Does Illinois Have An Income Tax Use our income tax calculator to find out what your take home pay will be in Illinois for the tax year Enter your details to estimate your salary after tax

The income tax system in Illinois is much simpler than in other states Here s what you need to know about the Illinois state income tax from the state s flat tax rate to available deductions credits and Illinois income tax is based on your federal adjusted gross income AGI plus or minus certain additions and subtractions Learn what types of income are taxable or

Does Illinois Have An Income Tax

Does Illinois Have An Income Tax

https://cdn.osvehicle.com/does_illinois_have_a_tax_credit_for_electric_cars.jpg

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

https://files.taxfoundation.org/20230306143844/Compare-2023-state-gross-receipts-taxes-by-state-Delaware-gross-receipts-tax-Nevada-gross-receipts-tax-Ohio-gross-receipts-tax-Oregon-gross-receipts-tax-Texas-gross-receipts-tax.png

Find out how much you ll pay in Illinois state income taxes given your annual income Customize using your filing status deductions exemptions and more Income Tax Rates Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective July 1 2017 Corporations 7 percent of net income Trusts and

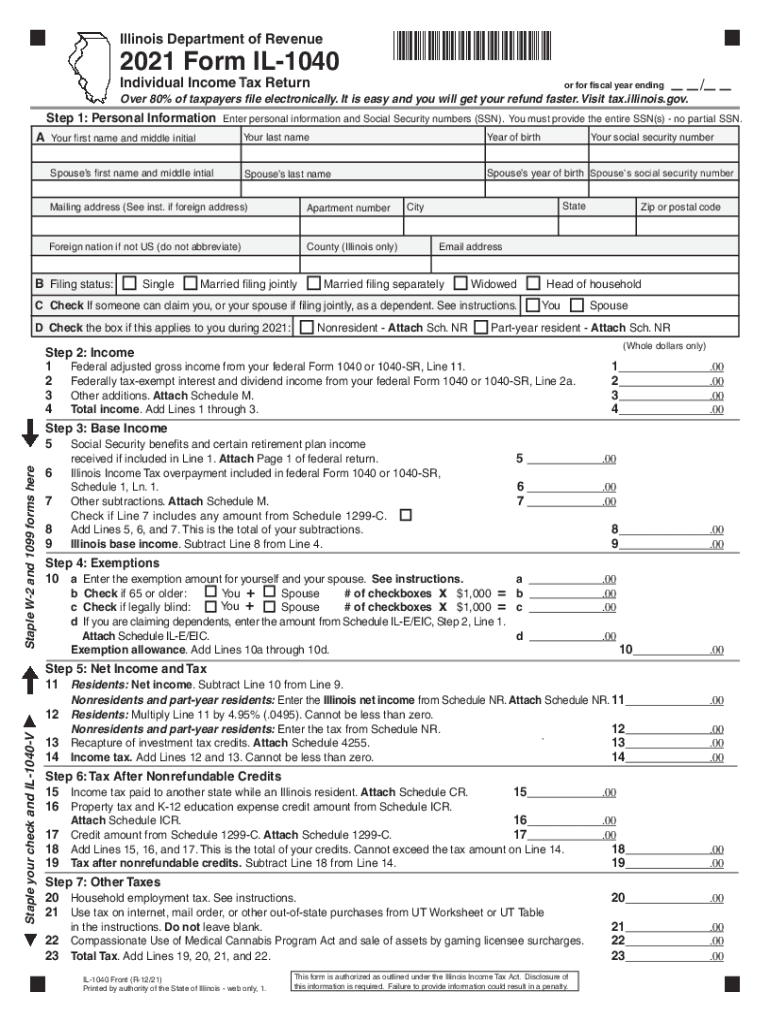

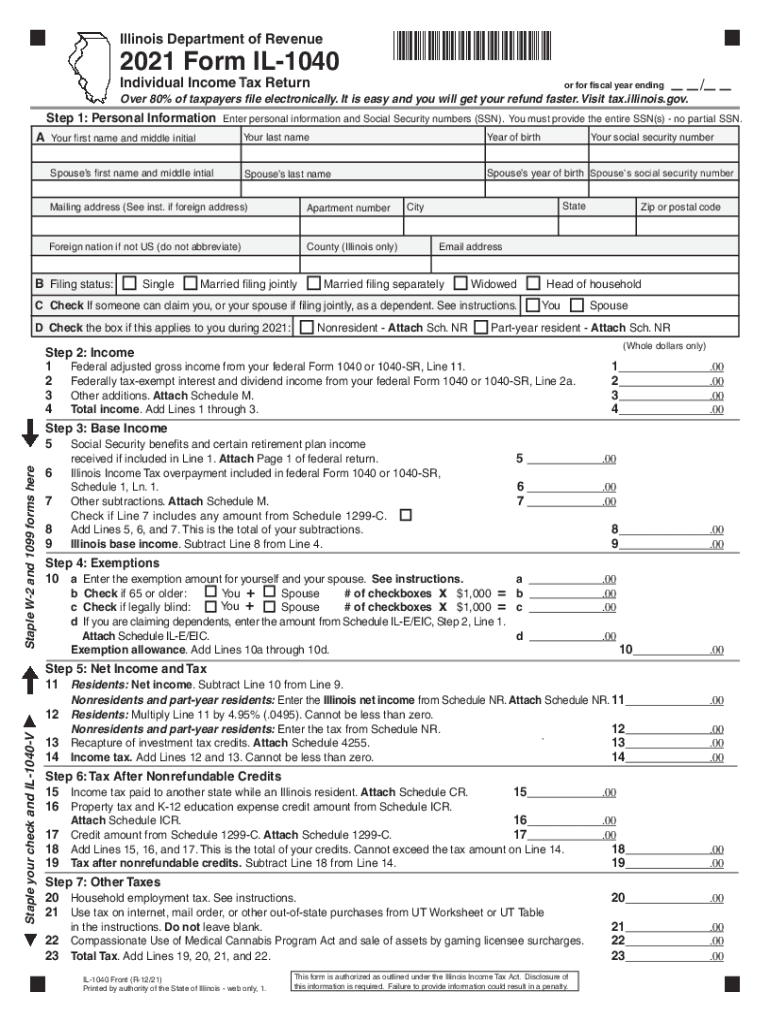

An Illinois resident you must file Form IL 1040 if you were required to file a federal income tax return or you were not required to file a federal income tax return but your Illinois Illinois imposes a flat individual income tax rate of 4 95 Illinois income taxes in retirement Income from most retirement plans is exempt including payments from qualified employee benefit

Download Does Illinois Have An Income Tax

More picture related to Does Illinois Have An Income Tax

How Many Cups Does Chicago Have

https://logocharts.com/wp-content/uploads/2021/12/How-many-cups-does-Chicago-have-scaled.jpg

Illinois Would Gain 3 4 Billion With Graduated Income Tax Rates

https://s2.reutersmedia.net/resources/r/?m=02&d=20190307&t=2&i=1363870221&w=1200&r=LYNXNPEF261TF

9 States With No Income Tax

https://cdn.aarp.net/content/dam/aarp/retirement/social-security/2020/07/1140-tax-free-road-sign.imgcache.rev3a16cba3390eea56f416a17a22024285.jpg

Illinois has a flat 4 95 percent individual income tax rate Illinois has a 9 5 percent corporate income tax rate Illinois also has a 6 25 percent state sales tax rate and an Illinois has a flat income tax of 4 95 which means everyone s income in Illinois is taxed at the same rate by the state No Illinois cities charge a local income tax on top of the state

Illinois flat income tax rate means that every resident regardless of income level pays the same individual income tax rate of 4 95 percent Nonresidents who work Illinois now levies the nation s highest state and local tax rates on residents costing each household 9 488 or more than 15 of their annual income in 2022 a

Illinois State Income Tax Form 2023 Printable Forms Free Online

https://www.southwestregionalpublishing.com/wp-content/uploads/2023/01/illinois-income-tax-form-Copy.png

What Is The Sales Tax In Texas WorldAtlas

https://www.worldatlas.com/r/w1200/upload/41/72/bb/shutterstock-402316468.jpg

https://www.forbes.com/advisor/income-tax-calculator/illinois

Use our income tax calculator to find out what your take home pay will be in Illinois for the tax year Enter your details to estimate your salary after tax

https://www.thebalancemoney.com/illinois...

The income tax system in Illinois is much simpler than in other states Here s what you need to know about the Illinois state income tax from the state s flat tax rate to available deductions credits and

Is Inheritance Taxable As Income In Illinois Does Illinois Have An

Illinois State Income Tax Form 2023 Printable Forms Free Online

Nevada Sales Tax Forms 2020 Semashow

Does Illinois Have Any Travel Restrictions Travel Erudition

Illinois State Income Tax Form Printable Printable Forms Free Online

Why Do We Pay Taxes A Complete Guide Action Economics

Why Do We Pay Taxes A Complete Guide Action Economics

Conversations With Dan Proft What Advantages Does Illinois Have

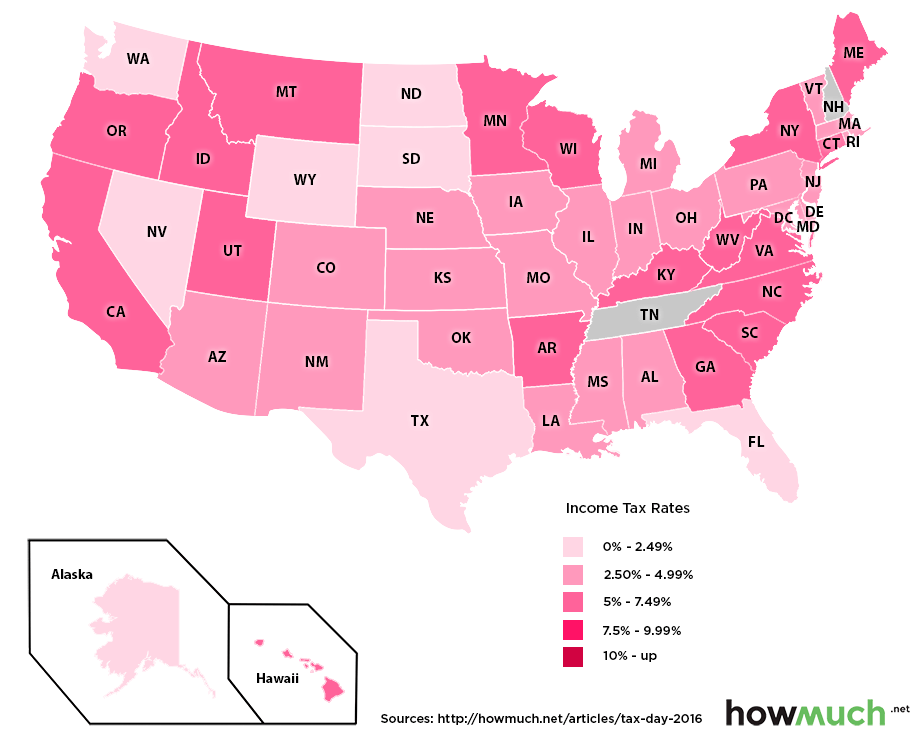

Ennegrecer Manguera Ordenado Income Tax Map Matar Ventilador

Illinois Castle Doctrine Does Illinois Have Castle Doctrine Castle Law

Does Illinois Have An Income Tax - Illinois Income Tax Filing IL 1040 Use MyTax Illinois to electronically file your original Individual Income Tax Return Go to Service