Electric Cars Tax Breaks Incentives And Rebates Web 22 ao 251 t 2022 nbsp 0183 32 Starting Jan 1 2023 more caveats come into effect Sedans have to be under 55 000 to qualify and the cost of trucks vans and

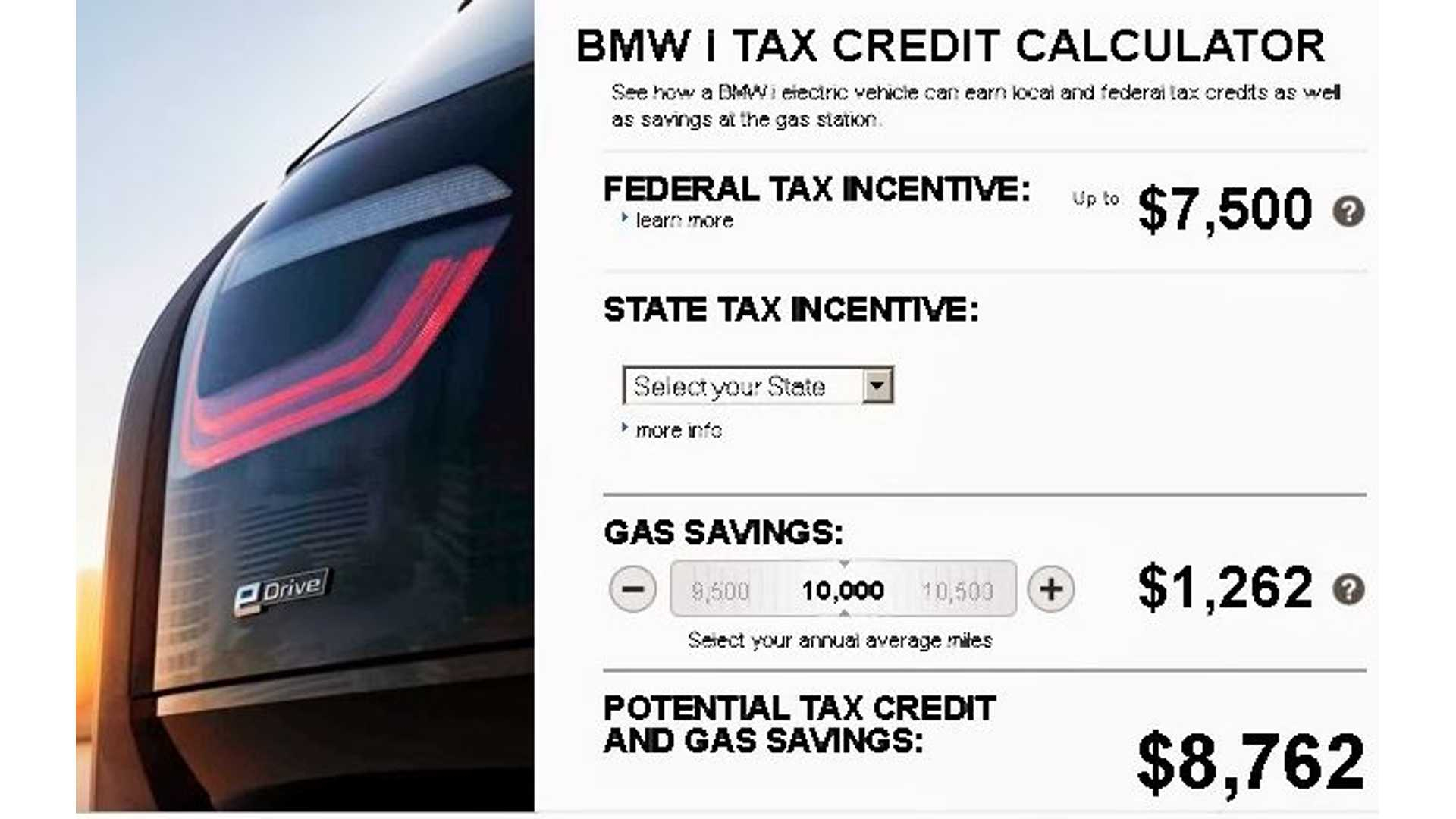

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit

Electric Cars Tax Breaks Incentives And Rebates

Electric Cars Tax Breaks Incentives And Rebates

https://www.electriccartalk.net/wp-content/uploads/washington-state-electric-car-incentives-electriccartalk-net.jpeg

Tax Rebates For Electric Car 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/going-green-states-with-the-best-electric-vehicle-tax-incentives-the-10.png

Pge Incentives For Electric Cars ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/pg-e-500-ev-rebate-priuschat.jpeg

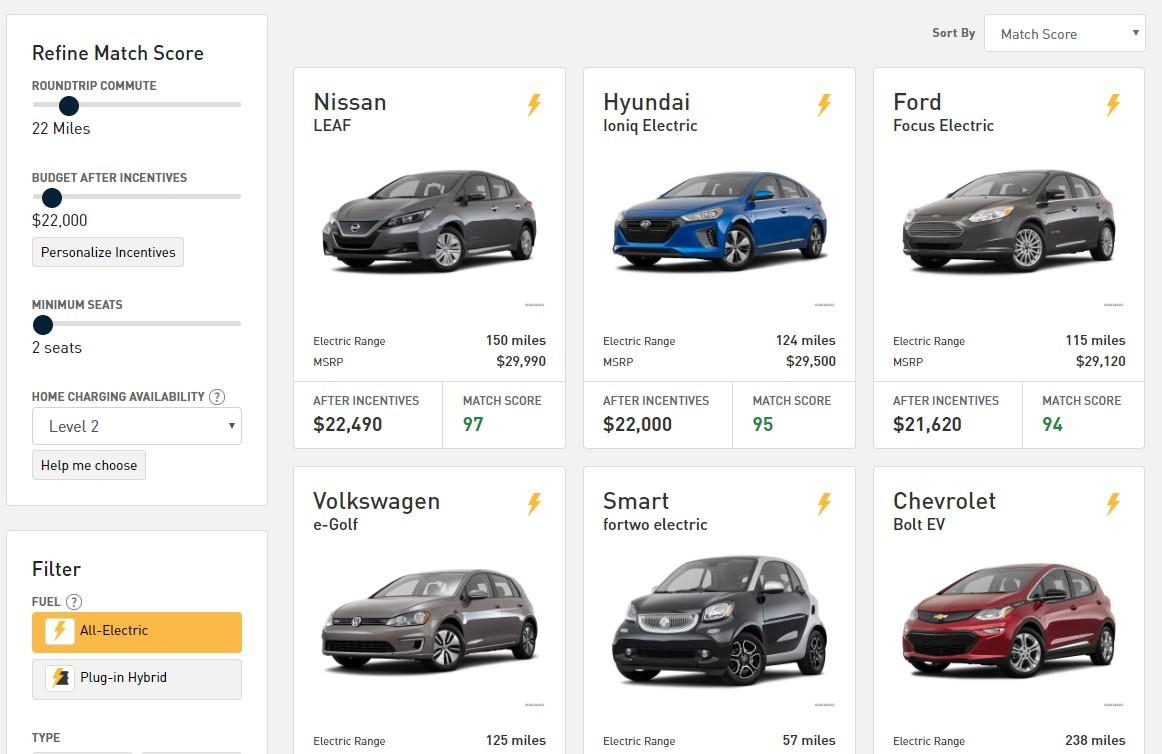

Web 7 ao 251 t 2023 nbsp 0183 32 Yes in addition to federal EV tax credits and local state incentives some automakers offer incentives on their electric vehicles These EV incentives vary month Web 3 janv 2023 nbsp 0183 32 Electric vehicles There are two relevant tax credits for new and used EVs each with different income limits and price caps The way it works for new vehicles is if

Web 7 sept 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 There are certain restrictions The used EV

Download Electric Cars Tax Breaks Incentives And Rebates

More picture related to Electric Cars Tax Breaks Incentives And Rebates

Rebates And Incentives For Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/3-electric-car-incentives-you-need-to-know-in-europe-7.png

Tax Rebates Electric Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/21-biggest-us-tax-incentives-for-electric-cars.png

Electric Cars Tax Breaks Incentives And Rebates In The Us 2023

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/tax-break-for-electric-vehicles-makes-a-comeback-in-washington-state-knkx.jpg

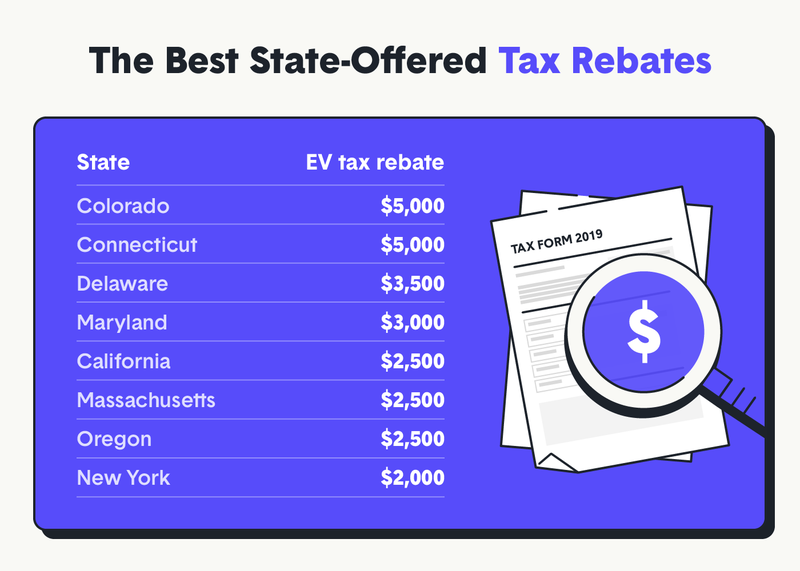

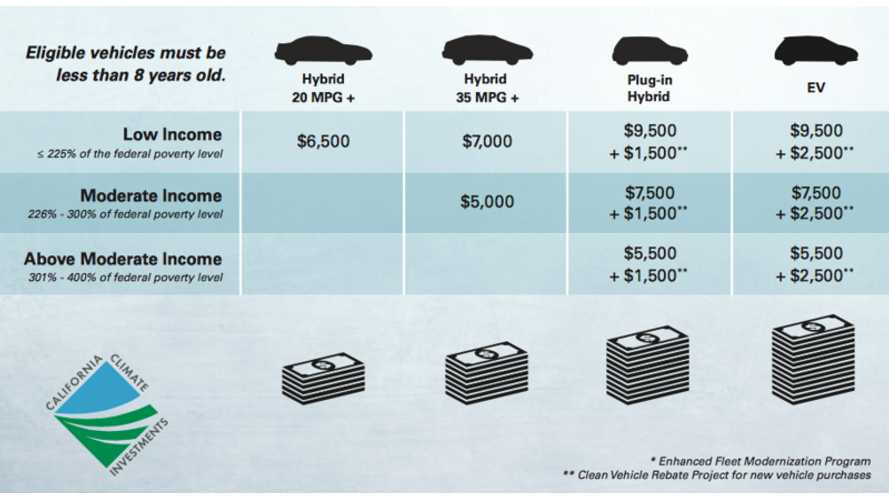

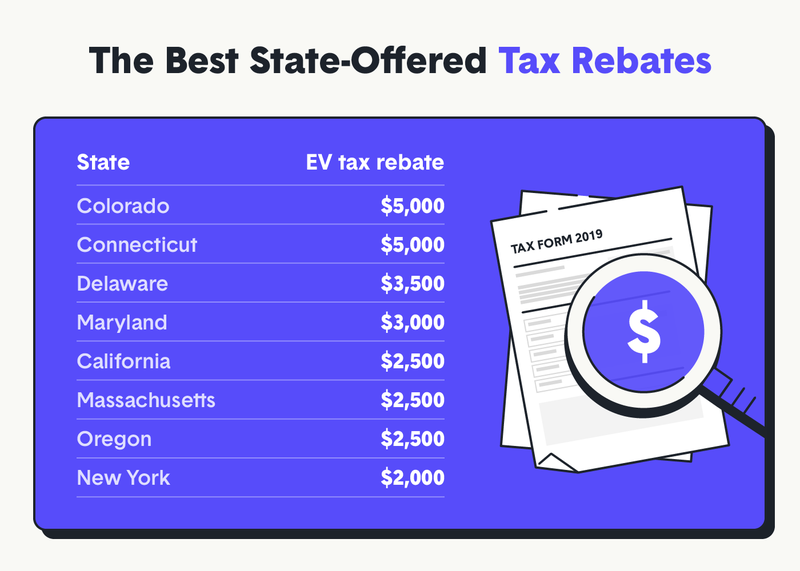

Web 25 juil 2023 nbsp 0183 32 State EV Tax Credits And Electric Vehicle Rebates Some states offer credits or rebates on EV purchases or leases while utility companies may offer breaks on Web 20 mars 2023 nbsp 0183 32 Indiana EV Tax Credits Guide The state of Indiana does not offer incentives for buying EVs though there are some programs available to help Indiana

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for Web 17 avr 2023 nbsp 0183 32 Updated 04 17 2023 03 17 PM EDT Americans can purchase 91 models of electric cars and trucks but as of Tuesday only 14 of them will qualify for federal tax

Opinion Pull The Plug On Electric car Tax Breaks Rebates And Other

https://images.drive.com.au/driveau/image/upload/c_fill,f_auto,g_auto,h_674,q_auto:eco,w_1200/v1/cms/uploads/fsn59orlhdne1vopispc

Ca Electric Car Rebate Income Limit ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/california-breaks-new-ground-with-plug-in-electric-car-incentive-4.jpg

https://www.npr.org/2022/08/22/1118052620

Web 22 ao 251 t 2022 nbsp 0183 32 Starting Jan 1 2023 more caveats come into effect Sedans have to be under 55 000 to qualify and the cost of trucks vans and

https://www.bloomberg.com/news/articles/2022-05-07/what-to-know-about...

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

California Electric Car Rebate Incentive Calculator 2023 Carrebate

Opinion Pull The Plug On Electric car Tax Breaks Rebates And Other

Politics Be Damned Electric Cars Aren t Really So Polarizing

California Votes Against Electric car Incentives Funded By Taxes The

California Electric Car Rebate EV Tax Credit Incentives Eligibility

Electric Vehicle EV Incentives Rebates

Electric Vehicle EV Incentives Rebates

Electric Cars Tax Breaks Incentives And Rebates In The Us 2023

Electric Car Tax Benefit

Famous Federal Incentive Electric Car 2022 Cars Protection

Electric Cars Tax Breaks Incentives And Rebates - Web 17 avr 2023 nbsp 0183 32 The Treasury Department has revealed which cars will be eligible for the new electric vehicle tax credits Fewer models are eligible for the new subsidy than in