Does Nj Tax Pensions Verkko Pensions and Annuities Pension and annuity income are taxable and must be reported on your New Jersey Income Tax return In some cases the taxable pension or annuity amount that you report on your New Jersey return may differ from the amount reported on your federal return

Verkko 4 jouluk 2023 nbsp 0183 32 If you are a New Jersey resident your pensions annuities and certain IRA withdrawals are taxable and must be reported on your New Jersey tax return However the taxable amount you report for federal tax purposes may not be the same as the amount you report for New Jersey purposes Verkko Overview of New Jersey Retirement Tax Friendliness Social Security is not taxed at the state level in New Jersey State income taxes will also be low for any retirees with income from retirement accounts and pensions below 75 000 for single filers or 100 000 for joint filers

Does Nj Tax Pensions

Does Nj Tax Pensions

https://leestaxservicellc.com/files/IMG_1348.png

Pensions Bulletin 2023 36 Lane Clark Peacock LLP

https://www.lcp.com/media/xcyhtj4r/new-pensions-bulletin-1200x627_v02.jpg

Want To Retire In Arizona Here s What You Need To Know Vision

https://images.squarespace-cdn.com/content/v1/5e987637e1c6961885db98a3/1666228079112-NCP07GQMAT4TPX946TMO/Vision_Blogs_October_Set2_Retiring+in+AZ.png

Verkko Taxation of Retirement Benefits This fact sheet contains general information about federal and New Jersey State income taxes and your retirement benefits from the New Jersey Divi sion of Pensions amp Beneits NJDPB The NJDPB cannot provide tax advice Verkko 11 tammik 2023 nbsp 0183 32 Since you retired in September of 2021 Gallo said you would most likely not have to pay New Jersey income taxes on your state pension until late 2024 or early 2025

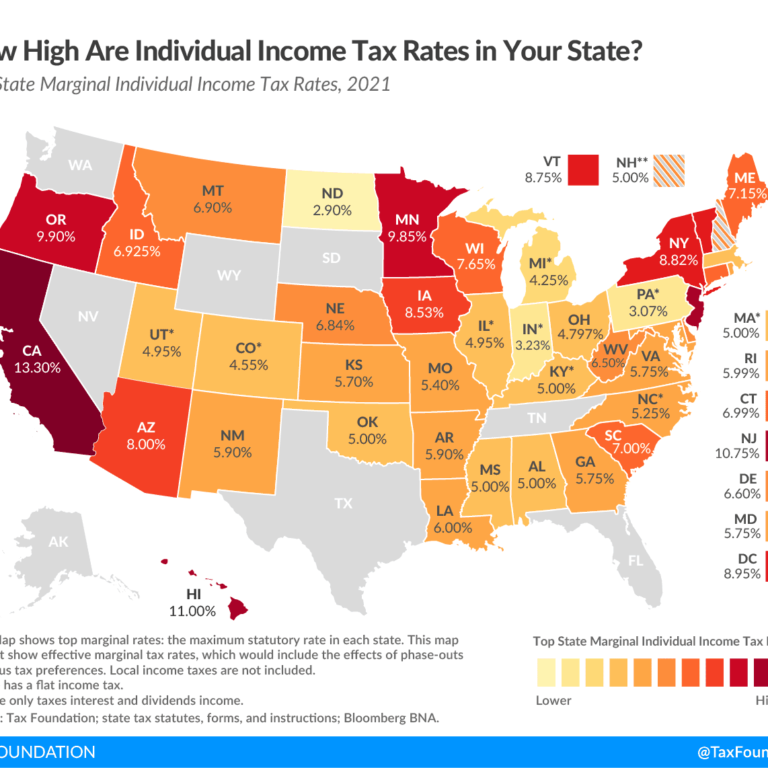

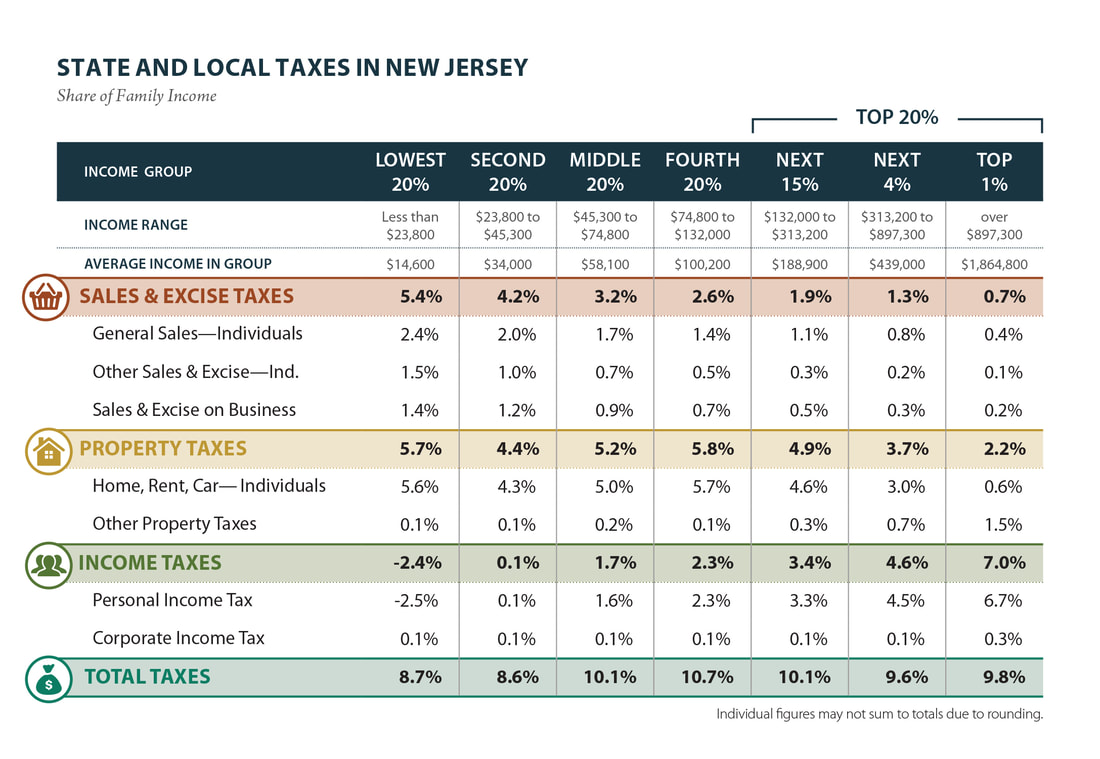

Verkko 22 kes 228 k 2021 nbsp 0183 32 New Jersey is historically one of the most expensive places to live in the United States In an effort to stop retirees from leaving the state starting in 2017 the state raised the amount of Verkko Alabama taxes on retirees A new law for 2023 makes the first 6 000 or distributions from retirement plans like IRAs and 401 k s tax exempt for retirees age 65 and older in Alabama

Download Does Nj Tax Pensions

More picture related to Does Nj Tax Pensions

Retiring These States Won t Tax Your Distributions

https://www.taxdefensenetwork.com/wp-content/uploads/2021/11/states-and-retirement-taxes-1-2500x1875.jpg

Wordly Account Gallery Of Photos

https://www.marylandmatters.org/wp-content/uploads/2021/05/Gaines-editor-final-1.jpg

States That Won t Tax Your Retirement Distributions In 2021

https://i.pinimg.com/originals/dc/a0/56/dca056eaee2dec98ced133abee117640.png

Verkko 4 jouluk 2023 nbsp 0183 32 You worked hard during your career to provide income through your retirement The State of New Jersey offers some retirement income exclusions you may qualify to use that can reduce your taxable income The current income limit for a Retirement Income Exclusion is 150 000 Pension Exclusion Total Income Verkko New Jersey does not tax U S military pensions or survivorship benefits But that exemption does not apply to civil service pensions or annuities even if it s based on military

Verkko 28 tammik 2022 nbsp 0183 32 New Jersey does not tax U S military pensions or survivorship benefits But that exemption does not apply to civil service pensions or annuities even if it s based on military service he said But New Jersey also has a pension exclusion for those who are 62 or older or permanently disabled or blind Karu said Verkko 6 syysk 2019 nbsp 0183 32 How will my pension be taxed in New Jersey Photo pixabay Q I just moved to New Jersey from Florida I have a pension from New York State for 55 000 How will my pension be taxed in New Jersey Newbie A Welcome to the Garden State You ve got a few things to consider

Kentucky Teachers Defend A Broken Pension System National Review

https://i0.wp.com/www.nationalreview.com/wp-content/uploads/2018/04/budget-pensions.jpg?fit=1200%2C700&ssl=1

Sovereign Pensions International Pension Services Offshore Pensions

https://www.sovereigngroup.com/wp-content/uploads/2021/04/shutterstock_714081109-bwg-1.jpg

https://www.nj.gov/treasury/taxation/documents/pdf/guides…

Verkko Pensions and Annuities Pension and annuity income are taxable and must be reported on your New Jersey Income Tax return In some cases the taxable pension or annuity amount that you report on your New Jersey return may differ from the amount reported on your federal return

https://www.nj.gov/treasury/taxation/njit6.shtml

Verkko 4 jouluk 2023 nbsp 0183 32 If you are a New Jersey resident your pensions annuities and certain IRA withdrawals are taxable and must be reported on your New Jersey tax return However the taxable amount you report for federal tax purposes may not be the same as the amount you report for New Jersey purposes

Act Now To Maximise Your Pension Contributions

Kentucky Teachers Defend A Broken Pension System National Review

State Pension MbarakDaeney

What States Do Not Tax Federal Pensions Government Deal Funding

Pensions The Liot Group Will File A Bill To Repeal The Reform Time News

NJ Lawmakers Moving Quickly To Boost Pensions For Some Of Their Own

NJ Lawmakers Moving Quickly To Boost Pensions For Some Of Their Own

Tax On Pensions Beware The Tax Trap GBM Accounts

New Jersey Taxes NewJerseyAlmanac

Tax Policy And The Family Cornerstone

Does Nj Tax Pensions - Verkko 11 tammik 2023 nbsp 0183 32 Since you retired in September of 2021 Gallo said you would most likely not have to pay New Jersey income taxes on your state pension until late 2024 or early 2025