Does Nps Have Tax Benefit National Pension Scheme NPS is a government sponsored pension scheme Know about National Pension Scheme tax benefits eligibility returns interest

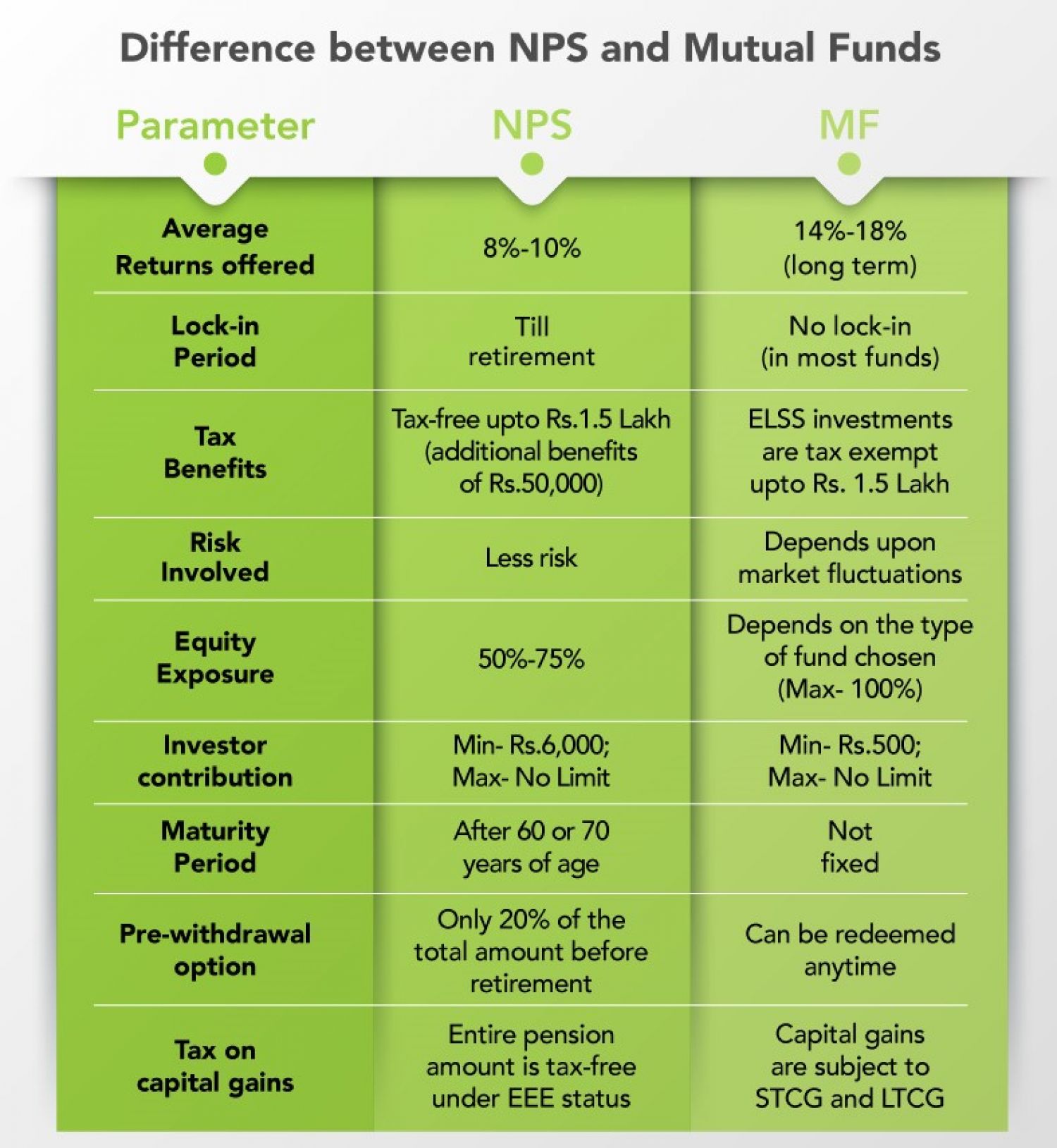

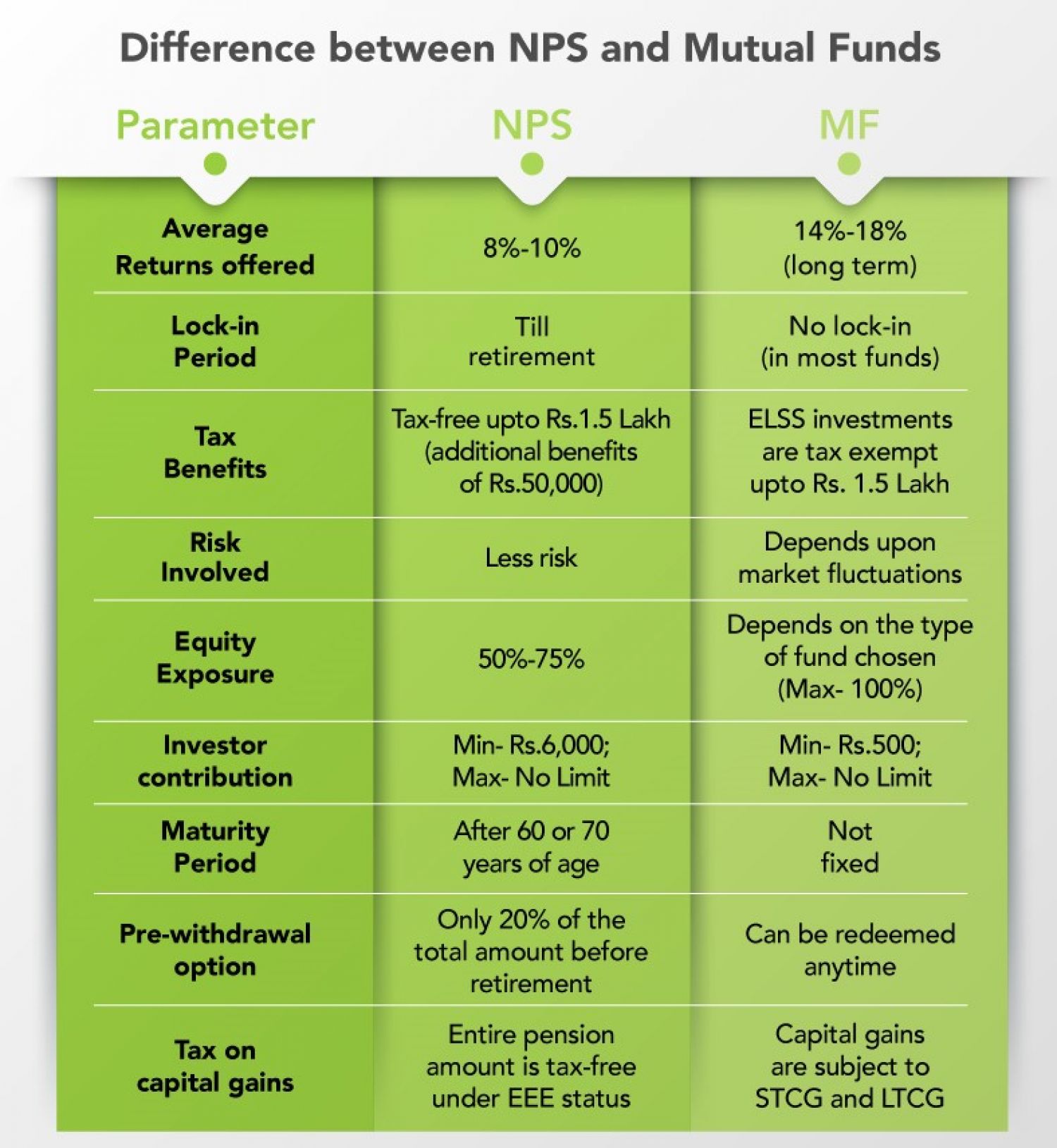

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 Yes NPS is a government backed retirement scheme which also provides taxation benefits under Section 80C of Income Tax Act It is independent of any investment made in provident or pension

Does Nps Have Tax Benefit

Does Nps Have Tax Benefit

https://carajput.com/art_imgs/why-we-should-invest-in-nps-just-for-the-tax-benefits.jpg

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

https://www.relakhs.com/wp-content/uploads/2019/08/Latest-NPS-Income-Tax-Benefits-for-FY-2019-2020-AY-2020-2021-pic.jpg

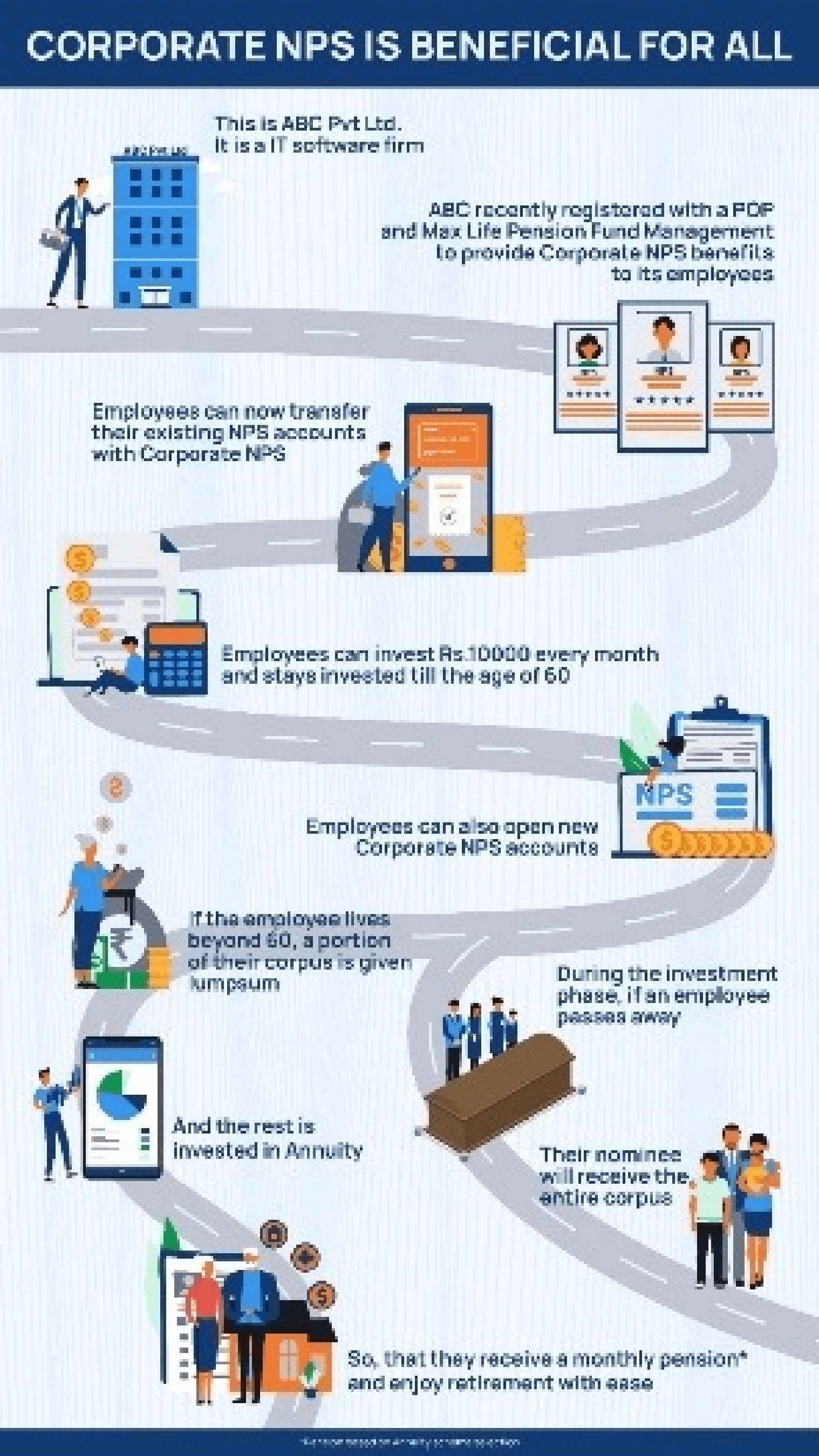

Employer contributions to NPS are part of taxable salary and employees can claim deductions under 80CCD 1 80CCD 1B and 80CCD 2 Learn how to calculate Employer s NPS contribution for the benefit of employee up to 10 of salary Basic DA is deductible from taxable income up to 7 5 Lakh Corporates Employer s Contribution

Contrary to popular belief an NPS account holder cannot withdraw the entire corpus after retirement and it is mandatory to keep aside at least 40 of the corpus to receive a regular pension from a You can get a tax benefit of up to 10 of the basic salary DA under section 80 CCD 1 up to the cumulative Rs 1 5 lakh limit under section 80C Also you can avail of an

Download Does Nps Have Tax Benefit

More picture related to Does Nps Have Tax Benefit

National Pension Scheme NPS

https://www.nirmalbang.com/App_Themes/images/nps-banner-new.png

Nps Solutions

https://www.maxlifepensionfund.com/content/dam/pfm/nps-solutions/corporate-nps-working-image.png

What Is A Nps Score

https://learn.g2crowd.com/hubfs/NPS-calculation.jpg

What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible As a self employed individual contributing to NPS you can claim an NPS tax benefit of up to 20 of your gross income under Section 80 CCD 1 and tax deduction

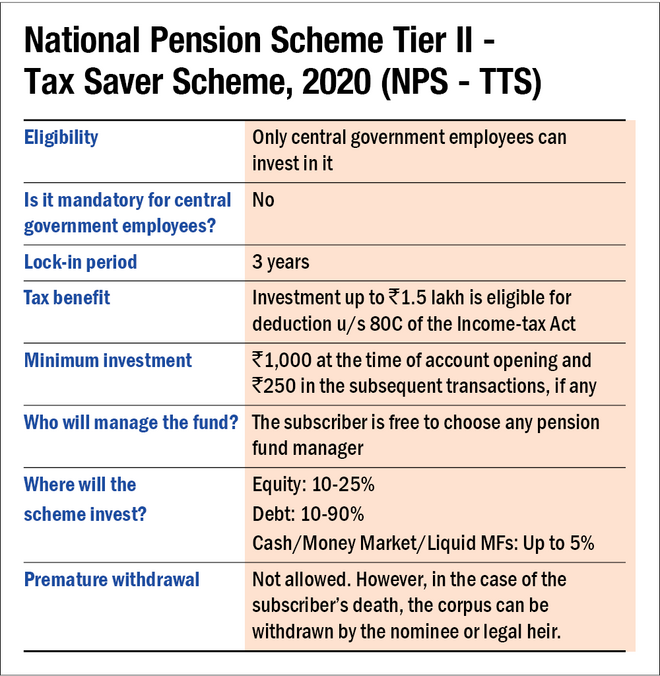

NPS National Pension Scheme tax benefits available only in Tier 1 NPS accounts NPS tax saving comes under Sec 80CCD 1 80CCD 1B 80CCD 2 deduction NPS is a low cost pension and investment product among the many NPS scheme benefits Besides being effective for retirement planning it is a key tool offering secure long term

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2016/10/NPS-Tax-Benefits.jpg

Understanding NPS Tax Benefit Eligibility Deductions Privileges

https://www.wishfin.com/blog/wp-content/uploads/2023/03/Understanding-NPS-Tax-Benefit.jpg

https://cleartax.in/s/nps-national-pension-scheme

National Pension Scheme NPS is a government sponsored pension scheme Know about National Pension Scheme tax benefits eligibility returns interest

https://npstrust.org.in/benefits-of-nps

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1

NPS Tax Benefit U s 80CCD 1 80CCD 2 And 80CCD 1B

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

You Can Claim This NPS Tax Benefit Under The New Income Tax Rates

NPS Tax Benefit And How To Withdraw It Times Of India

Top 5 Tax Benefit Questions Asked By Insurance Buyers Mintpro

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

NPS Are You Overestimating The Tax Benefit Unovest

New NPS Tier II Scheme Gives Tax Benefit To Central Government

Student Tax Credits And Deductions Loans Canada

Does Nps Have Tax Benefit - Employer contributions to NPS are part of taxable salary and employees can claim deductions under 80CCD 1 80CCD 1B and 80CCD 2 Learn how to calculate