Does The 7500 Tax Credit Work On A Lease Irs The amount of tax credit allowed for the New Clean Vehicle Credit is 7 500 You can only claim the allowable 3 000 the amount of your income tax liability because when

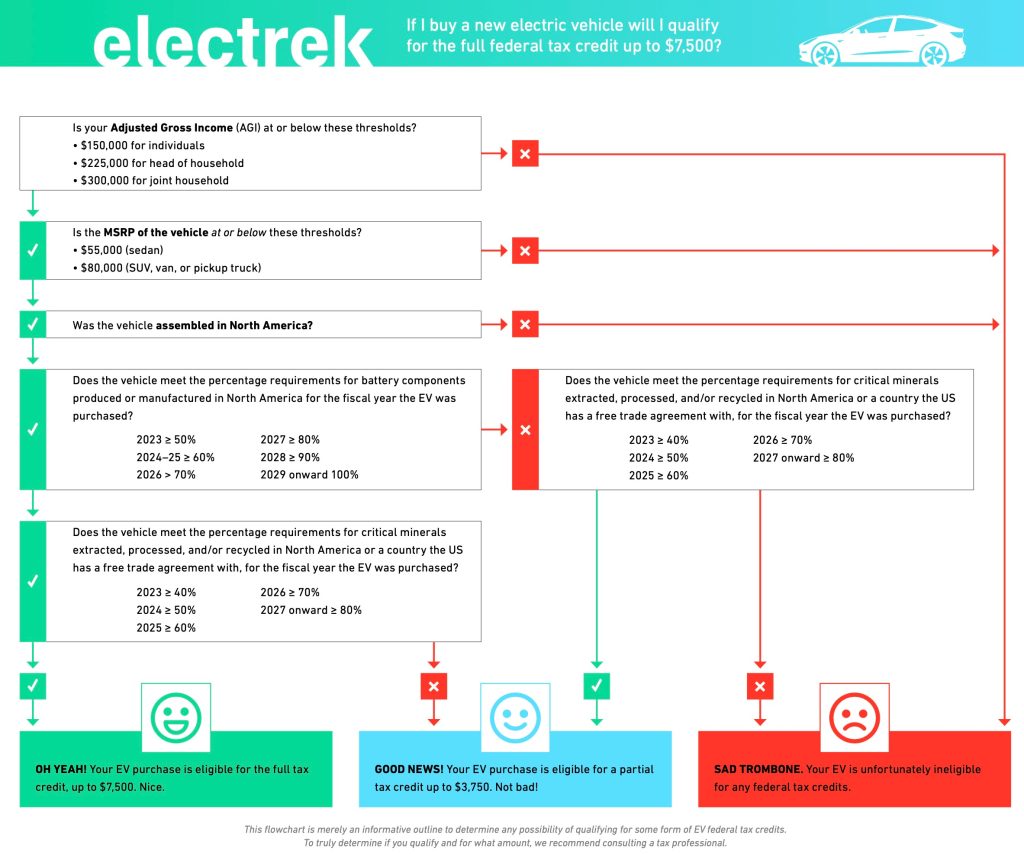

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 People who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to transfer

Does The 7500 Tax Credit Work On A Lease Irs

Does The 7500 Tax Credit Work On A Lease Irs

https://electrek.co/wp-content/uploads/sites/3/2022/12/Screenshot-2022-12-04-at-12.53.01-PM.jpg?quality=82&strip=all&w=1024

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://electrek.co/wp-content/uploads/sites/3/2021/01/EV-Federal-Tax-Credits.jpg?quality=82&strip=all&w=1600

What To Know About The 7 500 IRS EV Tax Credit For Electric Cars In

https://media.npr.org/assets/img/2023/01/06/gettyimages-1434797501_wide-81e5e737847555467ff1f49e67402d1a8e8c5801-s1100-c50.jpg

In late December the IRS clarified that vehicles that are leased to consumers can be eligible for a version of the tax credit that is much much easier to qualify for Beginning January 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is placed in

You could call it a tax pre fund Starting in January you ll be able to get an electric vehicle tax credit of up to 7 500 without having to wait for the IRS to process your return The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The Inflation Reduction Act of

Download Does The 7500 Tax Credit Work On A Lease Irs

More picture related to Does The 7500 Tax Credit Work On A Lease Irs

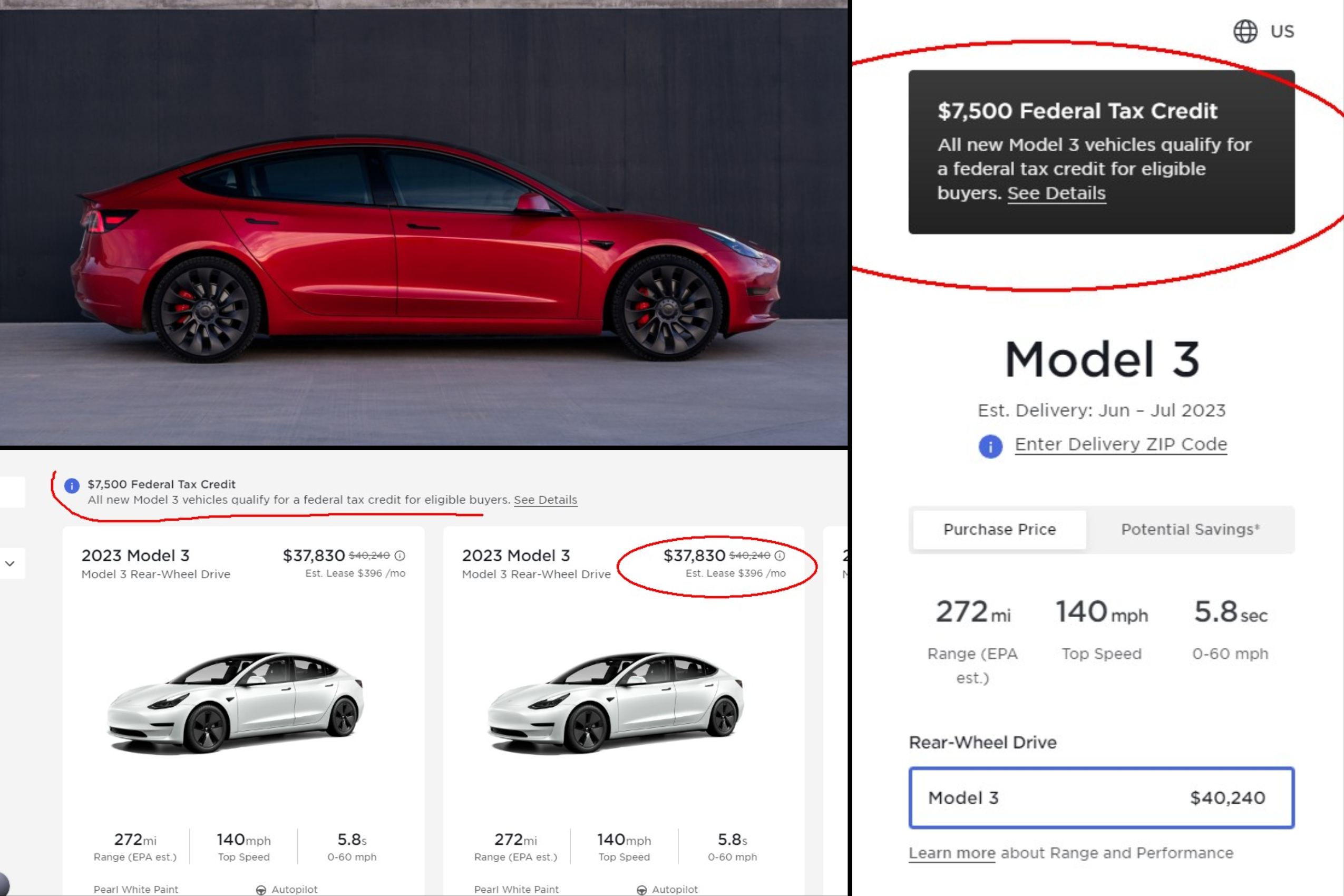

DOES TESLA LEASING QUALIFY FOR 7 500 TAX CREDIT YouTube

https://i.ytimg.com/vi/8gUckkPIIAw/maxresdefault.jpg

Black Bolt How Does The US 7 500 Tax Credit Work Sept 10 2021

https://i.ytimg.com/vi/MY05aw5oBSM/maxresdefault.jpg

7 500 EV Tax Credit Use It Or Lose It YouTube

https://i.ytimg.com/vi/W6QEuZFy5GI/maxresdefault.jpg

Interested in an EV that doesn t meet the North America assembly requirement of the tax credit Here are 15 cars that pass through the tax credit as an immediate 7 500 lease cash incentive through the manufacturer s Last year s Inflation Reduction Act provided a federal tax credit of up to 7 500 to use toward an EV A dealer can apply that credit to any leased electric vehicle no matter where it s made to reduce a customer s monthly

IRS guidance limits the number of EVs that qualify for the full 7 500 EV tax credit Those EV tax credit rules address requirements for critical mineral and battery component As of this writing there s a legislative loophole that lets the originator of the lease typically the automaker s finance division take the full 7 500 tax credit for a leased EV

The Complete List Of Eligible Cars For The 7 500 EV Tax Credit Carscoops

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

Tesla Warns That 7 500 Tax Credit For Model 3 RWD Will Be Reduced

https://cdn.motor1.com/images/custom/fact-sheet-ira-ev-tax-credits-electrification-coalition-and-safe.png

https://www.irs.gov/newsroom/topic-a-frequently...

The amount of tax credit allowed for the New Clean Vehicle Credit is 7 500 You can only claim the allowable 3 000 the amount of your income tax liability because when

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022

7 500 Tax Credit For EVs Start In 2023 How Will It Work YouTube

The Complete List Of Eligible Cars For The 7 500 EV Tax Credit Carscoops

The Restored 7 500 Tax Credit Helps The US Not Just EV Buyers

The Easiest Way To Get A 7 500 Tax Credit For An Electric Vehicle

How Tesla Bent IRA Rules To Get Full 7 500 Tax Credit For Model 3 RWD

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

The 7 500 Tax Credit For Electric Cars Is About To Change Yet Again NPR

How Tax Credits Work YouTube

A 7 500 Tax Credit For Electric Cars Changed Again These Are The

Does The 7500 Tax Credit Work On A Lease Irs - IRS states in their fact sheet topic G Q5 that businesses that lease vehicles are allowed to claim the commercial EV tax credit for each leased vehicle