Email Address For Hmrc Tax Return Your personal tax account or business tax account using HMRC online services the official HMRC app If HMRC needs to contact you about anything confidential they ll reply by phone or

If you would like to use email as one of the ways HMRC will contact you we ll need you to confirm in writing by post or email that you understand and accept the risks of using email that Contacting the HM Revenue Customs Income Tax Office by phone or in writing The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain

Email Address For Hmrc Tax Return

Email Address For Hmrc Tax Return

https://i.ytimg.com/vi/ua7dEV180N8/maxresdefault.jpg

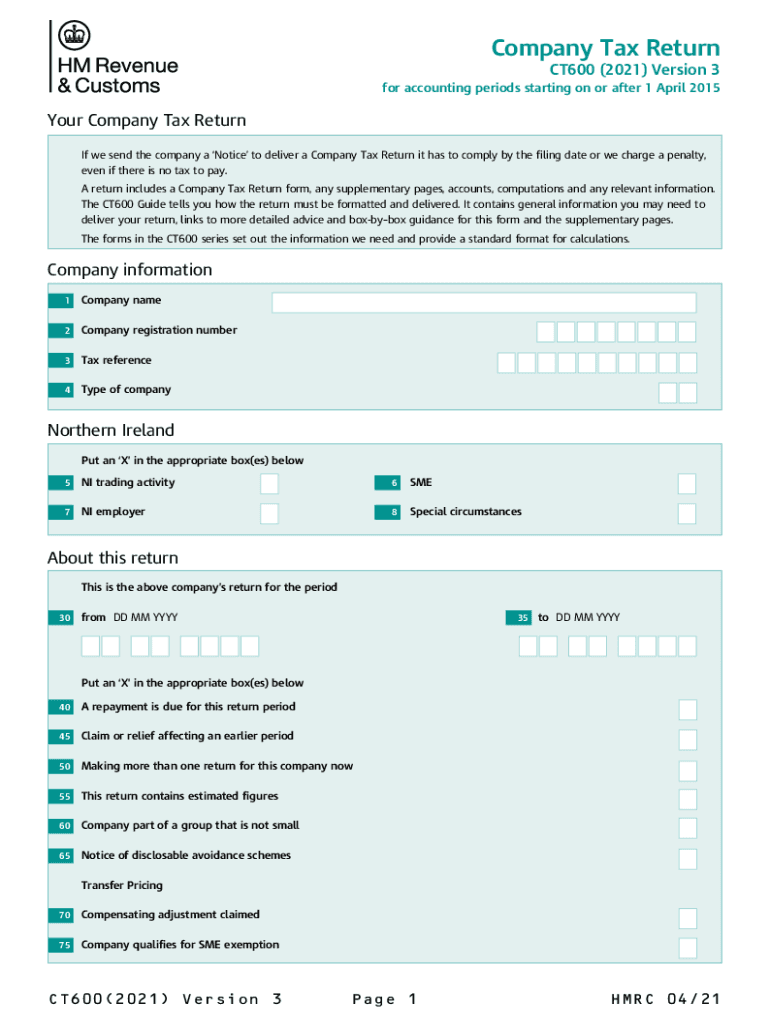

Hmrc Form Ca9176 Printable

https://www.pdffiller.com/preview/454/115/454115474/large.png

Hmrc Bill Pay Management And Leadership

https://www.norfolk.gov.uk/-/media/norfolk/images/business/trading-standards/scams/20200211-hmrc-email-scam.jpg?h=589&w=609&la=en&hash=3F6C0C875CC4A9374D8D4E59716E078875E0FB22

Last Updated 08 September 2022 HM Revenue Customs have different addresses for Pay As You Earn PAYE Self Assessment SA and Capital Gains Tax CGT customers to use Deciding which address to use is the fun part This is a freeview At a glance guide to writing to HMRC addresses What is Self Assessment and why is it important Self Assessment is the process of filing your personal tax return with HMRC This should cover all of your taxable income for the tax year You need to submit a Self Assessment if you during the tax year were Self employed as a sole trader and earned more than 1 000 after tax relief

You cannot contact HMRC by email You will either need to telephone 441355359022 or write to HM Revenue and Customs BX9 1AS You can appeal penalties provided we have received your tax A list of regularly used HMRC contact information including telephone numbers online contact options and postal addresses together with a number of tips This information will help direct tax agents to the appropriate point of contact within HMRC

Download Email Address For Hmrc Tax Return

More picture related to Email Address For Hmrc Tax Return

Received A Letter From HMRC Following These Tips Will Help You Avoid

https://www.lamontpridmore.co.uk/wp-content/uploads/2022/08/Scam-letter.png

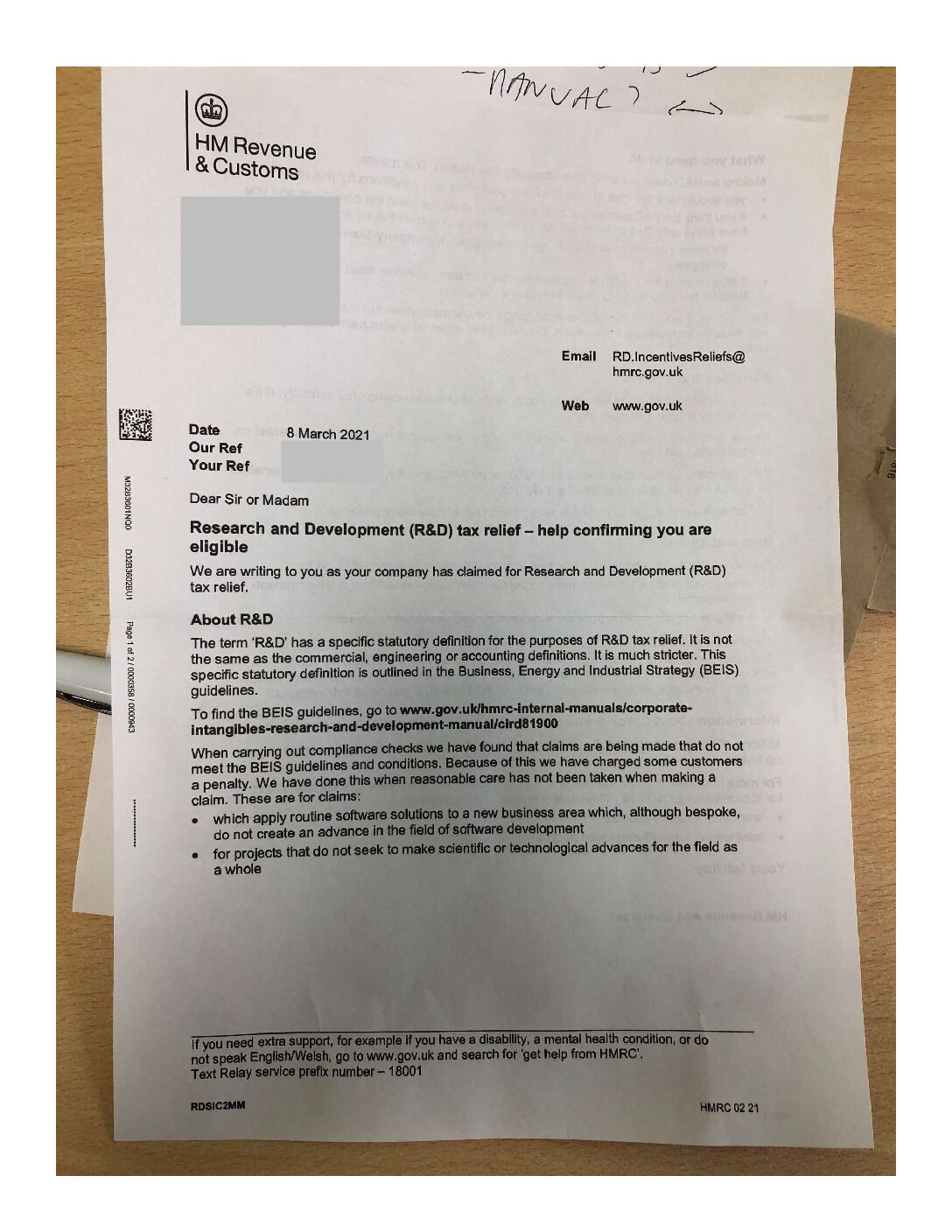

HMRC R D Compliance Check Eligibility Nudge Letters

https://forrestbrown.co.uk/wp-content/uploads/2021/03/Example-HMRC-compliance-check-nudge-letter.png

HMRC Give Tax Relief Pre approval Save The Thorold Arms

https://i1.wp.com/save.thethoroldarms.co.uk/wp-content/uploads/2016/06/20160525-SITR-Tax-Rebate-Letter-from-HMRC.jpg?w=2384&ssl=1

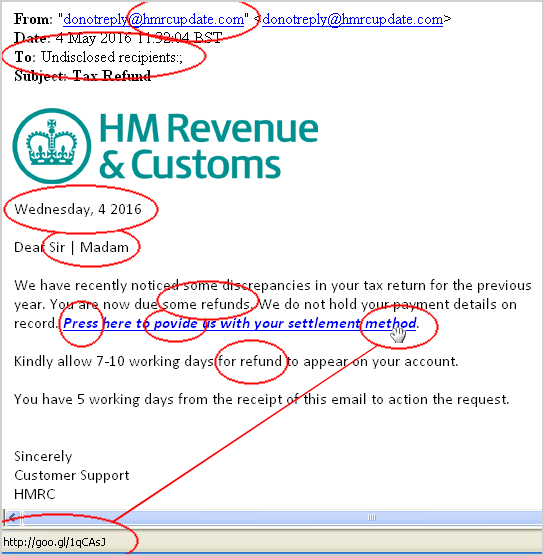

If your circumstances changed in the tax year 6 April 2020 to 5 April 2021 you may need to fill in a full tax return You can use the Short Tax Return if you were a paid employee or had taxable benefits or expense payments were self employed with an annual turnover of less than 85 000 Find out how fill out HMRC s self assessment tax return for the 2022 23 tax year and what income you need to declare You can find HMRC s address on your forms and any other correspondence watch out for fake HMRC calls texts and emails 24 Jan 2024 Seven tips for 2022 23 self employed tax returns

You can get all the current directors names here Here is a list of HMRC people that may be useful If you can add to it do let me know through the contact page Sam Louks telephone 03000 530 709 or email samuel louks hmrc gov uk Andrew Martel telephone 03000 517 495 or email andrew martel hmrc gov uk National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200 3600 Online debit and credit card payment support 0300 200 3601 VAT general enquiries 0300 200 3700 Tax Credits helpline 0345 300 3900 You can find more relevant numbers on the contact HMRC page Contact HMRC by phone time your call right

HMRC Warning As Automated Phone Call Scam Circulates Targeting Britons

https://cdn.images.express.co.uk/img/dynamic/23/590x/secondary/HMRC-UK-2798396.jpg?r=1607523224366

Customs Forms Printable Printable Forms Free Online

https://www.pdffiller.com/preview/22/555/22555649/large.png

https://www.gov.uk/government/organisations/hm...

Your personal tax account or business tax account using HMRC online services the official HMRC app If HMRC needs to contact you about anything confidential they ll reply by phone or

https://www.gov.uk/government/publications/...

If you would like to use email as one of the ways HMRC will contact you we ll need you to confirm in writing by post or email that you understand and accept the risks of using email that

HMRC 2021 Paper Tax Return Form

HMRC Warning As Automated Phone Call Scam Circulates Targeting Britons

CT600 Company Tax Return Forms HMRC Andica Limited Fill And Sign

Britain Tax Department Hi res Stock Photography And Images Alamy

134 In 3 No 7 Have You Or Your Clients Received A NUDGE Letter

HMRC Security Notice Requests HMRC Fraud Investigation Service

HMRC Security Notice Requests HMRC Fraud Investigation Service

Hmrc Tax Return

Received An HMRC Tax Refund Email It s Probably A Phishing Scam

HMRC JamilMeryem

Email Address For Hmrc Tax Return - What is Self Assessment and why is it important Self Assessment is the process of filing your personal tax return with HMRC This should cover all of your taxable income for the tax year You need to submit a Self Assessment if you during the tax year were Self employed as a sole trader and earned more than 1 000 after tax relief