Does The Child Tax Credit Increase My Refund Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Some tax credits are refundable If a taxpayer s tax bill is less than the amount

For 2023 taxes filed in 2024 the Child Tax Credit is 2 000 for children under age 17 Up to 1 600 of that amount is refundable Learn what it means for your taxes Remember you could get a refund of up to 1 500 per child with the child tax credit 7 But here s the deal A big refund like that isn t really a good thing Because that s actually your money the

Does The Child Tax Credit Increase My Refund

Does The Child Tax Credit Increase My Refund

https://www.al.com/resizer/pc0fe2ASg7gqF95M0g5gW9VCFkI=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/X4QF7BYSU5DRXPZWDOD4P564SQ.jpg

Can I Opt Out Of The Child Tax Credit Payments Here s The Answer Dogwood

https://vadogwood.com/wp-content/uploads/sites/12/2021/07/Child-Tax-Credit1.jpg

Child Tax Credit Update Here s Three Reasons You Should Opt Out Of

https://www.the-sun.com/wp-content/uploads/sites/6/2021/09/kc-child-tax-credit-comp-1.jpg?w=1040

ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The amount of your Child Tax Credit will be reduced if your adjusted gross Topic E Advance Payment Process of the Child Tax Credit Topic F Updating Your Child Tax Credit Information During 2021 Topic G Receiving Advance

The child tax credit is a nonrefundable tax credit that can reduce your federal income tax liability to zero for qualifying families Because it s nonrefundable it cannot generate a refund For the refundable portion of the credit or the additional child tax credit you may receive up to 1 600 per qualifying child Are you missing important tax dates

Download Does The Child Tax Credit Increase My Refund

More picture related to Does The Child Tax Credit Increase My Refund

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

https://cdn.mos.cms.futurecdn.net/atBAeA95EXm3hifrNbAKPV.jpg

Changes To The Child Tax Credit For 2014 Good Financial Cents

http://www.goodfinancialcents.com/wp-content/uploads/2014/04/IMG-Changes-to-the-child-tax-credit.png

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

So you cannot receive the entire 2 000 back as a tax refund even if you have a 0 tax liability and qualify for the full credit amount But there is some good news The American Rescue Plan Act of 2021 temporarily changed the child tax credit to make it more accessible for lower income families and increased the refund amount That credit expansion expired at the end

Similar to other credits the child tax credit lowers the amount you owe in taxes The tax credit is refundable if you don t owe any taxes which means you can How can the expanded and increased Child Tax Credit and advance Child Tax Credit payments coupled with the current income tax withholding from my pay

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

Child Tax Credit Lifted 3 Million Kids From Poverty In July Market

https://image.cnbcfm.com/api/v1/image/106861483-1617113659020-gettyimages-1260805862-dsc06953.jpeg?v=1629909897

https://www.irs.gov/newsroom/tax-credits-for...

Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Some tax credits are refundable If a taxpayer s tax bill is less than the amount

https://www.investopedia.com/.../c/chil…

For 2023 taxes filed in 2024 the Child Tax Credit is 2 000 for children under age 17 Up to 1 600 of that amount is refundable Learn what it means for your taxes

New Child Tax Credit Explained When Will Monthly Payments Start

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

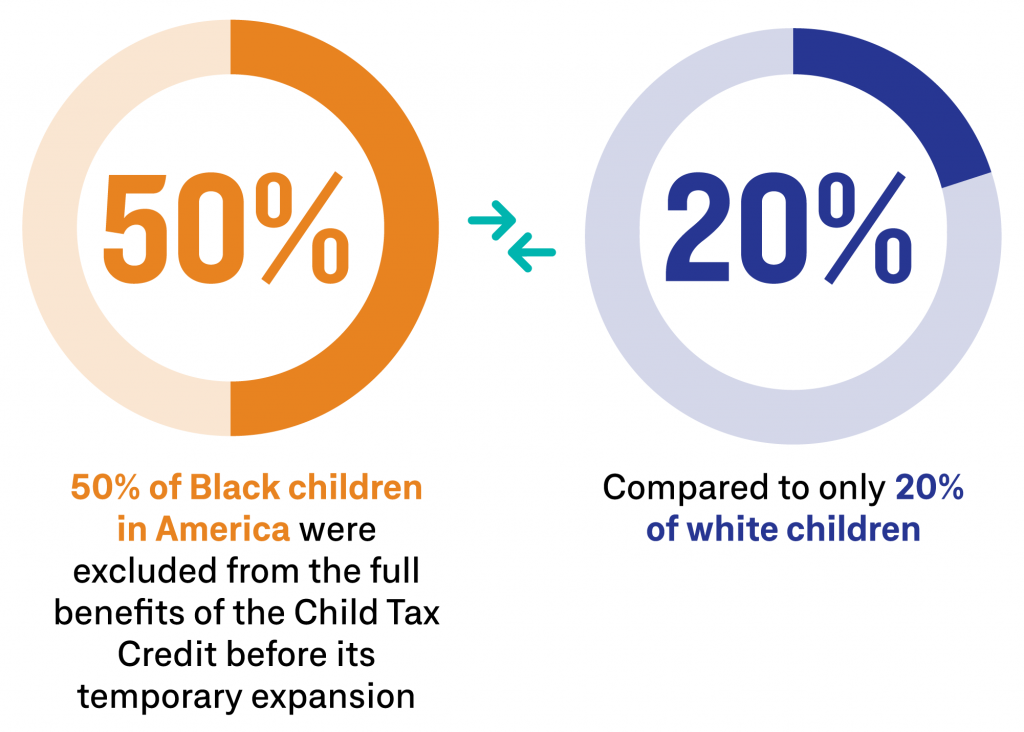

The Child Tax Credit Proved Unrestricted Cash Keeps Families Out Of

At What Income Do You No Longer Get Child Tax Credit Leia Aqui Do

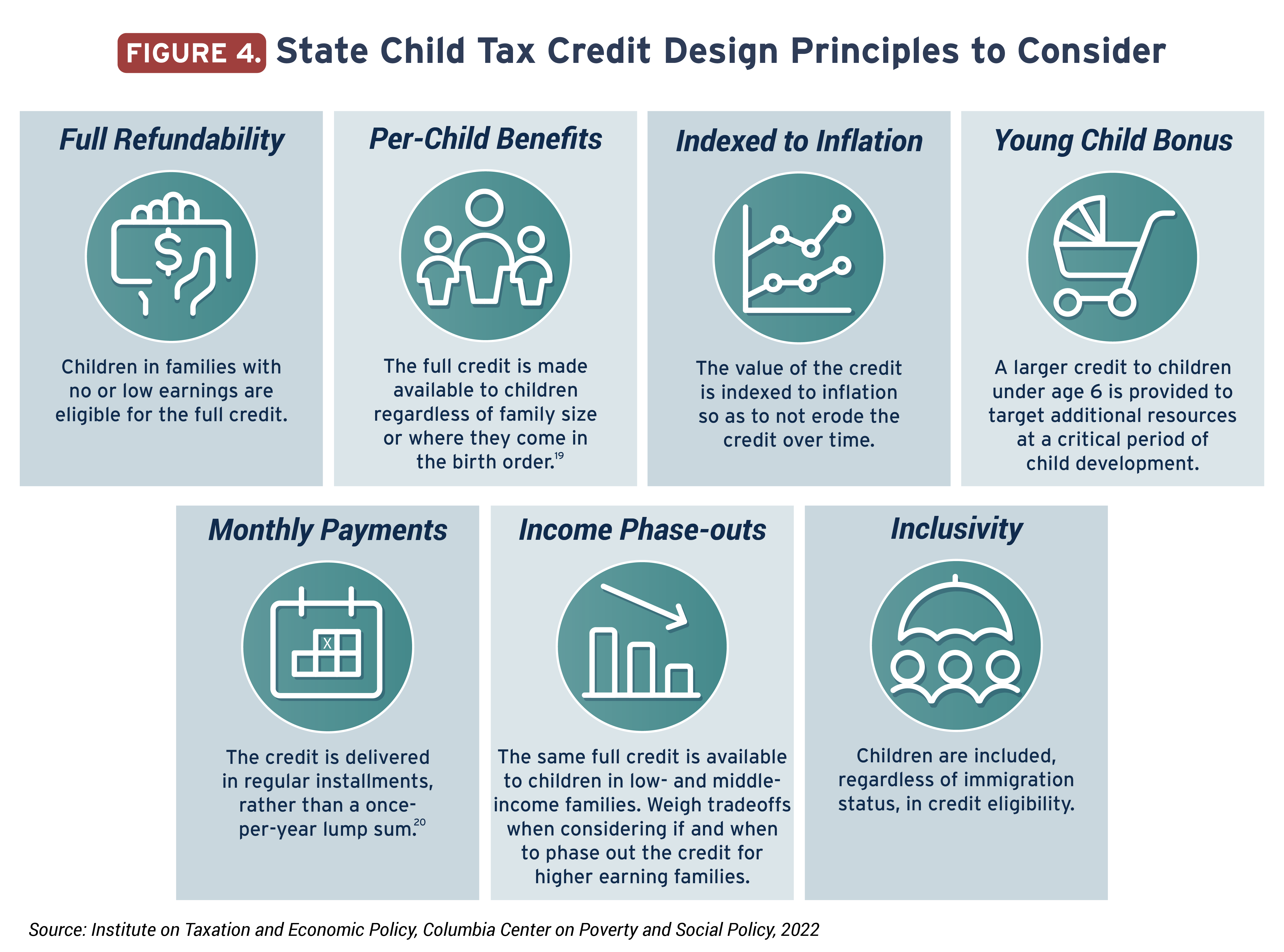

Making The Expanded Child Tax Credit Permanent And Fully Refundable

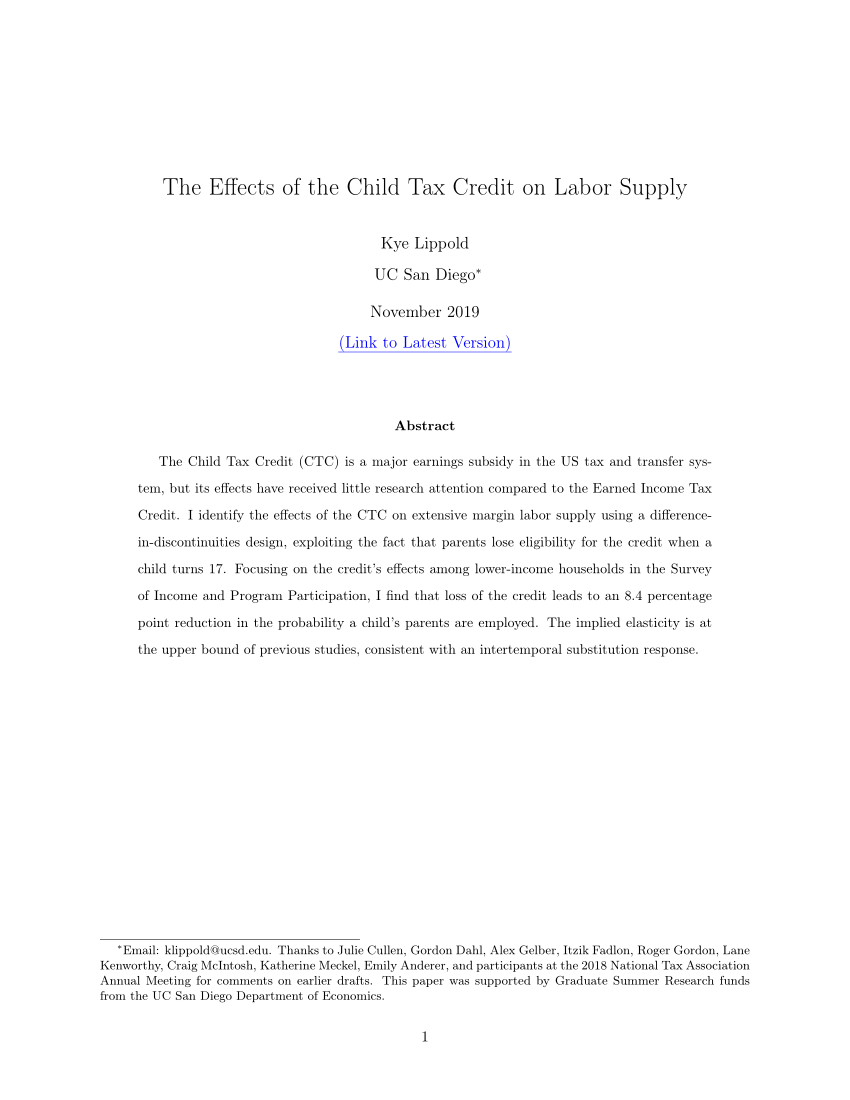

PDF The Effects Of The Child Tax Credit On Labor Supply

PDF The Effects Of The Child Tax Credit On Labor Supply

Watch CBS Mornings Child Tax Credit Set To Expire Full Show On CBS

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

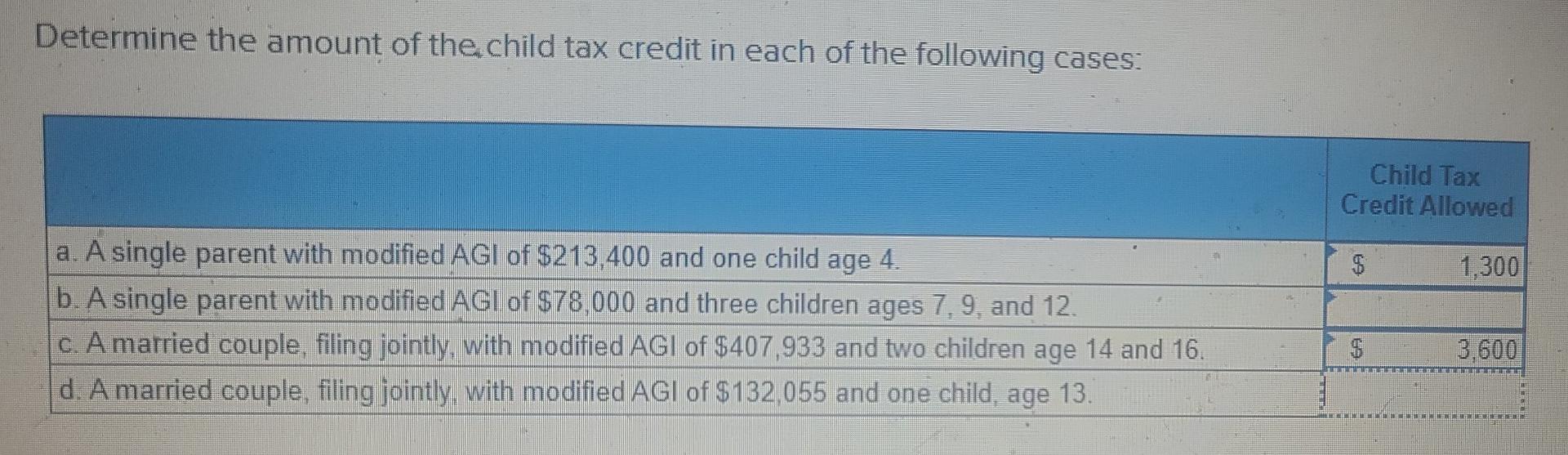

Solved Determine The Amount Of The Child Tax Credit In Each Chegg

Does The Child Tax Credit Increase My Refund - Topic E Advance Payment Process of the Child Tax Credit Topic F Updating Your Child Tax Credit Information During 2021 Topic G Receiving Advance