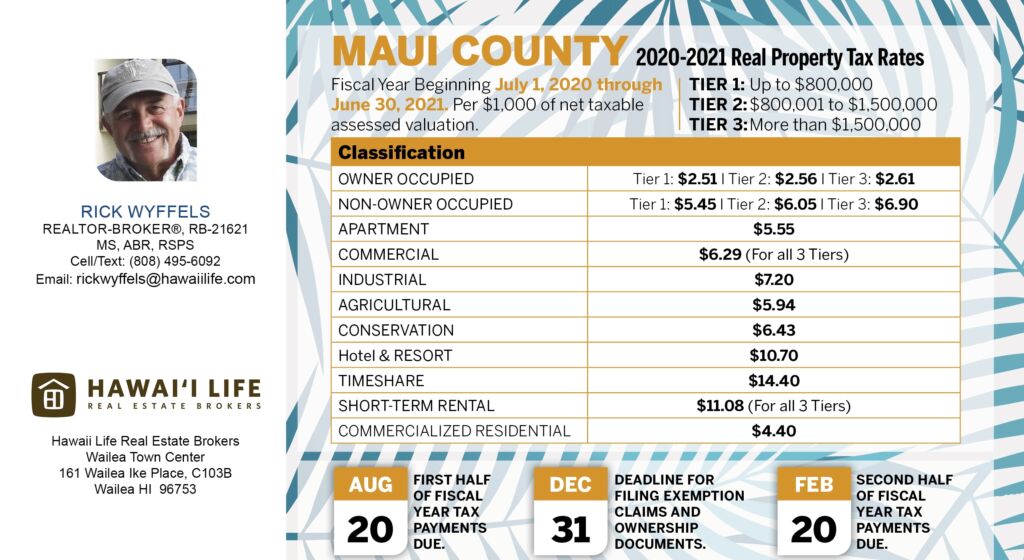

Hawaii Pensions Hawaii doesn t tax all pension income but there are some things you should know to avoid a surprise at tax time Under current Hawaii law any retirement income from an out of state source is subject to the state income tax This includes pensions Social Security and other income that exceeds the exemptions set by the state code The personal tax exemption is currently 1 040 for a single individual and 2 080 for a married couple

Corporate Tax Rates Around The World 2016

https://taxfoundation.org/wp-content/uploads/2015/10/international2.jpg

/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png)

Does Hawaii Tax Pensions And Social Security

https://i2.wp.com/www.thebalance.com/thmb/FyniSZoEEqxL0so7fcVHWHLaKTo=/1000x1000/smart/filters:no_upscale()/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png

https://ttlc.intuit.com/community/retirement/...

The good news is that public pension income is totally tax exempt in Hawaii The bad news is that all other forms of retirement income are taxed and are not eligible for any kind of deduction Hawaii entirely exempts some types of retirement income including Social Security retirement benefits and public pension income but fully taxes income

https://support.taxslayer.com/hc/en-us/articles/...

Hawaii does not tax qualifying distributions from Employer funded pension plan Federal civil service retirement Military pension State or county retirement system If you received distributions from a private employer pension plan and you made contributions to the pension plan your distribution is partially taxable

670m Of State Pension Underpayments Recorded In Financial Year Ending 2023

Corporate Tax Rates Around The World 2016

Autumn Budget 2022 The UK Is Now A High tax State We d Better Get

States That Don t Tax Pensions 2023 Wisevoter

August 13 2022

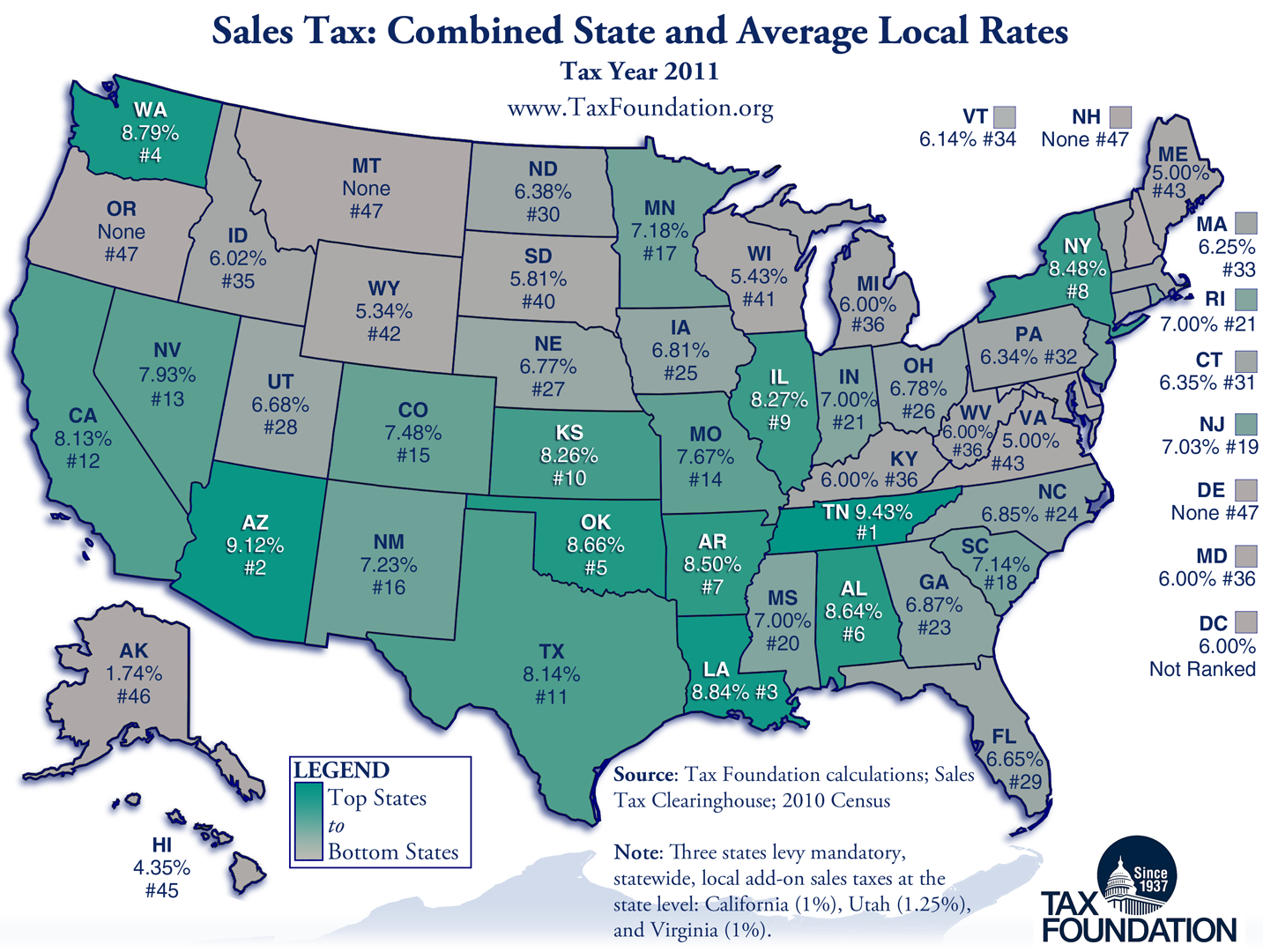

Sales Tax I Hawaii Hawaiibloggen

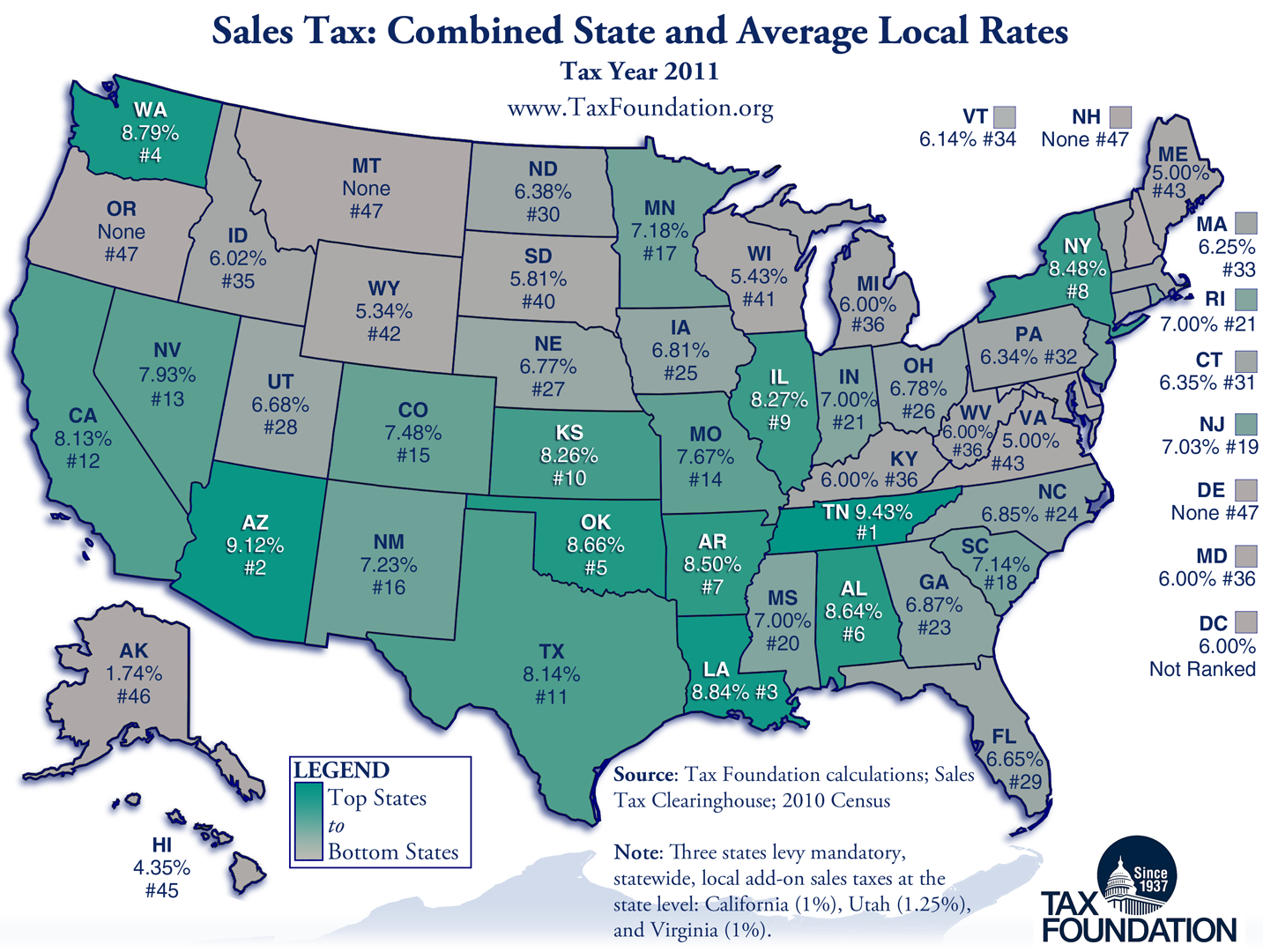

Sales Tax I Hawaii Hawaiibloggen

The American States With The Richest Retirees Might Surprise You

Does The State Of Hawaii Tax Retirement Income

Retiring These States Won t Tax Your Distributions

Does Hawaii Tax State Pensions - Contributions are tax deferred for federal income tax purposes and may be withdrawn when you retire or leave government service If your membership date is after June 30 2011 you will earn an interest rate of 2