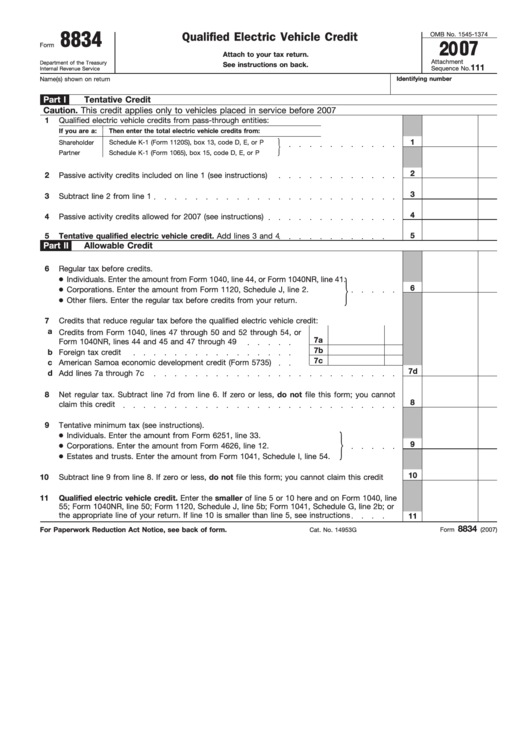

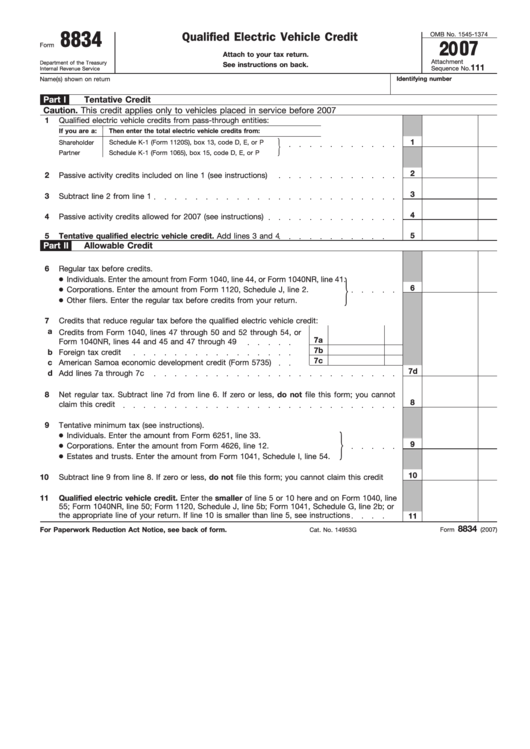

Electric Car Tax Credit 2022 Form Information about Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file Form 8936 is used to figure credits for qualified plug in electric drive motor vehicles placed in service during the tax year

Use Parts I and V of Schedule A Form 8936 to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed in service during your tax year Partnerships and S corporations must file this form to claim the credit To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those interested in claiming tax credits for an electric vehicle purchased after the Inflation Reduction Act s enactment on August 16 2022

Electric Car Tax Credit 2022 Form

Electric Car Tax Credit 2022 Form

https://data.formsbank.com/pdf_docs_html/147/1471/147139/page_1_thumb_big.png

EV Tax Credits And Rebates List 2022 Guide

https://avtowow.com/wp-content/uploads/2021/02/Copy-of-Header-Image-1-1-1.png

All About Tax Credit For EV PHEV And Hybrid Cars CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/954000/800/954828.jpg

Form 8936 is an IRS form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements Internal Revenue Code 30D a determines the Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further changes to the eligibility rules will begin in 2023

In 2022 the available credit you can take is the Qualified Plug in Electric Vehicle Credit This non refundable tax credit is for four wheeled plug in electric vehicles that meet particular battery specifications The credit is worth All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

Download Electric Car Tax Credit 2022 Form

More picture related to Electric Car Tax Credit 2022 Form

Update To List Of Eligible EVs Electric Vehicles For The Clean

https://i0.wp.com/alloysilverstein.com/wp-content/uploads/2022/09/Clean-Vehicle-Credit-2022.png?resize=800%2C1200&ssl=1

Electric Car Tax Credits OsVehicle

https://cdn.osvehicle.com/1666444202247.png

Ev Tax Credit 2022 Retroactive Shemika Wheatley

https://images.hgmsites.net/med/ev-tax-credit-support--climate-nexus-may-2019_100702679_m.jpg

The Qualified Plug In Electric Drive Motor Vehicle Credit is a tax credit available for certain new plug in electric vehicles EVs placed in service before 2023 Namely the credit is worth up to 7 500 under Internal Revenue Code Section 30D But new provisions in 2022 s Inflation Reduction Act have made the EV tax credit easier to claim As of 2024 any qualified buyer can transfer their clean vehicle tax credit to a registered

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit People who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to transfer

Electric Car Tax Credits Explained From Price Caps To Income Limits

https://images.barrons.com/im-598527?height=630&width=1200

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green

https://uploads-ssl.webflow.com/5b89215f86d604eeaac8ad09/5cc0dcfc277db2d132c15682_Fully Electric Vehicles that Qualify for the Federal Tax Credit.jpg

https://www.irs.gov/forms-pubs/about-form-8936

Information about Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit including recent updates related forms and instructions on how to file Form 8936 is used to figure credits for qualified plug in electric drive motor vehicles placed in service during the tax year

https://www.irs.gov/instructions/i8936

Use Parts I and V of Schedule A Form 8936 to figure the clean vehicle credit amount for each qualified commercial clean vehicle you placed in service during your tax year Partnerships and S corporations must file this form to claim the credit

Electric Car Tax Credit Everything That You Have To Know Get

Electric Car Tax Credits Explained From Price Caps To Income Limits

New EV Tax Credits For 2023 Every Electric Vehicle Incentive

Government Electric Vehicle Tax Credit Electric Tax Credits Car

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Accelerating The Plug in Electric Vehicle Tax Credit In The US

Accelerating The Plug in Electric Vehicle Tax Credit In The US

Nj Ev Tax Credit 2022 Alexia Orellana

2023 Electric Vehicle Tax Credit BenefitsFinder

Electric Vehicle Tax Credit Form 2021 Irs Federal Phelcky

Electric Car Tax Credit 2022 Form - Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit is a non refundable credit For more information about how this affects your tax return go to our Nonrefundable Credit vs Refundable Credit FAQ