Does Leasing Electric Car Qualify For Tax Credit Dec 29 Reuters The U S Treasury Department said on Thursday that electric vehicles leased by consumers can qualify starting Jan 1 for up to 7 500 in commercial clean vehicle tax

Buyers can get federal tax credits for EV models not on the list allowed by the Inflation Reduction Act if they lease them As of April 18 the entire structure of federal tax The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric

Does Leasing Electric Car Qualify For Tax Credit

Does Leasing Electric Car Qualify For Tax Credit

https://www.debt.com/wp-content/uploads/2019/02/car-buying-woman.jpg

U S Car Brands Will Benefit Most From Electric Vehicle Tax Breaks

https://static01.nyt.com/images/2023/04/17/multimedia/17ev-credits-1-vbpt/17ev-credits-1-vbpt-videoSixteenByNine3000.jpg

These 34 Electric Cars Won t Qualify For Biden s New EV Tax Credits

https://www.carscoops.com/wp-content/uploads/2022/08/EVs-tax-credits.jpg

IRS states in their fact sheet topic G Q5 that businesses that lease vehicles are allowed to claim the commercial EV tax credit for each leased vehicle This People who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to transfer

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 The U S Department of Treasury s gift to electric vehicle shoppers and global automakers for the new year was to make many more EVs and plug in hybrids eligible for the federal tax subsidy of up

Download Does Leasing Electric Car Qualify For Tax Credit

More picture related to Does Leasing Electric Car Qualify For Tax Credit

New Rules Which Electric Vehicles Qualify For The Federal Tax Credit

https://s.hdnux.com/photos/01/27/02/00/22814758/4/rawImage.jpg

These 28 Electric Cars Qualify For A Tax Credit The Plugin Report

https://pluginreport.com/wp-content/uploads/2020/11/which-electric-cars-qualify-for-a-tax-credit.jpg

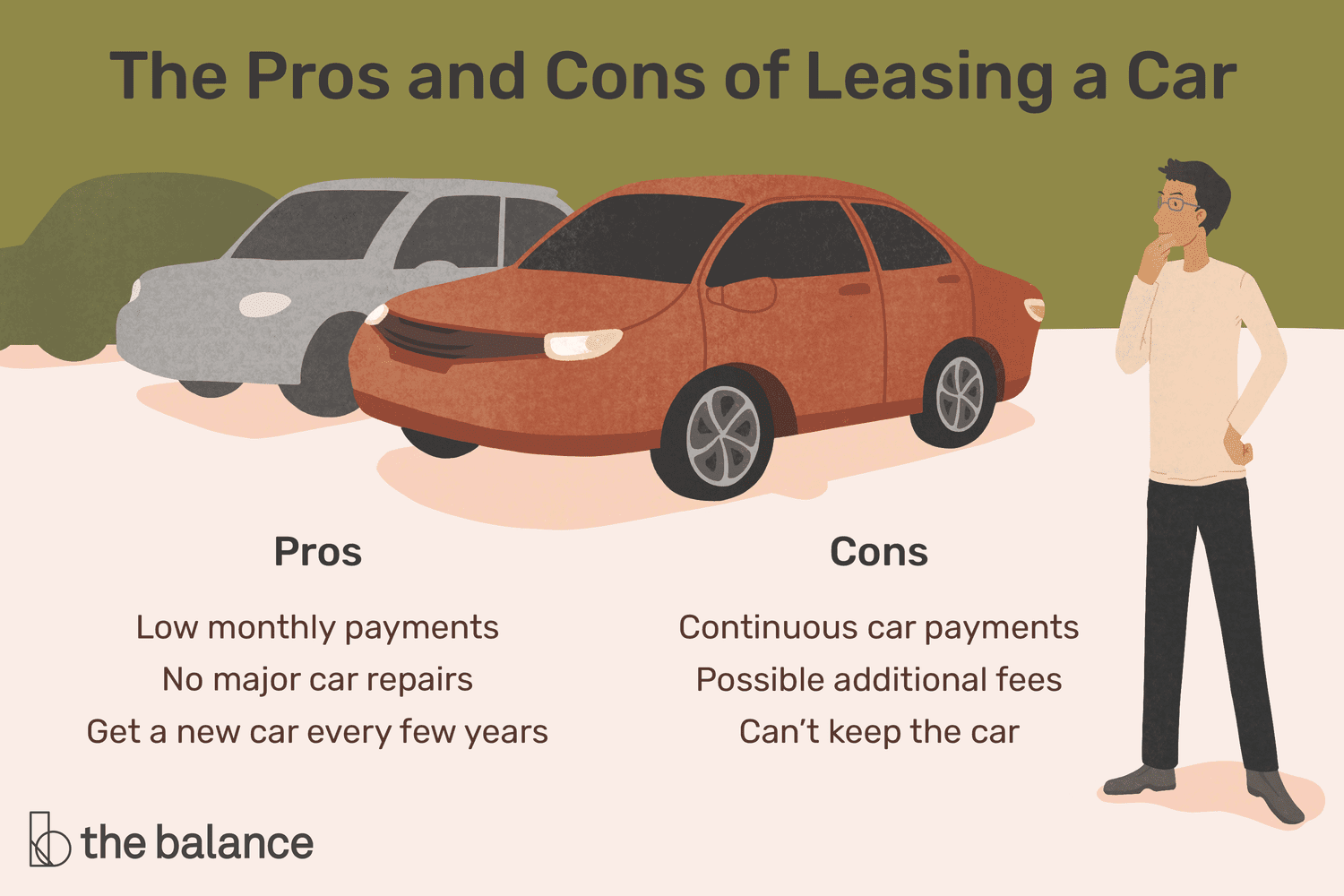

How Leasing A Car Works A Comprehensive Guide The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/08/should-i-lease-a-car-2385821_final-77bc5701d1754852924843b99da8e765.png

How Almost Any Electric Vehicle Can Qualify for the 7 500 EV Tax Credit Leasing EVs has become increasingly popular since new guidance on the lucrative tax break took effect in April If you bought or leased a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under IRC 30D

Federal EV tax credits in 2024 top out at 7 500 if you re buying a new car and 4 000 if you re buying a used car while the bank or the automaker s finance company can take a 7 500 tax Can You Get a Tax Credit If You Lease an EV Yes New federal rules make EVs eligible for a federal tax credit of up to 7 500

Rivian Forums R1T R1S Owners News Discussions RIVN Stock

https://www.rivianforums.com/forum/attachments/d428cfec-e782-475a-be36-314fe3df331f-jpeg.30501/

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

https://www.reuters.com/business/autos...

Dec 29 Reuters The U S Treasury Department said on Thursday that electric vehicles leased by consumers can qualify starting Jan 1 for up to 7 500 in commercial clean vehicle tax

https://www.caranddriver.com/news/a44131850/...

Buyers can get federal tax credits for EV models not on the list allowed by the Inflation Reduction Act if they lease them As of April 18 the entire structure of federal tax

Tesla Model Y And Other Electric Vehicles Will Now Qualify For 7 500

Rivian Forums R1T R1S Owners News Discussions RIVN Stock

IRS Officially Updates Its EV Tax Credit Rules Cutting Out Even More

These Electric Cars Qualify For The EV Tax Credits

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most EVs No Longer Qualify

Can You Get Federal Tax Credit For Leasing An Electric Car

Can You Get Federal Tax Credit For Leasing An Electric Car

/https://www.forbes.com/wheels/wp-content/uploads/2023/01/EVLeaseCredit_Main.png)

No Tax Credit For An EV Try Leasing Forbes Wheels

Electric Car Leasing Electric Vehicle Charging And Range

Hybrid Vs Electric Cars What s The Difference Hyundai Of Asheville

Does Leasing Electric Car Qualify For Tax Credit - The U S Department of Treasury s gift to electric vehicle shoppers and global automakers for the new year was to make many more EVs and plug in hybrids eligible for the federal tax subsidy of up