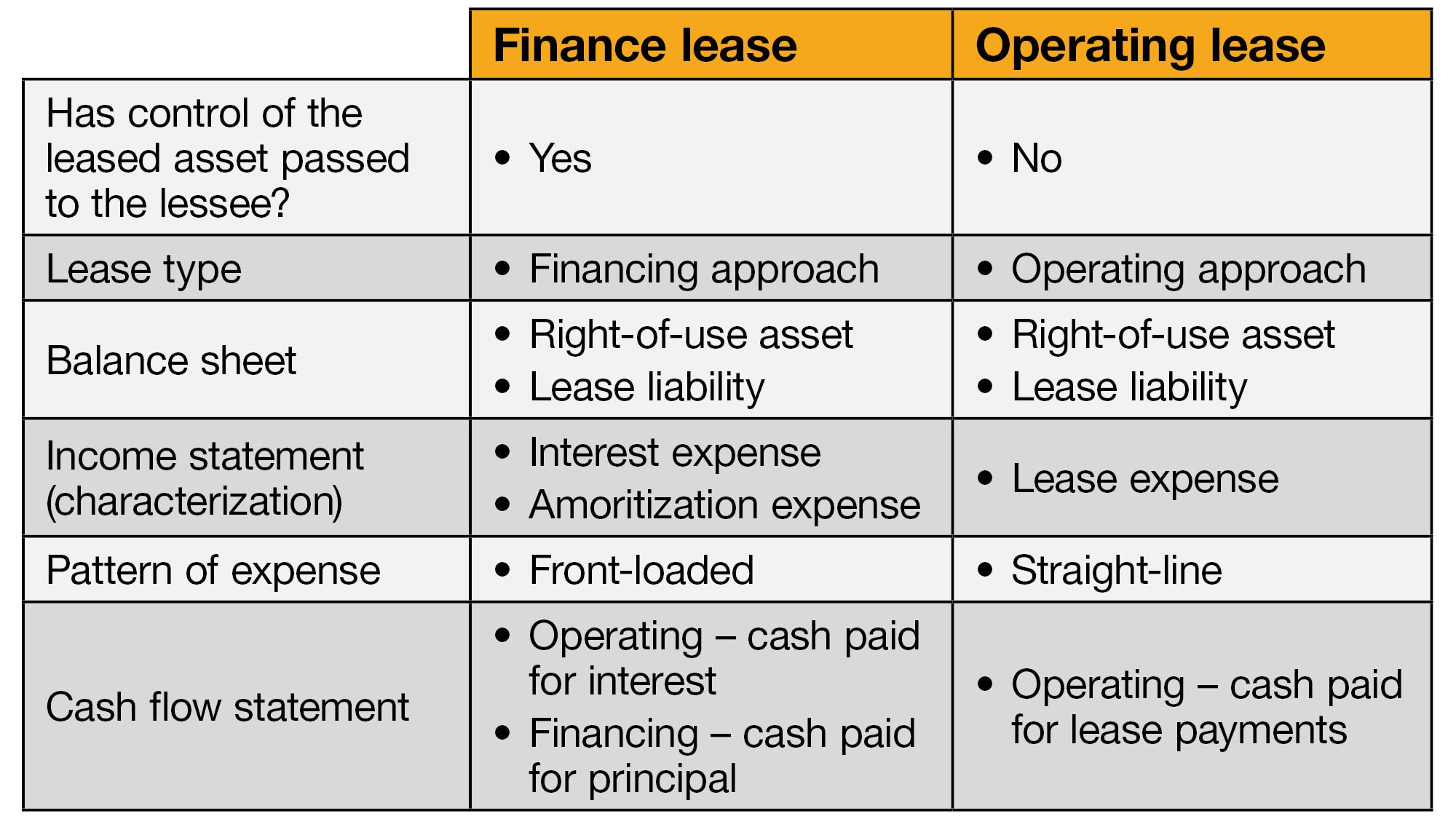

Electric Vehicle Lease Tax Deduction Many limited companies choose to lease vehicles via an operating lease This means that they rent a vehicle from a leasing company for an agreed period typically 2 3 years At the end of this time the vehicle is returned to the leasing company The big advantage of leasing an electric or hybrid car with emissions of See more

When your company buys a new unused electric car you can claim a 100 first year capital allowance This allows you to deduct the full cost of the vehicle from your taxable profits in the There is a tax credit available for leased electric vehicles There s also a catch The tax credit belongs to the lessor not to you the lessee Qualified buyers who meet certain income limits can

Electric Vehicle Lease Tax Deduction

Electric Vehicle Lease Tax Deduction

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

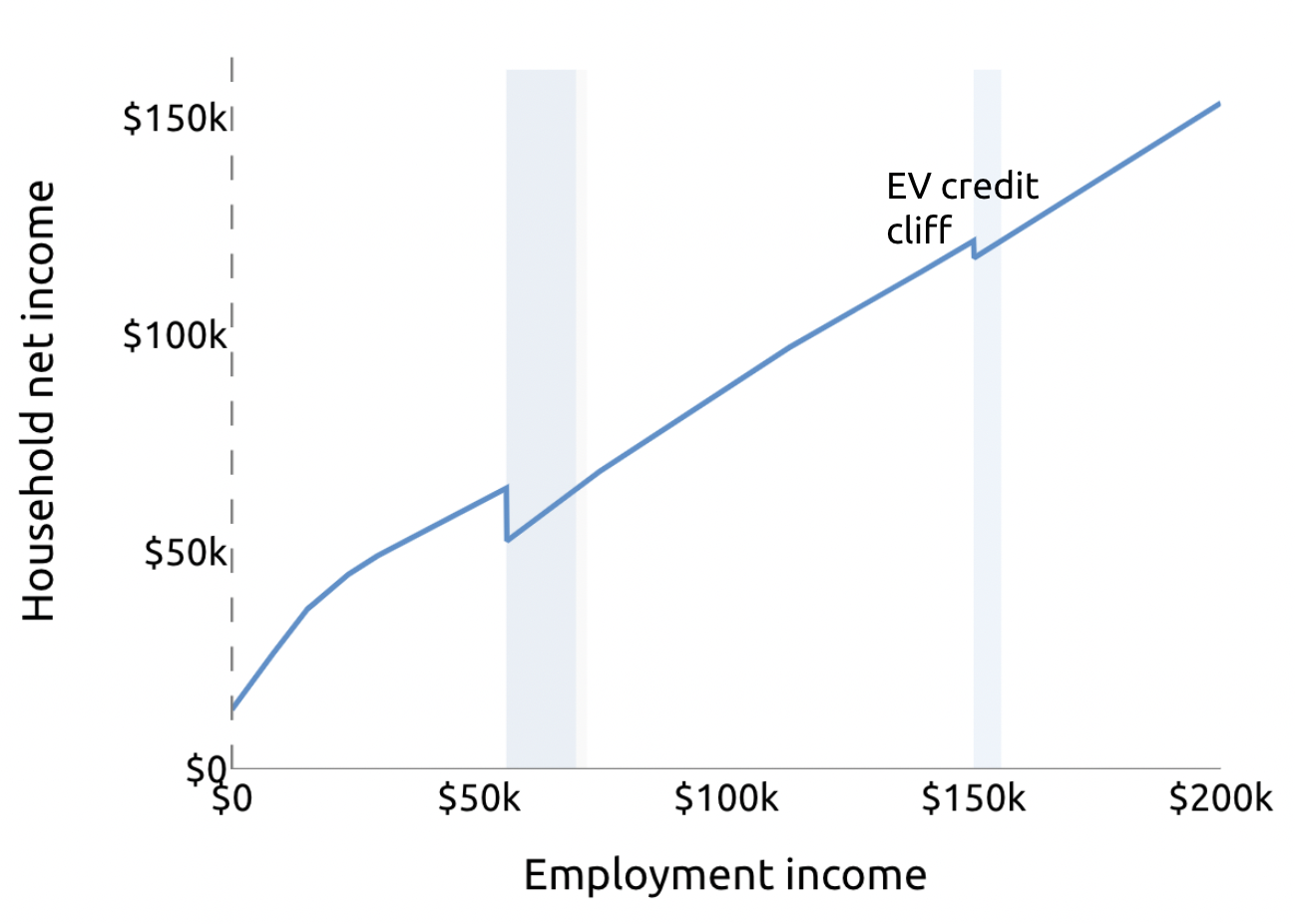

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

Virginia Lease Agreement

https://www.simplifyem.com/forms/download/virginia_lease_agreement_screenshot.jpg

Hiring or leasing a car is an allowable and tax deductible expense but you must disallow 15 of your costs if the vehicle CO2 emissions are more than 50g km This was previously set at What Is the 15 Block on Lease Payments In the UK if a company leases a car with high CO emissions it cannot deduct the full cost of the lease payments when calculating

For business leases the full amount of the rentals can be set against tax for CO 2 emissions up to 110 g km For cars with CO 2 in excess of 110 g km only 85 of the rentals can be deducted VAT on leased vehicles can be reclaimed up to By leasing your car you won t qualify for the relief on the cost of the car as a whole in one go However you still get tax relief on the actual payments you make Sometimes depending on the CO2 emissions currently

Download Electric Vehicle Lease Tax Deduction

More picture related to Electric Vehicle Lease Tax Deduction

Financing Equipment Lease Tax Benefits In Canada Filing Taxes

https://filingtaxes.ca/wp-content/uploads/2021/12/photo-1619379104040-5c22149c734d.jpg

Tax Deduction To EV Customers

https://images.hindustantimes.com/telugu/img/2022/12/21/960x540/Statiq_1671634466431_1671634466624_1671634466624_1671636488559_1671636500435_1671636500435.webp

The Inflation Reduction Act Discourages Electric Vehicle Buyers From

https://www.ubicenter.org/assets/images/2022-08-03-ira-ev-credit-cliff/ev_cliff.png

Leasing an electric vehicle As under a lease agreement the company does not legally own the asset there is no available deduction for the capital cost of the vehicle Instead the full monthly payment may be deducted Owners of some plug in electric vehicles may be eligible for tax deductions when they confirm their status as taxpayers They must have started driving the cars in the same year they claimed the tax credits In the case of

Unlike with a combustion engined car businesses can deduct the full cost of buying or leasing an electric vehicle from their pre tax profits resulting in lower tax bills Section 80EEB has been introduced allowing a deduction for interest paid on loan taken for the purchase of electric vehicles A deduction for interest payments up to Rs

Section 80EEB Of Income Tax Act Deduction On Purchase Of Electric Vehicle

https://housing.com/news/wp-content/uploads/2023/02/Section-80EEB-of-Income-Tax-Act-Deduction-on-purchase-of-electric-vehicle-f-686x400.jpg

Car Lease Tax Deduction Calculator Have A Large Ejournal Lightbox

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/618dba8442921d611fb15553_car-lease-tax-write-off-line-9.png

https://www.thp.co.uk › leasing-electric-cars

Many limited companies choose to lease vehicles via an operating lease This means that they rent a vehicle from a leasing company for an agreed period typically 2 3 years At the end of this time the vehicle is returned to the leasing company The big advantage of leasing an electric or hybrid car with emissions of See more

https://taxlab.co.uk › a-limited-companys-guide-to...

When your company buys a new unused electric car you can claim a 100 first year capital allowance This allows you to deduct the full cost of the vehicle from your taxable profits in the

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Section 80EEB Of Income Tax Act Deduction On Purchase Of Electric Vehicle

Can I Get A Tax Deduction For My Electric Car Lease

Tax Advantages Of Leasing Versus Buying Fiore Toyota

Car Lease Tax Deduction Calculator Have A Large Ejournal Lightbox

Deduction On Electrical Vehicle For Interest Paid On Loan

Deduction On Electrical Vehicle For Interest Paid On Loan

New Business Tax Credits For Buying Electric Vehicles

Car Lease Tax Deduction Hmrc Jeraldine Will

New Lease Accounting Standard Right of use ROU Assets Crowe LLP

Electric Vehicle Lease Tax Deduction - Hiring or leasing a car is an allowable and tax deductible expense but you must disallow 15 of your costs if the vehicle CO2 emissions are more than 50g km This was previously set at