Income Tax Rebate On Fd Web 18 janv 2022 nbsp 0183 32 In case you need to add your interest income from FDs to your total income you have to pay the tax either on or before March 31 of the relevant financial

Web 29 juin 2022 nbsp 0183 32 Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can Web 9 nov 2020 nbsp 0183 32 A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can

Income Tax Rebate On Fd

Income Tax Rebate On Fd

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

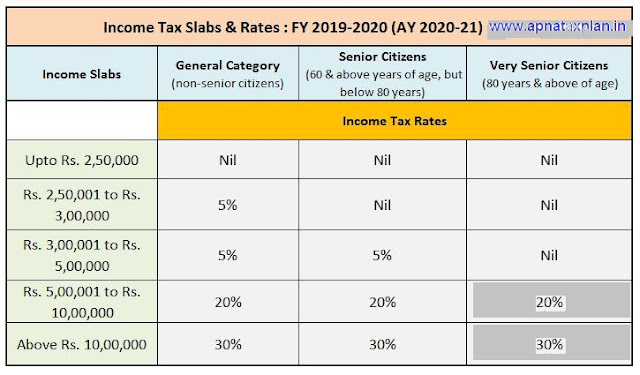

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Web 8 sept 2023 nbsp 0183 32 Tax exemptions on FDs are only available in case of interest received on FCNR B and NRE FD accounts Tax exemptions refers to income that are excluded Web The interest income you earn from an FD is fully taxable The interest earnings form a part of your total tax liability You must also know that when you earn interest on an FD in a

Web Tax Benefits on Fixed Deposits Individuals with fixed deposit accounts can claim deductions of up to Rs 1 5 lakh on the amount invested by them in fixed deposits This TDS on fixed Web 9 janv 2018 nbsp 0183 32 According to current income tax laws if an individual opts for old existing tax regime then under Section 80C of the Income tax Act you can claim deduction for investments up to Rs 1 5 lakh in a financial year

Download Income Tax Rebate On Fd

More picture related to Income Tax Rebate On Fd

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay Web A tax saving Fixed Deposit offers the benefit of deducting your investment amount from your taxable income as per Section 80C of the Income Tax Act 1961 The same cannot be

Web TDS on FD is deducted under the Income Tax Act 1961 Fixed Deposit is a financial instrument offered by banks and other financial institutions to save money and earn a Web 11 mars 2019 nbsp 0183 32 Yes you can claim deduction under Section 80 DDB of Rs 40 000 in the year in which the expenditure has been incurred As per Section 80DDB when a person

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

https://i1.wp.com/only30sec.com/wp-content/uploads/2020/12/Income-tax-Sections-of-deductions-and-rebates-for-Residents-and-Non-Residents.png?w=1303&ssl=1

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

https://navi.com/blog/taxability-of-interest-on-fixed-deposits

Web 18 janv 2022 nbsp 0183 32 In case you need to add your interest income from FDs to your total income you have to pay the tax either on or before March 31 of the relevant financial

https://cleartax.in/s/fixed-deposit

Web 29 juin 2022 nbsp 0183 32 Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Georgia Income Tax Rebate 2023 Printable Rebate Form

Section 87A Tax Rebate FY 2019 20 How To Check Rebate Eligibility

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Deferred Tax And Temporary Differences The Footnotes Analyst

Income Tax Rebate On Fd - Web 3 sept 2023 nbsp 0183 32 Almost every bank offers a rebate on FD interest for senior citizens FD Interest Taxable You might think is FD tax free No it s not tax free Nevertheless you