Does The Government Give Rebates For Solar Panels The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home

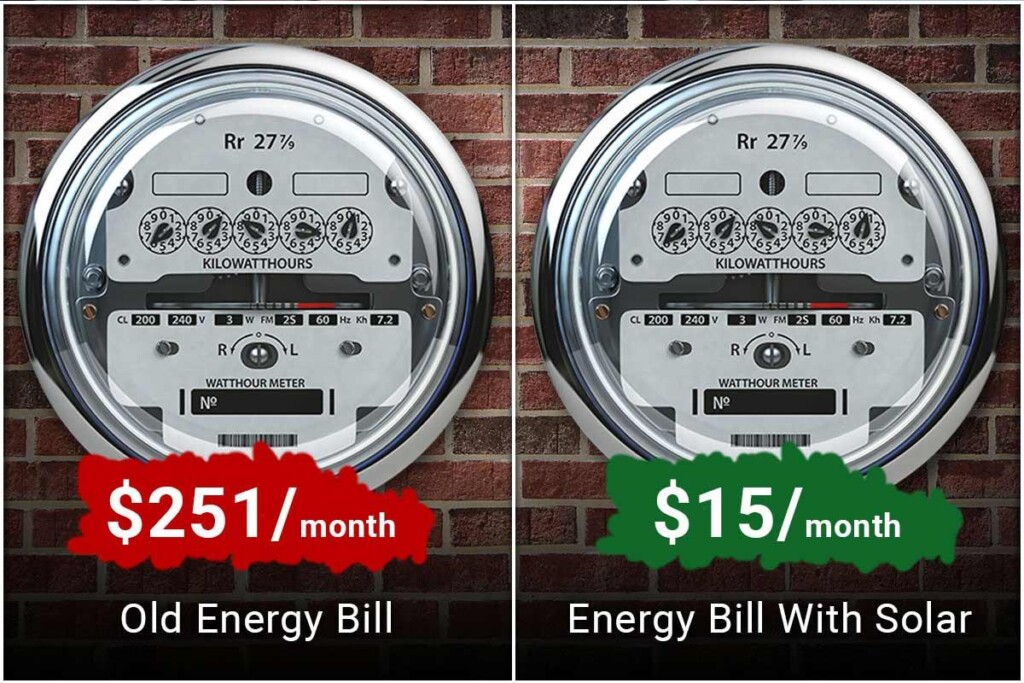

For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit Under most circumstances subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law 7 When this is the case the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit

Does The Government Give Rebates For Solar Panels

Does The Government Give Rebates For Solar Panels

https://www.powersmartsolutions.com.au/wp-content/uploads/2019/06/Business-Insider.jpg

Solar Panel Rebates For Homeowners SolvingSolar

https://www.solvingsolar.com/wp-content/uploads/2021/07/31056004_engineers-are-checking-the-solar-panel-for-maintenance-and-clea.jpg

Get Government Rebate And Incentives For Solar Panels Installed In Your

https://aesinspect.com/wp-content/uploads/2020/06/solar-panel-technology-energy-1080x675.jpg

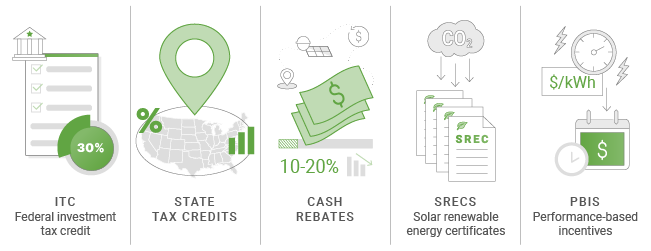

The Investment Tax Credit ITC or solar federal tax credit is a nationwide incentive for homeowners and business owners who install solar panels The credit is worth 30 of your total Fortunately governments and even some utilities offer generous incentives to bring down that price and encourage more people to go solar The best one is the federal tax credit which puts 30 of the cost back in your pocket down to

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating Some states local governments and even utility and solar companies offer solar rebates to homeowners or low income service providers who install solar equipment Sometimes solar rebates are given directly to the resident and other times they re given to the solar contractor who can then charge less for installations

Download Does The Government Give Rebates For Solar Panels

More picture related to Does The Government Give Rebates For Solar Panels

Aid To The Areas Affected By The Fires What Cases Do They Cover And

https://imagenes.elpais.com/resizer/lT5QWy3fL-6d153zwQVklxRnmvM=/1200x0/cloudfront-eu-central-1.images.arcpublishing.com/prisa/KNY5IQENKWF4AR5BVMGD4TSUIY.jpg

Solar Rebates And Incentives EnergySage

https://www.energysage.com/cms/filer/62/b3/62b3dbae-89e4-4ba5-af09-448648575217/es_learn_itc-01_2022.png

Government Solar Tax Rebates V2 The Price Chopper

https://www.thepricechopper.com/wp-content/uploads/2022/01/electricity_meter-1024x683.jpg

Dollar for dollar the federal solar tax credit is the greatest economic incentive for homeowners to invest in solar panels and or battery storage With a little extra paperwork during tax season you can effectively recover 30 of the total cost of your solar system with no maximum limit If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

The Australian Government s Small scale Renewable Energy Scheme SRES reduces the cost of most new residential and business rooftop solar systems Rebates and loans are also provided by some state and territory governments and local councils To encourage more homeowners like you to go solar governments electric utilities and other organizations offer financial incentives rebates and tax credits that make solar more affordable when you purchase a system through a solar plan such as Sunrun s BrightBuy or BrightAdvantage

FAQ Skylit

https://skylit.ca/wp-content/uploads/2021/06/FISKWEB2.jpg

N J Man Admits He Duped Government Out Of Millions By Faking Solar

https://www.nj.com/resizer/pPuaGNvkjTDQOWBuIgKZFsyqiTM=/1280x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/SZASEWUM5NFGRGHMDP5XXYLRN4.jpg

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home

https://www.energy.gov/sites/default/files/2023-03/...

For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit

How To Claim Solar Rebates Solar Panels Residential Solar Best

FAQ Skylit

Why Does The Government Give Away Free Cell Phones

Illinois Tax Rebates For Solar Panels Electric Cars And Chargers Save

About Incentives Rebates For Solar Energy In Your Home

How Much Money Does The Government Give To Solar Energy Thales

How Much Money Does The Government Give To Solar Energy Thales

Are There Any Tax Rebates For Hybrid Cars In 2022 2022 Carrebate

Save Money While Going Green Solar Panel Rebates And Incentives

How Much Money Does The Government Give Arcadia National Park Thales

Does The Government Give Rebates For Solar Panels - The 30 solar tax credit is available until 2032 before reducing to 26 in 2033 22 in 2034 and expiring completely in 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence