Electric Vehicle Charger Tax Credit Form Use Form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year The part of the credit attributable to business investment use is

A recently expired federal tax break for electric vehicle EV chargers got new life under the recently passed Inflation Reduction Act a move that will give taxpayers up to 1 000 in a tax To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return

Electric Vehicle Charger Tax Credit Form

Electric Vehicle Charger Tax Credit Form

https://ccsbestpractice.org.uk/wp-content/uploads/2022/08/innovation-1.jpg

Home EV Charger Installation In NH Heritage Home Service

https://justcallheritage.com/wp-content/uploads/2022/11/ev-charger-plugged-in-vehicle-scaled.jpg

Exicom 22 KW EV AC Charger At Rs 83000 piece Electric Vehicle Charger

https://5.imimg.com/data5/SELLER/Default/2021/9/SL/LO/ME/98170676/exicom-ev-ac-charger-7-5-kw-1000x1000.png

The US Treasury s EV charger tax credit which is claimed using IRS Form 8911 is limited to 1 000 for individuals claiming for home EV chargers and 100 000 up from 30 000 for business For consumers who purchase and install an electric vehicle charger for their principal residence the tax credit equals 30 of the cost up to a maximum credit of 1 000 per charging port

Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Tax credits are available for home chargers and This incentive provides a credit for up to 30 of the cost of qualified alternative fuel vehicle refueling property placed in service by the taxpayer The credit may be claimed

Download Electric Vehicle Charger Tax Credit Form

More picture related to Electric Vehicle Charger Tax Credit Form

Electric Vehicle Chargers The Federal Tax Credit Is Back

https://zevsociety.com/wp-content/uploads/2022/09/B2.png

Tax Credit For Electric Vehicles Khou

https://media.khou.com/assets/KHOU/images/fda45742-0ba4-4512-b143-375cf49d3da4/fda45742-0ba4-4512-b143-375cf49d3da4_1920x1080.jpg

Ev Charger Tax Credit Form

https://i.pinimg.com/originals/a9/b0/00/a9b000c597949528990db733d150da3d.jpg

Complete your full tax return then fill in form 8911 You ll need to know your tax liability to calculate the credit We re EV charging pros not CPAs so we recommend getting advice from a tax professional The section 30C provision provides a tax credit for up to 30 of the cost of installing qualified alternative fuel vehicle refueling property such as chargers and hydrogen

To claim the credit EV drivers must file Form 8911 with the IRS You don t get the credit automatically when you purchase an EV charger you must submit income and state Use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year The credit attributable to depreciable property refueling property

32A EV Charger Smart Home Charging Station 220V Electric Vehicle

https://i.ebayimg.com/images/g/UV4AAOSw-f5jFbzR/s-l1600.jpg

IP65 Commercial Electric Vehicle Charging Stations OCPP1 6 22kW Fast

https://www.smartev-charger.com/photo/ps133755012-ip65_commercial_electric_vehicle_charging_stations_ocpp1_6_22kw_fast_charger.jpg

https://www.irs.gov › pub › irs-pdf

Use Form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year The part of the credit attributable to business investment use is

https://www.forbes.com › ... › ev-charg…

A recently expired federal tax break for electric vehicle EV chargers got new life under the recently passed Inflation Reduction Act a move that will give taxpayers up to 1 000 in a tax

Harmons Electric Vehicle Charger FAQs Harmons Grocery

32A EV Charger Smart Home Charging Station 220V Electric Vehicle

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Fast Electric Vehicle Charger DC EV Charging Station On Discout China

How To Qualify For The Maximum Electric Vehicle Tax Credit McGill

How To Qualify For The Maximum Electric Vehicle Tax Credit McGill

Tool Parts Type 2 Plug Electric Car Charger CE Certificated Ev Charging

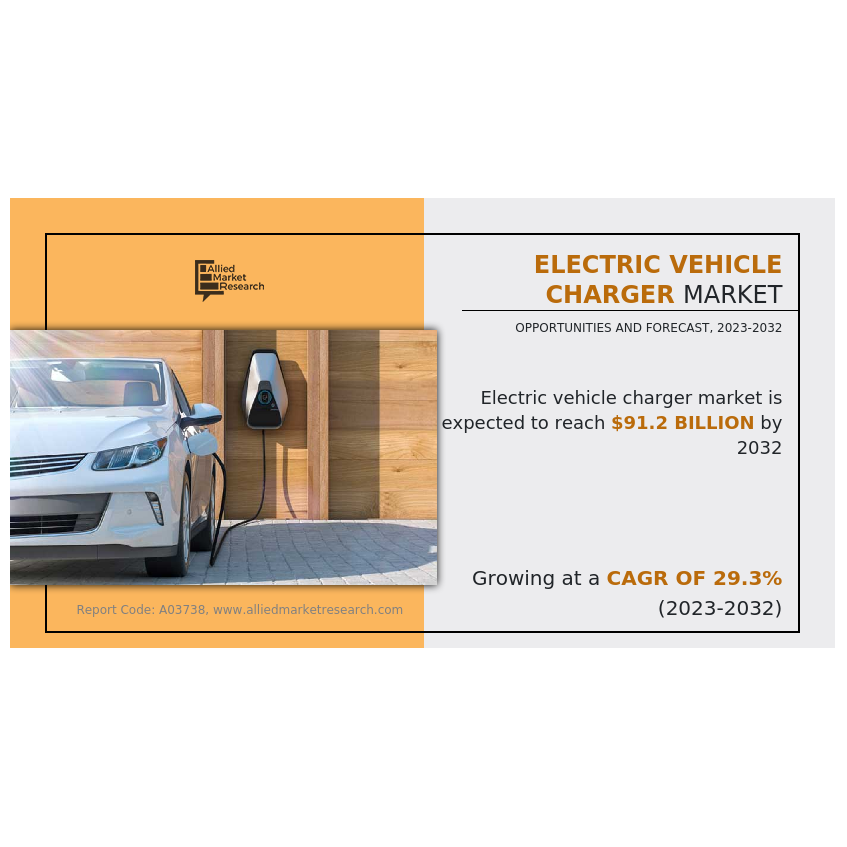

EV Market Forecast 2023 Top Trends That Will Affect EVs In 2023

Electrifying Growth Electric Vehicle Charger Market Eyes 91 2 Billion

Electric Vehicle Charger Tax Credit Form - For consumers who purchase and install an electric vehicle charger for their principal residence the tax credit equals 30 of the cost up to a maximum credit of 1 000 per charging port