Does Leasing A Hybrid Car Qualify For Tax Credit Buyers can get federal tax credits for EV models not on the list allowed by the Inflation Reduction Act if they lease them

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids Dec 29 Reuters The U S Treasury Department said on Thursday that electric vehicles leased by consumers can qualify starting Jan 1 for up to 7 500 in commercial clean vehicle tax credits

Does Leasing A Hybrid Car Qualify For Tax Credit

Does Leasing A Hybrid Car Qualify For Tax Credit

https://www.debt.com/wp-content/uploads/2019/02/car-buying-woman.jpg

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

Lexus Responds To EV Price Wars With Whopping RZ Discount CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/1156000/300/1156312.jpg

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Remember any plug in hybrid including those from Hyundai Kia and Toyota such as the RAV4 Hybrid pictured and other models from BMW becomes eligible for the credit when it s The U S Department of Treasury s gift to electric vehicle shoppers and global automakers for the new year was to make many more EVs and plug in hybrids eligible for the federal tax subsidy of up

Download Does Leasing A Hybrid Car Qualify For Tax Credit

More picture related to Does Leasing A Hybrid Car Qualify For Tax Credit

What Is A Hybrid Car How Do They Work Advantage

https://advantage.com/wp-content/uploads/2022/05/what-is-a-hybrid-car.jpg

Ev Car Tax Rebate Calculator 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

Toyota To Raise A Hybrid Car In India Before Going 100 Electric EV

https://evultimo.com/assets/uploads/media-uploader/toyota-hybrid1648566092.jpg

According to the U S Department of Energy you can receive a tax credit of up to 7 500 for each electric vehicle you purchase on or after January 1 2010 The IRS will give a federal tax If you bought or leased a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under IRC 30D

Many manufacturers explicitly mention the tax credit in their advertised lease deals Audi and Volkswagen call it an EV Lease Bonus and Dodge calls it a Hybrid Electric Federal Tax As of August 2024 the following fully electric and plug in hybrid vehicles may be eligible for either a full or partial tax credit if delivered on or after Jan 1 2024 The IRS urges

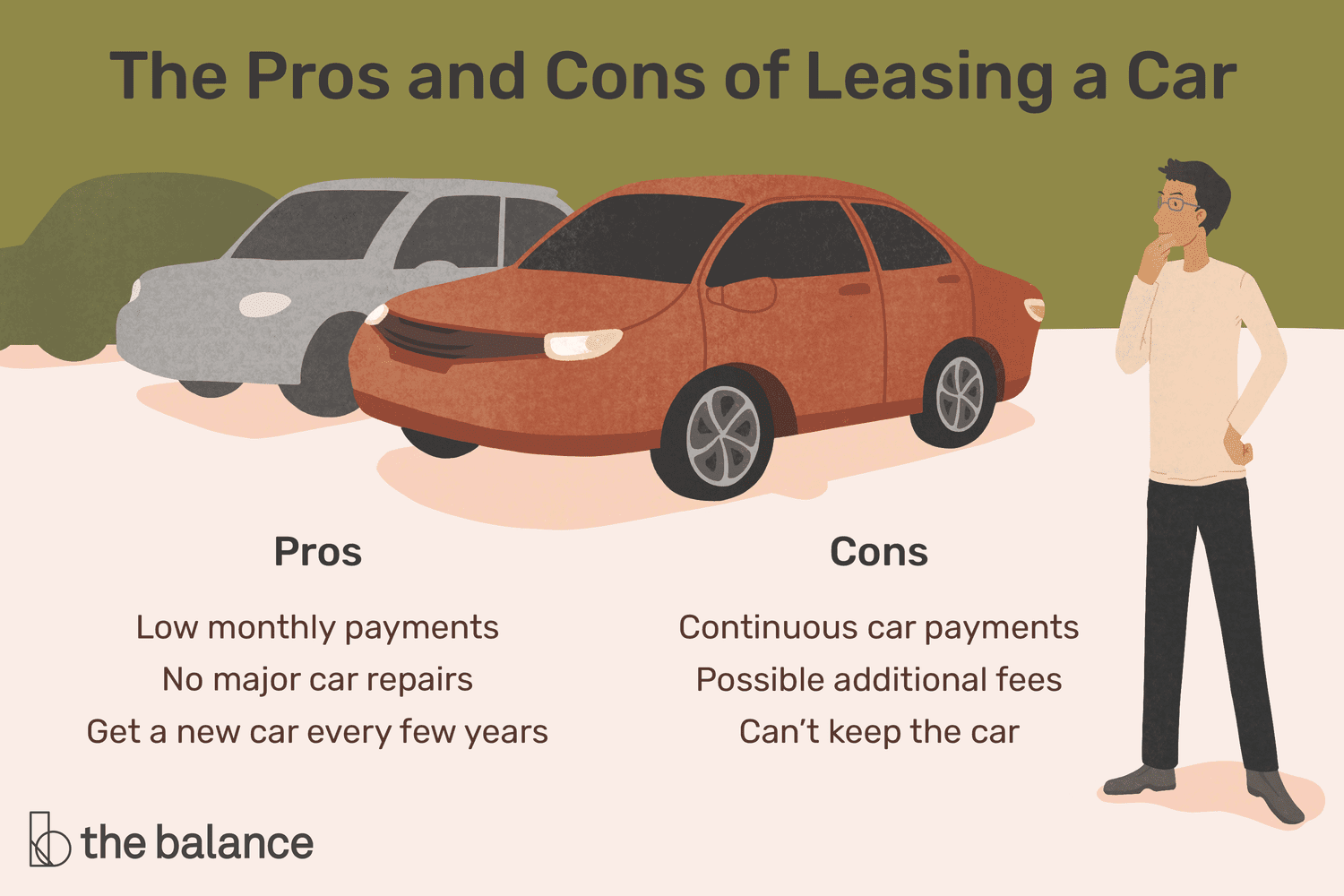

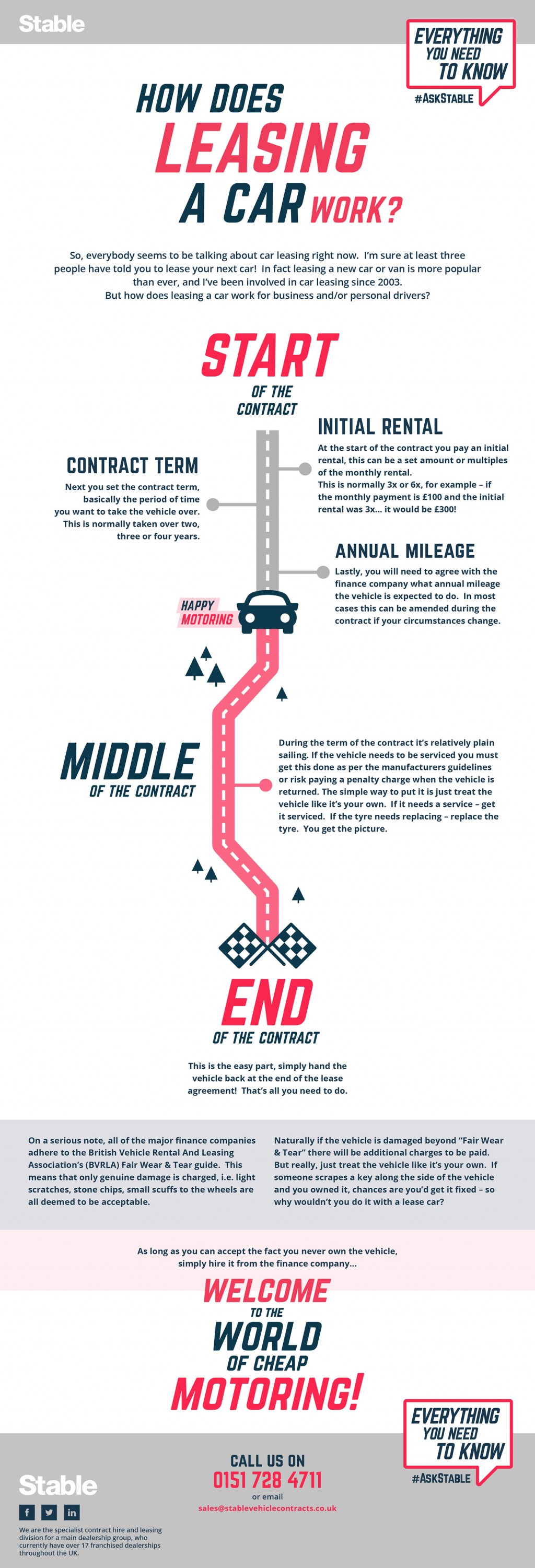

How Leasing A Car Works A Comprehensive Guide The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/08/should-i-lease-a-car-2385821_final-77bc5701d1754852924843b99da8e765.png

All About Tax Credit For EV PHEV And Hybrid Cars CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/954000/800/954828.jpg

https://www.caranddriver.com/news/a44131850/leasing-an-ev-tax-credit

Buyers can get federal tax credits for EV models not on the list allowed by the Inflation Reduction Act if they lease them

https://www.cars.com/articles/heres-which-hybrids...

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

How Leasing A Car Works A Comprehensive Guide The Tech Edvocate

Car Donation Tax Deduction Tax Benefits Of Donating A Car

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Leasing A Hybrid Car What It s Like AutoLux Sales And Leasing

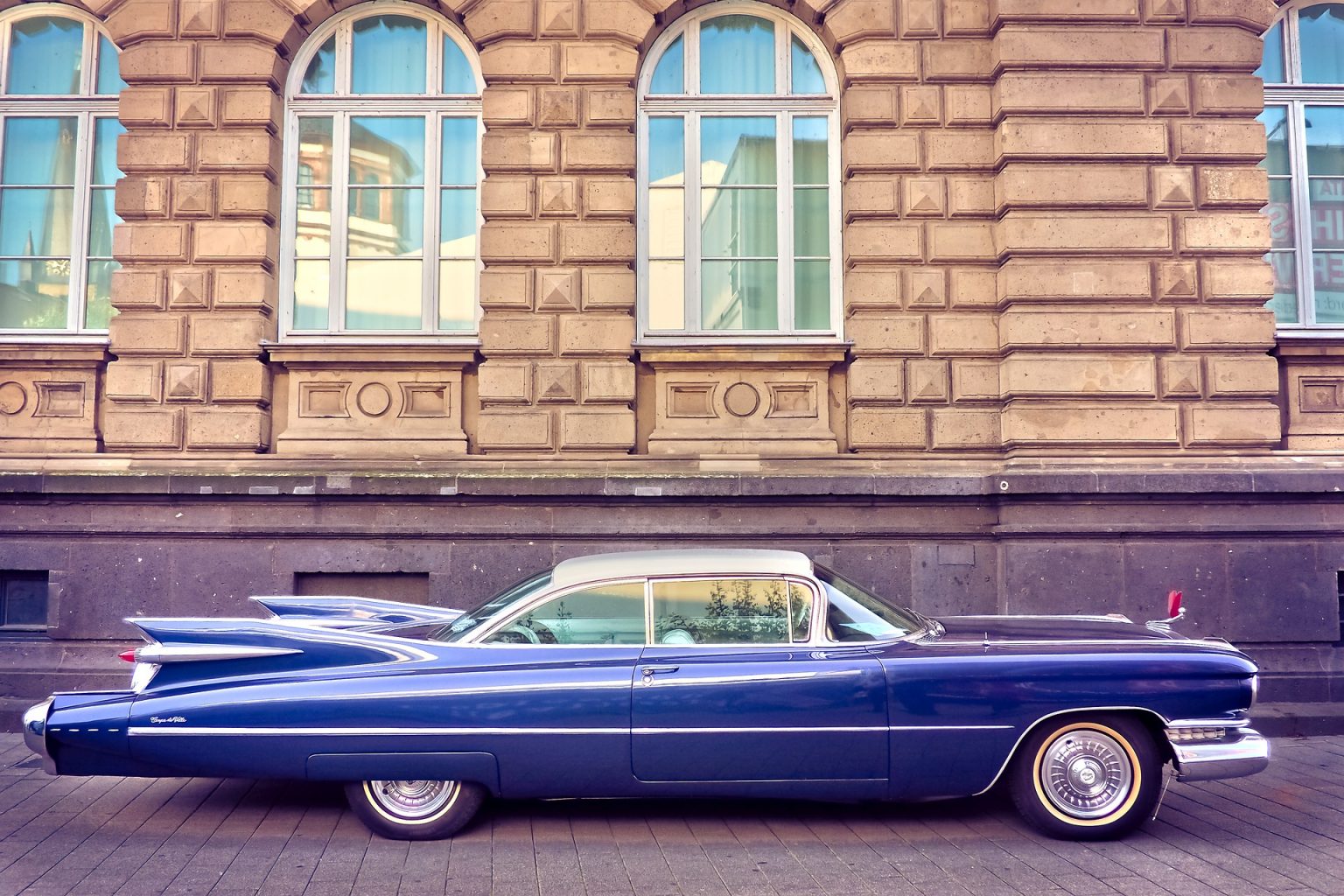

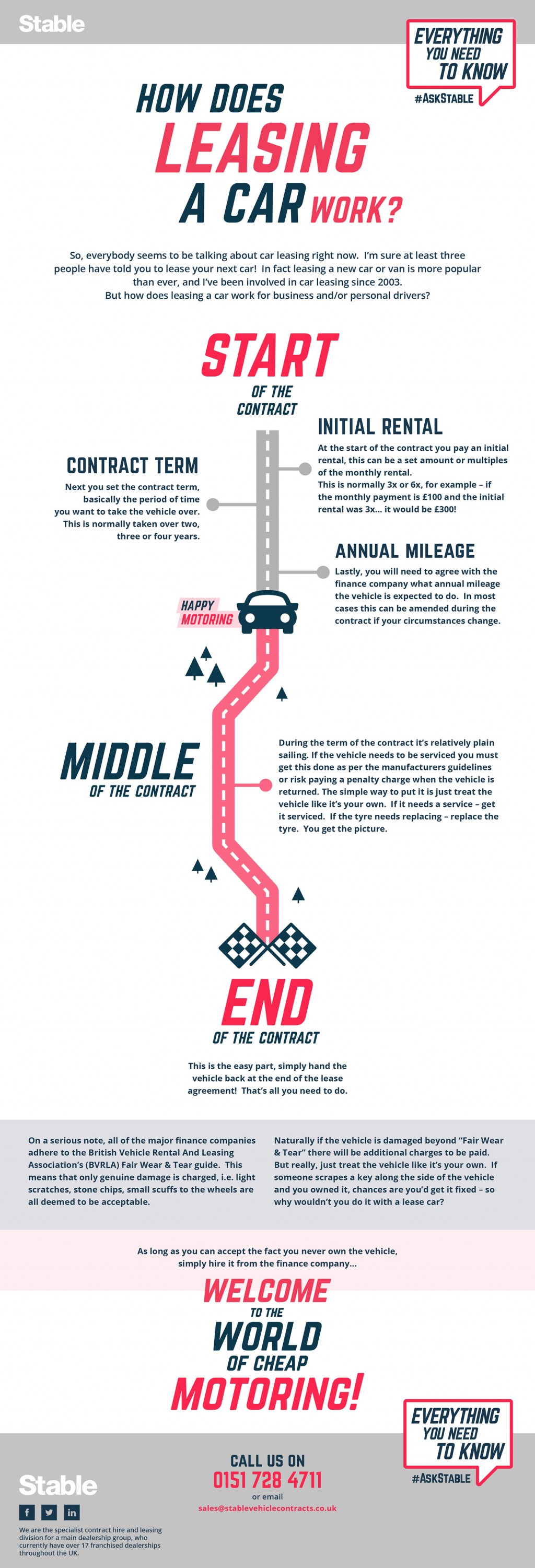

Infographic How Does Leasing A Car Work

Infographic How Does Leasing A Car Work

Safety Tips For Vehicle Maintenance The Benefits Of Leasing A Car

Does The Solo Electric Car Qualify For A Tax Credit OsVehicle

/https://www.forbes.com/wheels/wp-content/uploads/2023/01/EVLeaseCredit_Main.png)

No Tax Credit For An EV Try Leasing Forbes Wheels

Does Leasing A Hybrid Car Qualify For Tax Credit - You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032