Education Loan Tax Rebate Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

Web If you pay qualified education expenses in both 2022 and 2023 for an academic period that begins in the first 3 months of 2023 and you receive tax free educational assistance or Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is

Education Loan Tax Rebate

Education Loan Tax Rebate

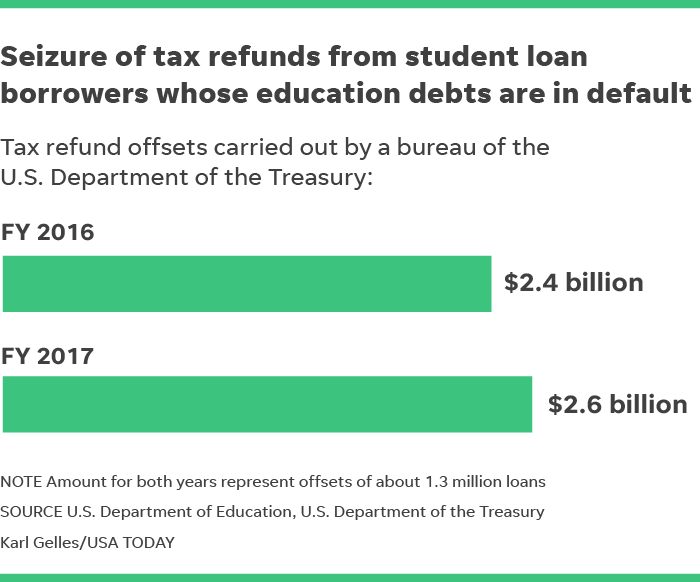

https://www.gannett-cdn.com/media/2018/04/17/USATODAY/USATODAY/636595805484628789-041718-TAX-SEIZURES-Online.png

Cool Student Loans Extension Date Ideas Rivergambiaexpedition

https://i2.wp.com/www.studentloanplanner.com/wp-content/uploads/2017/01/student-loan-payment-calculator-image-1.jpg

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

https://i1.wp.com/frugaling.org/wp-content/uploads/2014/01/StudentLoan1098-E.jpg

Web To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on the education Web 16 juin 2021 nbsp 0183 32 You can claim tax deductions against education loans under Section 80E of the Income Tax Act However there are a few things to keep in mind about tax

Web In short Education Loan Tax Benefits allow students to save a good amount of money on their overseas education loans Get in touch with our team of experts at ELAN Loans Web Education Loan Tax 80E Rebate Calculator Most accurate calculator for section 80E education loan income Tax exemption The easiest and the quickest way to calculate your education loan income tax benefits as

Download Education Loan Tax Rebate

More picture related to Education Loan Tax Rebate

Sbi Education Loan Form Filling Sample Pdf Fill Online Printable

https://www.pdffiller.com/preview/415/209/415209699/large.png

Interest Rates Unsubsidized Student Loans Noviaokta Blog

https://studentloanhero.com/wp-content/uploads/Federal-Student-Loan-Interest-Rates.png

Education Loan Tax Calculator As Per RBI Stats 2023 24 Section 80E

https://www.wemakescholars.com/images/background-design/education-loan-tax.png

Web 12 avr 2019 nbsp 0183 32 Posted In education loan On April 12 2019 With the growing costs of Education parents are taking up Education loan increasingly to fund their child s Web 31 oct 2019 nbsp 0183 32 Department for Education Published 31 October 2019 Last updated 10 May 2023 See all updates Get emails about this page Contents Register your interest

Web 5 avr 2019 nbsp 0183 32 80 E of the Income Tax Act of India 1961 you can claim for the tax benefit against the entire interest paid Well the tax benefit is available only on an education loan applied for higher studies and Web An education loan tax benefit is a provision that allows individuals to claim a tax deduction on the interest paid on a loan taken for higher education This tax benefit is available in

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

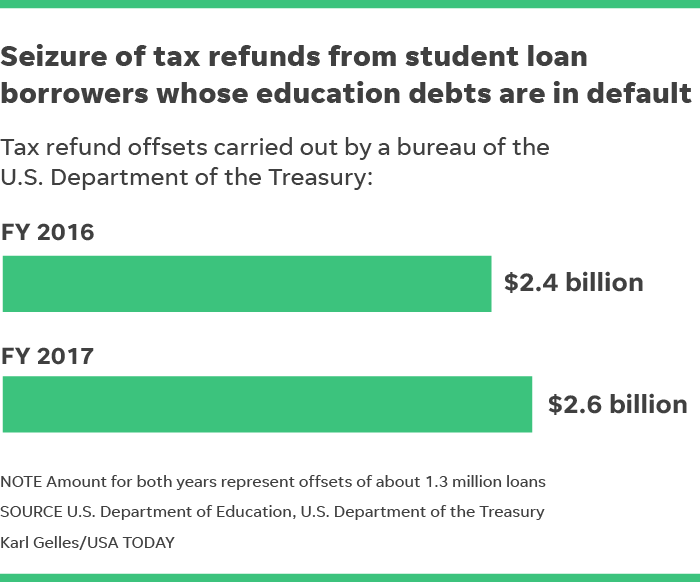

Education Property Tax Rebate Continues In 2022 City Of Portage La

https://www.city-plap.com/cityplap/wp-content/uploads/2022/07/EPTC-1-768x576.jpg

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

https://www.irs.gov/publications/p970

Web If you pay qualified education expenses in both 2022 and 2023 for an academic period that begins in the first 3 months of 2023 and you receive tax free educational assistance or

Provincial Education Property Tax Rebate Roll Out Rural Municipality

What Does Rebate Lost Mean On Student Loans

Education Rebate Income Tested

Education Loan Form Pdf

How Can You Find Out If You Paid Taxes On Student Loans

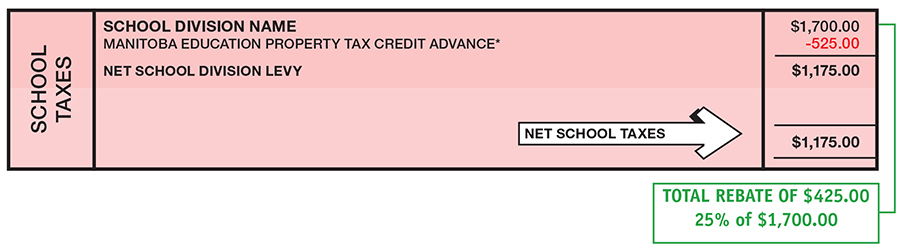

Tax Tables Weekly Ato Review Home Decor

Tax Tables Weekly Ato Review Home Decor

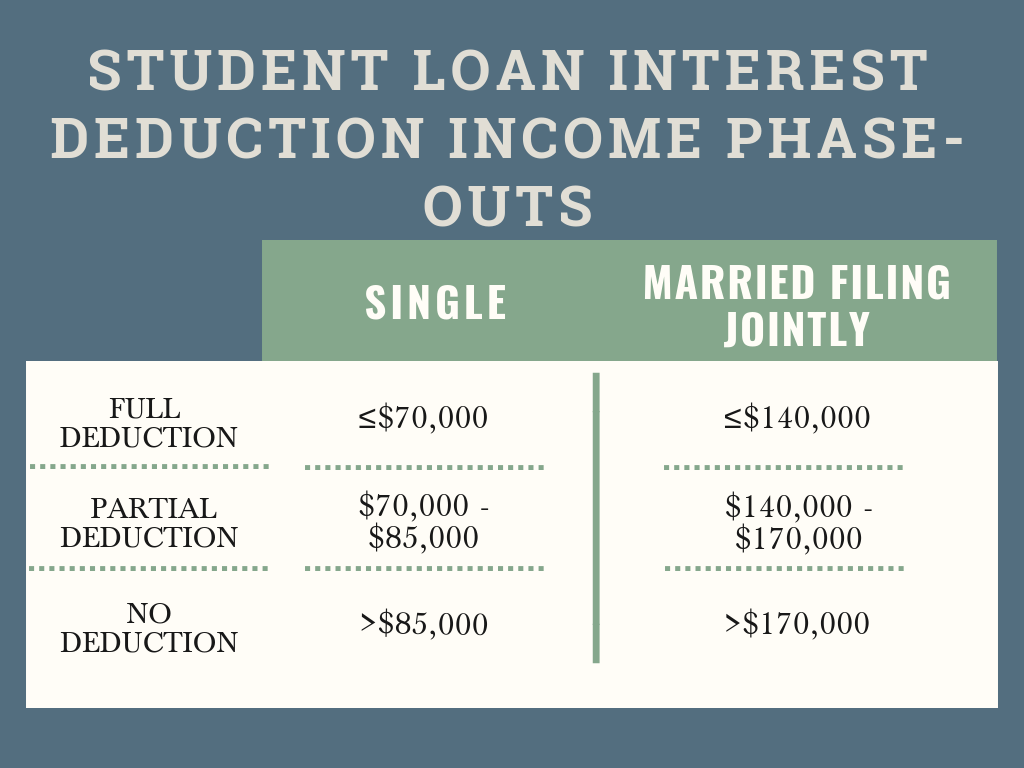

Can I Write Off Student Loan Interest Loan Walls

What Does Rebate Lost Mean On Student Loans

Student Loan Interest Deduction Worksheet Fill Online Printable

Education Loan Tax Rebate - Web 16 f 233 vr 2021 nbsp 0183 32 The Income Tax Act sets no maximum limits on the tax benefits However students can only obtain tax benefits from the interest paid on the education loan