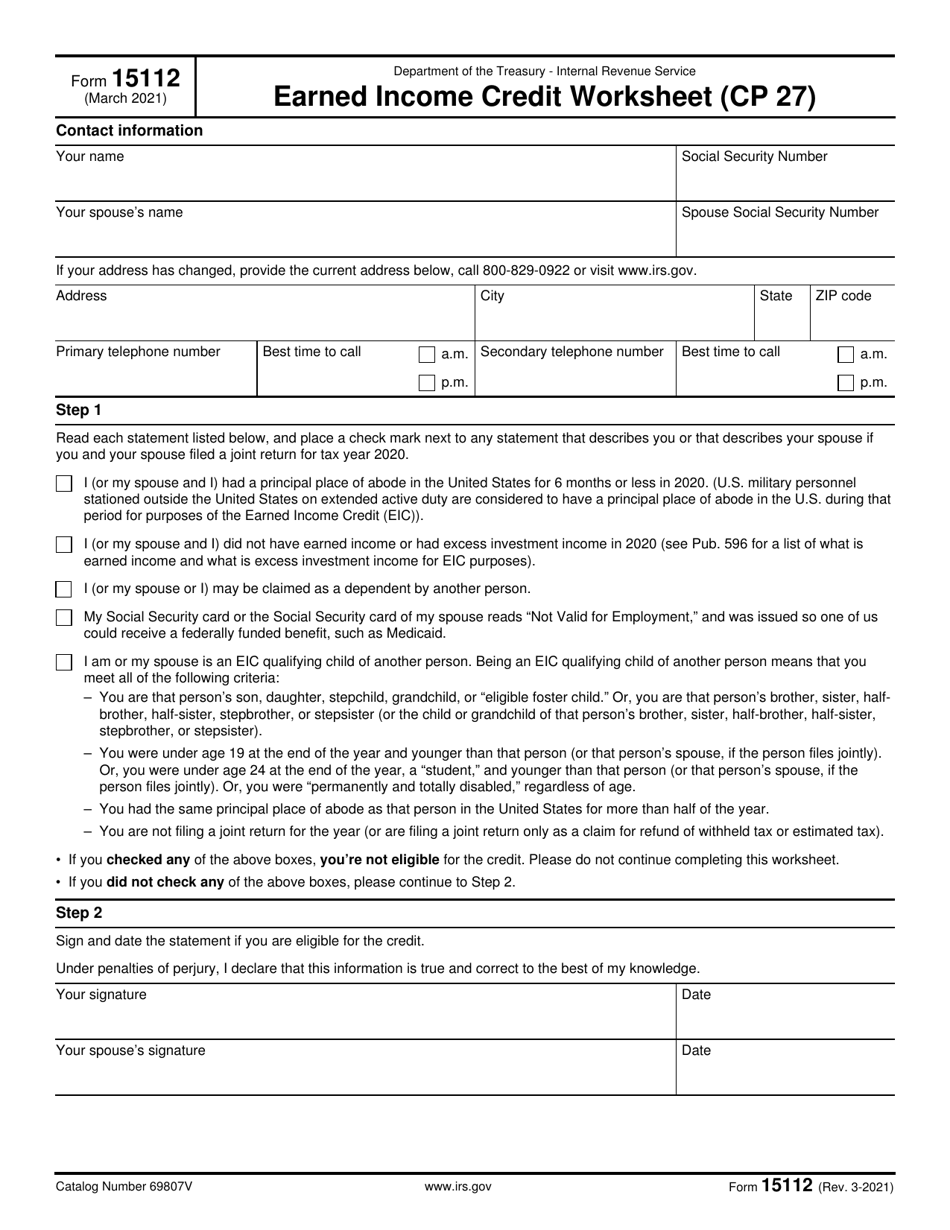

Earned Income Tax Credit Rules 2021 To qualify for the EITC you must Have worked and earned income under 63 398 Have investment income below 11 000 in the tax year 2023 Have a valid Social Security number by the due date of your 2023 return including extensions Be a U S citizen or a resident alien all year Not file Form 2555 Foreign Earned Income

A3 For 2021 the Earned Income Tax Credit generally is available to the following eligible taxpayers who are at least 19 years old without qualifying children Individuals who have earned income of less than 21 430 Spouses filing a joint return who have earned income of less than 27 380 Home Credits Deductions Individuals Use the EITC Assistant General Info Earned Income Tax Credit EITC Assistant The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you qualify 1 General Info 2 Filing Status 3 AGI 4 Qualifying Children 5 Results

Earned Income Tax Credit Rules 2021

Earned Income Tax Credit Rules 2021

https://uploads-ssl.webflow.com/56b26b90d28b886833e7a055/57ca19588bb9d6ee1a1ed827_pexels-photo-58728.jpeg

This Is Earned Income Tax Credit Awareness Day

https://dfcby4322olzt.cloudfront.net/wp-content/uploads/2018/01/eitc.jpg

Earned Income Credit Calculator 2021 DannielleThalia

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

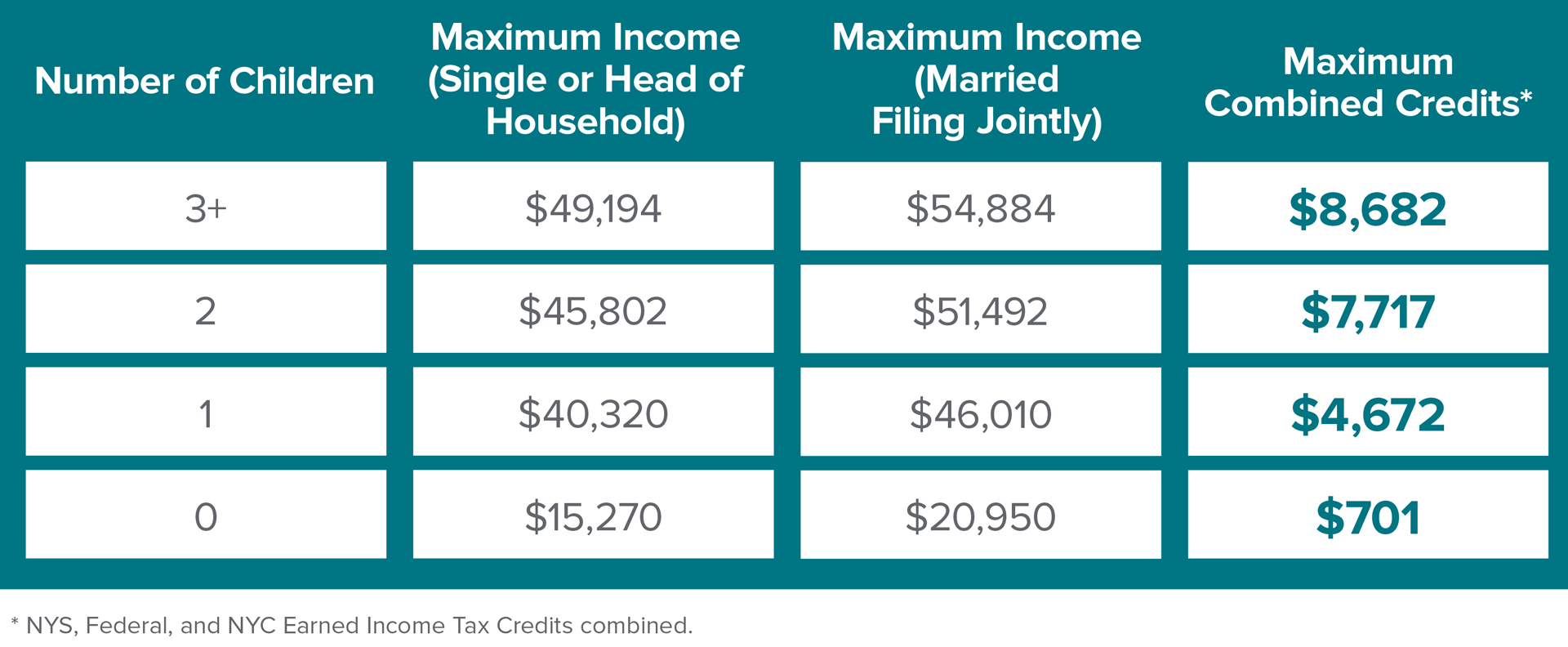

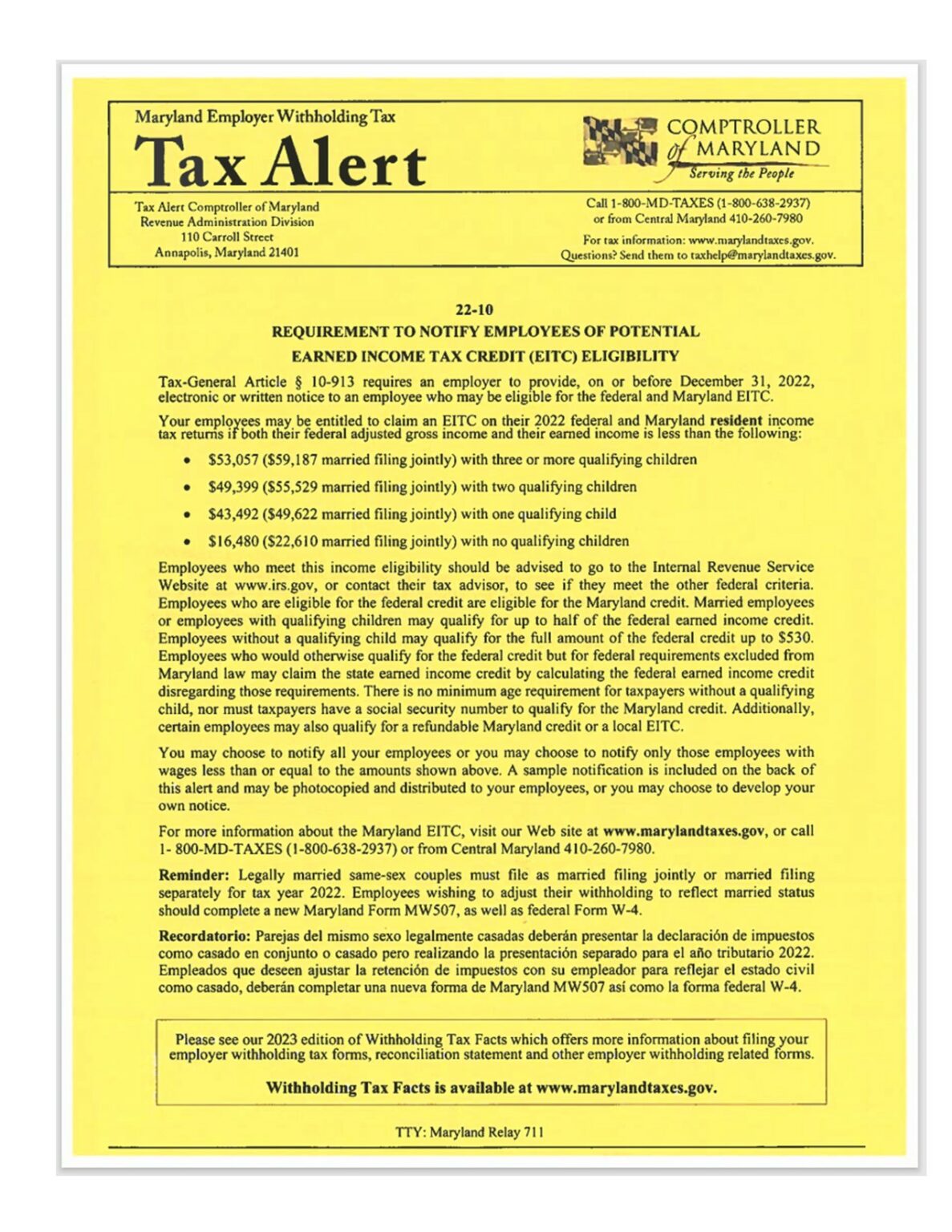

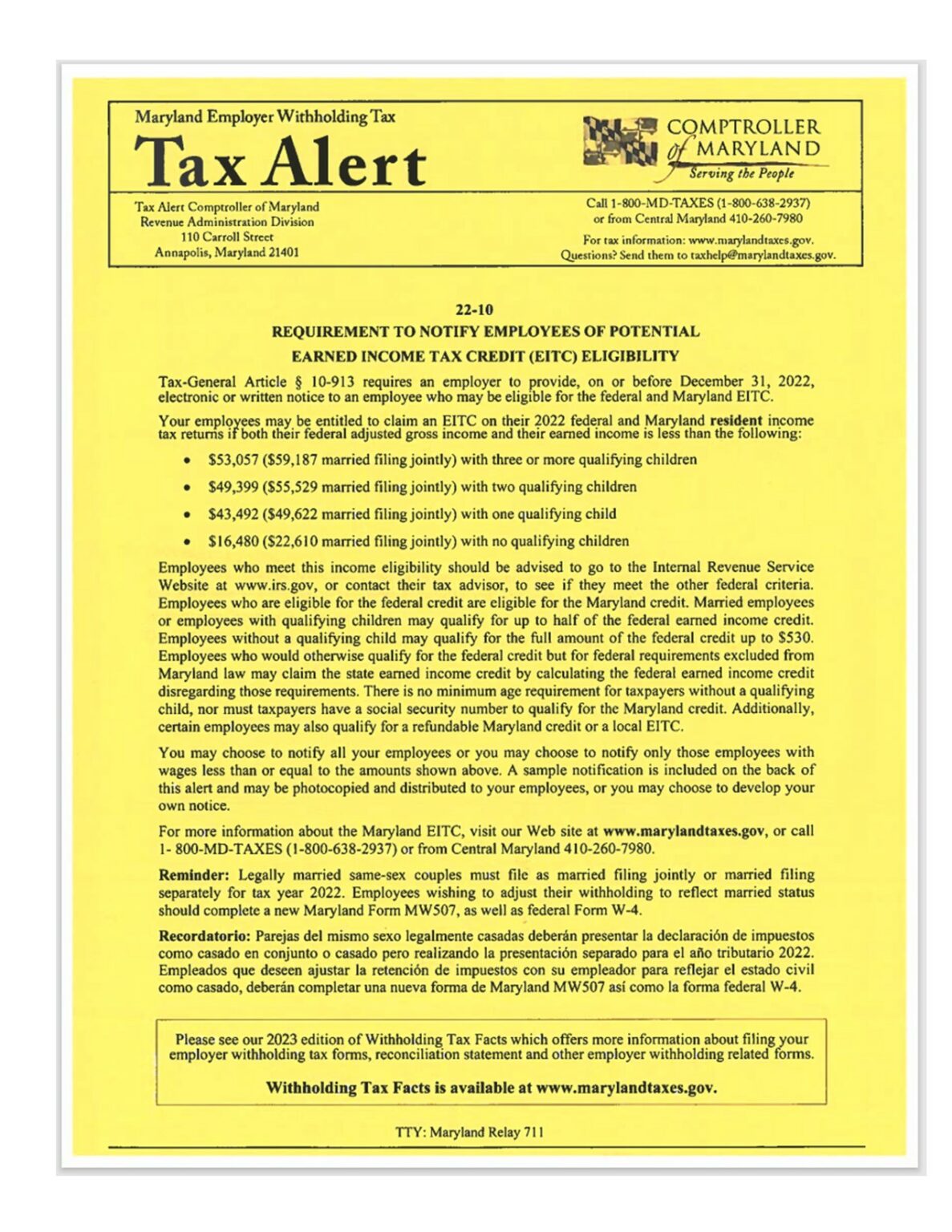

Income Limits and Range of EITC Get income limits for claiming the EITC Nationwide Tax Forums Get professional education resources Awareness Day Spread the word about refundable credits Find more information about EITC on IRS gov Taxpayer claiming the EITC who file Married Filing Separately must meet the eligibility requirements under the special rule in the American Rescue Plan Act ARPA of 2021 See Who Qualifies for the EITC The income limits for earned income adjusted gross income and investment income are adjusted for cost of living each year

Taxpayers claiming the EITC who file Married Filing Separately must meet the eligibility requirements under the special rule in the American Rescue Plan Act ARPA of 2021 Income Limits and Amount of EITC for additional tax years The American Rescue Plan Act of 2021 made several changes to the Earned Income Tax Credit Some of these changes were temporary for the 2021 tax year only others are permanent Changes expanding EITC for 2021 and future years There are several changes that expand the EITC for 2021 and future years

Download Earned Income Tax Credit Rules 2021

More picture related to Earned Income Tax Credit Rules 2021

What Is The Earned Income Tax Credit Table 2021 Brokeasshome

https://www.tax.ny.gov/images/press/eitctableeighteen.jpg

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Who Is Eligible For The Earned Income Tax Credit Medium

https://miro.medium.com/v2/da:true/resize:fit:1200/0*192vbxywjokVeji1

Can I claim the Earned Income Credit Tests for qualifying You typically qualify if How much can I earn and still qualify Special rules for tax years 2020 and 2021 Does my child qualify Example Who is an eligible foster child What about my New rules for Earned Income Tax Credit 2021 2022 and many see changes resulting in larger refunds With the passing of the American Rescue Plan Act of 2021 came some big changes to the Earned Income Tax Credit or EITC These changes can make a huge impact on families filing tax returns for tax year 2021

Beginning in 2021 an individual can now claim the EIC with up to 10 000 of investment income which will be indexed for inflation in future years Before this change individuals were prevented from claiming the EIC if By law we must wait until mid February to issue refunds to taxpayers who claim the Earned Income Tax Credit Still not sure if you qualify for the EITC These resources may help Basic EITC qualifications Earned income Income limits and credit tables Rules for qualifying children Disability and the Earned Income Tax Credit How to

Earned Income Tax Credit Horizon Goodwill Industries

https://horizongoodwill.org/wp-content/uploads/2022/12/tax-1-1-1187x1536.jpg

Earned Income Tax Credit Parameters 1975 2000 Dollar Amounts

https://www.researchgate.net/publication/254426242/figure/tbl1/AS:393290550661129@1470779182610/Earned-Income-Tax-Credit-Parameters-1975-2000-Dollar-amounts-unadjusted-for-inflation.png

https://www.irs.gov/credits-deductions/individuals/...

To qualify for the EITC you must Have worked and earned income under 63 398 Have investment income below 11 000 in the tax year 2023 Have a valid Social Security number by the due date of your 2023 return including extensions Be a U S citizen or a resident alien all year Not file Form 2555 Foreign Earned Income

https://www.irs.gov/newsroom/irs-issues-questions...

A3 For 2021 the Earned Income Tax Credit generally is available to the following eligible taxpayers who are at least 19 years old without qualifying children Individuals who have earned income of less than 21 430 Spouses filing a joint return who have earned income of less than 27 380

What Is The Earned Income Tax Credit Table 2021 Brokeasshome

Earned Income Tax Credit Horizon Goodwill Industries

Earned Income Worksheet 2022

Earned Income Tax Credit 2013 1040Return File 1040 1040ez And

What Is The Earned Income Credit Table Brokeasshome

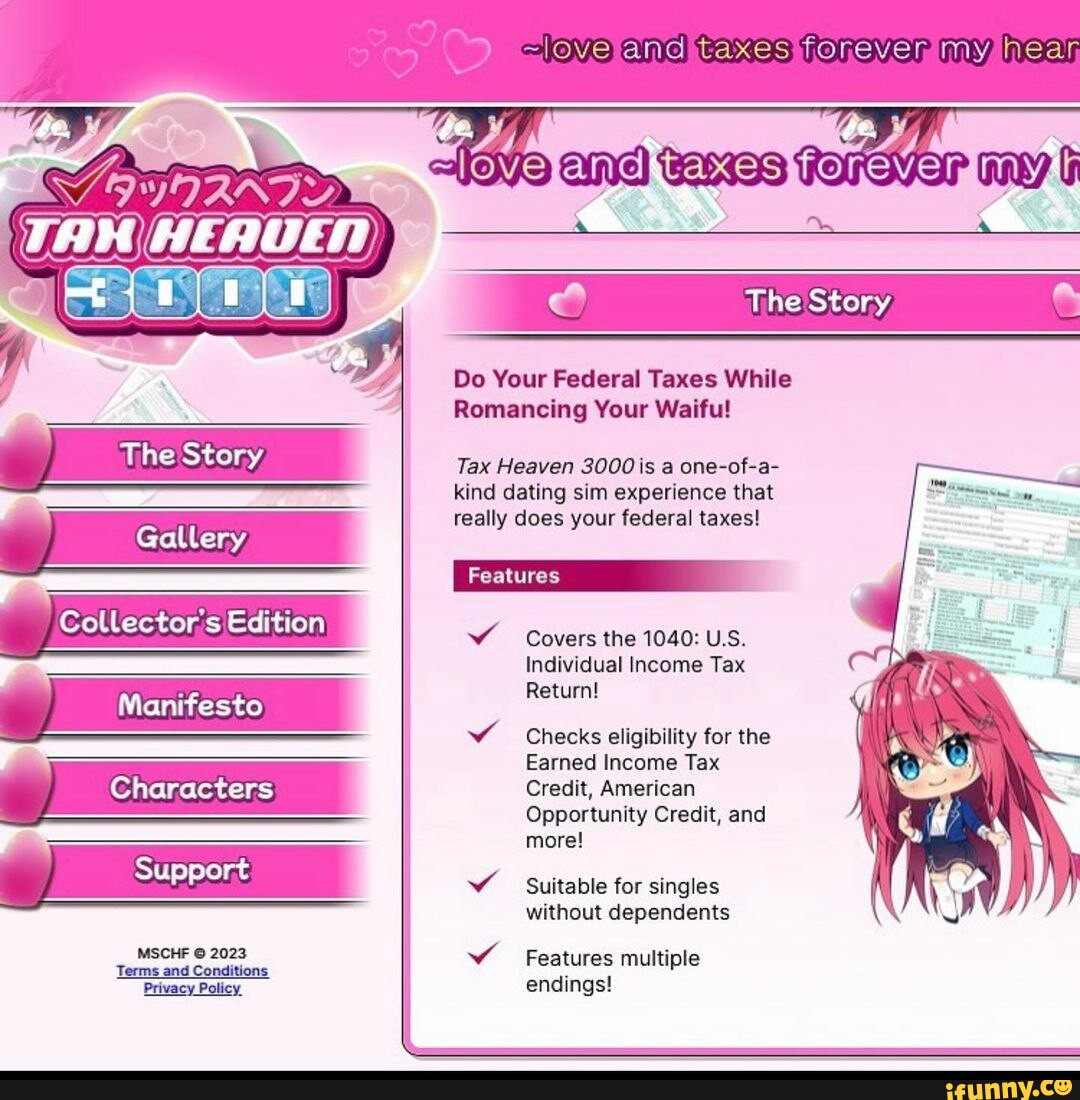

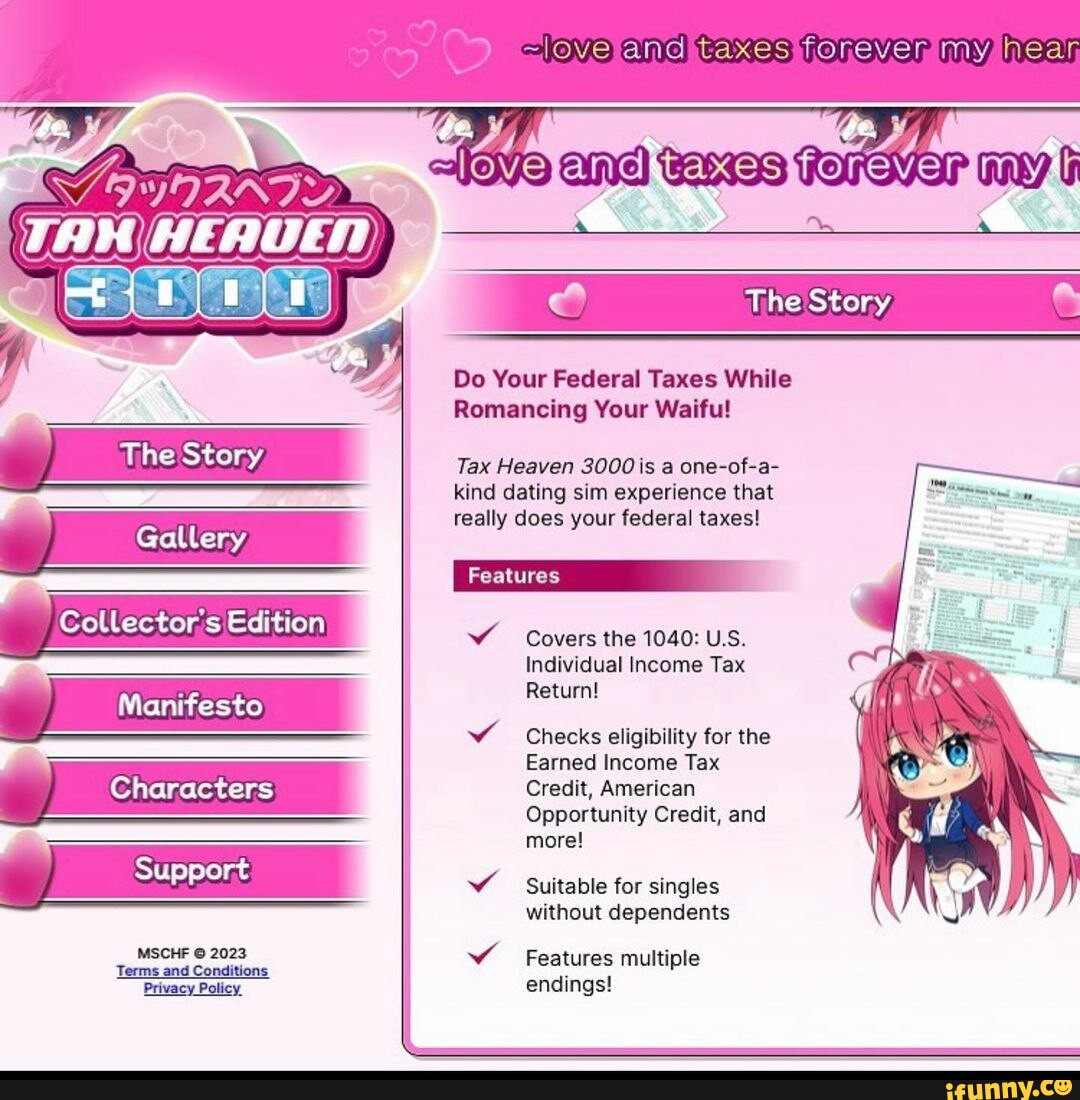

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

Child Tax Credit 2021 Table Earned Income Credit Table 2018

Foreign Earned Income Tax Worksheet 2021

State Tax Credits Tax Credits For Workers And Families

Earned Income Tax Credit Rules 2021 - The amount of the credit a taxpayer receives is based on the prior year s earned income and family composition In other words the 2023 EITC is based on 2023 earned income and other 2023 factors but will not