Electric Vehicle Credit Irs 2021 Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit is an IRS form that allows the owners of certain electric vehicles to claim a tax credit on their tax return The form can be

Electric Vehicle Credit Irs 2021

Electric Vehicle Credit Irs 2021

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most EVs No Longer Qualify 2022

https://thumbor.forbes.com/thumbor/fit-in/960x/filters:format(jpg)/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

The Qualified Plug In Electric Drive Motor Vehicle Credit is a tax credit available for certain new plug in electric vehicles EVs placed in service before 2023 Namely the credit is worth up to 7 500 under Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so

Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Make sure you meet the The federal tax credit for electric cars has been around for more than a decade You can get 7 500 back at tax time if you buy a new electric vehicle but not

Download Electric Vehicle Credit Irs 2021

More picture related to Electric Vehicle Credit Irs 2021

Electric Vehicle Tax Credit 2023 Electric Vehicle Tax Credit Survives

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/08/GettyImages-1252669337-ev-tax-credit-electric-vehicle-tax-credit-2400x1440.jpg

IRS Form 8936 Plug in Electric Drive Motor Vehicle Credit EVAdoption

https://evadoption.com/wp-content/uploads/2017/07/IRS-form-8936-Plug-in-Electric-Drive-Motor-Vehicle-Credit.png

IRS Reclassification Of Electric Vehicle Rules Leaves Some Tesla Models

https://www.autospies.com/images/users/Agent009/main/Model Y IRS.jpg

Sound like something you qualify for Claim the credit on IRS Form 8936 Clean Vehicle Credit 2023 to 2032 In 2023 the credit is renamed the Clean Vehicles Credit There s also a new Credit for Previously Owned Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified Beginning with tax year 2023 in addition to a new North America final assembly requirement the former 7 500 credit is broken into two new credits worth up

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

IRS Changes EV Tax Credit Vehicle Classifications Here s The New List

https://www.carscoops.com/wp-content/uploads/2023/02/khjglfghj-1024x576.jpg

https://www.irs.gov/clean-vehicle-tax-credits

Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png?w=186)

https://www.irs.gov/credits-deductions/...

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue

2021 Electric Car Tax Credit Irs Ngoc Schafer

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Form 8911 For 2023 Printable Forms Free Online

See The EIC Earned Income Credit Table Income Tax Return Income

How Do The Used And Commercial Clean Vehicle Tax Credits Work Blink

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F22638222%2Fmerlin_2873147.jpg)

There Are A Few Things They Don t Tell You When Renting An Electric Car

%2Fcdn.vox-cdn.com%2Fuploads%2Fchorus_asset%2Ffile%2F22638222%2Fmerlin_2873147.jpg)

There Are A Few Things They Don t Tell You When Renting An Electric Car

US Federal 7 500 Electric Vehicle Credit Expiry Date By Automaker

Irs Electric Car Tax Credit ElectricCarTalk

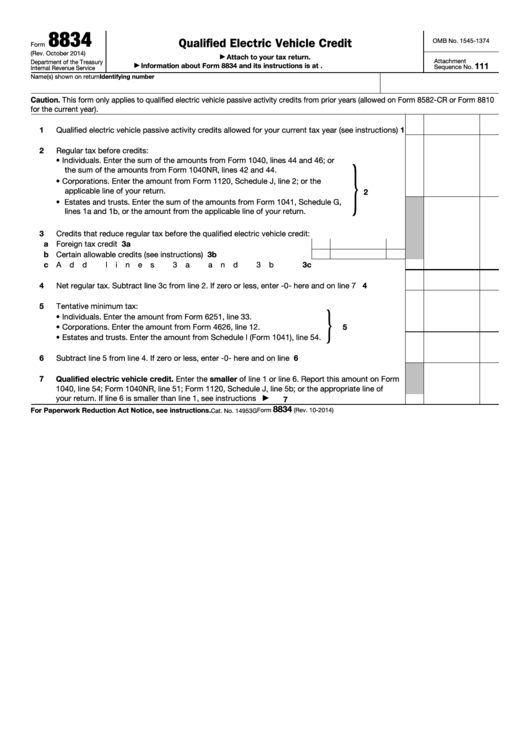

Fillable Form 8834 Qualified Electric Vehicle Credit Printable Pdf

Electric Vehicle Credit Irs 2021 - Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Make sure you meet the