Does New Jersey Tax Your Pension And Social Security But if your pension would normally be taxable New Jersey does have a retirement income exclusion commonly called the pension exclusion This allows

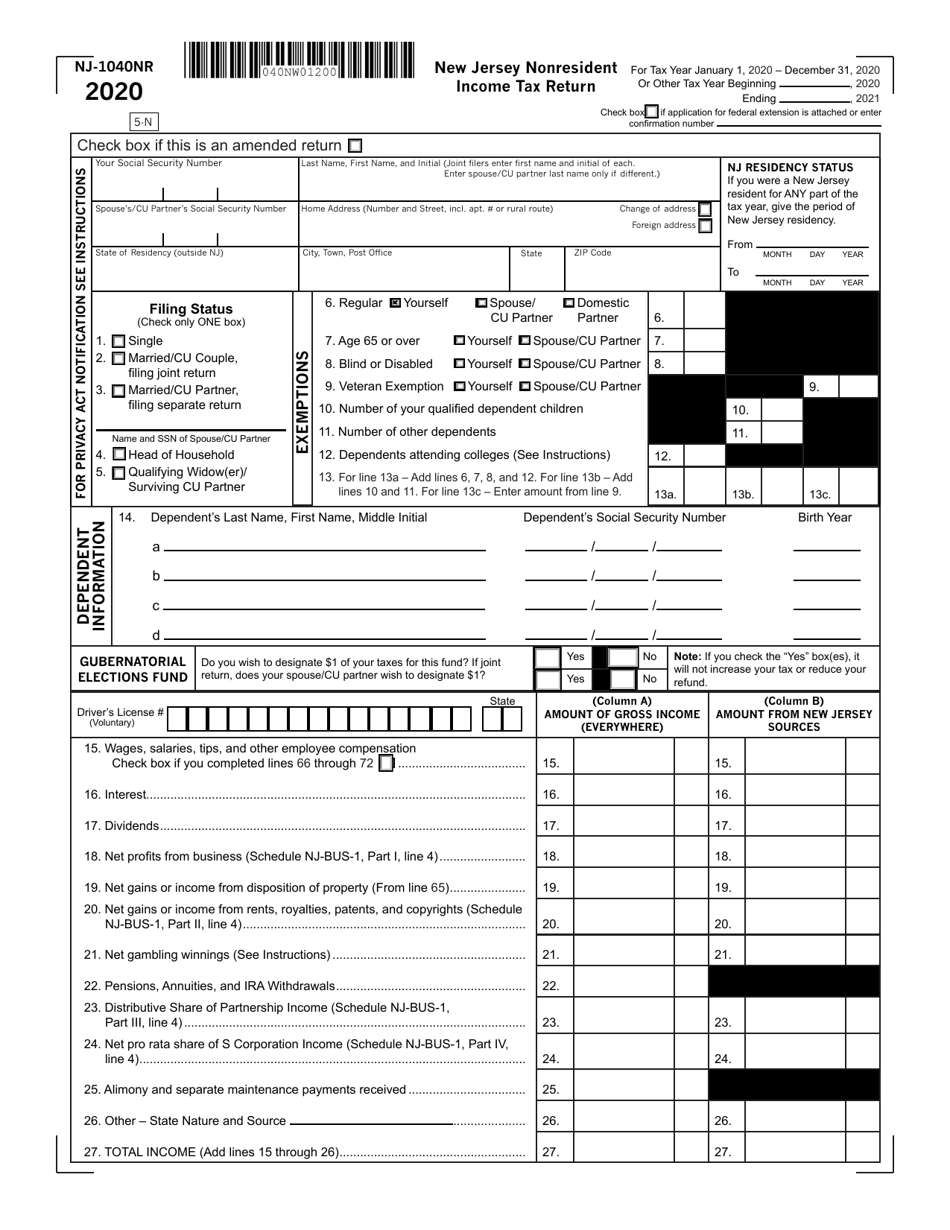

Pensions and Annuities Pension and annuity income are taxable and must be reported on your New Jersey Income Tax return In some cases the taxable pension or annuity You qualify for the pension exclusion if You and or your spouse civil union partner if filing jointly were 62 or older or disabled as defined by Social Security guidelines on the last

Does New Jersey Tax Your Pension And Social Security

Does New Jersey Tax Your Pension And Social Security

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2017/12/01/USATODAY/usatsports/retirement-1-getty_large.jpg?width=3200&height=1680&fit=crop

Workers Pension Fund Not For Borrowing NLC Warn Governors

https://lawcarenigeria.com/wp-content/uploads/2020/12/pension-e1562619027391.jpg

Verw sten Gew hnliche Zur cktreten New Jersey Tax Free Verbrannt

https://www.njpp.org/wp-content/uploads/2017/09/NJ-income-tax-bracketsproposed-01.jpg

Military pensions are not reportable but civil service pensions are New Jersey does not tax Social Security benefits Please subscribe now and support the local journalism YOU rely New Jersey provides several avenues for retirees to potentially exclude a portion of their pension income from taxation Individuals aged 62 or older may qualify

How your pension is taxed You can find informa tion on both the three year rule and the general rule methods in the instructions for the Form NJ 1040 If you are at least 62 or The following benefits are not taxable and should not be reported as pension income Social Security and Railroad Retirement benefits Pension payments received

Download Does New Jersey Tax Your Pension And Social Security

More picture related to Does New Jersey Tax Your Pension And Social Security

Tips For Senior Citizens In Managing Debt And Enjoy Your Retirement

https://i.pinimg.com/736x/ff/0d/90/ff0d9097e44226396ef6b6ab86911a36.jpg

Can I Get VA Pension And Social Security Wildoner Law PLLC

https://wildonerlaw.com/wp-content/uploads/2021/06/SS-072721.jpg

Esop Payout Calculator

https://www.mortgagecalculator.org/images/pension-fund.png

Does New Jersey tax Social Security benefits No But you may pay federal taxes on a portion of your Social Security benefits depending on your income Up to 50 Since New Jersey does not tax Social Security income the 100 000 does not include Social Security he said In 2020 the maximum pension exclusion was 100 000 for

And let s be clear New Jersey does indeed provide a range of tax benefits that can make it a financially attractive option for retirees The generous pension exclusions property tax To be eligible you and or your spouse or civil union partner if filing jointly must be 62 or older or disabled as defined by Social Security guidelines on the last day

INPRS PERF Pension Payment Dates

https://www.in.gov/inprs/images/2023PERF-TRFPaymentDateCalendar.jpg

LOVE YOUR MONEY New Jersey On Path To Tying For Highest Corporate Tax

https://files.taxfoundation.org/20180312103730/NJCIT2018-02.png

https://www.nj.com/advice/2020/02/i-get-a-pension...

But if your pension would normally be taxable New Jersey does have a retirement income exclusion commonly called the pension exclusion This allows

https://www.nj.gov/treasury/taxation/documents/pdf/...

Pensions and Annuities Pension and annuity income are taxable and must be reported on your New Jersey Income Tax return In some cases the taxable pension or annuity

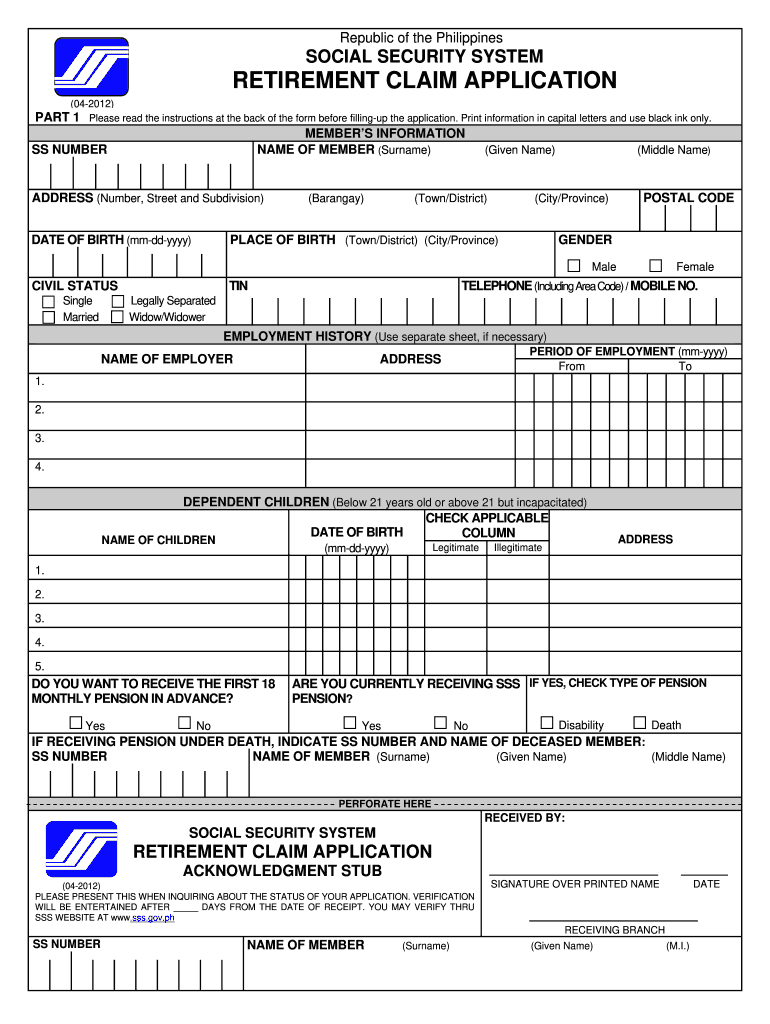

Social Security Retirement Application Form PDF Fill Out And Sign

INPRS PERF Pension Payment Dates

Pension Payment Dates 2019 Malaysia Social Security Super Taxes

Isp 3033 2018 2024 Form Fill Out And Sign Printable PDF Template

Nj Tax Refund Status Skylasem

Will A Government Pension Reduce My Social Security Benefits Coastal

Will A Government Pension Reduce My Social Security Benefits Coastal

Teacher s Retirement And Social Security Social Security Intelligence

What Is A Pension Plan And How Does It Work GOBankingRates

When To File For Social Security Retirement Benefits Early

Does New Jersey Tax Your Pension And Social Security - Income wise filers whose NJ gross income all income except Social Security benefits New Jersey municipal bond interest and Federal government bond