Does Llc S Get 1099 Uncover key insights on 1099 rules for LLCs S Corps tax classifications form nuances and compliance tips in our comprehensive easy to follow guide

An LLC will receive a 1099 if it is a sole proprietorship or a multi member LLC taxed as a partnership If the LLC has filed as an S corporation it will not need to file a 1099 There is nothing in the tax code that says LLCs specifically are exempt from 1099 reporting and many payers issue 1099s to LLCs whether they are required or not But here s the kicker LLCs should only

Does Llc S Get 1099

Does Llc S Get 1099

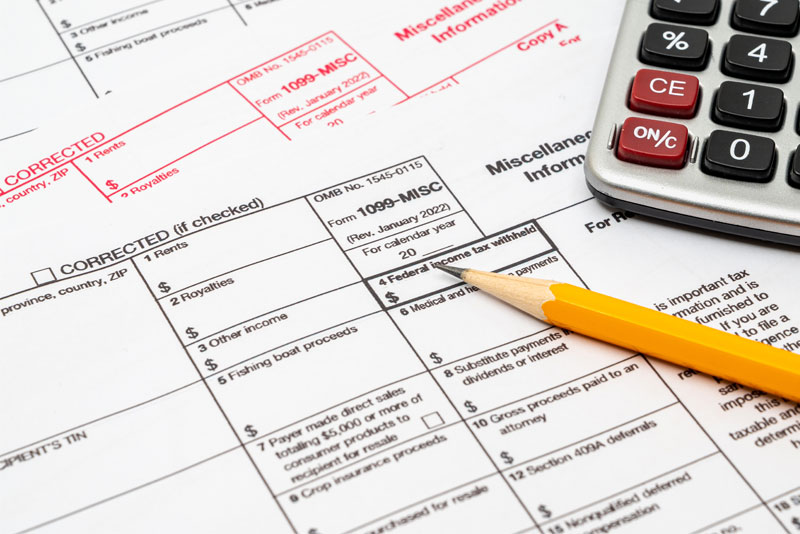

http://static1.squarespace.com/static/57a8a9cb1b631bbe67ccc714/57a8b0796a49636b2ef6a29a/5a4eedbd0852296d709c19d8/1515123134131/what-is-a-1099-misc-formdepauw-johnson-10-99-form-2017-1099misc-1048x682.jpg?format=1500w

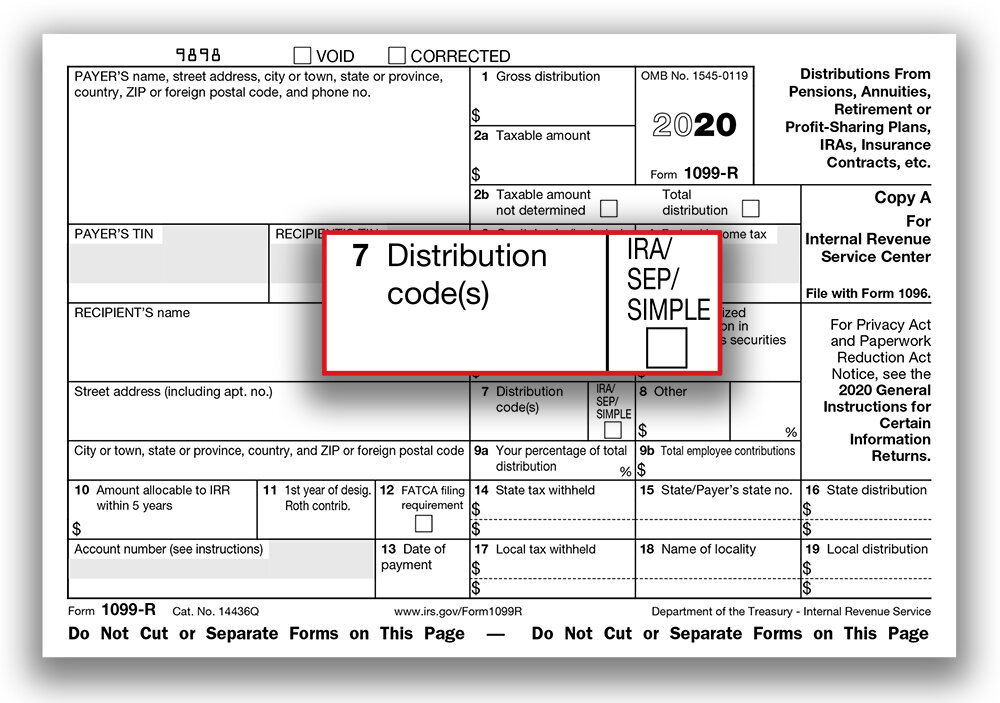

IRS Form 1099 R Box 7 Distribution Codes Ascensus

http://static1.squarespace.com/static/59c529e3cd0f689fe65fe62d/59c53ff3cd39c39d4b3ce369/5fda3cce5debe67d3595d8c7/1608214822239/1099R+with+callout+1000px.jpg?format=1500w

Does An LLC Get A 1099

https://www.corpnet.com/wp-content/uploads/2022/11/1099-Misc-Forms.jpg

LLCs can be trickier to determine whether a 1099 is needed because they don t all receive the same tax treatment For example a single member LLC is taxed like a sole proprietorship so you ll Unfortunately there s no cut and dried answer to the question Do LLCs get 1099s because not every LLC gets the same tax treatment If a contractor files

Do LLCs Get a 1099 Business owners freelancers and independent contractors often opt for a limited liability company LLC as their business structure An LLC that elects corporation tax status does not receive a 1099 unless the payment in question is for health care the purchase of fish attorney fees in lieu of

Download Does Llc S Get 1099

More picture related to Does Llc S Get 1099

How To Read Your 1099 R And 5498 Robinhood

https://images.ctfassets.net/fomw95h5b4ty/750v6J4OcVJ4qgG92KAfQj/548cbf16b32045a5733b44426b765446/example-1099-r.png

How Form 1099 K Affects Your E Commerce Business Digital

https://digital.com/wp-content/uploads/2022/02/Form-1099-K-1024x672.png

How To File A 1099 Form For Vendors Contractors And Freelancers

https://assets-global.website-files.com/60a6b551be6130e4e5b19b98/6184e97fc0fca378123537f5_Screen Shot 2021-11-03 at 8.41.45 AM.png

If your business pays an LLC more than 600 a year for rent business services or independent contractors you ll need to issue a federal form 1099 to report those payments to the Internal Revenue Service Generally C corporations S Corporations and LLCs formed as corporations or S Corps don t need to receive a 1099 NEC or 1099 MISC On irs gov check the 1099 NEC

However many LLC owners often wonder whether their company is subject to receiving a 1099 form In this article we will delve into the intricacies of tax Do LLCs get a 1099 The answer is not a simple yes or no This article provides some guidelines for knowing when an LLC should get a 1099

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/1099-example.png

How To File A 1099 Form For Vendors Contractors And Freelancers

https://assets-global.website-files.com/60a6b551be6130e4e5b19b98/62febbe85290864275ec05d3_Blog_Hero_1099.png

https://www.moneyaisle.com/do-llc-s-corporations-get-a-1099

Uncover key insights on 1099 rules for LLCs S Corps tax classifications form nuances and compliance tips in our comprehensive easy to follow guide

https://taxsharkinc.com/does-s-corp-get-1099

An LLC will receive a 1099 if it is a sole proprietorship or a multi member LLC taxed as a partnership If the LLC has filed as an S corporation it will not need to file a 1099

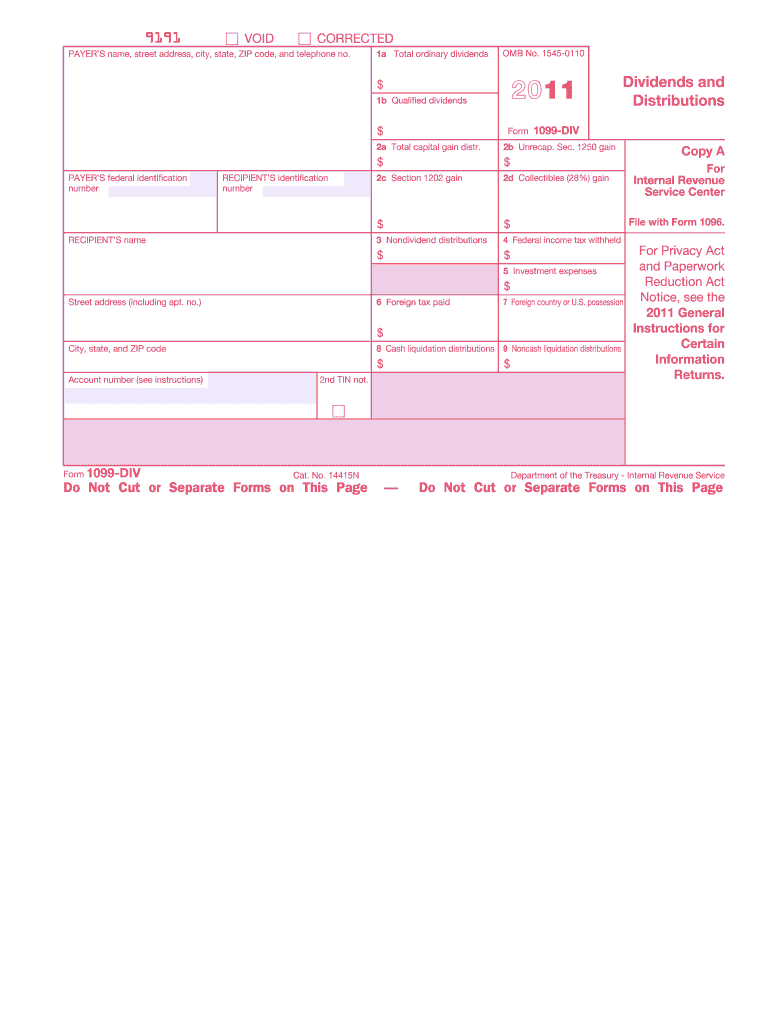

1099 Div Fillable Form Fill Out And Sign Printable PDF Template SignNow

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

1099 MISC User Interface Miscellaneous Income Data Is Entered Onto

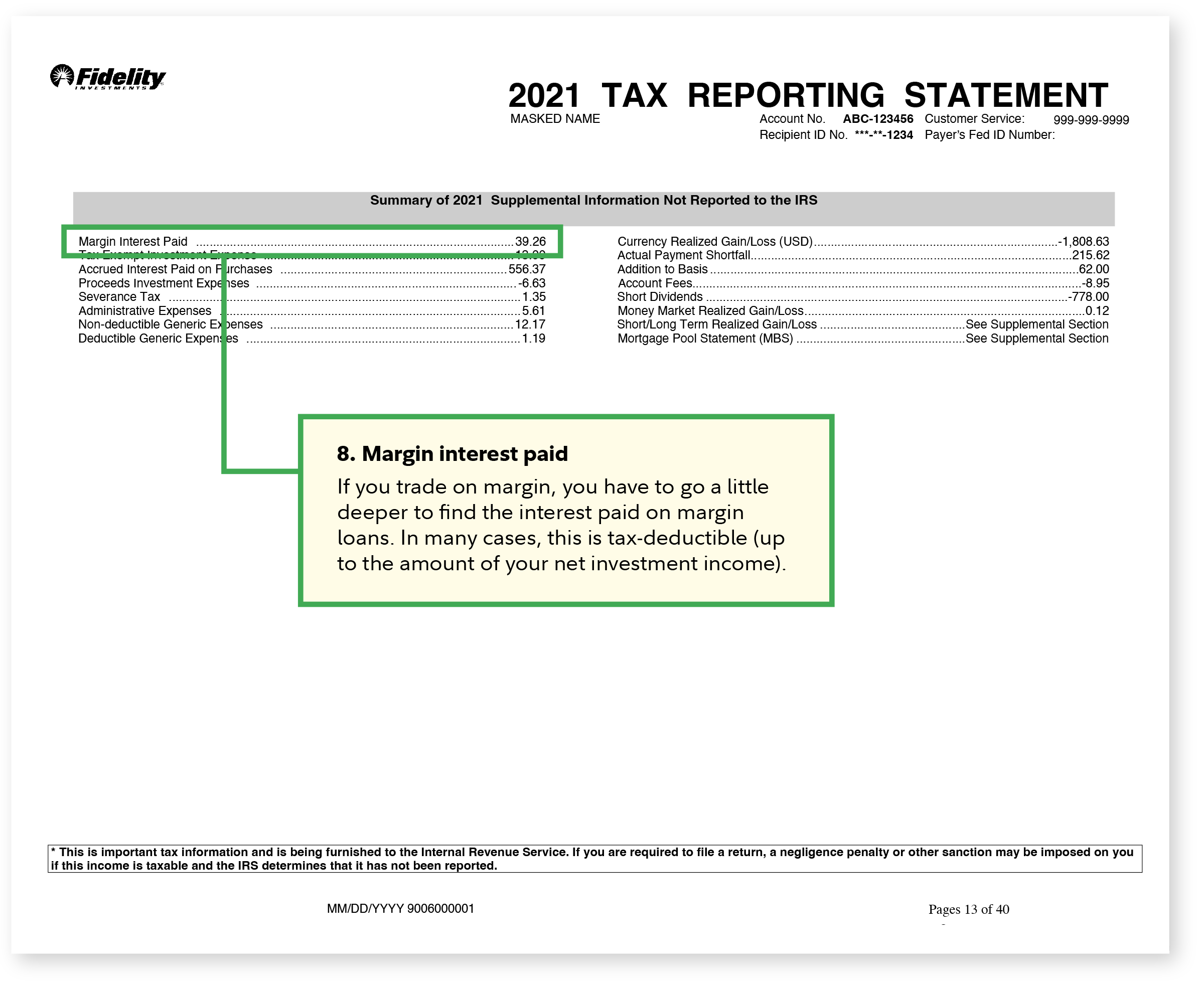

1099 Tax Form 1099 Fidelity

File 1099 5 Important Facts To Know Before Filing Your 1099s

1099 Fillable Form Download Printable Forms Free Online

1099 Fillable Form Download Printable Forms Free Online

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

Form 1099 G Definition

1099 MISC Tax Basics

Who Needs A 1099 Compass Consulting Services

Does Llc S Get 1099 - Does an LLC Partnership Get a 1099 Form 1099 is used by businesses when they paid someone for services who wasn t a regular W 2 employee They are