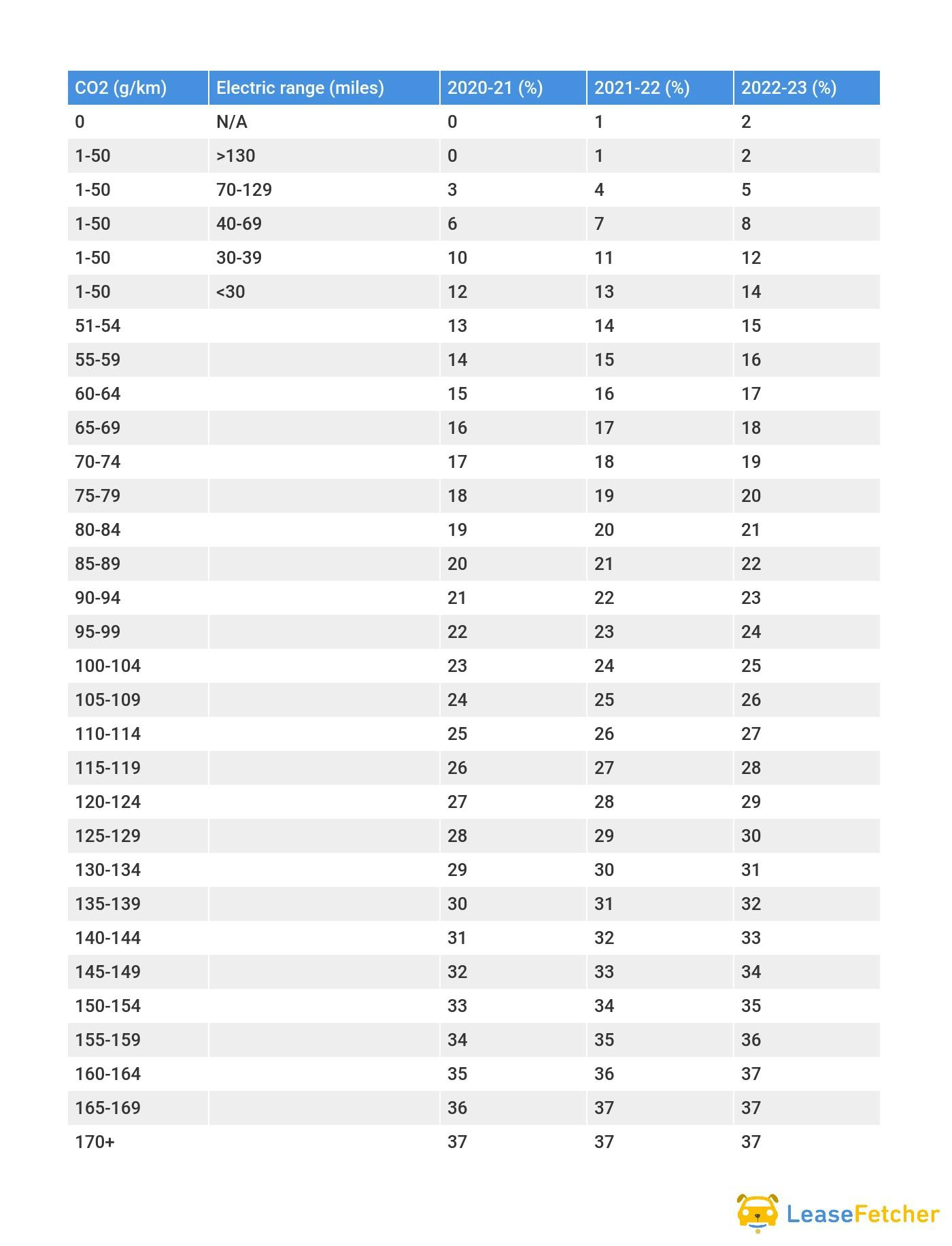

Electric Car Tax Benefits Uk Electric cars with zero emissions fall into the lowest benefit in kind tax band resulting in lower tax liabilities for employees This makes electric vehicles very attractive for businesses and employees As a comparison the percentage for a petrol or diesel car could be as high as 37

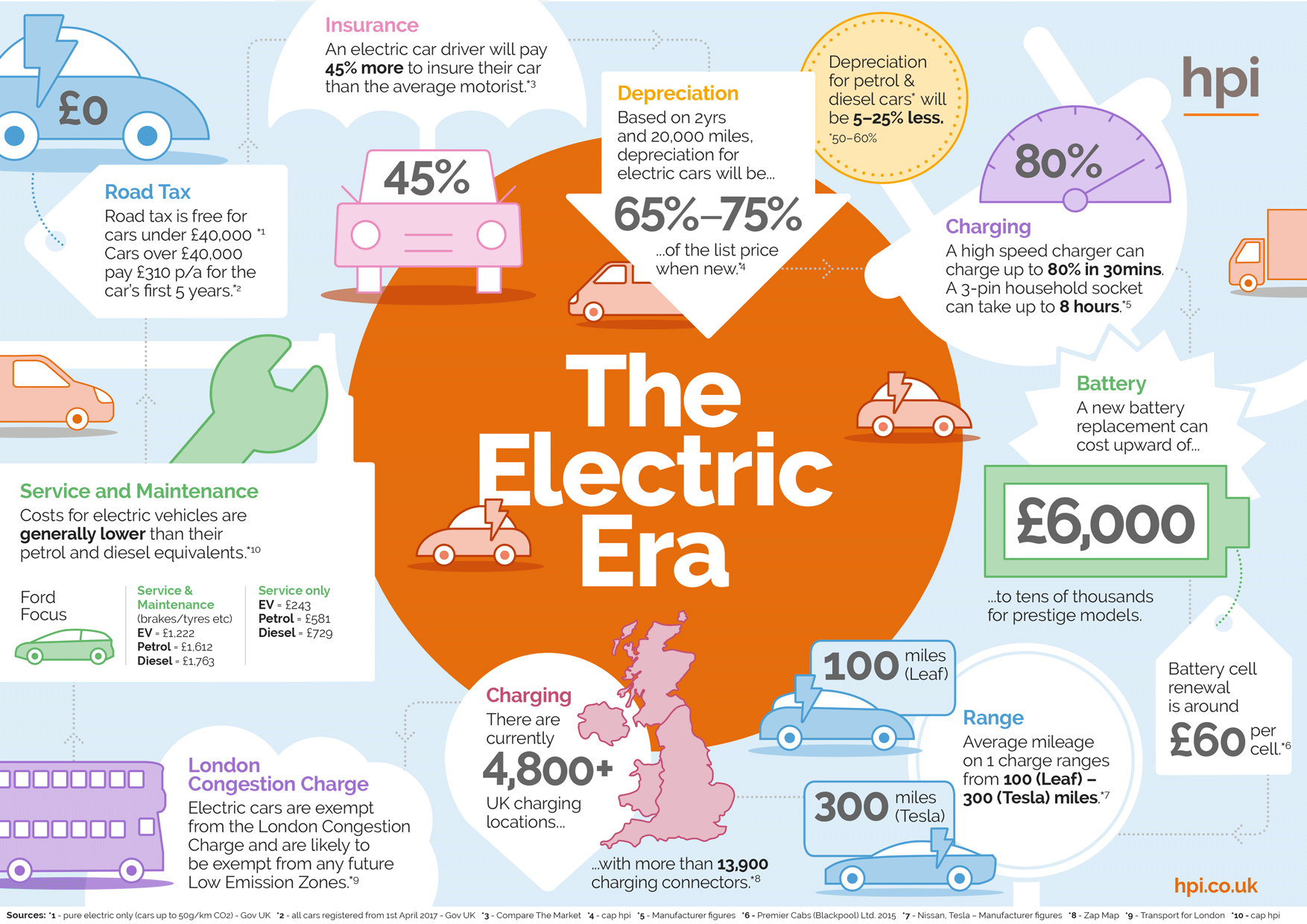

Electric vehicles EVs currently enjoy free road tax also called Vehicle Excise Duty However from 1 April 2025 drivers of electric cars in the UK will need to pay for road tax for the first time The government will continue to use the tax system to support the transition to electric vehicles including using favourable first year VED rates for the lowest emission cars favourable

Electric Car Tax Benefits Uk

Electric Car Tax Benefits Uk

http://www.kafarr.co.uk/wp-content/uploads/2021/07/Electric-Car-Tax-Benefits3.jpg

Electric Car Tax Benefits For The Self Employed Mazars United Kingdom

https://www.mazars.co.uk/var/mazars/storage/images/media/local-contents/united-kingdom/new-brand-imagery/industries/healthcare-ls/thinking-of-going-electric-social/55022365-1-eng-GB/Thinking-of-going-electric-social.jpg

2023 Electric Vehicle Tax Credit BenefitsFinder

https://benefitsfinder.com/wp-content/uploads/sites/4/2023/02/electric-vehicle-tax-credits-1024x684.jpg

Find out whether you have to pay road tax vehicle tax for your EV and what tax incentives there are for business EVs There are a wide range of tax benefits available now for zero or low emission vehicles with 2 and 4 wheels and this article explains what s on offer if you choose to finance the investment through your company Calculating benefit in kind for

The current 2024 Benefit In Kind BIK rate in the UK is 2 for electric cars The 2 BIK rate is set to remain at 2 for the 2024 25 tax year after which it will increase by 1 a year each year to reach 5 in 2027 2028 In this comprehensive guide we explore BIK rates for EVs Unlike with a combustion engined car businesses can deduct the full cost of buying or leasing an electric vehicle from their pre tax profits resulting in lower tax bills

Download Electric Car Tax Benefits Uk

More picture related to Electric Car Tax Benefits Uk

Company Car Tax Benefits For Electric Vehicles Go Electric

https://go-charge.co.uk/wp-content/uploads/2020/08/electric-car-tax-benefits.png

Company Car Tax On Electric Cars How Much Do You Pay Lease Fetcher

https://images.prismic.io/leasefetcher/17a4ca84-bda6-4e58-aa1c-9e10e1b776db_Bik+electric+cars+WLTP.jpg?auto=compress,format

Electric Cars And Benefit In Kind Tax FAQs GreenCarGuide

https://www.greencarguide.co.uk/wp-content/uploads/2019/05/gcg-confused-faq-header-2640x1040.jpg

From 6 April 2020 the benefit in kind for fully electric cars is being reduced to 0 for the tax year 2020 2021 increasing to 1 in 2021 2022 and 2 in 2022 2023 of an EV s taxable list price The government has confirmed that company car tax for EVs will increase 1 each year from 2025 to a total of 5 in April 2028 By contrast the most polluting cars will pay 37 company car

Summary of Electric Car Tax Benefits A battery electric vehicle BEV has 2 Benefit in Kind BIK in 2023 2024 and 2024 2025 From 1 April 2020 until 31 March 2025 all zero emission vehicles are exempt from the Vehicle Excise Duty expensive car supplement The UK government has announced plans to make owners of electric cars pay Vehicle Excise Duty VED from 2025 a change from current rules that exempt such electric vehicles EVs from this

Electric Car Tax Credit Everything That You Have To Know Get

https://getelectricvehicle.com/wp-content/uploads/2020/03/20200323_222104_0000-2137228502-683x1024.png

How Electric Car Tax Works CAR Magazine

https://car-images.bauersecure.com/pagefiles/93884/electric_car_tax.jpg

https://www.taxassist.co.uk/resources/articles/the...

Electric cars with zero emissions fall into the lowest benefit in kind tax band resulting in lower tax liabilities for employees This makes electric vehicles very attractive for businesses and employees As a comparison the percentage for a petrol or diesel car could be as high as 37

https://www.rac.co.uk/drive/electric-cars/running/...

Electric vehicles EVs currently enjoy free road tax also called Vehicle Excise Duty However from 1 April 2025 drivers of electric cars in the UK will need to pay for road tax for the first time

Benefits Of Electric Cars The 10 Most Reliable Luxury Electric Cars

Electric Car Tax Credit Everything That You Have To Know Get

Car Tax Changes New Electric Car Tax Charge Is Needed To save The

Electric Car Tax Benefits Shaw Austin Accountants Chester

Electric Car Tax Breaks For Company Directors Get Your FREE Guide

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Electric Car Tax Credits And Rebates Charged Future

Electric Vehicle Tax Credit Explained Rhythm

Electric Car Tax Credits OsVehicle

Electric Car Tax Benefits Uk - Unlike with a combustion engined car businesses can deduct the full cost of buying or leasing an electric vehicle from their pre tax profits resulting in lower tax bills