Dutch Income Tax Credit Depending on one s income level everyone in the Netherlands is entitled to the general tax credit including expats The tax credit is calculated and credited to your tax balance on your salary by your employer so it is not

However if you have income from a country without a treaty with the Netherlands you do not automatically have to pay income tax on this in the Netherlands You will then be Depending on one s income level everyone in the Netherlands is entitled to the general tax credit including expats The tax credit is calculated and credited to your tax balance on

Dutch Income Tax Credit

Dutch Income Tax Credit

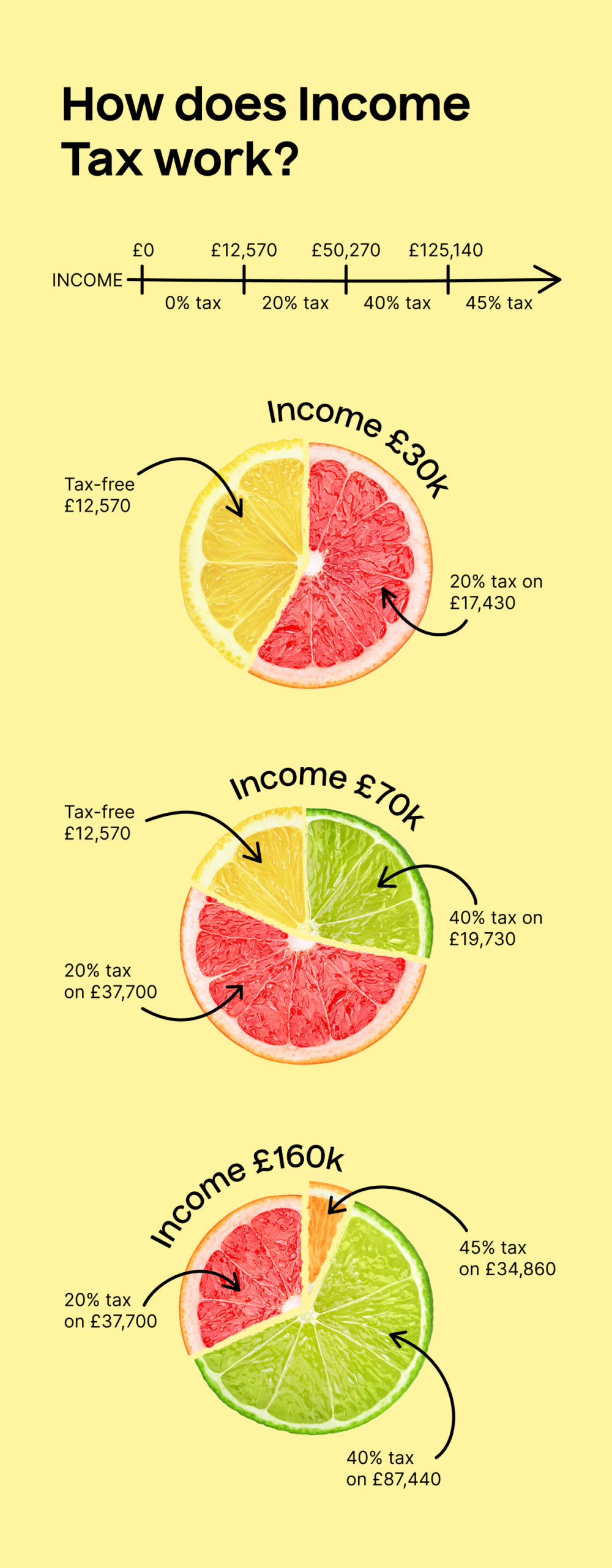

https://taxscouts.com/wp-content/uploads/TaxScouts_IncomeTax-scaled.jpg

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VBGWLCZVOFNVRCJGLVLCPWB75I.jpg)

All You Need To Know About Dutch Income Taxes News In The Netherlands

https://www.reuters.com/resizer/Wb1b2sq_iwwqEC-F3i7NeUiECS8=/1920x1005/smart/filters:quality(80)/cloudfront-us-east-2.images.arcpublishing.com/reuters/VBGWLCZVOFNVRCJGLVLCPWB75I.jpg

How To Avoid The Hidden Cost Of Interest On Your Dutch Income Tax

https://www.iamexpat.nl/sites/default/files/styles/ogimage_thumb/public/oldimages/5b4b8f15442e5b43b9bc73746071af641470385120.jpg

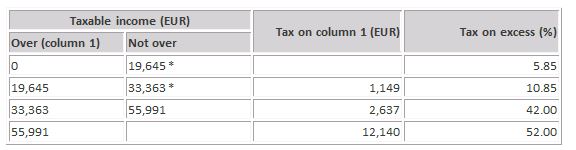

Foreign tax credit See Foreign income in the Income determination section for a description of the foreign tax credit regime Small investments There is a system of Individual Other tax credits and incentives Last reviewed 01 July 2024 Levy rebates Resident partial non resident and qualifying non resident taxpayers are entitled to so

The Netherlands taxes its residents on their worldwide income non residents are subject to tax only on income derived from specific sources in the Netherlands mainly income Under conditions every resident of the Netherlands and every employee working in the Netherlands is entitled to the personal tax credit The 2023 personal tax credit for a full year resident earning 73 031 or less is

Download Dutch Income Tax Credit

More picture related to Dutch Income Tax Credit

Dutch Income Declaration For Belgian Cross border Workers Grenzinfopunkt

https://grenzinfo.eu/wp-content/uploads/2023/03/Dutch-income-declaration-for-Belgian-cross-border-workers.jpg

Memo Dutch Income Tax Deadline Stock Photo Image Of Memo Business

https://thumbs.dreamstime.com/z/memo-dutch-income-tax-deadline-reminder-to-fill-statement-netherlands-written-53090080.jpg

The Dutch Tax System And The Income Tax Return ExpatsHaarlem

https://expatshaarlem.nl/wp-content/uploads/2021/12/scott-graham-5fNmWej4tAA-unsplash-845x321.jpg

Every taxpayer in the Netherlands is entitled to receive the general tax credit algemene heffingskorting and every working person is entitled to receive the labour tax credit arbeidskorting or loonheffingskorting Calculations for 2022 About 30 Ruling The salary criteria for the 30 ruling as per January 2022 are as follows The salary amount does not matter if working with

The tax credit means parents pay less in income tax and national insurance contributions The income related combination tax credit is intended for parents living and working in Dutch tax rates premiums social security and tax credits for 2022 in the Netherlands Holland

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Together Abroad

https://www.togetherabroad.nl/_images_upload/togeth_139081371252e62210dd6cc.jpg

https://www.iamexpat.nl/.../dutch-tax-credits

Depending on one s income level everyone in the Netherlands is entitled to the general tax credit including expats The tax credit is calculated and credited to your tax balance on your salary by your employer so it is not

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VBGWLCZVOFNVRCJGLVLCPWB75I.jpg?w=186)

https://www.belastingdienst.nl/wps/wcm/connect/bld...

However if you have income from a country without a treaty with the Netherlands you do not automatically have to pay income tax on this in the Netherlands You will then be

Corporate Income Tax Annual Tax Return Form Excel Template And Google

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

Explaining The Dutch Income Tax System Expat Arrivals

Earned Income Credit The Only Things You Need To Know Income

Your No Nonsense Guide To Taxes In The Netherlands

Dutch Tax Credits Benefits Tax Breaks In The Netherlands

Dutch Tax Credits Benefits Tax Breaks In The Netherlands

Tax Refund Netherlands

Earned Income Tax Credit EITC Are You Eligible Kiplinger

Royal Dutch Shell To Buy BG Group For Nearly 70 Billion The New York

Dutch Income Tax Credit - Under conditions every resident of the Netherlands and every employee working in the Netherlands is entitled to the personal tax credit The 2023 personal tax credit for a full year resident earning 73 031 or less is