Employee Tax Rebate Web 18 mai 2023 nbsp 0183 32 To make a claim just search employee tax relief on GOV UK It is the quickest way of getting a tax refund on your work related expenses and ensures you get 100 of the money back

Web The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees after Web Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit

Employee Tax Rebate

Employee Tax Rebate

https://storage.googleapis.com/mmstudio-images/gallery/featured/pr-89083226-1665779704521.jpg

Receive The Largest Eligible Employee Retention Tax Credit Rebate

https://blog.cbcofnewyorkcity.com/wp-content/uploads/2023/04/1-cbc-ertc-tax-rebate.jpg

Tax Rebate For Redundancy Employee Tax

https://employeetax.co.uk/wp-content/uploads/2020/08/tax-refund-options-notepad-infographics-pencils-1200x630-cropped.jpg

Web 24 sept 2022 nbsp 0183 32 LOS ANGELES CA ACCESSWIRE September 24 2022 The Employee Retention Credit ERC or Employee Retention Tax Credit ERTC program is the last Web 26 janv 2021 nbsp 0183 32 As a result of the new legislation eligible employers can now claim a refundable tax credit against the employer share of Social Security tax equal to 70 of

Web 2 avr 2021 nbsp 0183 32 WASHINGTON The Internal Revenue Service today issued guidance for employers claiming the Employee Retention Credit under the Coronavirus Aid Relief Web 12 oct 2022 nbsp 0183 32 Tax reliefs and allowances for businesses employers and the self employed Find out about tax reliefs and allowances available from HMRC if you run a business

Download Employee Tax Rebate

More picture related to Employee Tax Rebate

Calam o Get A Tax Rebate On Employee Wages Through This ERTC

https://p.calameoassets.com/220225201122-48b57e56e9c28cdd5b09dce4b6fec9c6/p1.jpg

Tools Tax Rebate Using Capital Allowance For Employees Employee Tax

https://employeetax.co.uk/wp-content/uploads/2020/08/capital-allowances-768x512-1.jpeg

Budget 2019 INCOME TAX REBATE Play Smart Go Tax free Up To Rs 10 Lakh

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2019/02/02/785703-incometax-istock-020219.jpg

Web Refunds for employees If you stop work part way through the tax year you may be due a refund of PAYE This can also apply if you have been on a temporary or emergency tax Web 11 f 233 vr 2022 nbsp 0183 32 1 Home office deduction The home office deduction may be the largest deduction available if you re self employed If you work 100 remotely as a W 2 employee you do not qualify for this

Web 3 mars 2016 nbsp 0183 32 complete Self Assessment tax returns except current year claims are claiming for expenses over 163 2 500 are claiming for more than 5 different jobs When you Web 15 ao 251 t 2014 nbsp 0183 32 Claim a tax refund if you ve overpaid tax You can also use this form to authorise a representative to get the payment on your behalf From HM Revenue amp

Michelin Retired Employee Tire Rebate 2023 Tirerebate

https://www.tirerebate.net/wp-content/uploads/2022/08/michelin-tire-rebate-form-2018-universal-network-1.jpg

Uniform Tax Rebate In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/08/4-compressed.jpg

https://www.gov.uk/government/news/dont-mi…

Web 18 mai 2023 nbsp 0183 32 To make a claim just search employee tax relief on GOV UK It is the quickest way of getting a tax refund on your work related expenses and ensures you get 100 of the money back

https://www.irs.gov/coronavirus/employee-retention-credit

Web The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees after

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Michelin Retired Employee Tire Rebate 2023 Tirerebate

Best Uniform Tax Rebate Company EmployeeTax

Goodyear Employee Tire Rebate Program GoodYearRebate

Claim Your UK Tax Rebate Online EmployeeTax

Standard Deduction For 2021 22 Standard Deduction 2021

Standard Deduction For 2021 22 Standard Deduction 2021

The Employee Retention Tax Credit Retroactive Filing Is Ongoing

3 100 Government Rebate Illustrations Royalty Free Vector Graphics

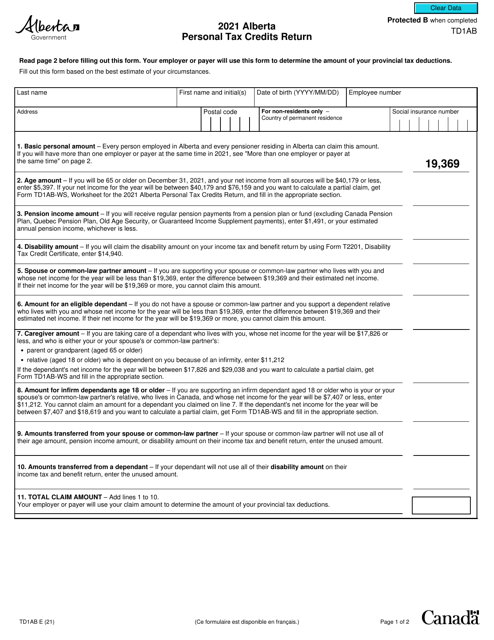

Printable Td1 Form Printable Blank World

Employee Tax Rebate - Web 6 avr 2023 nbsp 0183 32 you had more than one job at the same time you are a student and you only worked during the holidays other income which HM Revenue amp Customs HMRC tax