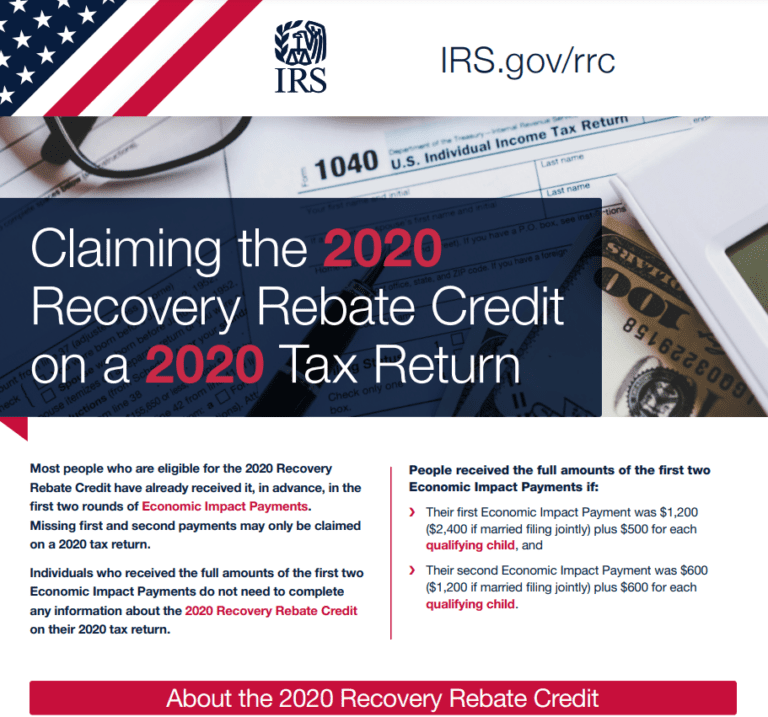

Eligibility For Recovery Rebate Credit Web 8 f 233 vr 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim

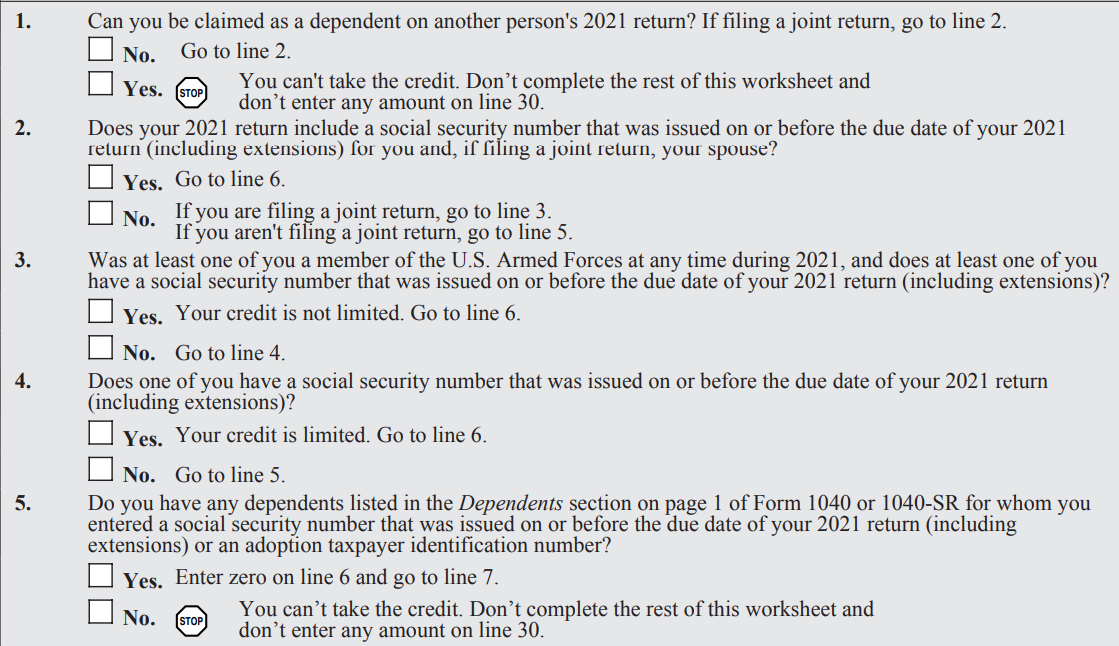

Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax Web 10 d 233 c 2021 nbsp 0183 32 An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the

Eligibility For Recovery Rebate Credit

Eligibility For Recovery Rebate Credit

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

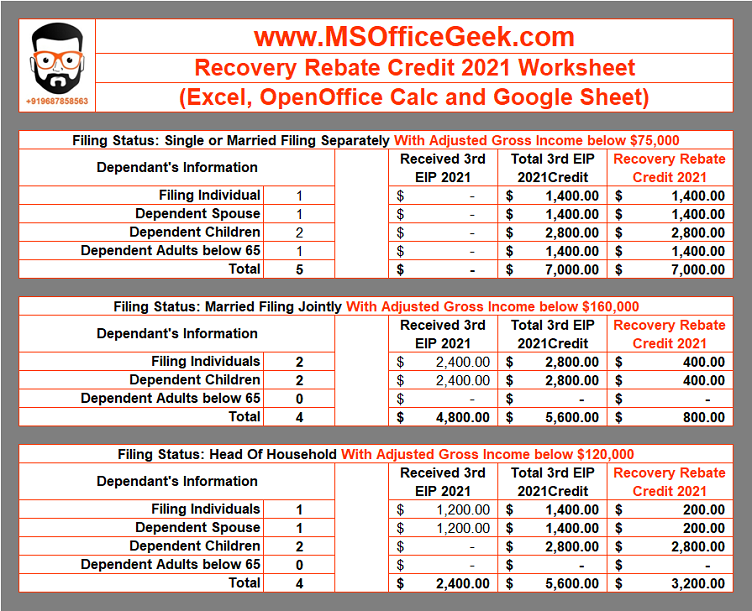

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

Recovery Rebate Credit Taking Forever Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-credit-printable-rebate-form-4.png?w=670&h=627&ssl=1

Web 1 d 233 c 2022 nbsp 0183 32 Who is eligible for the 2020 Recovery Rebate Credit Qualifying for the initial advance payments was based on the information that the government had at the time of distributing the payments This Web Married taxpayers filing jointly where one spouse has a work eligible SSN and one spouse does not are eligible for a payment of 1 400 in addition to 1 400 per each qualifying

Web 17 ao 251 t 2022 nbsp 0183 32 To be eligible for the credit you must have Been a U S citizen or U S resident alien in 2020 and or 2021 Not have been a dependent of another taxpayer for tax years 2020 and or 2021 Had a Web 12 oct 2022 nbsp 0183 32 You re generally eligible to claim the recovery rebate credit if in 2021 you Were a U S citizen or U S resident alien

Download Eligibility For Recovery Rebate Credit

More picture related to Eligibility For Recovery Rebate Credit

Recovery Rebate Credit 2020 Calculator KwameDawson

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

Recovery Rebate Credit How Does It Work Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/proconnect.intuit.com/community/image/serverpage/image-id/2609i6F2345BD501809A1/image-size/large?v=1.0&px=999

Web 16 nov 2022 nbsp 0183 32 Individuals who were eligible but did not receive the first or second Economic Impact Payment or received less than the full amounts may be eligible to claim the Web 14 janv 2022 nbsp 0183 32 The recovery rebate credit for the 2021 tax year as for 2020 must be netted against any economic impact payment EIP a taxpayer and or spouse if filing

Web In general the tax authorities in these five U S territories will provide the Recovery Rebate Credit RRC to eligible residents Territory residents should direct questions Web 23 mai 2022 nbsp 0183 32 IRS mostly correct on recovery rebate credits TIGTA says The IRS correctly calculated taxpayers eligibility for a recovery rebate credit in the 2021 filing

Recovery Rebate Credit 2020 Calculator KwameDawson

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108Part2-764112.jpg

https://www.irs.gov/newsroom/check-your-recovery-rebate-credit-eligibi…

Web 8 f 233 vr 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Recovery Credit Printable Rebate Form

Recovery Rebate Credit 2020 Calculator KwameDawson

How Do I Claim The Recovery Rebate Credit On My Ta

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Recovery Rebate Credit 2020 Calculator KwameDawson

Recovery Rebate Credit 2020 Calculator KwameDawson

Recovery Rebate Credit 2022 Eligibility Recovery Rebate

1040 EF Message 0006 Recovery Rebate Credit Drake20

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Eligibility For Recovery Rebate Credit - Web 30 mars 2022 nbsp 0183 32 The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund