Electric Car Lease Tax Deduction Hmrc Sole Trader Recently we shows you how buying an electric car via your company allows you to offset the full cost of the vehicle against tax In this second instalment we re going to take a look at the tax implications of leasing electric

My client is purchasing a new electric car for use in his sole trader business and is considering different finance options available to him This 2022 guide to tax rules on electric vehicles is primarily for limited companies although we cover the key points for sole traders in the FAQ below It s also aimed at small businesses where generally the owner and the

Electric Car Lease Tax Deduction Hmrc Sole Trader

Electric Car Lease Tax Deduction Hmrc Sole Trader

https://www.palladiumfinancialgroup.com.au/wp-content/uploads/2022/02/Tax-Deductions-You-Can-Claim-As-Sole-Trader.jpg

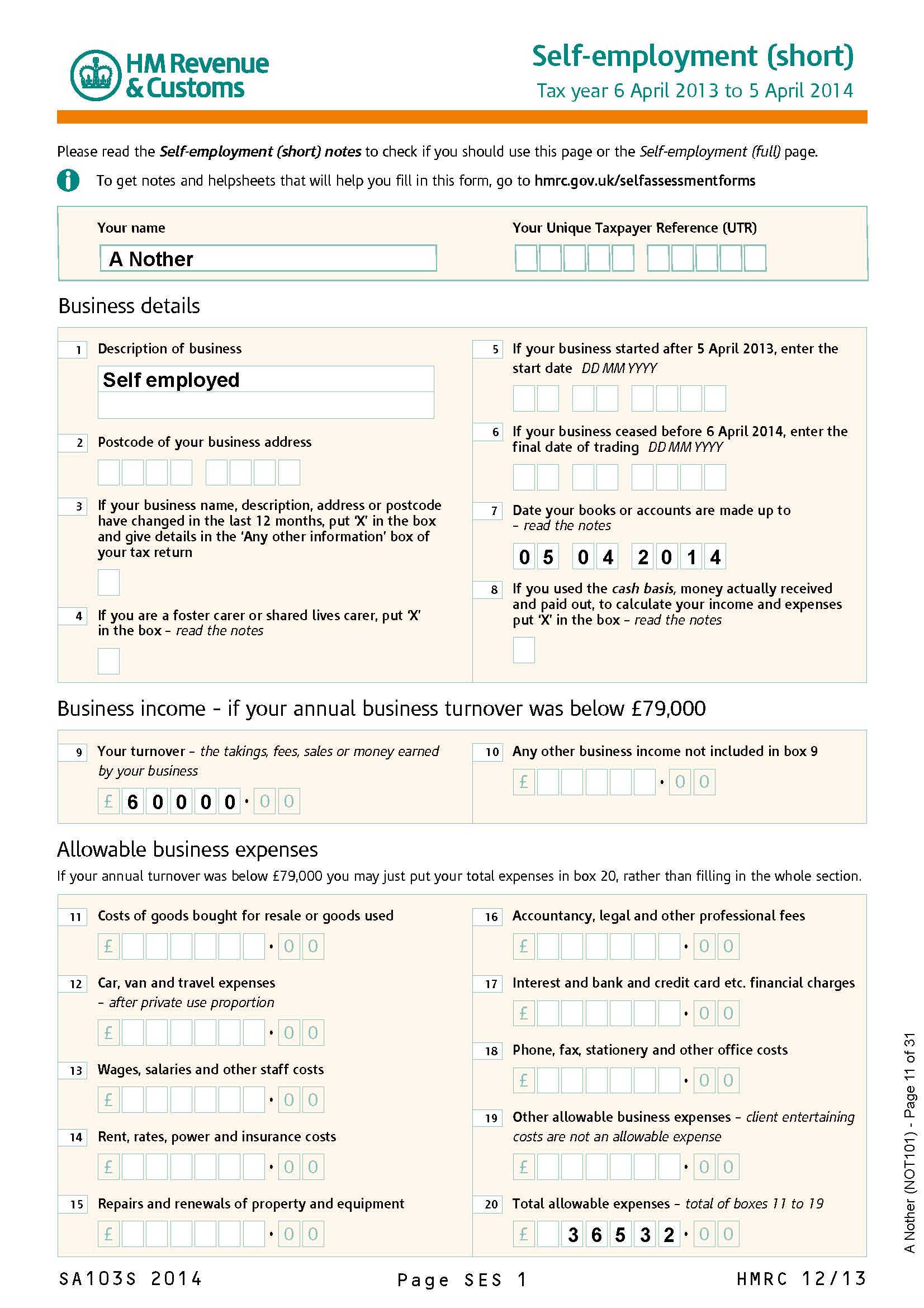

How To Complete Your Tax Return As A Sole Trader A Step By Step Guide

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/6273a2ecdf11bd4fa434268f_WjjZDXlRGWMXD8EDH1MAMfTN5C5Y_5SYe0OjATBIFH49cTchlzeRYGNrGSZU4nRN0CjIb_rjI1pk7BHH8qOX4T31sE3gpdxuu8kF_aQ0DKuMSs6rCdkd0FzGAtguErD1OyTVy1d7ChHJVNQbAg.jpeg

How To Complete Your Tax Return As A Sole Trader A Step By Step Guide

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/6273a312d44c223c7e14d513_R7OgsNjH4lig39o8XRd69U_UntN9gZN64X-layY-5kLM2h2EPqAwUKrQJEo8MT3dbnndQsaPLQpYTnmGyqa5KWJrD2D4WY1WXbi4F0gEgQKqYDPSynhakOIXRElrzkwPB9N7AN1zMGktXtHqKg.png

One of the most attractive incentives available is the capital allowances for electric cars This explores how capital allowances work for businesses and self employed individuals and how you can maximise your tax All cars are treated the same for VAT purposes whether they are electric cars or hybrid or petrol or diesel HMRC VAT Notice 700 64 guidance applies equally to outright purchases hire and

The tax implications of an electric vehicle differ based on whether you are a Sole trader Partnership or if you operate through a Limited Company We have outlined the key tax points to consider should you wish to purchase For sole traders relief would be at their marginal rate of tax 20 40 or 45 rather than at the 19 corporation tax rate

Download Electric Car Lease Tax Deduction Hmrc Sole Trader

More picture related to Electric Car Lease Tax Deduction Hmrc Sole Trader

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

Car Lease Tax Deduction Hmrc Jeraldine Will

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110ca9f70af240a0f6ca9e1_60d829126103922a99639c6c_Is-car-loan-interest-tax-deductible.jpeg

Can I Get A Tax Deduction For My Electric Car Lease

https://etz65cx3ect.exactdn.com/wp-content/uploads/pexels-kindel-media-9800029-scaled.jpg

A business can deduct a percentage of the price of cars against taxable profits This type of tax relief is referred to as a capital allowance The higher the capital allowance the faster the tax The tax treatment of electric vehicles whether you are considering a brand new car or a second hand model varies depending on several factors such as vehicle use how

In this guide we cover how self employed car leasing works including tax benefits advantages of leasing and what you ll need to secure finance So if you need a company car for your Electric Vehicles Electric vehicles qualify for the 100 First Year Allowance meaning the full cost of the vehicle can be deducted from taxable profits in the year of

Car Lease Tax Deduction Hmrc Jeraldine Will

https://www.mazumamoney.co.uk/app/uploads/2018/01/shutterstock_1921919561-scaled.jpg

How To Do A Tax Return As A Sole Trader The 6 Sole Trader Deductions

https://lh3.googleusercontent.com/proxy/uEObG7wpx1qnJrG7EbZzO3TaxvNo-MO-yUTThISL9HPhFQsfdTCaG1KxhN7wmwOLdV4W8yqc4CE0TW_ZP6pITkEN2vf_7Y115itdxa-MsP3DUoO6srKvzQ=w1200-h630-p-k-no-nu

https://www.thp.co.uk/leasing-electric-cars

Recently we shows you how buying an electric car via your company allows you to offset the full cost of the vehicle against tax In this second instalment we re going to take a look at the tax implications of leasing electric

https://www.cronertaxwise.com/community/my-vip-tax...

My client is purchasing a new electric car for use in his sole trader business and is considering different finance options available to him

How Do You Register As A Sole Trader Pandle

Car Lease Tax Deduction Hmrc Jeraldine Will

Definition Of A Sole Trader Financials And Accounting Blog

How To Complete Your Tax Return As A Sole Trader A Step By Step Guide

Car Lease Tax Deduction Calculator Have A Large Ejournal Lightbox

HMRC Changes For Sole Traders And Partnerships Folkes Worton

HMRC Changes For Sole Traders And Partnerships Folkes Worton

Product Detail

Sole Trader Tax Deductions Top Tips 2023

Car Lease Tax Deduction Calculator Have A Large Ejournal Lightbox

Electric Car Lease Tax Deduction Hmrc Sole Trader - The tax implications of an electric vehicle differ based on whether you are a Sole trader Partnership or if you operate through a Limited Company We have outlined the key tax points to consider should you wish to purchase