Health Care Rebate Taxable Income Web 12 mars 2021 nbsp 0183 32 You do not have to include it as income on your tax return as long as you did not take an itemized deduction for the premiums on last year s return The rebate

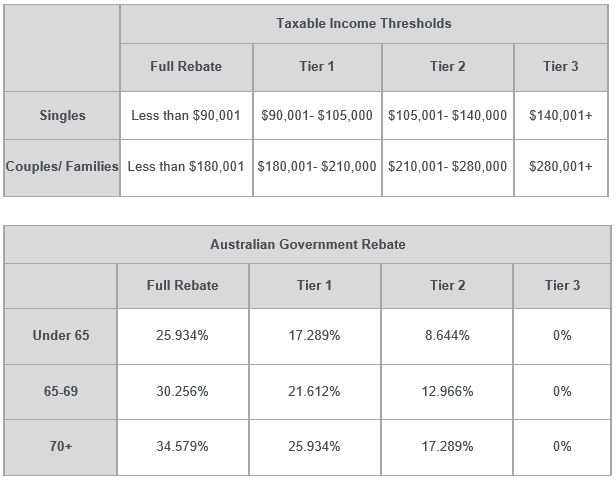

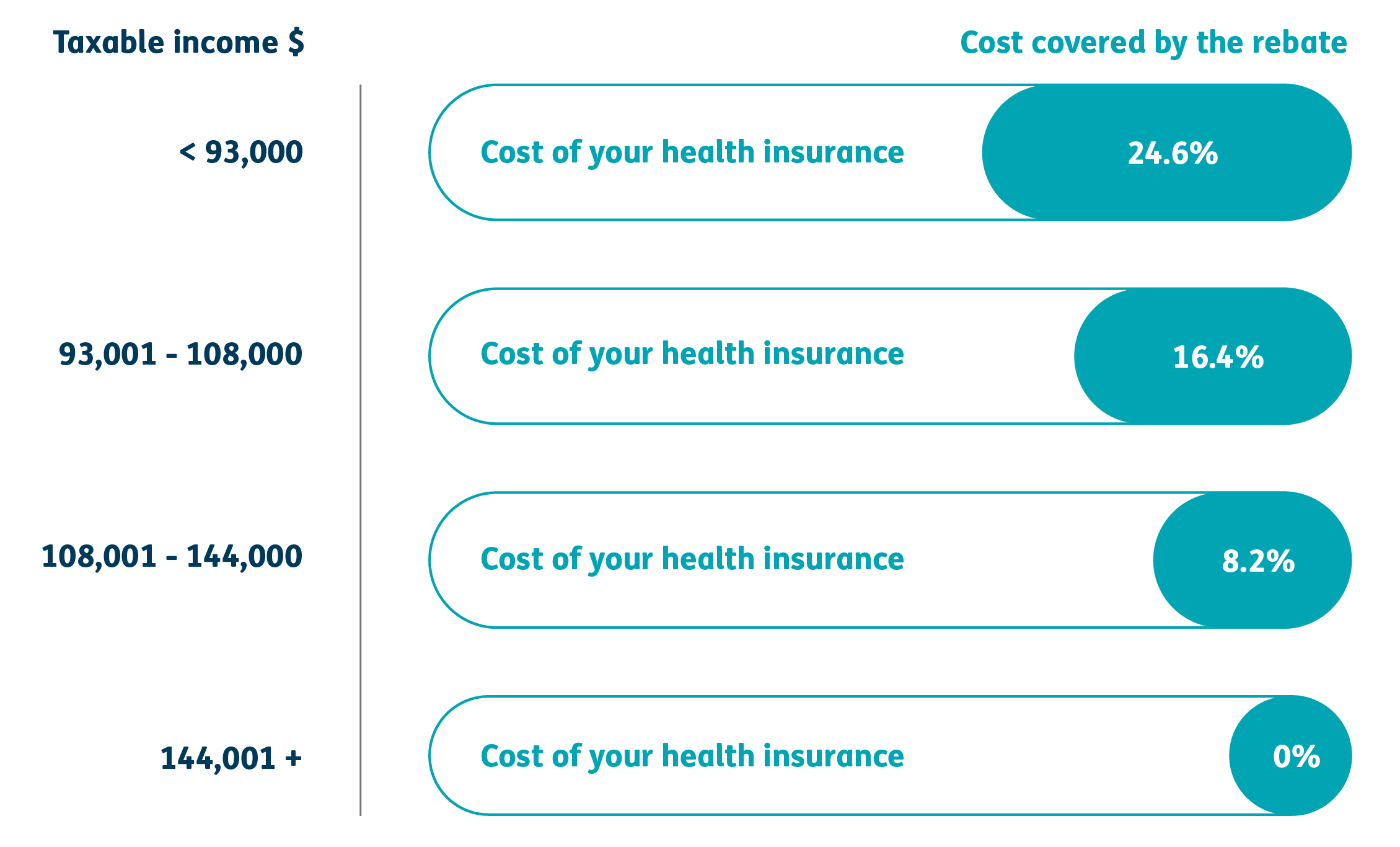

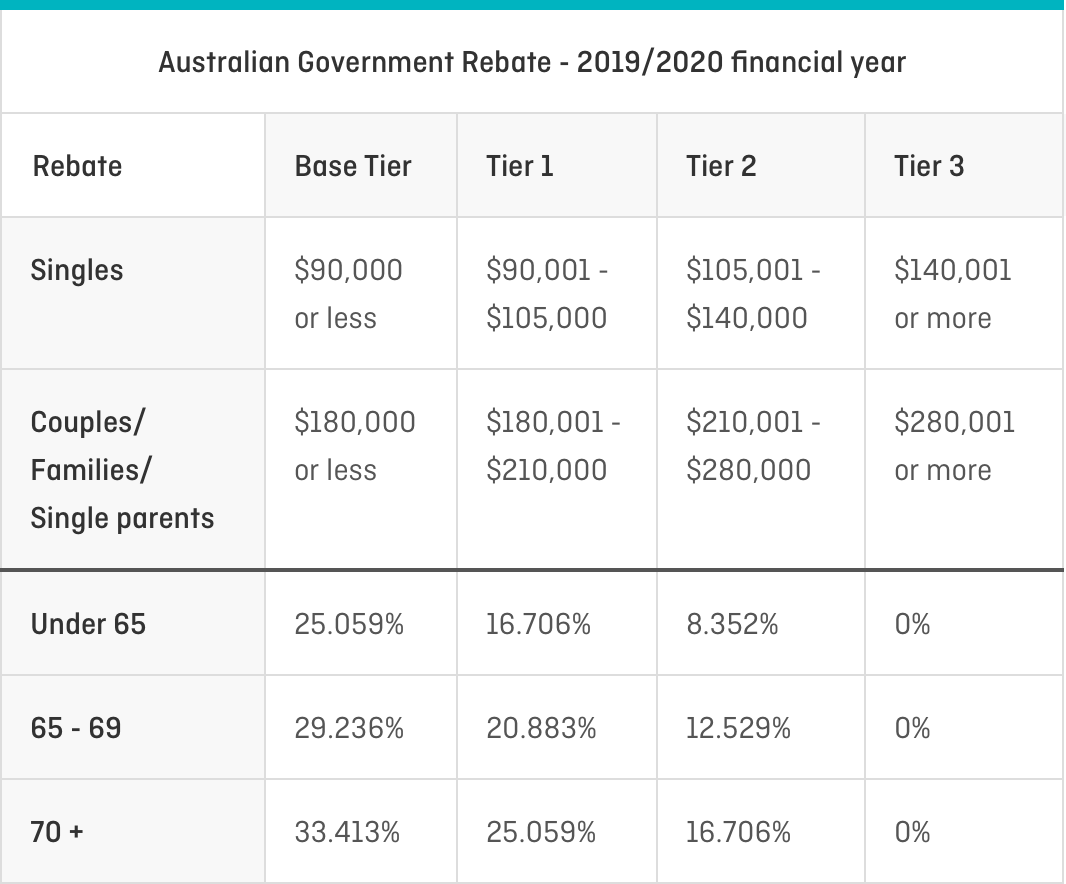

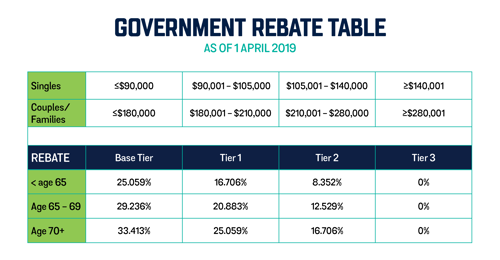

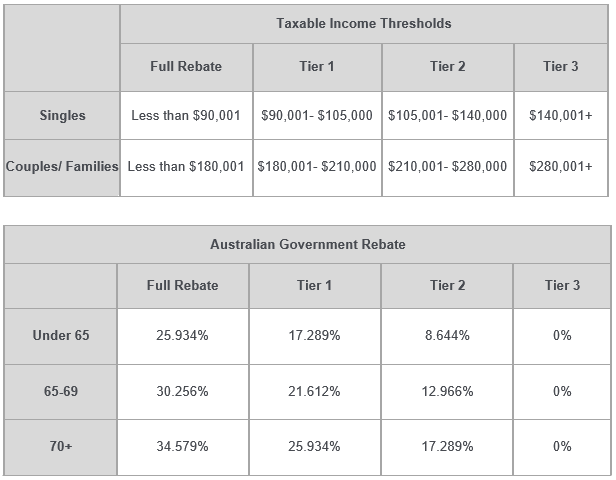

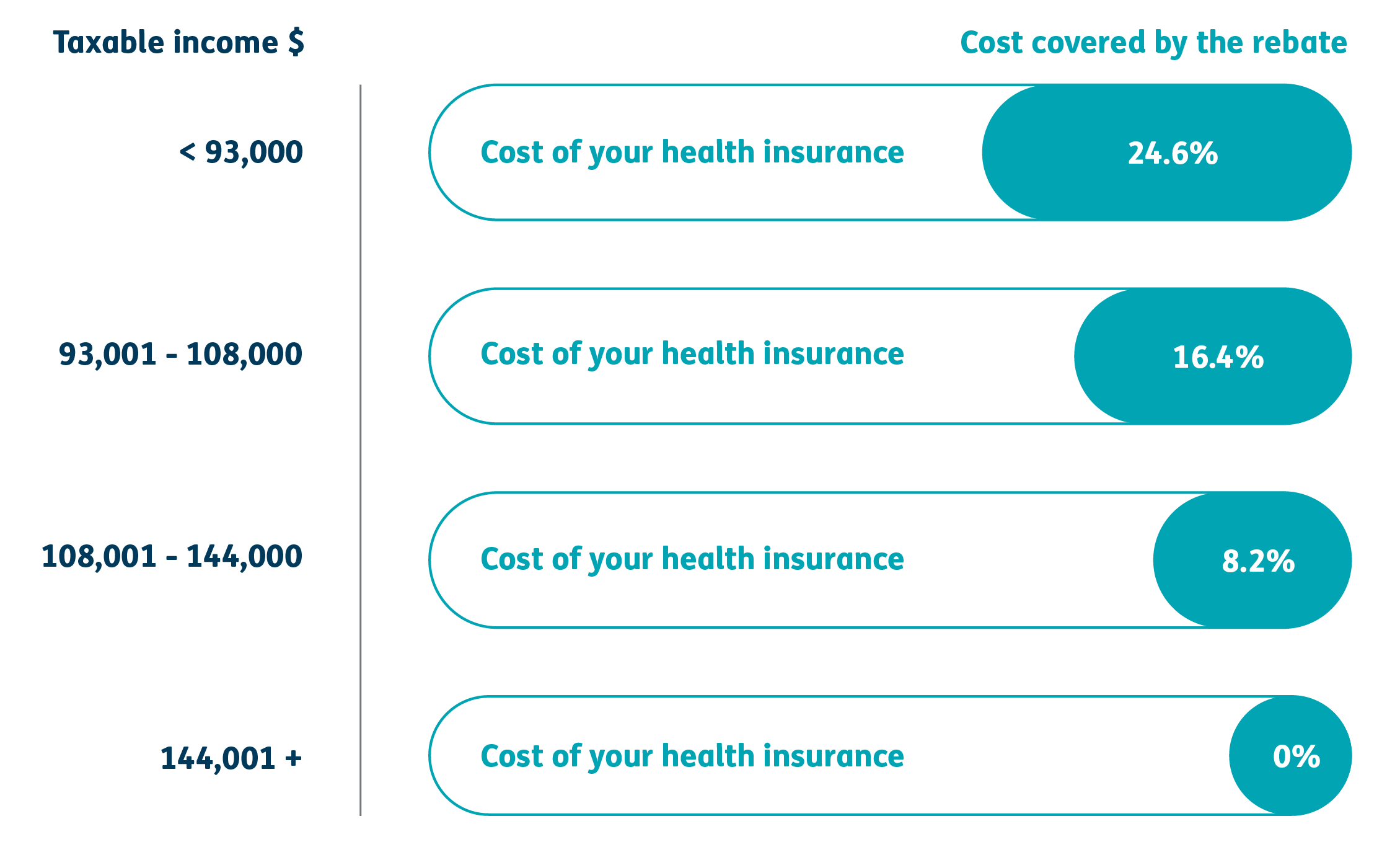

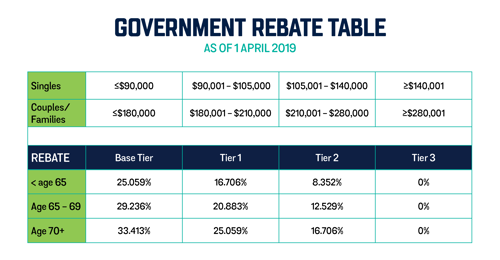

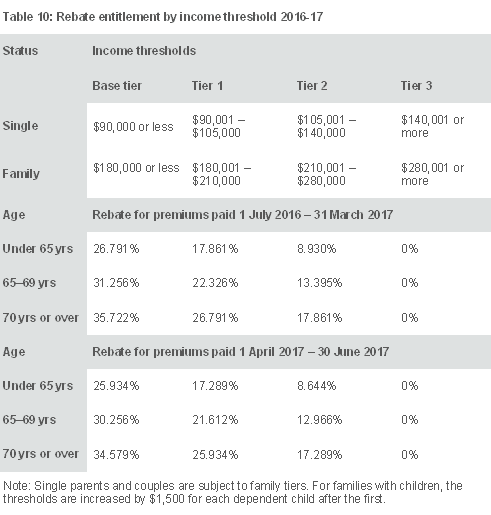

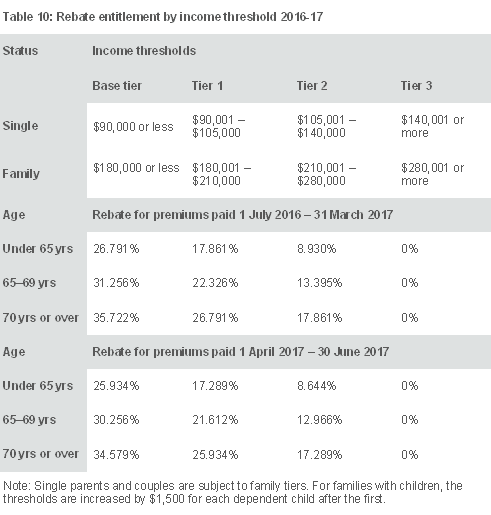

Web Find out when you have to pay the Medicare levy surcharge and the income thresholds and rates Last modified 30 Jun 2023 QC 49962 The private health insurance rebate is a Web If you have a taxable income of less than 140 000 as a single or 280 000 as a family you could be eligible to save on your private hospital cover premiums Read on to discover if you can qualify for the rebate

Health Care Rebate Taxable Income

Health Care Rebate Taxable Income

https://www.bcvfs.com.au/wp-content/uploads/2020/02/592ba46f77d1db4322b6393e_table-should-i-get-private-health-insurance-frankston-2.png

New To Private Health Insurance HBF Health Insurance

https://www.hbf.com.au/-/media/images/hbf/health-insurance/extras/singles-under-65.png?la=en&hash=46D4FB6E7BDC69C8763810EDA3F938B622C37A8C

Private Health Insurance Quote Qantas Insurance

https://insurance.qantas.com/dist/static/table-agr-6a9b38.png

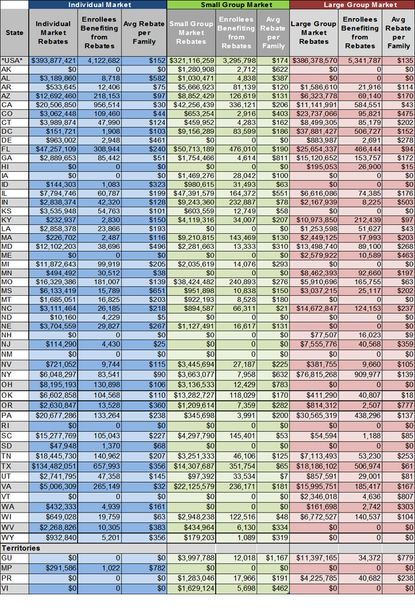

Web 30 juin 2023 nbsp 0183 32 If you are eligible for the rebate you can claim the rebate either through your private health insurance provider your private health insurance provider will apply the Web Income for surcharge purposes is used to test your eligibility for the private health insurance rebate It is not the same as your taxable income To be eligible for the

Web 10 mars 2023 nbsp 0183 32 You might be able to deduct your health insurance premiums and other health care costs from your taxable income which can lower the amount of money you owe the IRS come April Web Medicare gives Australian residents access to health care It is partly funded by taxpayers who pay a Medicare Levy of 2 of their taxable income If your taxable income falls

Download Health Care Rebate Taxable Income

More picture related to Health Care Rebate Taxable Income

What Is The Annual Private Health Insurance Rate Rise

https://asset.compareclub.com.au/content/guides/health-insurance/2021-rate-rise/health-insurance-rebates.jpg

Recovery Rebate Income Limits Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-q-a-about-recovery-rebates-student-loans-health-care-4.png

Incomes That Qualify For Lower Health Care Costs Income Chart

https://www.healthcare.gov/assets/coveragechart-big-table.jpg

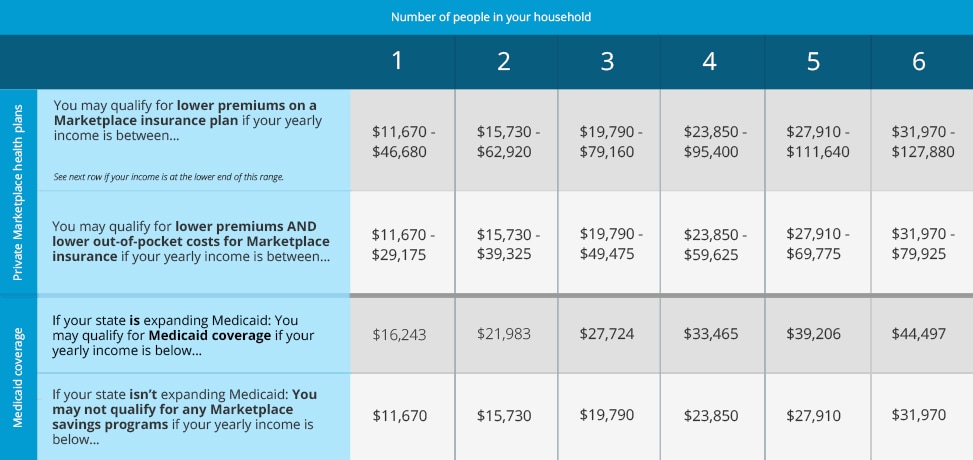

Web New lower costs available 2022 health coverage amp your federal taxes If you had Marketplace coverage at any point during 2022 you must file your taxes and quot reconcile quot Web A1 MLR rebates paid by Insurance Company either as cash payments or as premium reductions are return premiums Return premiums reduce Insurance Company s taxable

Web ACA rebates are taxable if you pay your health insurance premiums with pre tax dollars or you your employer receive tax benefits after deducting premiums on your tax return If Web 25 oct 2022 nbsp 0183 32 However some health insurance reimbursements are taxable while others aren t With so many different options it can be hard to know which health insurance

Tax Time And Private Health Insurance Teachers Health

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

Affordable Care Act 2022 Income Limits 2022 CGR

https://i2.wp.com/www.financialsamurai.com/wp-content/uploads/2013/10/ACA-income-limit-for-subsidies.png

https://ttlc.intuit.com/community/taxes/discussion/do-i-have-to...

Web 12 mars 2021 nbsp 0183 32 You do not have to include it as income on your tax return as long as you did not take an itemized deduction for the premiums on last year s return The rebate

https://www.ato.gov.au/.../Private-health-insurance-rebate

Web Find out when you have to pay the Medicare levy surcharge and the income thresholds and rates Last modified 30 Jun 2023 QC 49962 The private health insurance rebate is a

1 Billion In Health Insurance Rebates Taxable Or Tax free Kiplinger

Tax Time And Private Health Insurance Teachers Health

Private Health Insurance Rebate Navy Health

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Medicare Levy Surcharge Private Health Insurance What s The Link

Medicare Levy Surcharge Private Health Insurance What s The Link

Are Health Benefits Taxable

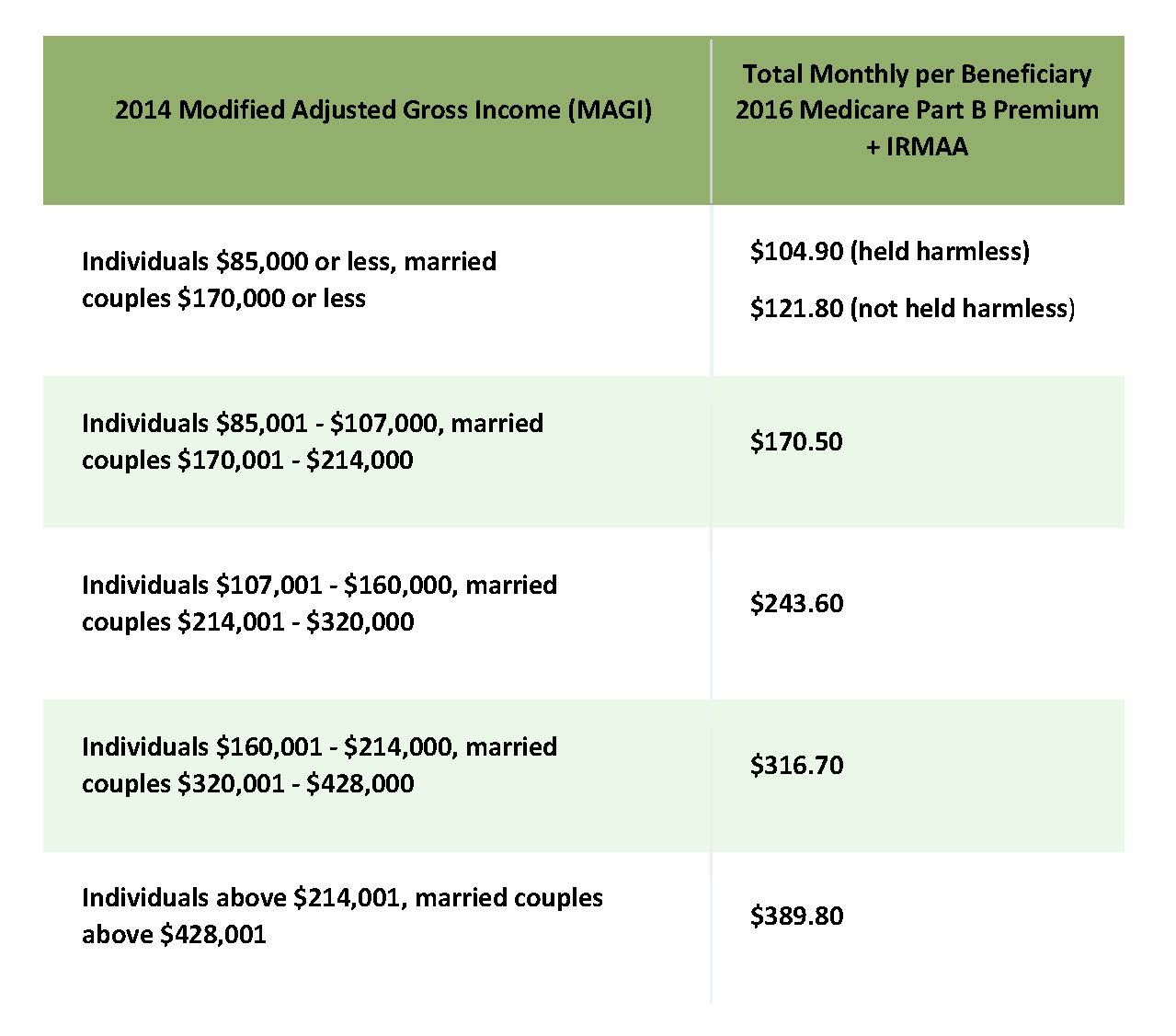

How To Help Clients Minimize The Sting Of 2016 Medicare Premium Rates

When Is Medicare Disability Income Taxable

Health Care Rebate Taxable Income - Web Income for surcharge purposes is used to test your eligibility for the private health insurance rebate It is not the same as your taxable income To be eligible for the