Does Hawaii Tax Your Pension Hawaii does not tax qualifying distributions from Employer funded pension plan Federal civil service retirement Military pension State or county retirement system If you

Hawaii taxation of pension income is somewhat of a mixed bag Our income tax law has an exemption for compensation received in the form of a pension for past services Hawaii does not collect income tax on pensions or benefits from the state s retirement system It also doesn t tax Social Security benefits However all other forms of retirement income are

Does Hawaii Tax Your Pension

Does Hawaii Tax Your Pension

https://si-interactive.s3.amazonaws.com/prod/ai-cio-com/wp-content/uploads/2020/11/19111548/CIO-111920-Hawaii-Pension-Up-iStock-1038532990-web.jpg

Tax Charities Division Hawaii Laws And Regulations

https://ag.hawaii.gov/tax/wp-content/themes/hic_state_template_parent/images/og-image.jpg

Hawaii Federal Tax Id Number Search April Tax

https://www.khon2.com/wp-content/uploads/sites/8/2019/10/image003_1555639513429_83193399_ver1.0.png?w=900

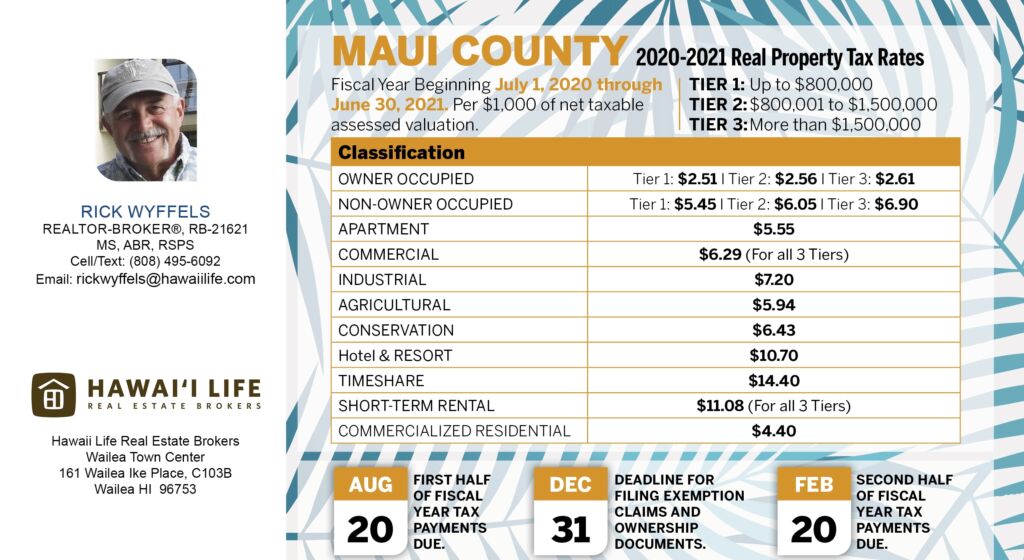

Under current Hawaii law any retirement income from an out of state source is subject to the state income tax This includes pensions Social Security and other income that exceeds the exemptions set by the state Federal Income Tax Withholding 2024 W 4P Pension Tax Withholding Form FAQ Refer to tax withholding tables for approximate federal income taxes to be withheld Mailing

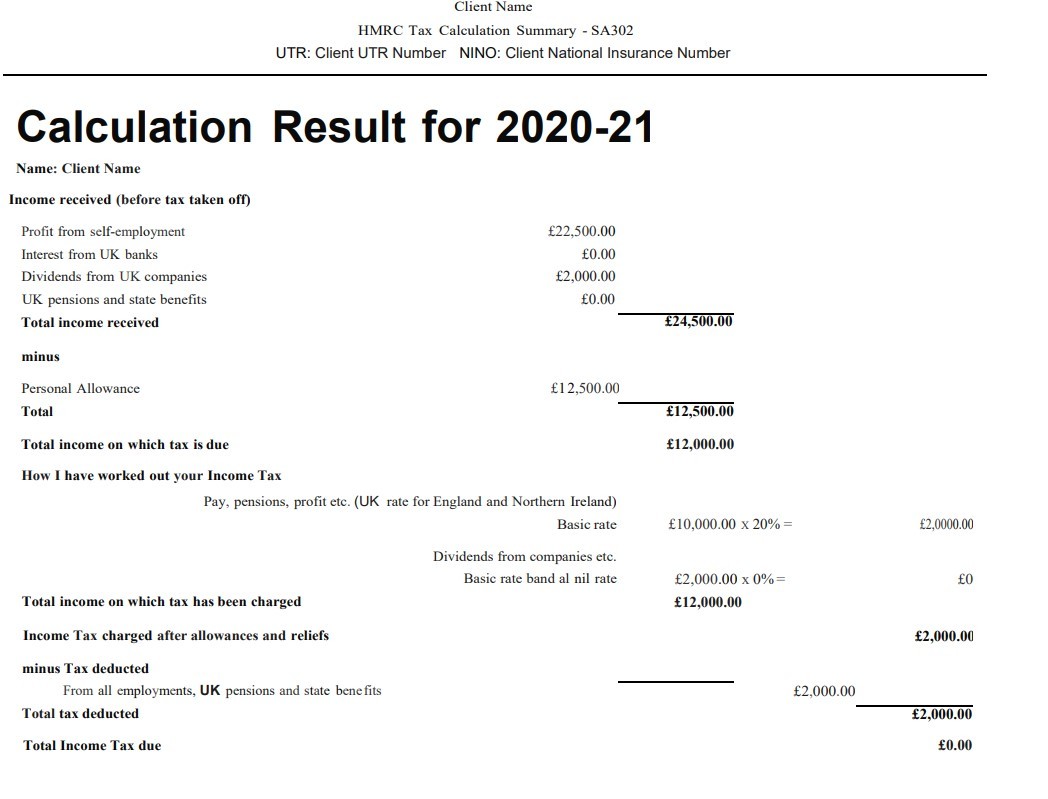

Q How do I change my federal tax withholding A You may download the W 4P that is available on the following page https ers ehawaii gov resources all forms Retirement Living takes an unbiased approach to our reviews We may earn money when you click a partner link Learn More Residents in Hawaii endure higher than average income tax rates but

Download Does Hawaii Tax Your Pension

More picture related to Does Hawaii Tax Your Pension

What Is Hawaii s General Excise Tax Grassroot Institute Of Hawaii

https://www.grassrootinstitute.org/wp-content/uploads/2023/02/GET-license.jpeg

/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png)

Does Hawaii Tax Pensions And Social Security

https://i2.wp.com/www.thebalance.com/thmb/FyniSZoEEqxL0so7fcVHWHLaKTo=/1000x1000/smart/filters:no_upscale()/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png

August 13 2022

https://trendingsimple.com/wp-content/uploads/are-property-taxes-high-in-maui-1024x560.jpg

If you contributed after tax dollars to your pension or annuity your pension payments are partially taxable You won t pay tax on the part of the payment that Hawaii Pensions Hawaii doesn t tax all pension income but there are some things you should know to avoid a surprise at tax time

Multiple Recipients of a Lump Sum Distribution If you shared a lump sum distribution from a qualified retirement plan when not all recipients were trusts a percentage will be Groceries are taxed at the full rate in Hawaii and the highest income tax bracket is 11 Retirees may get a break from paying state income taxes since some

Does The State Of Hawaii Tax Retirement Income

https://i1.wp.com/www.hawaiireporter.com/wp-content/uploads/2018/02/article-photo.png

How To Access Your SA302 s And Tax Year Overviews As Income Proof For

https://www.trinityfinancialgroup.co.uk/images/pdf/tax-overview-1.jpg

https:// support.taxslayer.com /hc/en-us/articles/...

Hawaii does not tax qualifying distributions from Employer funded pension plan Federal civil service retirement Military pension State or county retirement system If you

https://www. tfhawaii.org /wordpress/blog/2022/01/...

Hawaii taxation of pension income is somewhat of a mixed bag Our income tax law has an exemption for compensation received in the form of a pension for past services

Does Hawaii Tax Pensions And Social Security

Does The State Of Hawaii Tax Retirement Income

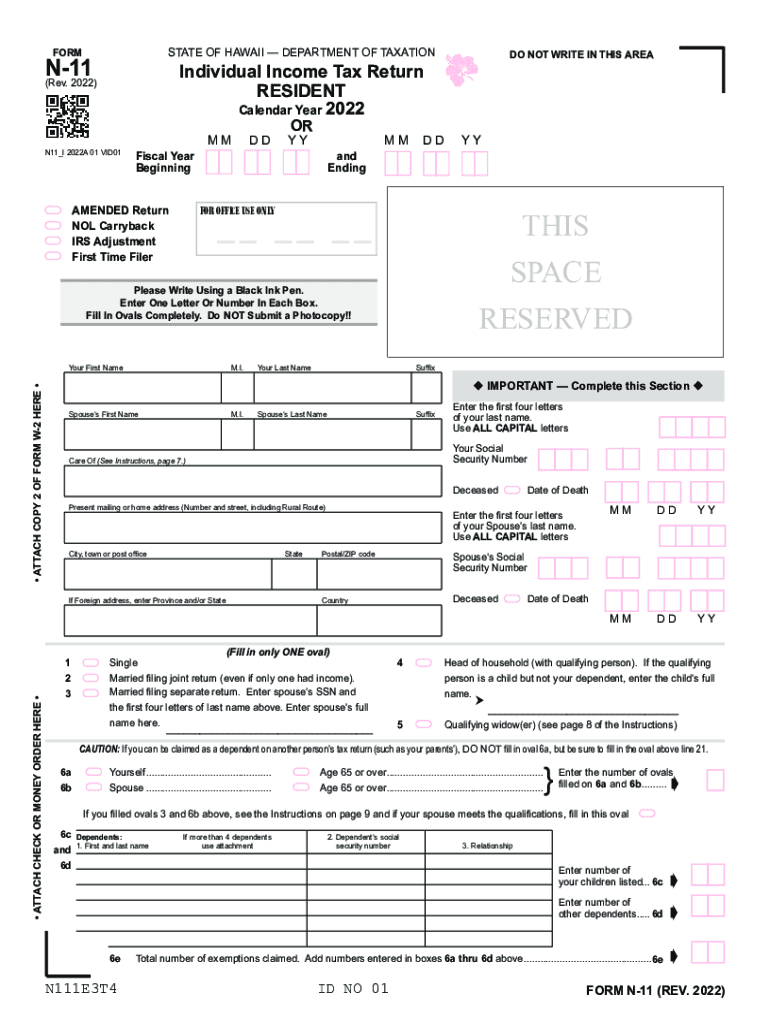

Hawaii Income Tax Return Fill Out Sign Online DocHub

Hawaii Tax Updates YouTube

Hawaii State Withholding Form 2023 Printable Forms Free Online

Do I Have To Get A New License When I Move To Hawaii

Do I Have To Get A New License When I Move To Hawaii

Does Hawaii Tax Pensions And Social Security

California Pension Funds Can t Resist Hawaii Conference On Taxpayer s

Does Hawaii Tax Pensions And Social Security

Does Hawaii Tax Your Pension - While the state of Hawaii initially introduced state sponsored retirement legislation in 2019 it did not pass But in May 2022 it was announced that Hawaii had