Does Nj Tax Social Security Retirement Benefits Social Security Railroad Retirement and Disability Benefits Social Security and Railroad Retirement benefits are not taxable under the New Jersey ncome ITax and should not be reported as income on your State return

Thirty seven states and D C either have no income tax AK FL NV SD TN TX WA WY or do not include Social Security benefits in their calculation for taxable income AL AZ AR CA DE DC GA HI ID IL IN IA KY LA ME MD MA MI MS NH NJ NY NC OH OK OR PA SC VA WI And let s be clear New Jersey does indeed provide a range of tax benefits that can make it a financially attractive option for retirees The generous pension exclusions property tax relief programs and exemptions for Social Security benefits can significantly reduce tax liabilities and help retirees maintain their financial well being

Does Nj Tax Social Security Retirement Benefits

Does Nj Tax Social Security Retirement Benefits

https://i.ytimg.com/vi/Q7Pg2M8W0Jc/maxresdefault.jpg

10 States With The Highest Average Social Security Retirement Benefit

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/05/12/USATODAY/usatsports/MotleyFool-TMOT-136b9a5a-d37e830e.jpg?width=3200&height=1680&fit=crop

Social Security Retirement Application Form Fill Out And Sign

https://www.signnow.com/preview/492/746/492746308/large.png

In an effort to stop retirees from leaving the state starting in 2017 the state raised the amount of retirement income that could be excluded from state taxes for those age 62 and older Retirement benefits except for Accidental Disability Retirement and Accidental Death benefits are sub ject to federal income tax However if you paid tax on any of your contributions to the retirement system in the past the portion of your monthly retirement ben efits representing a return of your previously taxed contributions is not taxable

Nontaxable Retirement Income The following benefits are not taxable and should not be reported as pension income Social Security and Railroad Retirement benefits Pension payments received because of permanent and total disability before age 65 The current income limit for a Retirement Income Exclusion is 150 000 Pension Exclusion Other Retirement Income Exclusion Special Exclusion Tax Year 2020 and Prior See the NJ 1040 instructions or Tax Topic Bulletin GIT 1 2 Retirement Income for more information Last Updated Monday 12 04 23

Download Does Nj Tax Social Security Retirement Benefits

More picture related to Does Nj Tax Social Security Retirement Benefits

How To Maximize Your Social Security Retirement Benefits National

https://national-disability-benefits.org/wp-content/uploads/2020/09/AdobeStock_126525020.jpeg

Retiring These States Won t Tax Your Distributions

https://www.taxdefensenetwork.com/wp-content/uploads/2021/11/states-and-retirement-taxes-1-2500x1875.jpg

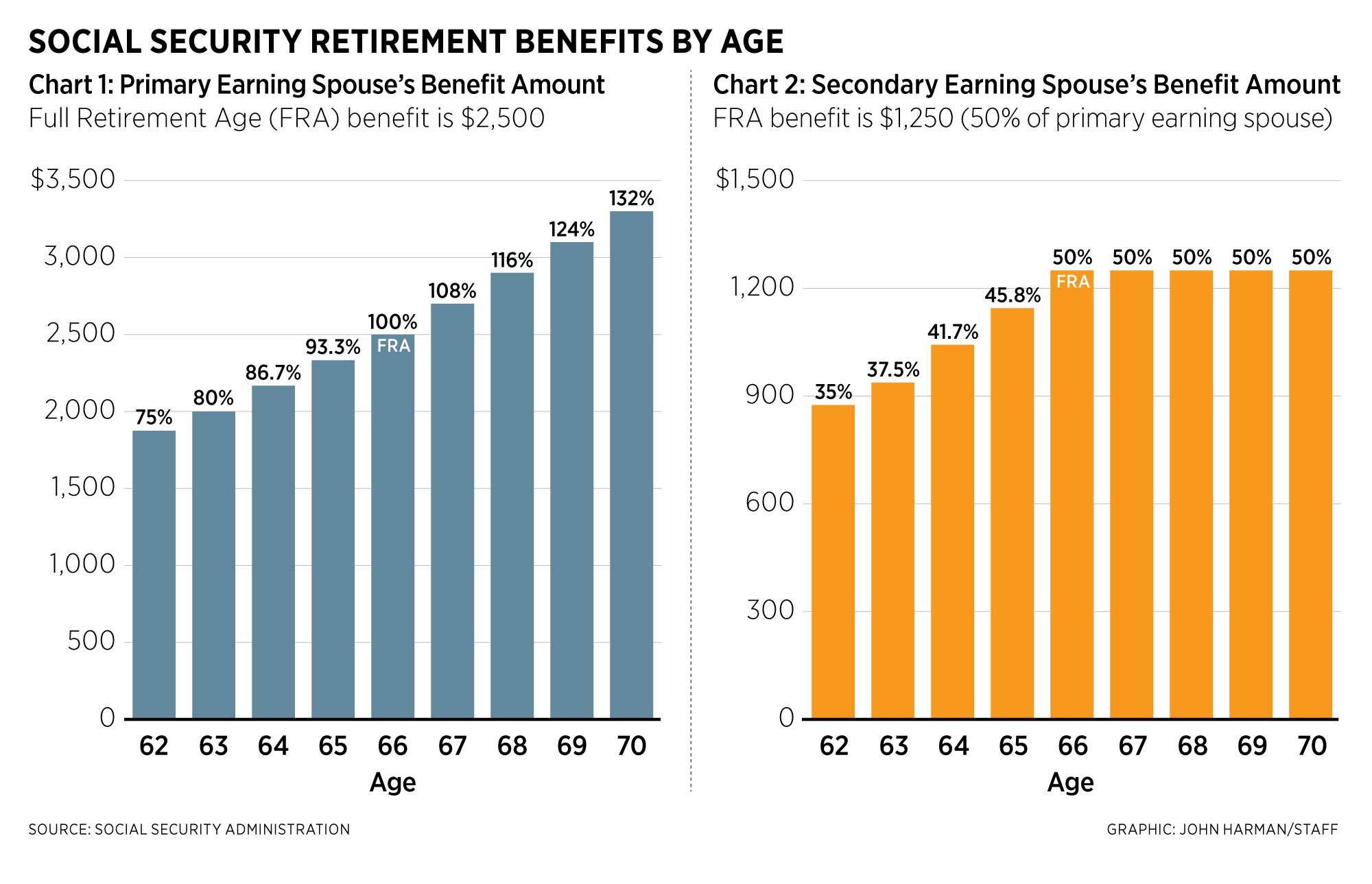

Social Security Retirement Age Chart Early Retirement

https://www.moaa.org/uploadedfiles/social-security-retirement-benefit_chart-internal.jpg

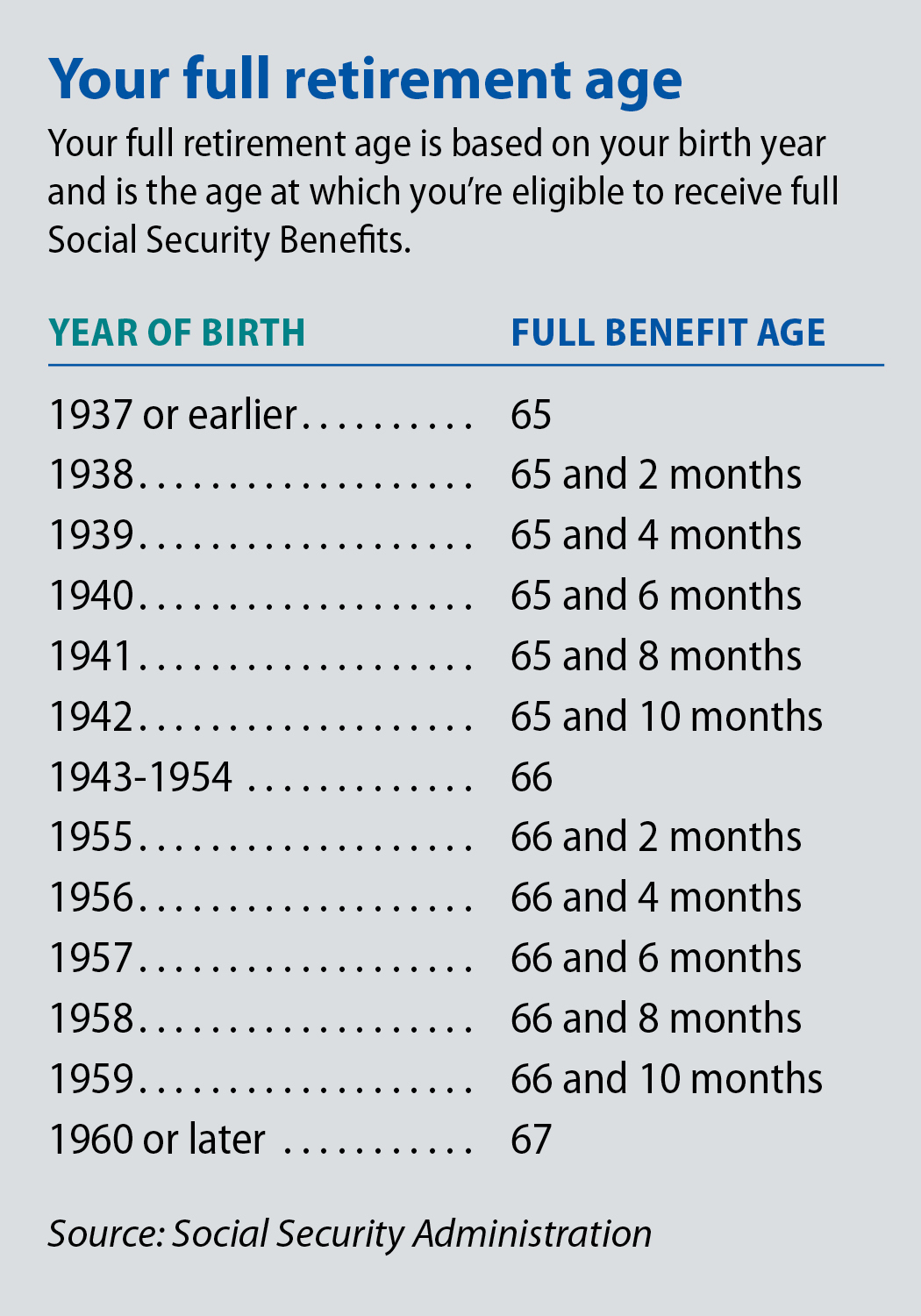

New Jersey tax on retirement income New Jersey doesn t tax Social Security retirement benefits Military pensions or Railroad Retirement benefits Taxpayers 62 and older or those who have a Online Guide to Retirement Retirement is a big step in life This guide will help you get information and make informed decisions about your retirement Please select the topic below to get more information Eligibility For Retirement Disability Retirement Survivor Benefits

For provisional income between 25 000 and 34 000 up to 50 of Social Security benefits are taxable If provisional income exceeds 34 000 up to 85 of benefits will be taxable The New Jersey retirement income tax exclusion is increasing but the qualifying cap is not The state doesn t tax Social Security benefits at all and even provides a special exclusion for taxpayers aged 62 and up who are not eligible for Social Security or Railroad Retirement benefits Posted on December 30 2017

When To Begin Taking Social Security Benefits PlanMember

https://cdn.planmember.com/fcdev/wp-content/uploads/sites/74/2022/06/SSChart2022.jpg

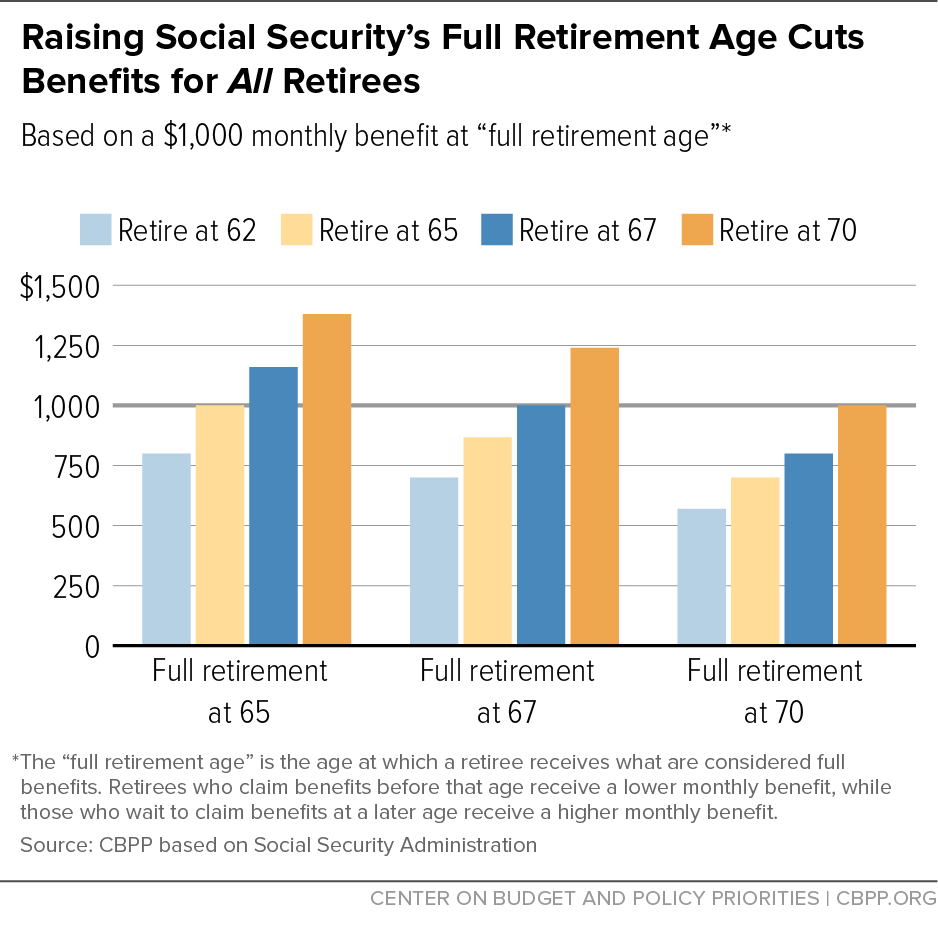

Raising Social Security s Retirement Age Cuts Benefits For All Retirees

https://www.cbpp.org/sites/default/files/styles/report_580_high_dpi/public/atoms/files/full-retirement-1.20.png?itok=oP3wIerO

https://www.nj.gov/treasury/taxation/documents/pdf/...

Social Security Railroad Retirement and Disability Benefits Social Security and Railroad Retirement benefits are not taxable under the New Jersey ncome ITax and should not be reported as income on your State return

https://taxfoundation.org/data/all/state/states...

Thirty seven states and D C either have no income tax AK FL NV SD TN TX WA WY or do not include Social Security benefits in their calculation for taxable income AL AZ AR CA DE DC GA HI ID IL IN IA KY LA ME MD MA MI MS NH NJ NY NC OH OK OR PA SC VA WI

Understanding Social Security Retirement Benefits Part I

When To Begin Taking Social Security Benefits PlanMember

Why Raising Social Security s Full Retirement Age Won t Be Easy

7 Hard to Believe Social Security Facts The Motley Fool

Bloomberg Lays Out Plans For Social Security Retirement Savings

Taxes On Social Security Benefits Inflation Protection

Taxes On Social Security Benefits Inflation Protection

How Do Dividends Affect Social Security Benefits Intelligent Income

When To File For Social Security Retirement Benefits Early

States That Tax Social Security Benefits Tax Foundation

Does Nj Tax Social Security Retirement Benefits - The current income limit for a Retirement Income Exclusion is 150 000 Pension Exclusion Other Retirement Income Exclusion Special Exclusion Tax Year 2020 and Prior See the NJ 1040 instructions or Tax Topic Bulletin GIT 1 2 Retirement Income for more information Last Updated Monday 12 04 23