Income Tax Rebate On Fd Interest Web 18 janv 2022 nbsp 0183 32 18 January 2022 Income Tax Fixed deposits are popular saving instruments that allow you to earn interest for depositing an amount for a fixed period You will get

Web 17 avr 2022 nbsp 0183 32 Interest earned on fixed deposits is taxable as per the Income Tax Act 1961 If you have FD in one or more bank accounts you should aggregate FD interest Web 12 nov 2020 nbsp 0183 32 The interest income you earn from an FD is fully taxable The interest earnings form a part of your total tax liability You must also know that when you earn

Income Tax Rebate On Fd Interest

Income Tax Rebate On Fd Interest

https://myinvestmentideas.com/wp-content/uploads/2012/12/Best-interest-rates-on-tax-saving-FD-in-India–Jan-2013.png

Bank FD Rates In India In Dec 2013 Myinvestmentideas

https://i0.wp.com/myinvestmentideas.com/wp-content/uploads/2013/12/Bank-FD-rates-in-Dec-2013-Interest-rate-chart.jpg

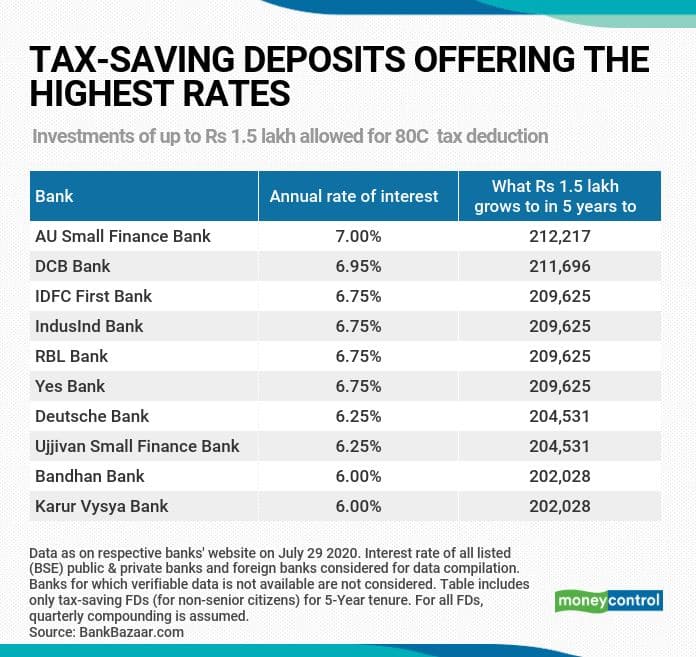

10 Tax saving Fixed Deposits That Offer The Best Interest Rates

https://images.moneycontrol.com/static-mcnews/2020/07/FD-July-31.jpg

Web 8 sept 2023 nbsp 0183 32 Tax exemptions on FDs are only available in case of interest received on FCNR B and NRE FD accounts Tax exemptions refers to income that are excluded Web 6 avr 2022 nbsp 0183 32 For instance Union Bank of India is currently offering an annualised return of 5 30 per cent on a fixed deposit of three years However do note that fixed deposits with

Web 8 avr 2021 nbsp 0183 32 Interest earned from bank fixed deposits is fully taxable for individuals while senior citizens can claim a deduction of up to 50 000 against the interest earned on savings and fixed deposit Web 29 juin 2022 nbsp 0183 32 Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can

Download Income Tax Rebate On Fd Interest

More picture related to Income Tax Rebate On Fd Interest

Latest Fixed Deposit fd Interest Rates Of Small Finance Banks Low

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/05/FD-Interest-Rates-of-Major-Banks-for-Tenure-Less-than-1-year-June-2020_Featured.png?fit=1276%2C871&ssl=1

Income Tax Deductions List FY 2019 20

https://www.relakhs.com/wp-content/uploads/2019/02/Revised-Section-87A-Tax-Rebate-impact-on-Income-tax-liability-calculation-FY-2019-20-AY-2020-21.jpg

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

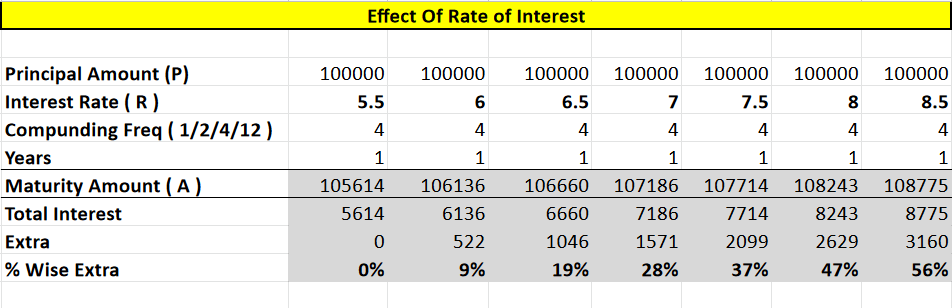

Web 8 d 233 c 2022 nbsp 0183 32 The tax deduction is limited to the actual amount of interest the taxpayer receives Senior Citizen A senior citizen can claim a tax deduction of up to Rs 50 000 Web 15 f 233 vr 2023 nbsp 0183 32 FD Interest is taxable at your slab rate or there is TDS on FD interest along with applicable surcharge cess For example if you have a total income of Rs 10 lakh

Web 3 sept 2023 nbsp 0183 32 To claim the deduction under 80TTA you need to add your total interest income under the head income from other sources in your Income Tax Return The Web 9 janv 2018 nbsp 0183 32 1 Only Individuals and Hindu Undivided Families HUFs can invest in tax saving FD scheme 2 The FD can be placed with a minimum amount which varies from

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

https://navi.com/blog/taxability-of-interest-on-fixed-deposits

Web 18 janv 2022 nbsp 0183 32 18 January 2022 Income Tax Fixed deposits are popular saving instruments that allow you to earn interest for depositing an amount for a fixed period You will get

https://www.taxwink.com/blog/income-tax-on-fd-interest

Web 17 avr 2022 nbsp 0183 32 Interest earned on fixed deposits is taxable as per the Income Tax Act 1961 If you have FD in one or more bank accounts you should aggregate FD interest

Latest Fixed Deposit FD Interest Rates Of Small Finance Banks

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Malaysia Personal Income Tax Guide 2020 YA 2019 2022

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Fed Rate Hike 2023 January

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Axis Fd Calculator Wholesale Outlet Save 44 Jlcatj gob mx

Section 87A Tax Rebate FY 2019 20 How To Check Rebate Eligibility

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate On Fd Interest - Web 11 nov 2019 nbsp 0183 32 Yes the interest income earned on bank post office Fixed Deposits or Recurring deposits is a taxable income The interest income is taxable as per