Does Hsa Ever Get Taxed How does my Health Savings Account affect my taxes A Health Savings Account HSA is a way to save money to pay for medical expenses and costs Contributions are tax free

One of the great things about an HSA is that no matter how much your account increases in value over time your earnings Since contributions for 2023 can be made to HSAs up until the federal tax deadline HSA administrators aren t required to send out Form 5498 SA which is an

Does Hsa Ever Get Taxed

Does Hsa Ever Get Taxed

http://milaskeeper.com/cdn/shop/articles/What-does-HSA-cover-when-you-re-pregnant--Mila-s-Keeper-1680563981.jpg?v=1683749214

HSA Vs PPO Choosing The Best Health Plan For You 7ESL

https://7esl.com/wp-content/uploads/2024/01/hsa-vs-ppo-NG-7ESL-scaled.jpg

Health Savings Account Does HSA Roll Over And Other Questions You May

https://phantom-marca.unidadeditorial.es/0763b21086b7b5463a35a509301a8aa7/resize/1200/f/jpg/assets/multimedia/imagenes/2023/07/16/16895424965194.jpg

A health savings account HSA is a tax advantaged way to save for qualified medical expenses HSAs pair with an HSA eligible health plan Because it offers potential tax HSA contributions are tax free For example if your tax rate is 22 percent and you contribute the maximum amount for 2023 which is 3 850 for an individual or 7 750 for

If you have a high deductible health plan you can make tax free contributions to a health savings account HSA to help cover medical expenses But you may wonder Distributions from an HSA that are used to pay qualified medical expenses aren t taxed An Archer MSA may receive contributions from an eligible individual and the eligible

Download Does Hsa Ever Get Taxed

More picture related to Does Hsa Ever Get Taxed

Financial Foundations FSA Vs HSA Hovis And Associates

https://hovisandassociates.com/wp-content/uploads/2022/02/2022-03-Image-HSA-v-FSA-balance.jpg

HSA Vs FSA

https://static.wixstatic.com/media/70f6ae_c10b3ecf981c45b08b85fc3001048ecf~mv2.png/v1/fill/w_980,h_551,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/70f6ae_c10b3ecf981c45b08b85fc3001048ecf~mv2.png

Comparisons Between An HSA And An FSA Ppt Download

https://slideplayer.com/slide/16431481/96/images/1/Comparisons+between+an+HSA+and+an+FSA.jpg

In short contributions to an HSA made by you or your employer may be claimed as tax deductions even if you don t itemize deductions on a Schedule A Form 1040 HSA Tax Time 101 is a resource that provides answers to some of the most frequently asked Health Savings Account HSA tax questions We organized the FAQs into three

HSA contributions reduce taxable income investment growth in the account is tax free and qualified withdrawals are tax free Money left over at the end of the year Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded

Are Super Withdrawals Tax Free In Australia One Click Life

https://oneclicklife.com.au/wp-content/uploads/2022/09/tax-super.jpg

HSA Vs FSA Understanding The Differences 7ESL

https://7esl.com/wp-content/uploads/2024/01/hsa-vs-fsa-NG-7ESL-scaled.jpg

https://1040.com/.../hsas-and-your-tax-return

How does my Health Savings Account affect my taxes A Health Savings Account HSA is a way to save money to pay for medical expenses and costs Contributions are tax free

https://smartasset.com/taxes/3-tax-reas…

One of the great things about an HSA is that no matter how much your account increases in value over time your earnings

Does Hsa Cover Therapy Cares Healthy

Are Super Withdrawals Tax Free In Australia One Click Life

The Best HSA Accounts And Providers Guide Morningstar

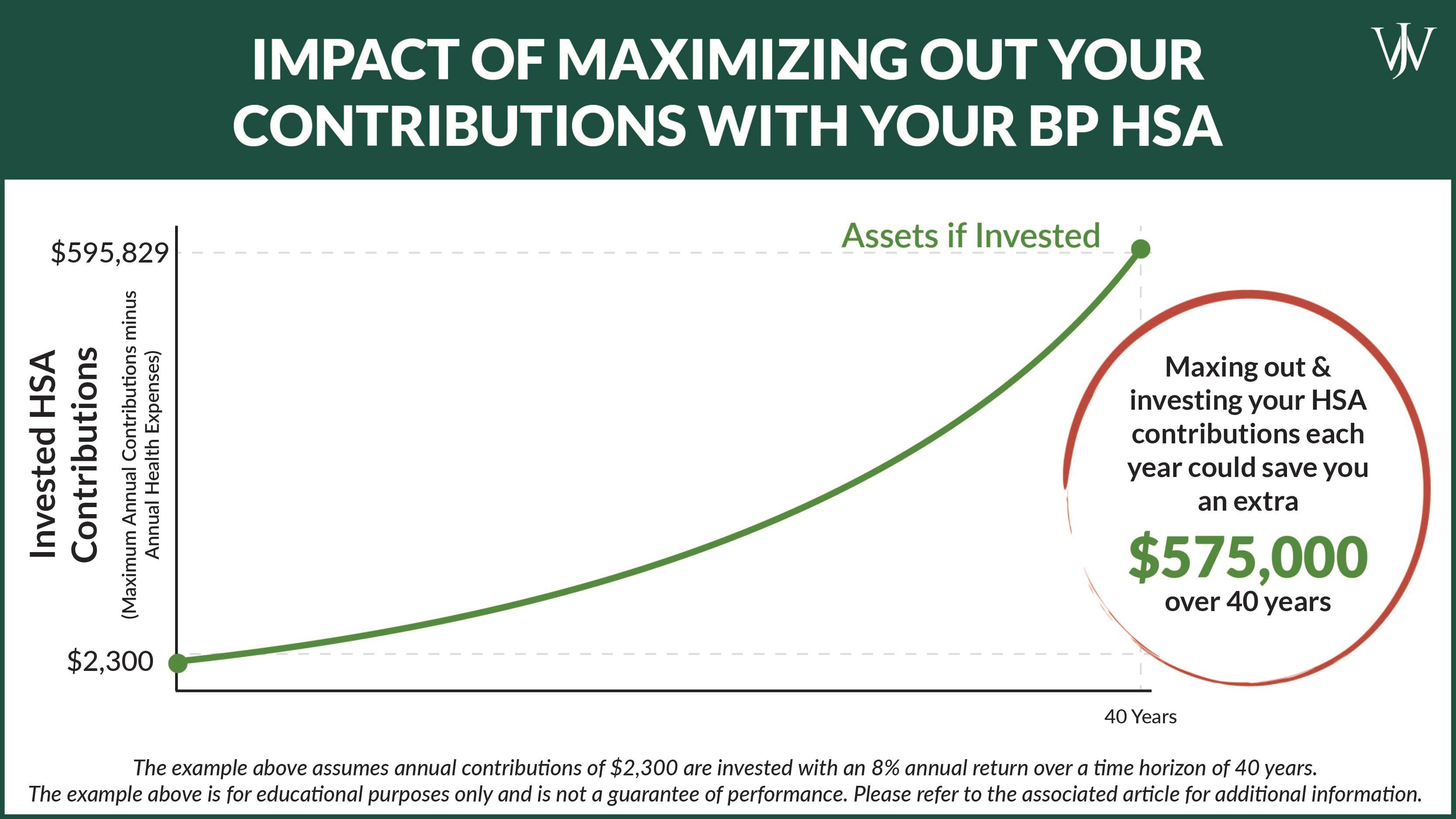

BP HSA Tax Benefits Investment Strategies To Consider In Open Enrollment

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

Employer Funded HSA What It Means For You And Your Employees

Employer Funded HSA What It Means For You And Your Employees

Lia Liar Pants On Fire Compass r PoliticalCompassMemes Political

Can I Use A FSA Or HSA Card On Eye Wear Pediatric Family Eyecare

Does HSA Money Roll Over Details On Retirement Savings

Does Hsa Ever Get Taxed - Distributions from an HSA that are used to pay qualified medical expenses aren t taxed An Archer MSA may receive contributions from an eligible individual and the eligible