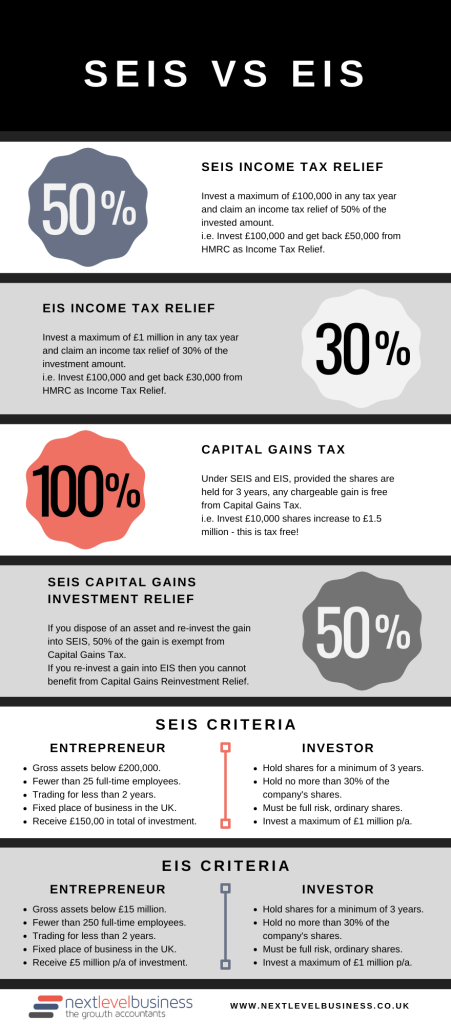

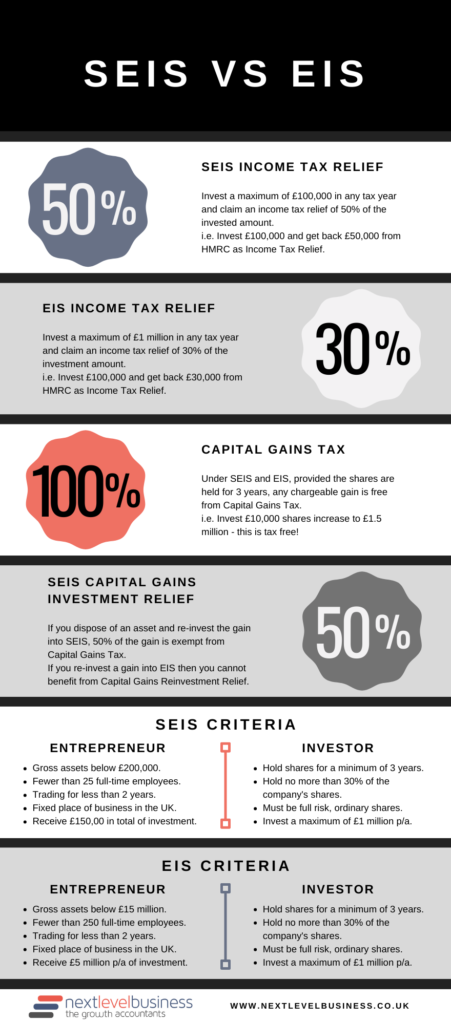

Eis Tax Benefits What are the SEIS EIS tax benefits for investors The different tax benefits for each scheme and what investors have to do to keep them As of April 6 2023 the eligibility

Gives income tax relief worth 50 of the amount subscribed by individual investors with an investment of less than 30 including directors who invest in EIS tax relief at a glance Income tax relief of up to 30 A 100 000 investment could provide a 30 000 saving on that year s income tax bill To claim this you must have

Eis Tax Benefits

Eis Tax Benefits

https://nextlevelbusiness.co.uk/wp-content/uploads/2021/09/SEIS-vs-EIS-Infographic-451x1024.png

HMRC Compliance Duties After You Receive Advanced Assurance Under SEIS

https://www.spondoo.co.uk/wp-content/uploads/2022/08/HMRC-Compliance-Duties-after-you-receive-Advanced-Assurance-under-SEIS-EIS-.png

How Do I Claim An EIS Loss Relief On My Taxes KBC

https://www.keybusinessconsultants.co.uk/wp-content/uploads/2020/12/How-Do-I-Claim-An-EIS-Loss-Relief-On-My-Taxes.jpg

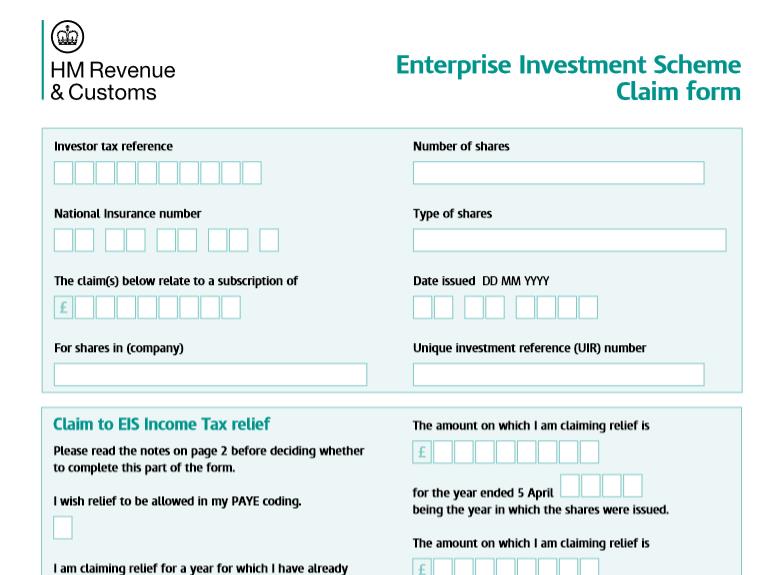

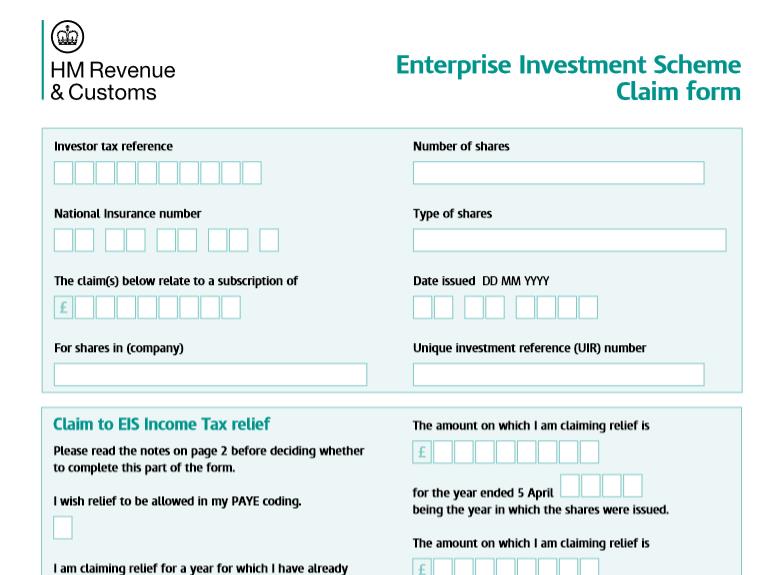

1 What is EIS income tax relief EIS income tax relief is a core tax incentive available under the Enterprise Investment Scheme EIS It enables investors to claim up to 30 income tax relief back from the Through the Enterprise Investment Scheme EIS eligible investors can claim up to 30 income tax relief on investments up to 1 million per tax year This extends to a further

6 facts you might not know about EIS tax advantages From 30 income tax relief to capital gains tax exemption and inheritance tax relief the Enterprise Briefly EIS offers tax benefits in the following ways 30 relief on Income Exemption from CGT on any gains after three years from the investment Capital Gains Tax deferral when gains are reinvested in

Download Eis Tax Benefits

More picture related to Eis Tax Benefits

EIS Income Tax Relief Restriction For Connected Parties Thompson

https://www.thompsontarazrand.co.uk/wp-content/uploads/2019/02/2019-02-14-986505-1.jpg

Claiming EIS Tax Relief For Investors Sleek

https://sleek.com/uk/wp-content/uploads/sites/6/2023/01/how-to-claim-eis-tax-relief.png

EIS Example 350PPM Ltd

https://i0.wp.com/350ppm.co.uk/wp-content/uploads/2018/02/EIS-example.png?ssl=1

1 Income tax relief Investors in EIS will find 30 per cent income tax relief is granted on qualifying investments made up to a maximum of 1m for the 2013 to 2014 The EIS benefits for investors include various types of tax relief We ve covered them all below Income Tax relief Up to 30 Income Tax relief For example if

Income tax relief If investing in an EIS qualifying business you can access up to 30 in income tax relief You can claim this 30 relief on investments up to EIS for Investors What are the benefits of EIS One of the main benefits of EIS investment is the potential to receive significant tax reliefs There are a number of different types of

What Are The Tax Benefits For Investors Under The Seed Enterprise

https://www.spondoo.co.uk/wp-content/uploads/2022/07/Benefits-of-SEIS-and-EIS.png

Tax Efficient Investments VCT And EIS Integrity365

https://plottcreative.s3.eu-west-2.amazonaws.com/integrity365/wp-content/uploads/2023/02/03164155/tax-efficient-investments-for-higher-rate-tax-payers-eis-vct-scaled.jpg

https://www.vestd.com/help/what-are-the-seis/eis-tax-benefits-for-investors

What are the SEIS EIS tax benefits for investors The different tax benefits for each scheme and what investors have to do to keep them As of April 6 2023 the eligibility

https://www.mandg.com/.../eis-vct-seis

Gives income tax relief worth 50 of the amount subscribed by individual investors with an investment of less than 30 including directors who invest in

What Is SEIS And EIS Tax Relief Schemes In The UK Startups Investment

What Are The Tax Benefits For Investors Under The Seed Enterprise

Buttermilch Blaubeer Eis Rezept Buttermilch Hausgemachtes Eis

Getting SEIS EIS Approval Advance Assurance From HMRC

EIS Tax Reliefs Uncovered With Oxford Capital Wednesday 25th May At

Here s How To Claim EIS Tax Reliefs This Tax Year

Here s How To Claim EIS Tax Reliefs This Tax Year

EIS Tax Relief Maximizing Savings And Minimizing Taxes YouTube

KTP Company PLT Audit Tax Accountancy In Johor Bahru

What Is EIS Tax Relief Envestors

Eis Tax Benefits - Briefly EIS offers tax benefits in the following ways 30 relief on Income Exemption from CGT on any gains after three years from the investment Capital Gains Tax deferral when gains are reinvested in