Does My Air Conditioner Qualify For Tax Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

Key Takeaways You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Does My Air Conditioner Qualify For Tax Credit

Does My Air Conditioner Qualify For Tax Credit

https://www.dynamicservices.com.au/wp-content/uploads/2021/11/1677470-scaled.jpg

4 PROVEN Ways To Reset Your Air Conditioner

https://homecaprice.com/wp-content/uploads/2023/02/reset-button-on-ac-unit-outside_URL.png

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

https://hvacseer.com/wp-content/uploads/2022/04/Minimalist-living-room-with-sofa-and-air-conditioner-1024x683.jpg

Energy Efficient Home Improvement Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation materials Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation

Here are the highlights of ENERGY STAR certified equipment that is eligible for the tax credits Products That Qualify Central air conditioning 300 for air conditioners recognized as ENERGY STAR Most Efficient Air source heat pumps 300 for Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps

Download Does My Air Conditioner Qualify For Tax Credit

More picture related to Does My Air Conditioner Qualify For Tax Credit

Why Is My Air Conditioner Ineffective Efficient Air Service

https://www.efficientairservice.com/wp-content/uploads/Efficient-Air-2020-Infographic-for-Blog.png

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

https://hvacseer.com/wp-content/uploads/2022/04/Carrier-air-conditioner-unit-at-office-2-e1649250081331.jpg

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps The 25C credit has an annual cap of 1 200 except heat pump Up to 600 each for a qualified air conditioner or gas furnace Up to 2 000 with a qualified heat pump heat pump water heater or boiler There are no income requirements for this tax credit and it cannot be combined with other federal programs

Starting in 2023 the tax credit provides homeowners up to 30 of the installation costs for qualified expenditures This tax credit program lasts until December 31 2032 The 25C credit has an annual cap of 30 of the installed costs with a maximum of 1 200 Qualified air conditioners or furnaces may receive up to 600 each The following energy efficient home improvements are eligible for the Energy Efficient Home Improvement Credit insulation materials or systems and air sealing materials or systems 30 of costs Home energy audits 30 of costs up to 150 see Q5 under the General Questions section

These 34 Electric Cars Won t Qualify For Biden s New EV Tax Credits

https://www.carscoops.com/wp-content/uploads/2022/08/EVs-tax-credits.jpg

Rivian Forums R1T R1S Owners News Discussions RIVN Stock

https://www.rivianforums.com/forum/attachments/d428cfec-e782-475a-be36-314fe3df331f-jpeg.30501/

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

https://airconditionerlab.com/what-hvac-systems...

Key Takeaways You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

The Best Self Employed Tax Deductions And Credits In 2022

These 34 Electric Cars Won t Qualify For Biden s New EV Tax Credits

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Why Is My Air Conditioner Leaking Seattle Heating Cooling LLC

Air Conditioning Calculator

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

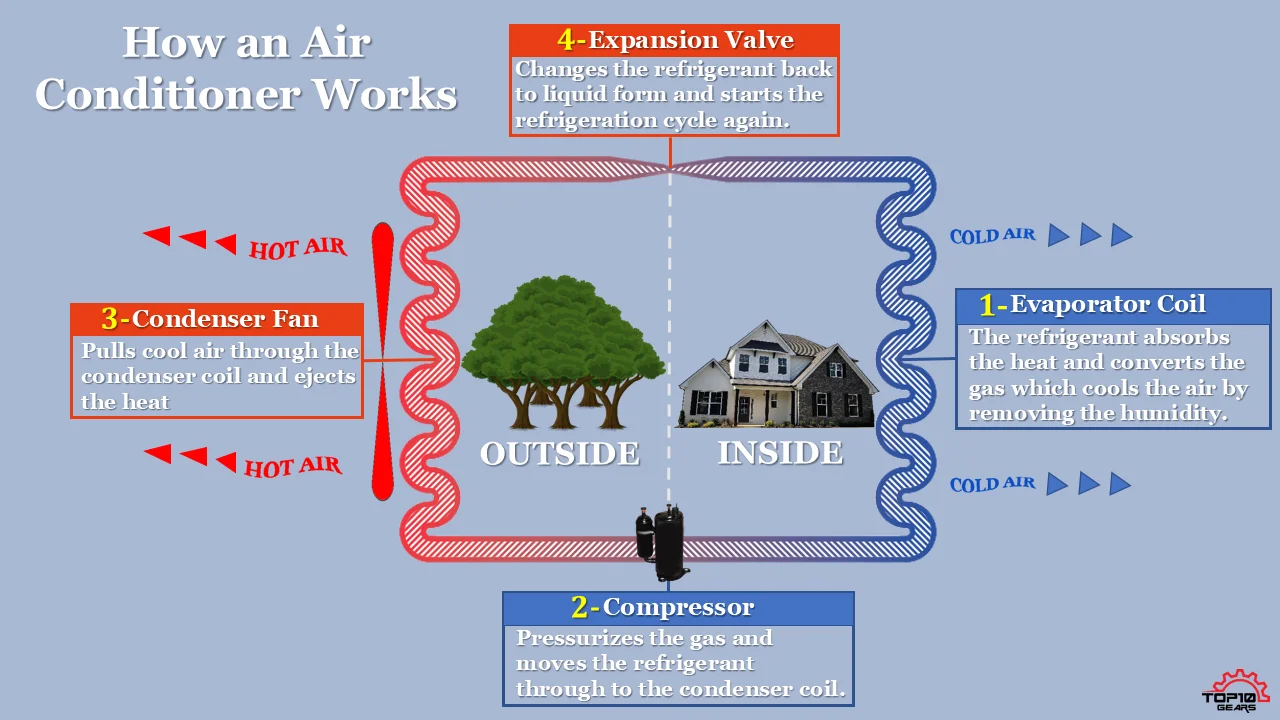

How AC Works All About Working Of An Air Conditioner Top10gears

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

Why Is My Air Conditioner Not Working WM Henderson

Does My Air Conditioner Qualify For Tax Credit - Energy Efficient Home Improvement Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation materials Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a