Earned Income Tax Credit Age Limit Find out the maximum EITC amounts you can claim based on your earned income AGI and number of children or relatives The tables show the credit limits for different tax years and

You may claim the Earned Income Tax Credit EITC for a child if your child meets the rules below To qualify for the EITC a qualifying child must Have a valid Social Security See the earned income investment income and adjusted gross income AGI limits as well as the maximum credit amounts for the current previous and upcoming tax years

Earned Income Tax Credit Age Limit

Earned Income Tax Credit Age Limit

https://ecm.capitalone.com/WCM/learn-grow/card/lgc694_hero_what-is-earned-income-tax-credit_v1.jpg

This Is Earned Income Tax Credit Awareness Day

https://dfcby4322olzt.cloudfront.net/wp-content/uploads/2018/01/eitc.jpg

Replace Minimum Wages With The Earned Income Tax Credit By Fred

https://uploads-ssl.webflow.com/56b26b90d28b886833e7a055/57ca19588bb9d6ee1a1ed827_pexels-photo-58728.jpeg

The income limits for earned income adjusted gross income and investment income are adjusted for cost of living each year Find the dollar amounts here To Claim EITC Earned Income Credit EIC table 2024 2023 or EITC tax table for 2023 2024 You must consult these tables to find the maximum AGI investment income and credit amounts for the

Investment income must be 11 600 or less Children must meet certain relationship age residency and joint return requirements to be a qualifying child See if your Below are the latest Earned Income Tax Credit EITC tables and income qualification thresholds adjusted for recent tax years and new legislation These limits are adjusted annually in line

Download Earned Income Tax Credit Age Limit

More picture related to Earned Income Tax Credit Age Limit

Earned Income Tax Credit EITC Erfahren Sie Wie Sie Sich

https://i.gofreedommoney.com/img/investing/earned-income-tax-credit-what-it-is-and-how-to-qualify.jpg

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Earned Income Tax Credit Horizon Goodwill Industries

https://horizongoodwill.org/wp-content/uploads/2022/12/tax-1-1-1187x1536.jpg

To qualify for the Earned Income Tax Credit or EITC you must Be at least 25 years old but not older than 65 If you re claiming jointly without children only one person needs to meet the age requirement You have to be 25 or older but under 65 to qualify for the EIC You also have to have lived in the United States for more than half of the year and can t be a dependent of another person In 2024 you can earn up to 18 591

For 2023 the maximum EITC amounts are 1 600 for a taxpayer without children in their household 2 3 995 for a taxpayer with one child 3 6 604 for a taxpayer The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe

Who Is Eligible For The Earned Income Tax Credit Medium

https://miro.medium.com/v2/da:true/resize:fit:1200/0*192vbxywjokVeji1

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

https://www.irs.gov › credits-deductions › individuals...

Find out the maximum EITC amounts you can claim based on your earned income AGI and number of children or relatives The tables show the credit limits for different tax years and

https://www.irs.gov › credits-deductions › individuals › ...

You may claim the Earned Income Tax Credit EITC for a child if your child meets the rules below To qualify for the EITC a qualifying child must Have a valid Social Security

Earned Income Tax Credit Parameters 1975 2000 Dollar Amounts

Who Is Eligible For The Earned Income Tax Credit Medium

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

What Is The Earned Income Credit Table Brokeasshome

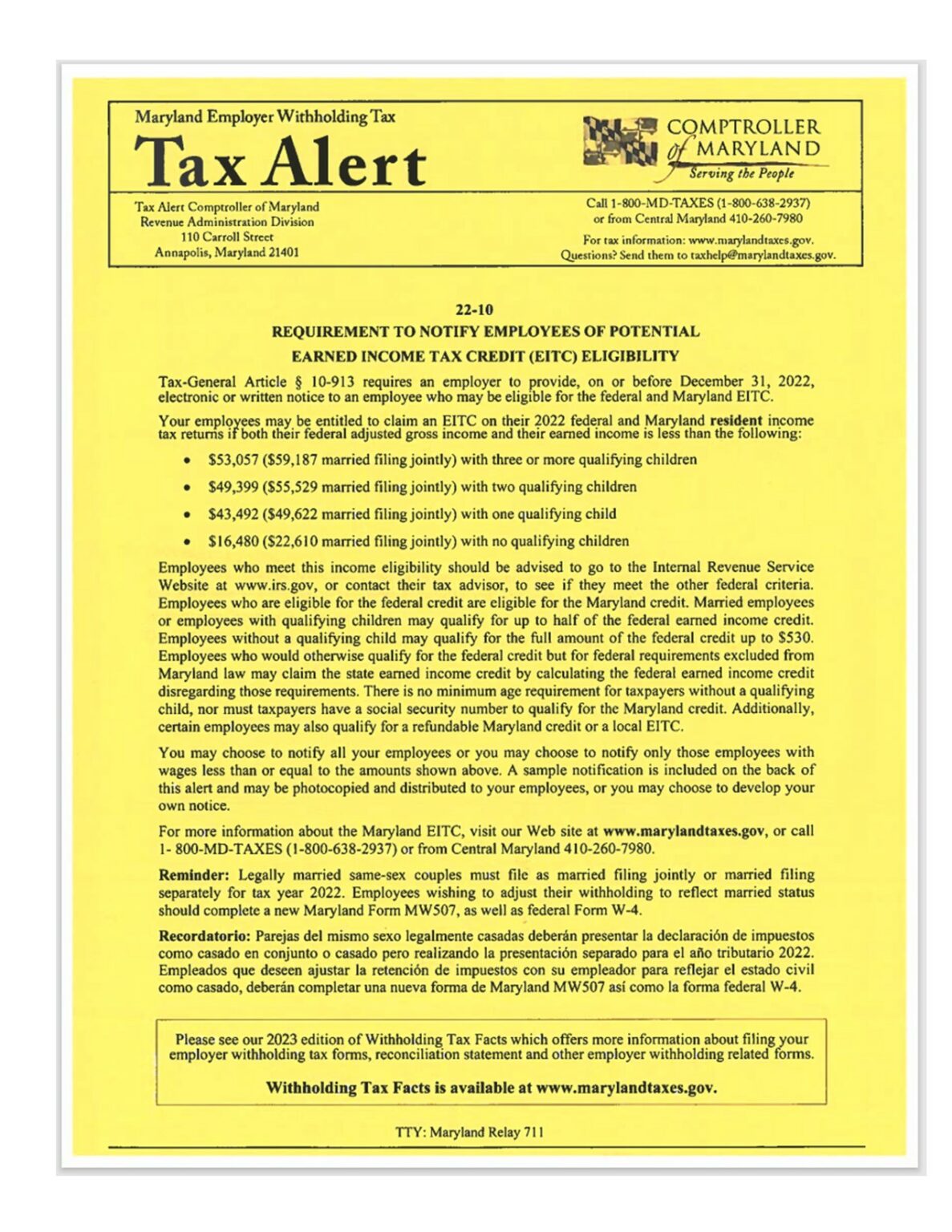

Earned Income Tax Credit And Child Tax Credit Have Powerful Anti

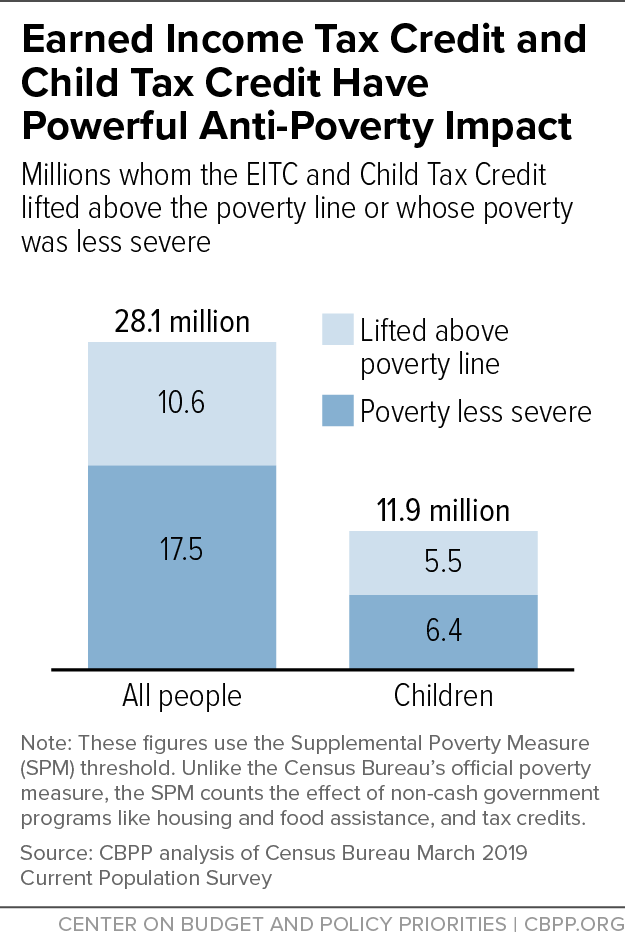

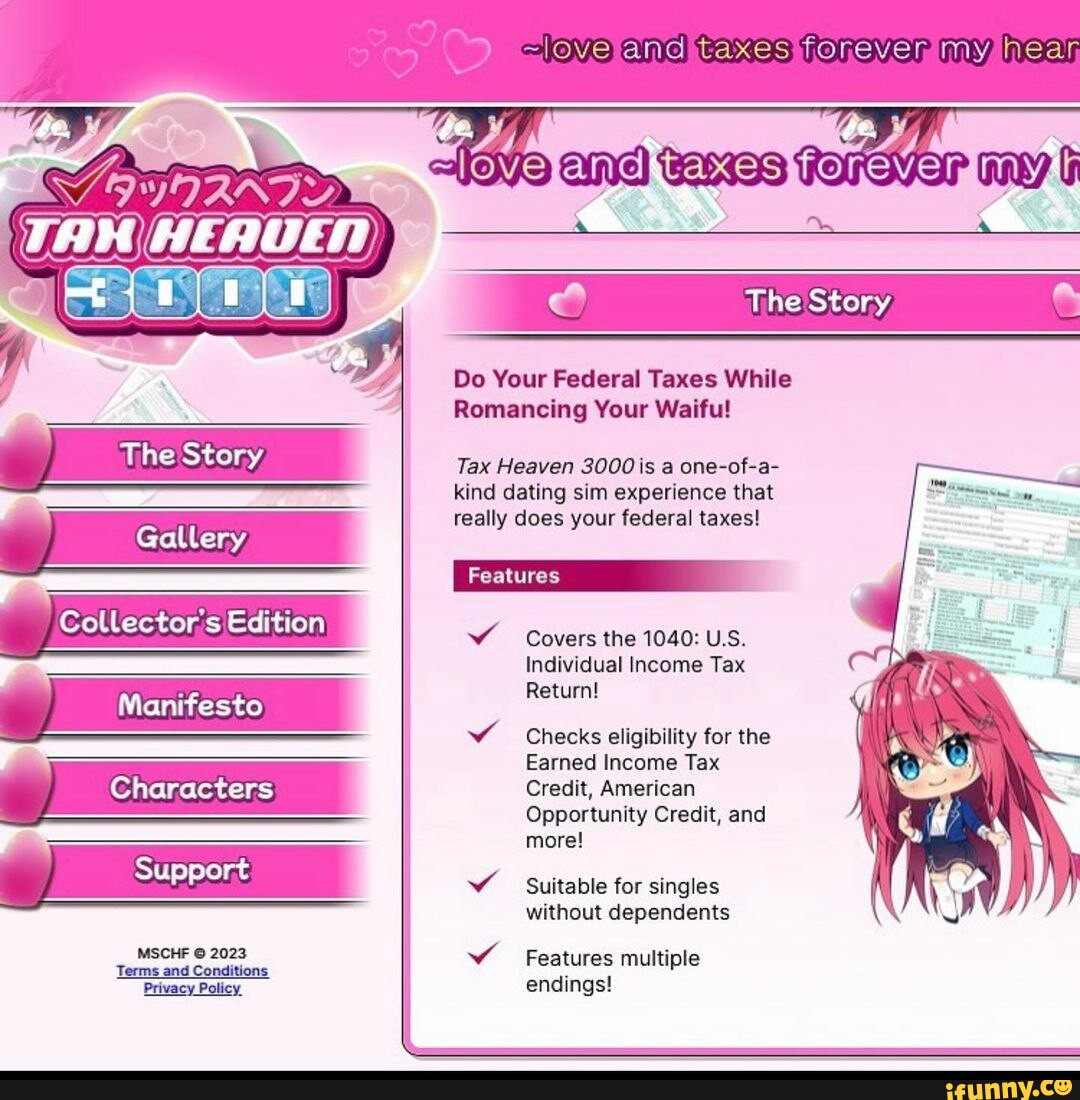

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

Earned Income Tax Credit 2013 1040Return File 1040 1040ez And

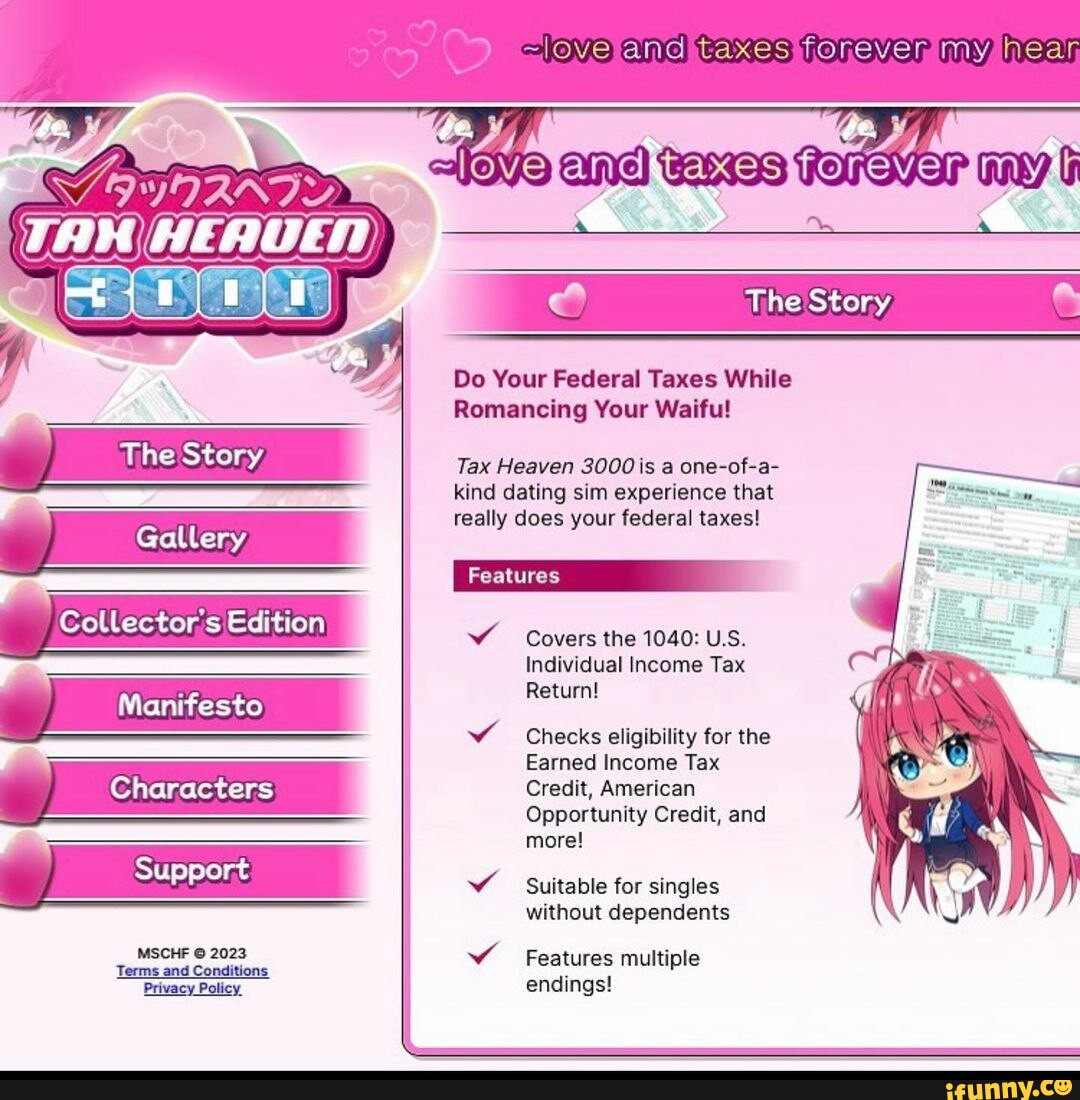

The Federal Earned Income Tax Credit Explained By Maryland Child

State Tax Credits Tax Credits For Workers And Families

Earned Income Tax Credit Age Limit - In 2025 the Earned Income amounts amounts of earned income at or above which the maximum amount of the earned income credit is allowed are no qualifying children