Does The State Of Maryland Tax Military Retirement The law will exempt up to 20 000 of military retirement income for Maryland residents who are 55 and older It will exempt up to 12 500 for retirees who are younger than 55

Maryland The first 5 000 is tax free that amount increases to 15 000 at age 55 Montana Up to 4 640 is exempt if gross income is less than 38 660 New Mexico Maryland Income Tax Subtraction for Military Retired Pay Retired service members under age 55 can subtract up to 12 500 of their military retired pay from their gross income

Does The State Of Maryland Tax Military Retirement

Does The State Of Maryland Tax Military Retirement

https://myarmybenefits.us.army.mil/Images/slides/StateTaxMap-MAB-Feb2022.png

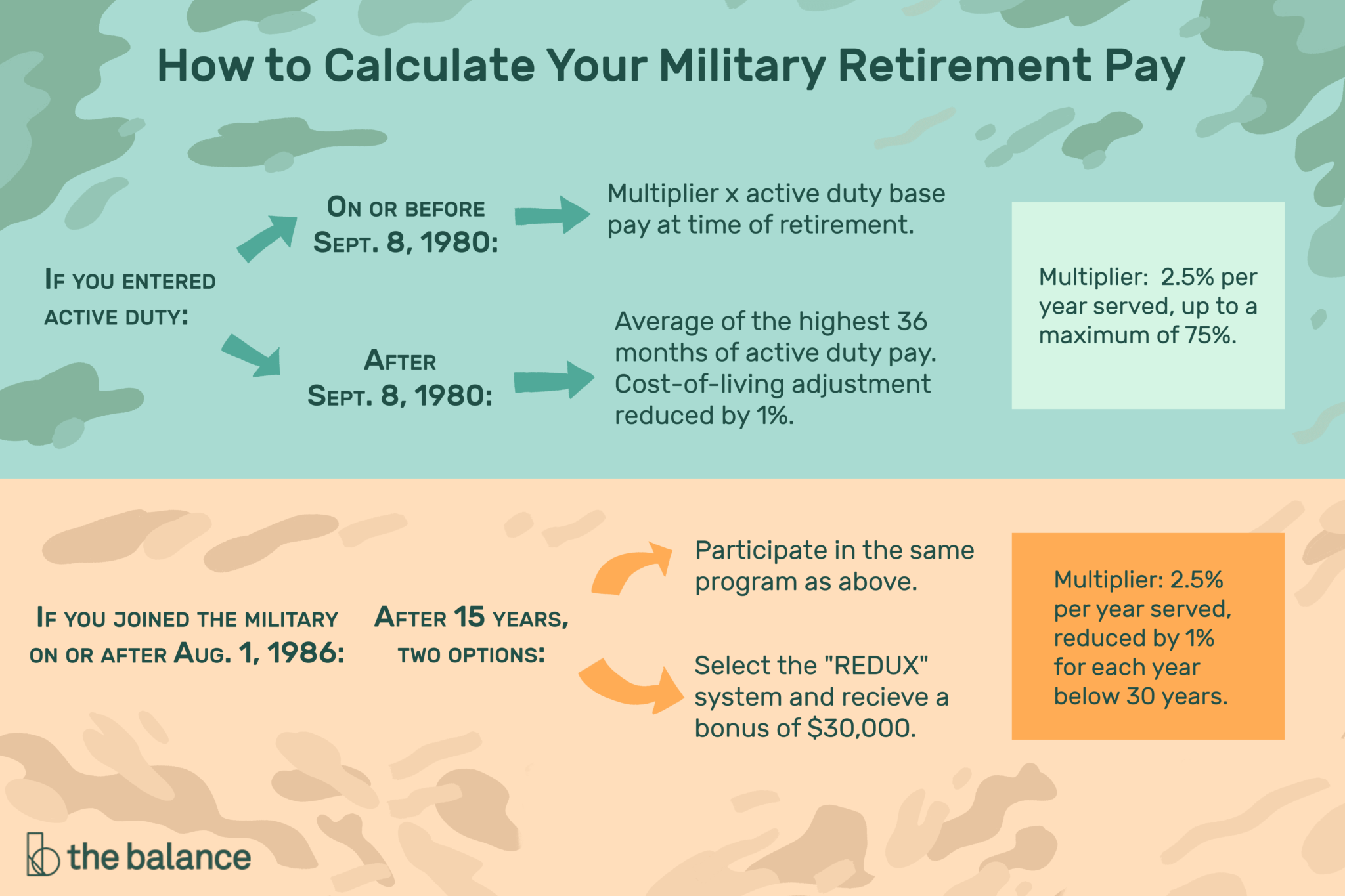

Average Federal Tax Rate On Military Retirement Pay Military Pay

https://military-paychart.com/wp-content/uploads/2020/12/understand-the-military-retirement-pay-system-2048x1365.png

Retiring These States Won t Tax Your Distributions

https://www.taxdefensenetwork.com/wp-content/uploads/2021/11/states-and-retirement-taxes-1-2500x1875.jpg

Included among Governor Moore s champion pieces of legislation signed today are H B 554 S B 553 Keep Our Heroes Home Act increases the military retirement income 2 California A bipartisan bill would eliminate state income taxes on military retirement pay and spouses covered in the Surviving Benefit Plan SBP Other

Military income Tax free Retired pay Follows federal tax rules Survivor Benefit Plan Up to 20 000 of military retirement is tax free for 2023 That goes up to 30 000 in 2024 The State of Maryland does not tax the military pay and does not use the military pay to increase the tax liability imposed on other income earned in Maryland With military

Download Does The State Of Maryland Tax Military Retirement

More picture related to Does The State Of Maryland Tax Military Retirement

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

States That Don t Tax Military Retirement Pay Discover Here

https://www.thesoldiersproject.org/wp-content/uploads/2023/04/military-retirement-tax-exemption.png

Maryland Tax And Labor Law Summary Care HomePay

https://s.cdn-care.com/img/cms/web/HomePay/Maryland-State-Page.jpg?v=210629

If you are a military retiree or the spouse or ex spouse of a military retiree and you receive military retirement income including death benefits you may be able to subtract up to Maryland is one of just 14 states that does not have a complete exemption of military retirement income from taxation West Virginia and Pennsylvania both fully exempt this

Up to 5 000 of military retirement income received by a qualifying individual during the tax year if the taxpayer has not yet attained the age of 55 or up to 15 000 of military Does Maryland tax Social Security benefits Can I claim Maryland s pension exclusion Does Maryland offer a tax break for long term care insurance Is there a special tax

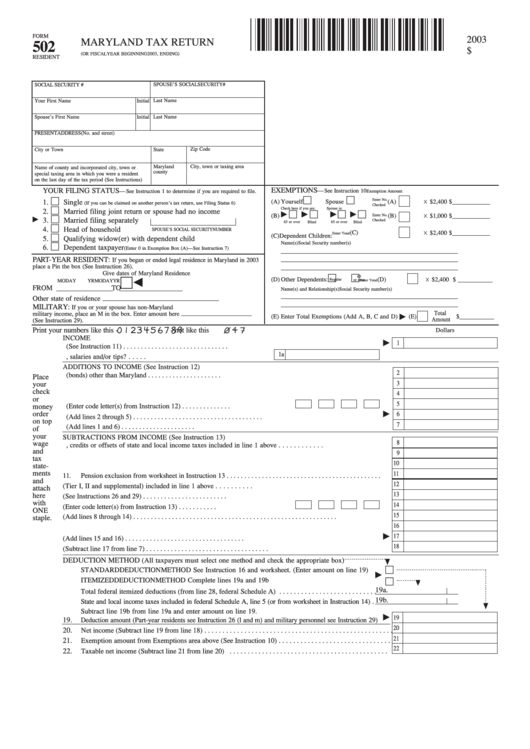

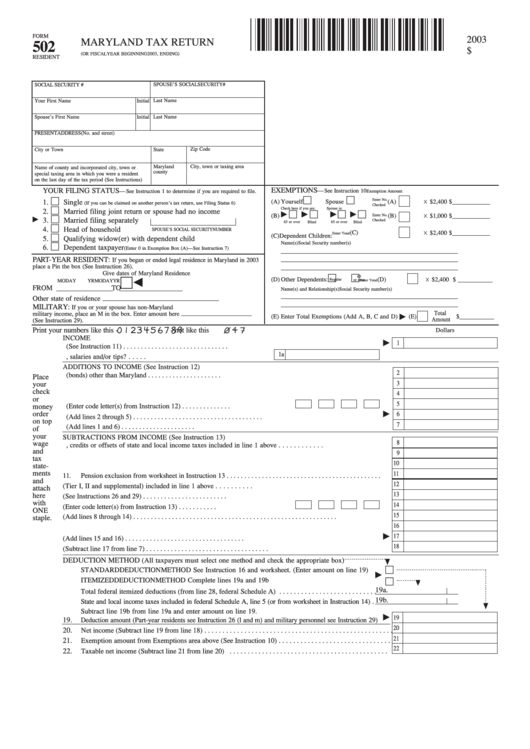

Blank Fillable Maryland Tax Return 502 Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/07/blank-fillable-maryland-tax-return-502.png

The Free State Foundation Maryland Should Lower Tax Rates To Attract

https://2.bp.blogspot.com/-aM87fUtZvp0/WxqnnHbyzVI/AAAAAAAAUXU/5ssOo3auNbgfbwRzQw0SY8ymG2pWeHfKwCLcBGAs/s1600/StateandLocal%2B060818.png

https://www.militarytimes.com/veterans/2023/05/14/...

The law will exempt up to 20 000 of military retirement income for Maryland residents who are 55 and older It will exempt up to 12 500 for retirees who are younger than 55

https://www.military.com/benefits/military-pay/...

Maryland The first 5 000 is tax free that amount increases to 15 000 at age 55 Montana Up to 4 640 is exempt if gross income is less than 38 660 New Mexico

States That Don t Tax Military Retirement 2023 Wisevoter

Blank Fillable Maryland Tax Return 502 Fillable Form 2023

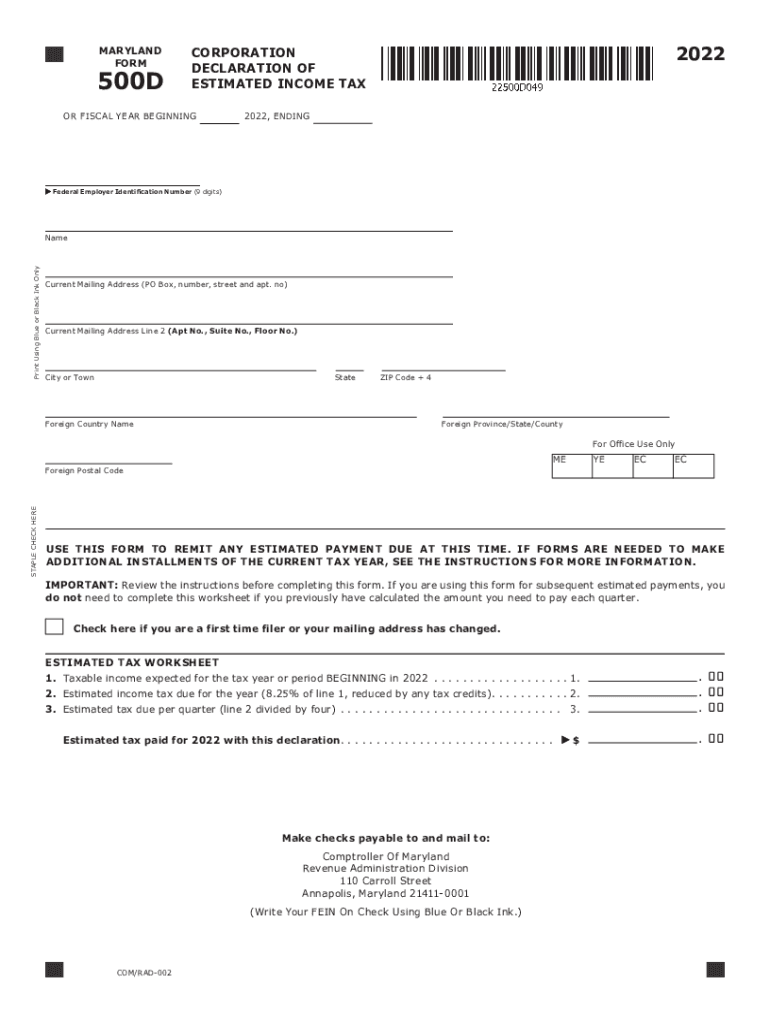

2022 Form MD Comptroller 500D Fill Online Printable Fillable Blank

Real ID Will Prompt Recall Of Some Maryland Driver s Licenses In June

States That Don t Tax Military Retirement A Detailed List

NC Gives Veterans Tax Credits On Income And Property Taxes Wfmynews2

NC Gives Veterans Tax Credits On Income And Property Taxes Wfmynews2

Maryland Withholding Tax Form WithholdingForm

12 States That Keep Retirement Dollars In Your Pocket Alhambra

Driving Without Your License In Maryland SH Block Tax Services

Does The State Of Maryland Tax Military Retirement - If you are a nonresident of Maryland stationed in Maryland on military orders the active duty military pay is not taxable on your return Any other income earned while in