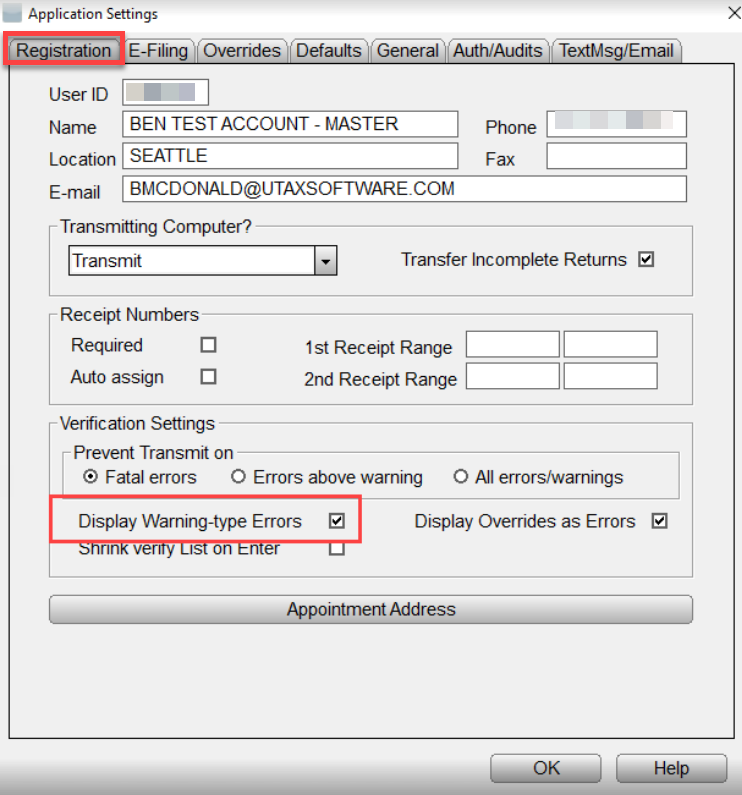

Irs Notice Recovery Rebate Credit Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return Web 16 nov 2022 nbsp 0183 32 The notice saying the IRS changed the amount of a 2020 Recovery Rebate Credit will also explain the reason for the change Review the 2020 tax return the 2020

Irs Notice Recovery Rebate Credit

Irs Notice Recovery Rebate Credit

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-8.png?fit=1060%2C795&ssl=1

1040 Rebate Recovery Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-103.jpg

Why Did My Refund Go Down After The IRS Adjusted My Tax Return aving

https://i0.wp.com/savingtoinvest.com/wp-content/uploads/2022/03/image-17.png?resize=768%2C352&ssl=1

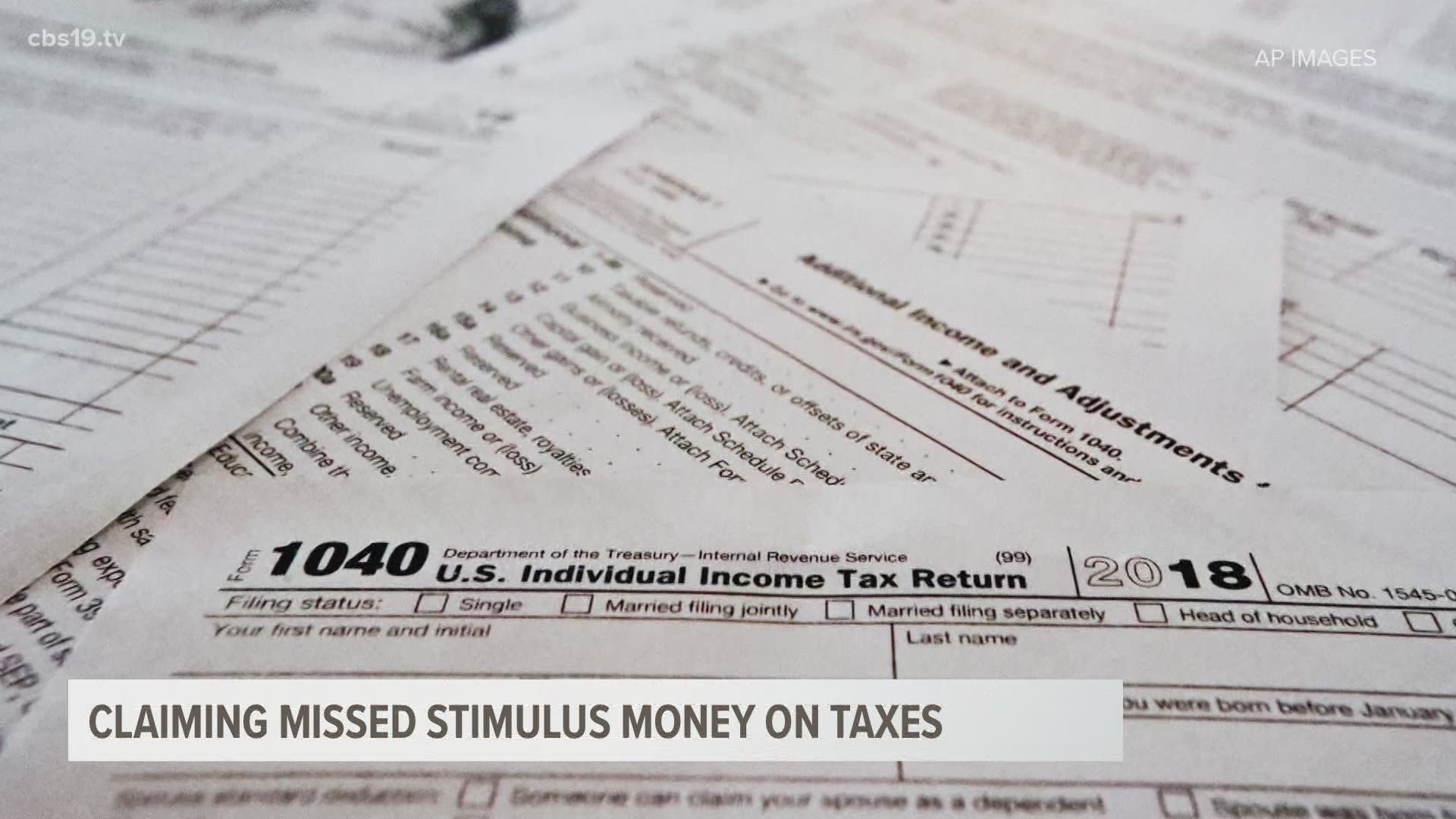

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form 1040 and Form

Web 13 avr 2022 nbsp 0183 32 IR 2022 83 April 13 2022 WASHINGTON The Internal Revenue Service today updated frequently asked questions FAQs for the 2021 Recovery Rebate Web 10 d 233 c 2021 nbsp 0183 32 To be eligible for the 2020 Recovery Rebate Credit you cannot be a dependent of another person You do not need to take any action as the notice is

Download Irs Notice Recovery Rebate Credit

More picture related to Irs Notice Recovery Rebate Credit

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

Economic Impact Payment Recovery Rebate Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/keep-irs-notice-about-economic-impact-payment-gene-bell-associates.jpg?resize=1024%2C683&ssl=1

Web The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim

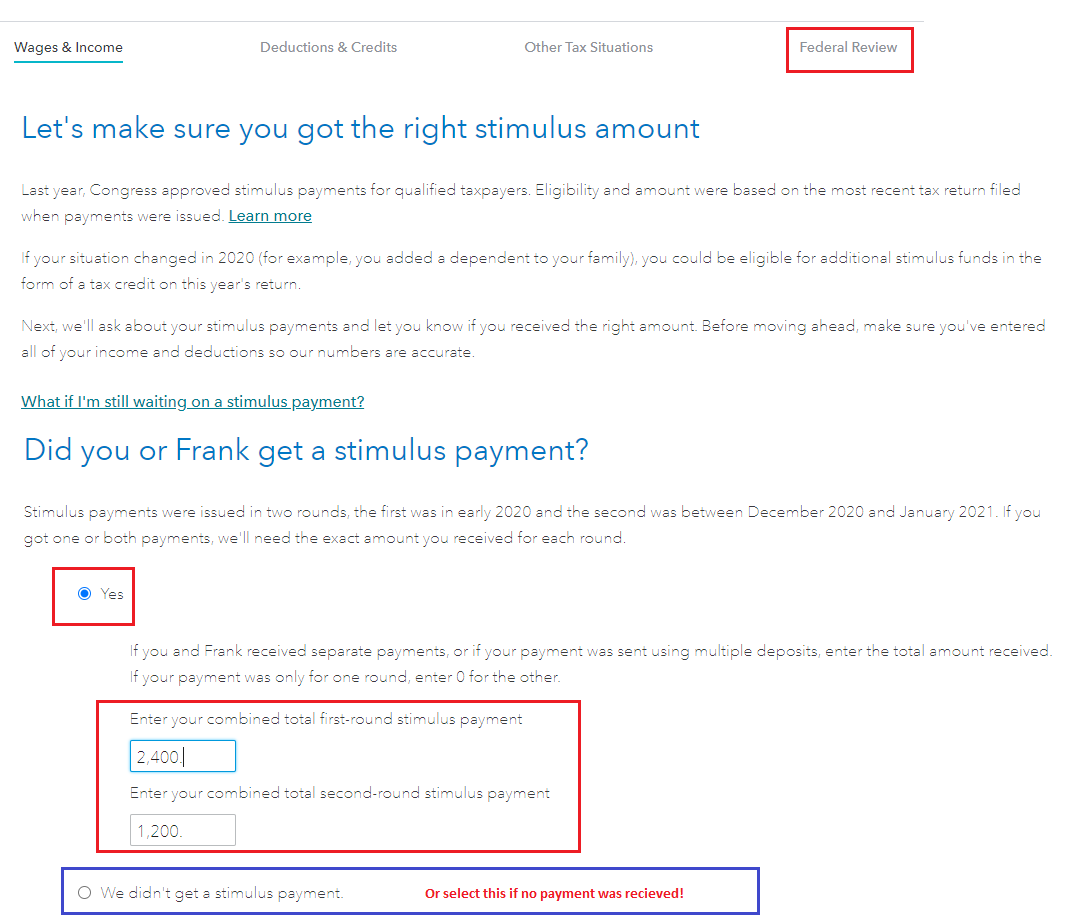

Web 28 juin 2021 nbsp 0183 32 Lots of people made mistakes when they answered the questions about the recovery rebate credit on a 2020 ta return If you answered incorrectly and did not enter Web The Recovery Rebate Credit is a special one time benefit that most people received last year in the form of an Economic Stimulus Payment But people who did not receive the

Federal Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-5.jpg?fit=1140%2C641&ssl=1

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.usatoday.com/gcdn/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?width=1320&height=990&fit=crop&format=pjpg&auto=webp

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/pub/taxpros/fs-2022-27.pdf

Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return

What If I Did Not Receive Eip Or Rrc Detailed Information

Federal Recovery Rebate Credit Recovery Rebate

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

1040 Line 30 Recovery Rebate Credit Recovery Rebate

2021 Recovery Rebate Credit Denied R IRS

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Irs Notice Recovery Rebate Credit - Web Recovery Rebate Credit The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be