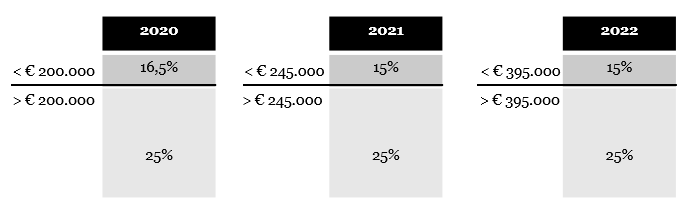

Dutch Corporate Income Tax Rates 2023 Changes to rate and first bracket As of 1 January 2023 Dutch corporate income tax CIT is levied at 19 was 15 over the first EUR 200 000 of the annual taxable amount

The lower corporate income tax rate will be increased from 15 to 19 Furthermore the tax bracket of the lower rate will be reduced from 395 000 to An overview of the Dutch tax rates for corporations in the year 2023 by Tax Consultants International BV

Dutch Corporate Income Tax Rates 2023

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VBGWLCZVOFNVRCJGLVLCPWB75I.jpg)

Dutch Corporate Income Tax Rates 2023

https://www.reuters.com/resizer/Wb1b2sq_iwwqEC-F3i7NeUiECS8=/1920x1005/smart/filters:quality(80)/cloudfront-us-east-2.images.arcpublishing.com/reuters/VBGWLCZVOFNVRCJGLVLCPWB75I.jpg

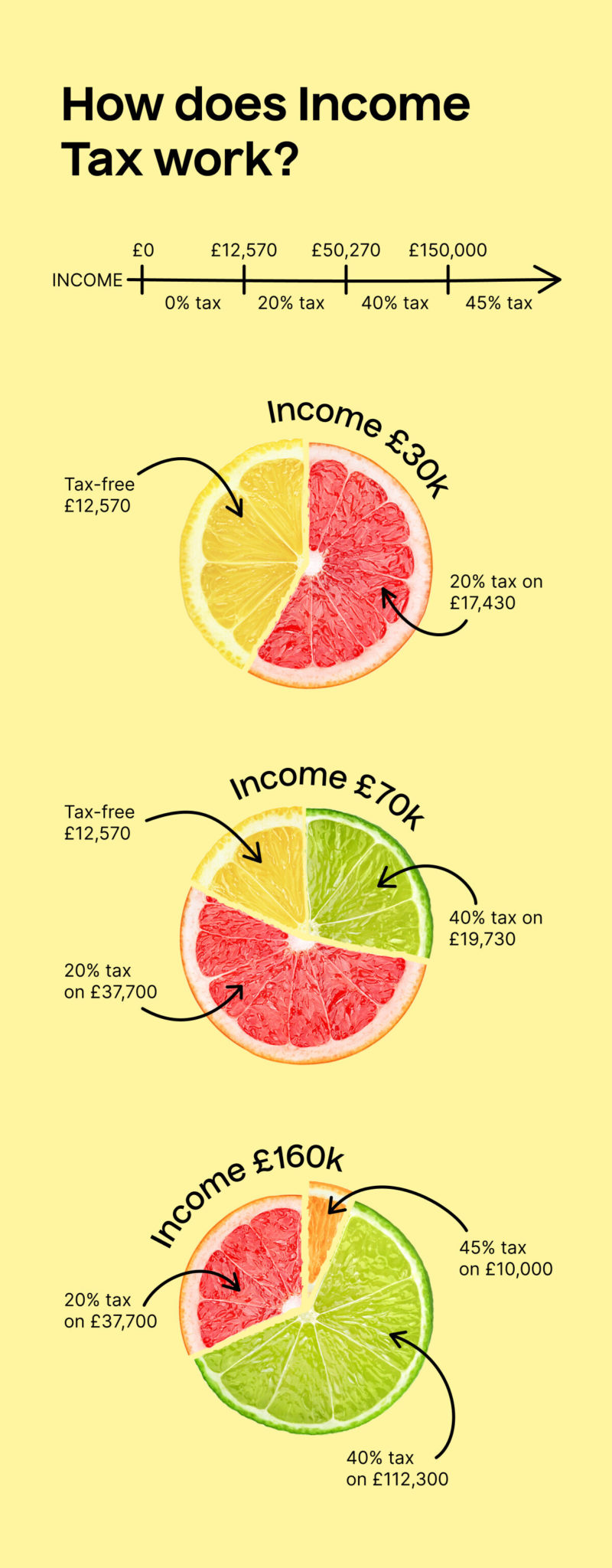

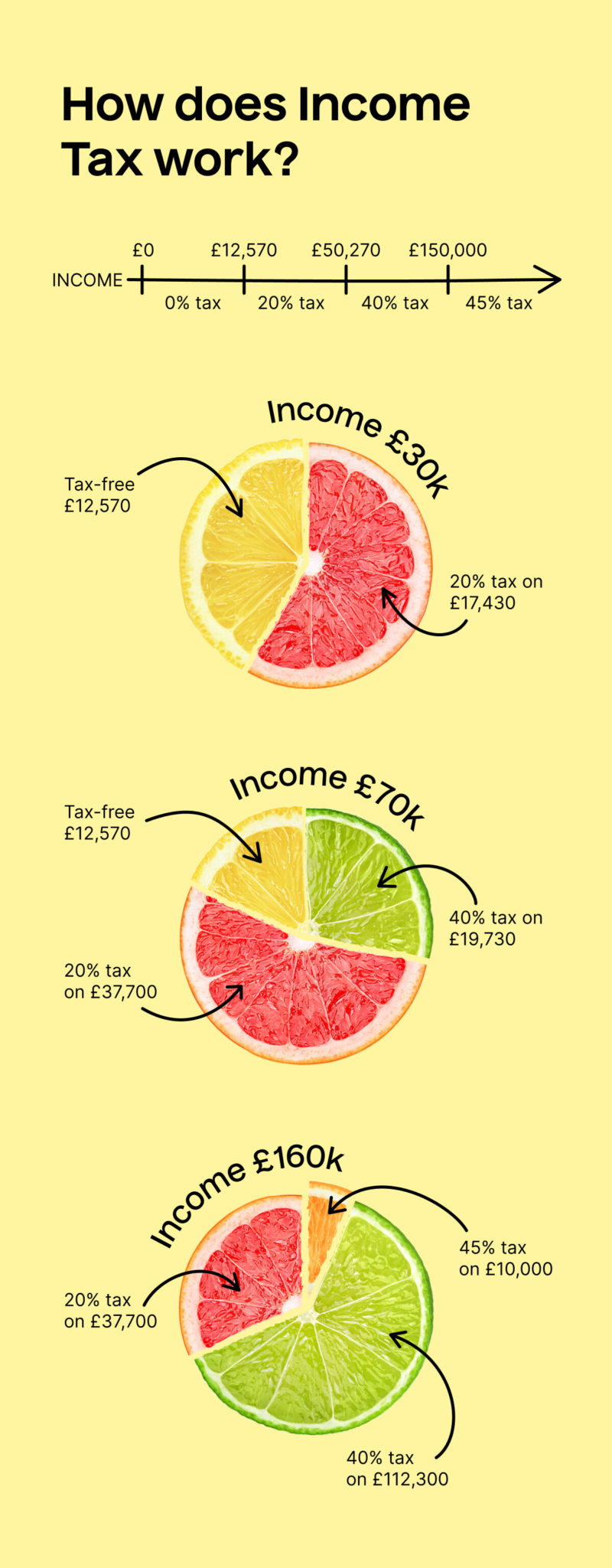

Income Tax Rates In The UK TaxScouts

https://taxscouts.com/wp-content/uploads/Infographic-1-800x2048.jpg

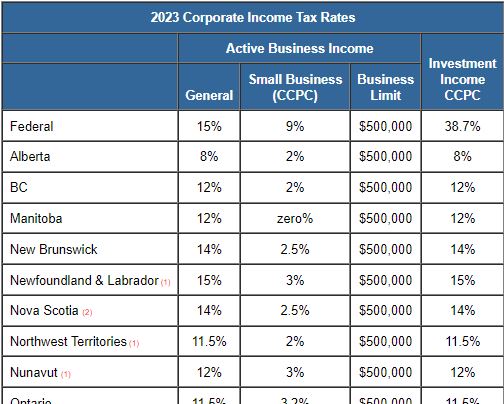

TaxTips ca Business 2023 Corporate Income Tax Rates

https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2023.jpg

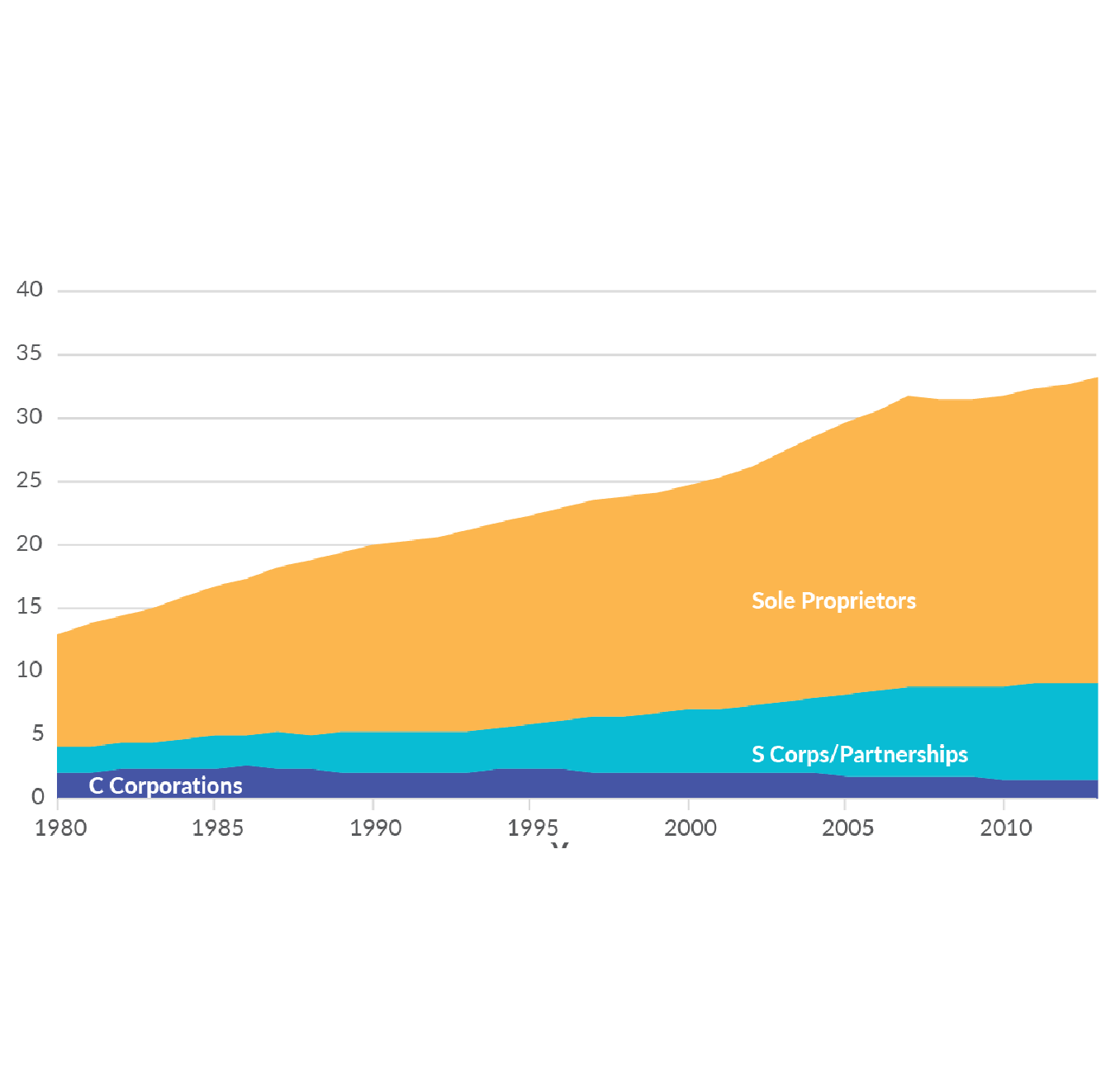

The new 2023 tax rates announced make the 30 ruling a 30 ruling till EUR 216 000 salary rule This implies the 30 ruling is applicable till a salary of EUR Corporate income tax rates in 2022 The corporate income tax rate depends on the taxable amount The taxable amount is the taxable profit in a year reduced by deductible losses

Increase of corporate income tax rates The lower corporate income tax rate will be increased from 15 to 19 Furthermore the tax bracket of the lower rate will Corporate income tax rates and threshold amount In the 2023 Tax Plan it is proposed to increase the lower corporate income tax rate from 15 to 19 whereby

Download Dutch Corporate Income Tax Rates 2023

More picture related to Dutch Corporate Income Tax Rates 2023

1 The Dutch Income Tax System 2015 Download Table

https://www.researchgate.net/profile/Egbert-Jongen/publication/323940089/figure/download/tbl1/AS:631574802485273@1527590575119/1-The-Dutch-income-tax-system-2015.png

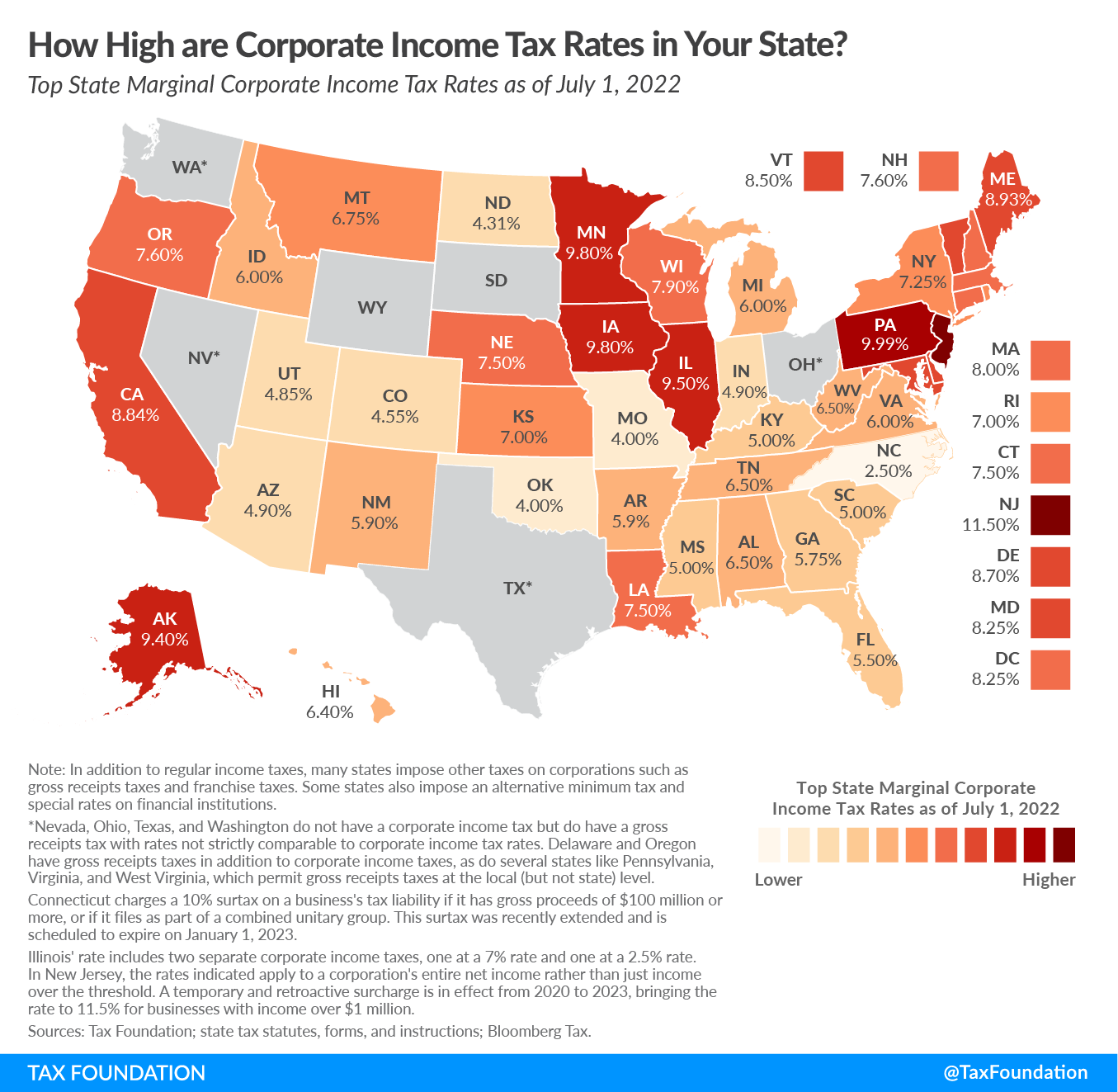

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

https://taxfoundation.org/wp-content/uploads/2022/01/2022-CIT-rates-July-Update-FV2-01.png

Netherlands Corporate Tax Rate 1981 2021 Data 2022 2023 Forecast

https://d3fy651gv2fhd3.cloudfront.net/charts/[email protected]?s=nldcorptax&v=202109081354V20200908

The Netherlands has a competitive statutory corporate income tax rate compared to the rest of Europe 19 per cent on the first 200 000 euro and 25 8 per cent for taxable profits exceeding 200 000 euro In addition the Personal income tax Box 1 basic rate decreases to 36 93 from 37 07 as of 2023 Two rates for substantial interest as of 2024 24 5 up to and including

What is corporate income tax vennootschapsbelasting Who has to file corporate income tax return Offsetting losses or profits Pay less tax with the innovation box The corporate income tax rates are 19 increased from 15 effective from 1 January 2023 on profits up to EUR 200 000 reduced from EUR 395 000 effective from 1

Corporate Income Tax For Dutch Companies In 2022 Rules Rates And CIT

https://static.tildacdn.com/tild6336-3939-4763-a566-613664343236/OG_Taxation_of_Salar.png

Netherlands Corporate Income Tax Calculator 2022 ODINT Consulting

https://ondemandint.com/wp-content/uploads/2022/04/vat.png

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VBGWLCZVOFNVRCJGLVLCPWB75I.jpg?w=186)

https://www.ibanet.org/document?id=Taxes-Country...

Changes to rate and first bracket As of 1 January 2023 Dutch corporate income tax CIT is levied at 19 was 15 over the first EUR 200 000 of the annual taxable amount

https://www.dentons.com/en/insights/alerts/2022/...

The lower corporate income tax rate will be increased from 15 to 19 Furthermore the tax bracket of the lower rate will be reduced from 395 000 to

Singapore Corporate Tax Rate Singapore Taxation Guide 2021

Corporate Income Tax For Dutch Companies In 2022 Rules Rates And CIT

Increasing Individual Income Tax Rates Would Impact U S Businesses

2022 Corporate Tax Rates In Europe Tax Foundation

2023 Corporate Tax Rates Federal State 1 800Accountant

Is Corporate Income Tax Needed Eye Witness News

Is Corporate Income Tax Needed Eye Witness News

Corporate Tax Definition And Meaning Market Business News

Personal Income Tax Rates 2019 TaxAble

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights

Dutch Corporate Income Tax Rates 2023 - Corporate Tax Rates around the World 2023 Of the 225 jurisdictions around the world only six have increased their top corporate income tax rate in 2023 a trend