Does Ohio Tax Pensions And Social Security Ohio does not tax Social Security benefits Ohio s income tax return starts with federal adjusted gross income which includes the taxable portion of your Social Security benefits if any To

While Ohio does not tax Social Security other types of retirement income such as pensions and 401 k withdrawals may still be taxable Ohio provides a retirement income Ohio does not tax Social Security retirement benefits including those that are taxed federally That along with the state s low cost of living can make it possible for some to live off Social Security benefits alone in many Ohio counties

Does Ohio Tax Pensions And Social Security

Does Ohio Tax Pensions And Social Security

https://g.foolcdn.com/editorial/images/705818/smiling-couple-sitting-outdoors.jpg

14 States That Don t Tax Pensions AND Social Security

https://s.yimg.com/ny/api/res/1.2/gZDdA36unNhGgkbeIk6T7g--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTY0MA--/https://media.zenfs.com/en/insidermonkey.com/b385056a105cf786248daee155a38111

State by State Guide To Taxes On Retirees Flagel Huber Flagel

https://fhf-cpa.com/wp-content/uploads/2022/05/retiree-tax-map-2021.png

Ohio only taxes retirement income included in federal adjusted gross income If your rollover did not result in you recognizing income on your federal return it will not be taxable to Ohio Although Social Security benefits are exempt other income sources like pensions retirement account withdrawals and investments are taxed Ohio applies a progressive tax

In general government pensions and retirement income are taxed in Ohio but there are some exceptions Social Security and some railroad retirement and military benefits are not taxed Also Ohio does not tax Whether your pension is subject to income taxes which it is in Ohio depends on your state and your pension When you are working you are subject to federal and state income tax if your state has one and Medicare and Social

Download Does Ohio Tax Pensions And Social Security

More picture related to Does Ohio Tax Pensions And Social Security

Social Security Benefits What Are The Best States To Retire For Taxes

https://phantom-marca.unidadeditorial.es/87de64cd0918352a0ee54d3ed50d1ac0/resize/1320/f/jpg/assets/multimedia/imagenes/2022/09/06/16624716085172.jpg

Does Idaho Tax Pensions And Social Security Grim Record Frame Store

https://d3i6fh83elv35t.cloudfront.net/static/2018/03/RTSW36K-768x482.jpg

Want To Retire In Arizona Here s What You Need To Know Vision

https://images.squarespace-cdn.com/content/v1/5e987637e1c6961885db98a3/1666228079112-NCP07GQMAT4TPX946TMO/Vision_Blogs_October_Set2_Retiring+in+AZ.png

Ohio income taxes in retirement Ohio doesn t tax Military pensions Railroad Retirement benefits or Social Security The state sales tax rate in Ohio is 5 75 Localities can add 52 rowsRetirement income and Social Security not taxable Tax info 601 923 7700 or dor ms gov Deduct public pension up to 37 720 or maximum social security benefit

Ohio does not tax Social Security although it does tax other forms of retirement income Retirees in Ohio should be aware however that state laws concerning Social Thirteen states tax Social Security benefits a matter of significant interest to retirees Each of these states has its own approach to determining what share of benefits is

Are You Due A Huge Pension Tax Refund Which News

https://s3.eu-west-1.amazonaws.com/prod.news.product.which.co.uk/news/wp-content/uploads/2017/03/Pensions.jpg

Does Idaho Tax Pensions And Social Security Ensure A Good Forum

https://www.sco.idaho.gov/Pages/img/fishing-snake-river-swan-falls-2_26690559116_o.jpg

https://tax.ohio.gov › individual › file-now › senior...

Ohio does not tax Social Security benefits Ohio s income tax return starts with federal adjusted gross income which includes the taxable portion of your Social Security benefits if any To

https://gudorffinancial.com › blog › how-social...

While Ohio does not tax Social Security other types of retirement income such as pensions and 401 k withdrawals may still be taxable Ohio provides a retirement income

Retiring These States Won t Tax Your Distributions

Are You Due A Huge Pension Tax Refund Which News

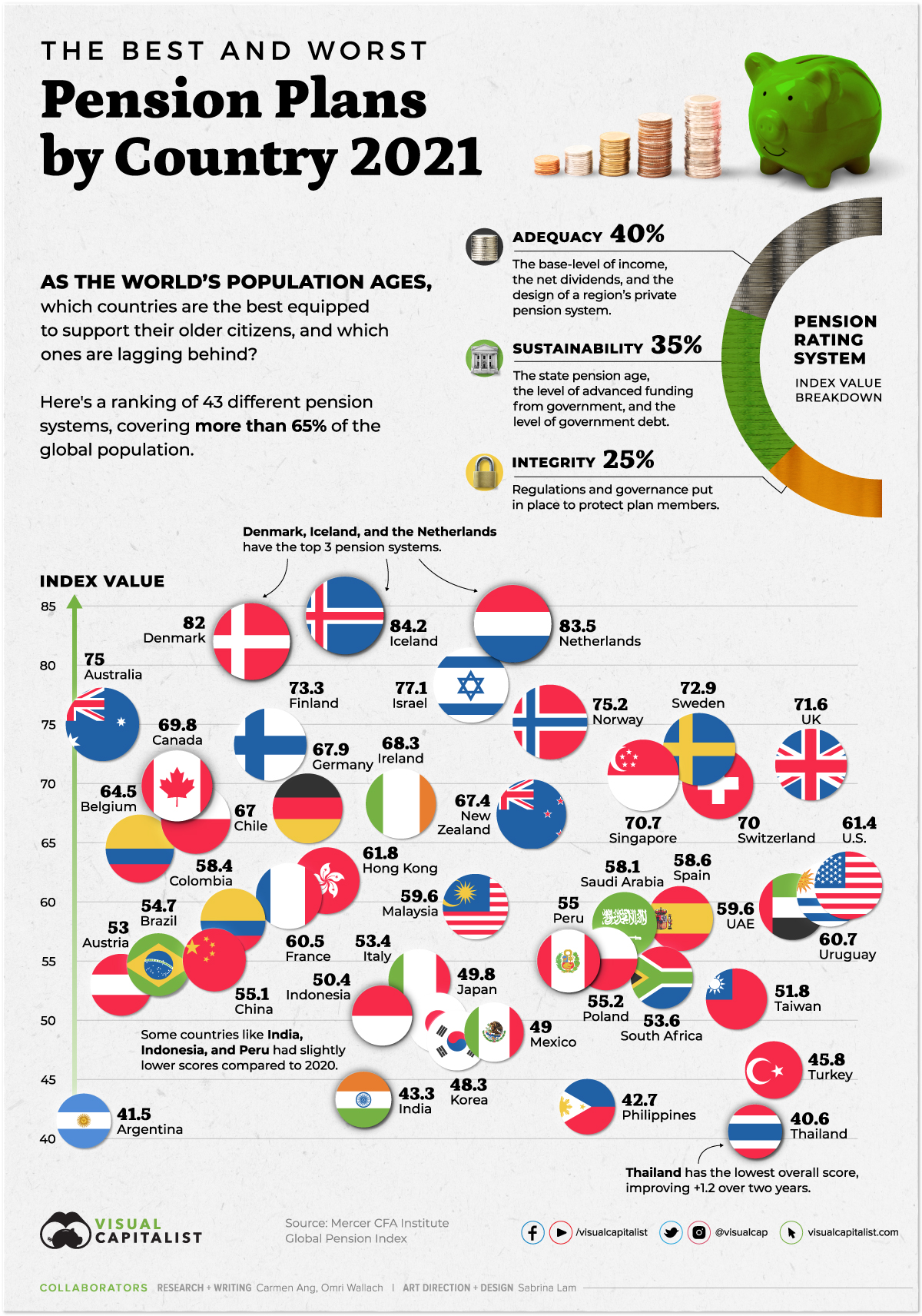

Ranked The Best And Worst Pension Plans By Country

/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png)

Does Hawaii Tax Pensions And Social Security

States That Don t Tax Pensions 2023 Wisevoter

Does Idaho Tax Pensions And Social Security Grim Record Frame Store

Does Idaho Tax Pensions And Social Security Grim Record Frame Store

12 401 Ok IRA

Does Hawaii Tax Pensions And Social Security

STATES THAT DON T TAX PENSIONS AND SOCIAL SECURITY

Does Ohio Tax Pensions And Social Security - Social Security Benefits There is no state tax on Social Security benefits Income Tax Range For 2024 there s a flat 3 tax on interest and dividends only 4 for 2023 but