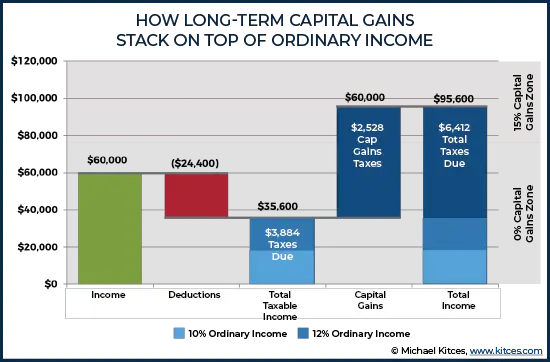

Does Standard Deduction Offset Capital Gains The standard deduction reduces capital gains if you have no ordinary income Also if there is room in the zero percent tax bracket you pay zero taxes on the amount that fits

Fortunately investment losses have a silver lining you can use capital losses to offset other capital gains reducing your overall tax bill If total capital losses exceed your capital gains you can deduct up to Capital gains taxes are levied on the profit from selling assets such as stocks or real estate They re calculated by subtracting the asset s purchase price from its selling

Does Standard Deduction Offset Capital Gains

Does Standard Deduction Offset Capital Gains

https://www.irstaxapp.com/wp-content/uploads/2020/02/quick-capital-gains-calculator.png

Can Passive Loss Tax Deductions Offset Capital Gains

https://s.yimg.com/ny/api/res/1.2/Jjn4rVZsyGzH7Rx2_9Nsxg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTUyNw--/https://media.zenfs.com/en/smartasset_475/a9b15a12a8855ab5ab1c7a9d390e7837

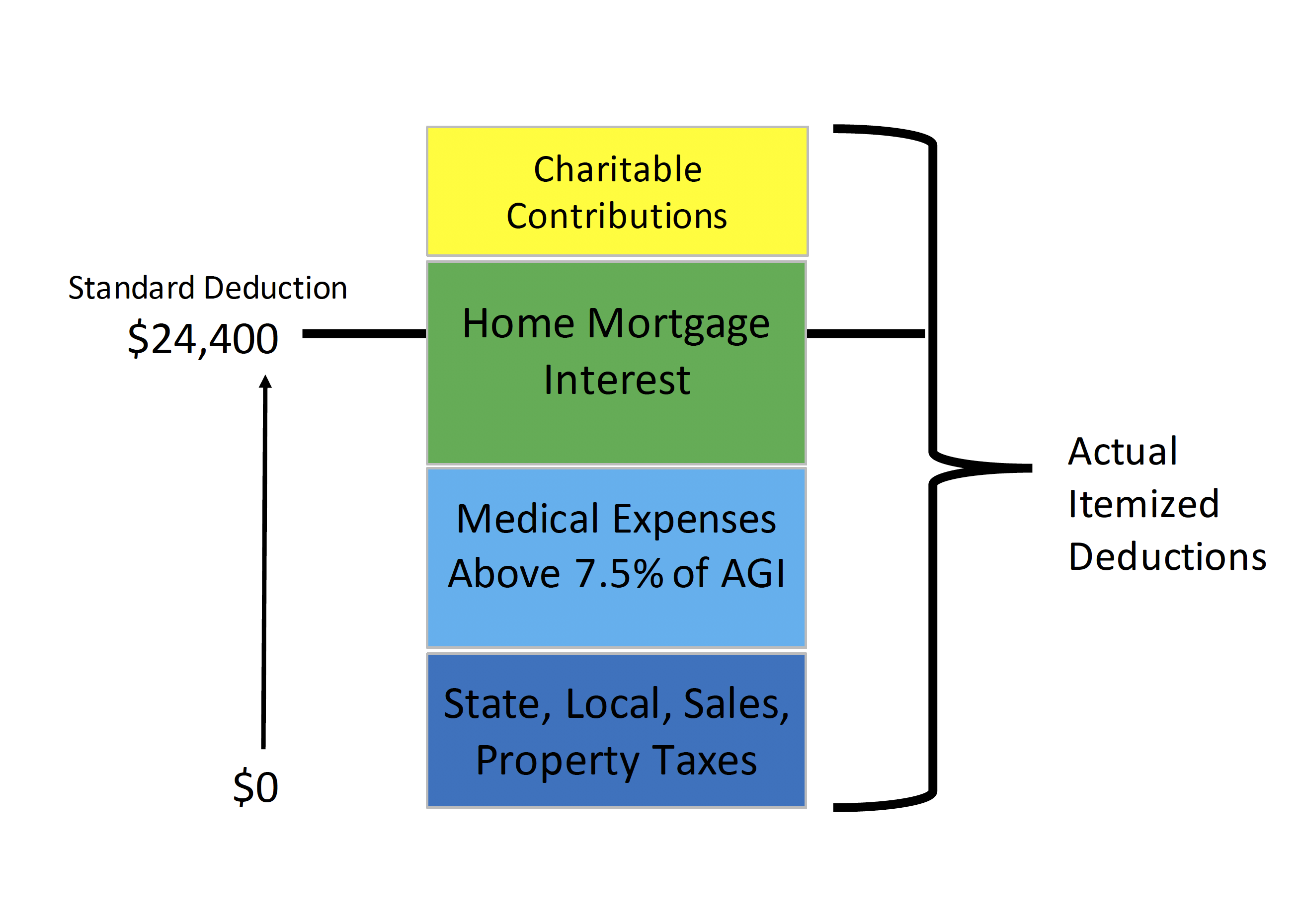

Itemized Vs Standard Tax Deductions Pros And Cons 2023

https://cdn.ramseysolutions.net/media/blog/taxes/personal-taxes/itemizing-vs-standard-deduction.png

Can I deduct my capital losses Yes but there are limits Losses on your investments are first used to offset capital gains of the same type So short term losses are first deducted against short term gains There is a 0 tax rate on long term capital gains for taxpayers whose income falls within certain limits Learn how to use that to realize gains without paying a tax

On screen text 2020 tax brackets with short term capital gains Animation Buckets show the breakdown of 82 000 in wages for a 2020 single filer using a standard deduction 9 875 taxed at 10 You can offset capital losses against your capital gains to reduce your total taxable income gain Once you ve identified the right assets for tax loss harvesting and you sell them the next step is offsetting capital

Download Does Standard Deduction Offset Capital Gains

More picture related to Does Standard Deduction Offset Capital Gains

Standard Deduction In Income Tax 2023 Examples InstaFiling

https://instafiling.com/wp-content/uploads/2022/12/Standard-Deduction-in-Income-Tax-980x551.png

What Is The Standard Deduction And How Does It Work Borshoff Consulting

https://borshoffconsulting.com/wp-content/uploads/9999/12/What-is-the-Standard-Deduction-and-How-Does-it-Work-Borshoff-Consulting-Blog-Image-1200x630-1-1024x538.jpg

2023 Form 1040 Standard Deduction Printable Forms Free Online

https://images.ctfassets.net/ifu905unnj2g/559i57L2mTIwb0IA9pbpog/7fd2ce773008246da36a27d2552b2643/Schedule_A.png

Capital losses can offset capital gains and you can deduct up to a net 3 000 in losses each year helping keep your adjusted gross income in a good place The standard deduction isn t divided between ordinary income and long term capital gains Along with other possible deductions the 12k standard deduction

If your net capital loss exceeds your net capital gains you can also offset your ordinary income by up to 3 000 1 500 for those married filing separately Yes you can claim all allowable deductions such as your Exemption and your Standard Deduction or Itemized Deductions Yes sales tax charitable donations

Deloitte Tax hand

https://www.taxathand.com/api/tax/v1/article/56680/image

.png)

How To Calculate Short Term Capital Gains Tax On Sale Of Shares Jordensky

https://uploads-ssl.webflow.com/629b1dcd203ede574e478a11/62e2671a8d153e9b5be366c3_Jordensky_Tax One person company to private (1).png

https://www.fiphysician.com/capital-gains-stack-on...

The standard deduction reduces capital gains if you have no ordinary income Also if there is room in the zero percent tax bracket you pay zero taxes on the amount that fits

https://www.schwab.com/.../how-are-c…

Fortunately investment losses have a silver lining you can use capital losses to offset other capital gains reducing your overall tax bill If total capital losses exceed your capital gains you can deduct up to

6 Tax Tricks The IRS Doesn t Tell You

Deloitte Tax hand

March 2019 Charitable Contributions Are They Still Tax Deductible

21 What Does It Mean To Offset Capital Gains With Losses Tip 8 YouTube

Capital Gains Deduction Eligibility For Proprietors Kalfa Law Firm

Tax Offset V Tax Deduction What s The Difference Alteris Financial

Tax Offset V Tax Deduction What s The Difference Alteris Financial

Tax Offset V Tax Deduction What s The Difference TIPS Financial

D duction Pour Gains En Capital EB Conseil Fiscal

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax

Does Standard Deduction Offset Capital Gains - There is a 0 tax rate on long term capital gains for taxpayers whose income falls within certain limits Learn how to use that to realize gains without paying a tax