Does My Heat Pump Qualify For Tax Credit Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695 Print Version PDF YOU CAN CLAIM 30

Tax credits are applied to the tax year you install the heat pump For example if your heat pump is deployed in 2023 you can redeem your credit when you submit your taxes in 2024 for Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses

Does My Heat Pump Qualify For Tax Credit

Does My Heat Pump Qualify For Tax Credit

https://www.certifiedheatandair.com/wp-content/uploads/2017/04/certified-heat-and-air-changing-heat-pump-filters-full.jpg

Why Does My Heat Pump Fan Keep Running Novak Heating

https://www.novakheating.com/wp-content/uploads/2023/01/Why-Does-My-Heat-Pump-Fan-Keep-Running_-1024x660.jpeg

Heat Pump Tax Credits And Rebates Now Available For Homeowners Moneywise

https://media1.moneywise.com/a/23311/heat-pump-tax-credit-rebate_facebook_thumb_1200x628_v20220927160351.jpg

Yes There is a 1 200 aggregate yearly tax credit maximum for all building envelope components home energy audits and energy property Electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves and biomass boilers have a separate aggregate yearly credit limit of 2 000 There are tax credits available in 2024 to help pay for your heat pump If you install an efficient heat pump you are eligible for a federal tax credit that will cover 30 up to 2 000 of the heat pump cost and installation

Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year For example installing an eligible air source heat pump can qualify for a 30 tax credit worth up to 2 000 for systems installed from 2023 2032 Credits decrease slightly after 2032 but still provide substantial savings

Download Does My Heat Pump Qualify For Tax Credit

More picture related to Does My Heat Pump Qualify For Tax Credit

2023 EV Tax Credit How To Save Money Buying An Electric Car Money

https://img.money.com/2022/12/News-Save-buying-electric-car-using-tax-credits.jpg?quality=85

Expired Tax Credits Expected To Be Renewed 2022 04 14 ACHR News

https://www.achrnews.com/ext/resources/2022/04-April/Heat-Pump-Tax-Credit.jpg?1649877799

5 Reasons To Buy A 2022 Hyundai Ioniq 5 Not A Ford Mustang Mach E

https://www.motorbiscuit.com/wp-content/uploads/2022/06/Hyundai-Ioniq-5.jpg

Who Qualifies for a Heat Pump Tax Credit or Rebate Any taxpayer would qualify for the federal tax credits For the tax credit program the new incentives will apply to equipment installed on The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the maximum federal tax credit for installing a heat pump increased to 30 of your project costs up to 2 000 under the

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems

Air Source Heat Pump Tax Credit 2023 Comfort Control

https://comfortcontrolspecialists.com/wp-content/uploads/2023/06/CCS-Air-Source-Heat-Pumps-Tax-Credit-750x420.jpg

Ioniq 5 And Many Other EVs May Lose Federal Tax Credit Eligibility

https://i.ytimg.com/vi/CP9u7GMQ6Qg/maxresdefault.jpg

https://www.energystar.gov/.../air-source-heat-pumps

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695 Print Version PDF YOU CAN CLAIM 30

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit

Tax credits are applied to the tax year you install the heat pump For example if your heat pump is deployed in 2023 you can redeem your credit when you submit your taxes in 2024 for

Heat Pump Covers From Hideawayz New Zealand Louvre Powder Coated

Air Source Heat Pump Tax Credit 2023 Comfort Control

Ev Car Tax Rebate Calculator 2023 Carrebate

Can I Combine My Heat Pump With A Gas Boiler Etc YouTube

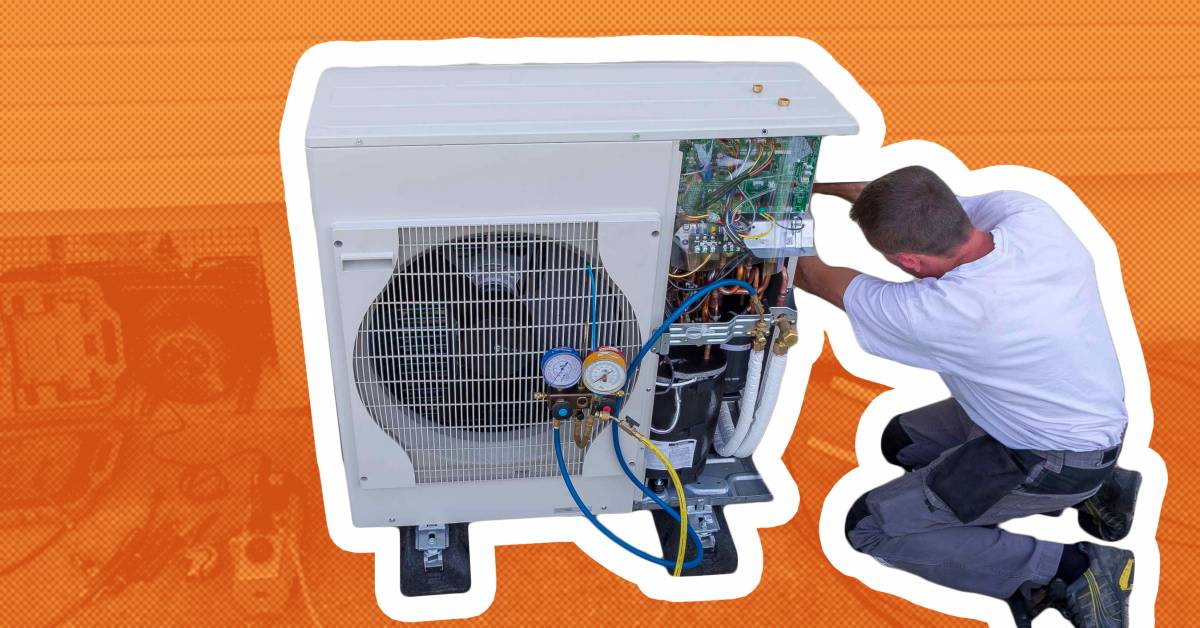

Heat Pump Repair Vancouver Lower Mainland Atmosphere AC Systems

The Inflation Reduction Act pumps Up Heat Pumps Hvac

The Inflation Reduction Act pumps Up Heat Pumps Hvac

How Long Will My Heat Pump Last YouTube

How To Calculate Electric Car Tax Credit OsVehicle

Rivian Forums R1T R1S Owners News Discussions RIVN Stock

Does My Heat Pump Qualify For Tax Credit - Bosch Home Comfort has numerous products that qualify for Federal state and local credits and incentives Our geothermal heat pumps tankless water heaters and high efficiency boilers are designed to save energy money and reduce dependence on non renewable natural resources