Employer Contribution To Nps Is Taxable Or Not In New Tax Regime Latest NPS benefits under new tax regime after Budget 2024 If your basic salary is Rs 1 lakh your employer can contribute Rs 10 000 10 of basic pay to the

The third deduction is in the form of employer s contribution of up to 10 per cent of salary basic component dearness allowance to the NPS Tier I account It is Additionally it is important to note that an individual whether employed or not can claim additional deduction of up to Rs 50 000 on the self contribution towards

Employer Contribution To Nps Is Taxable Or Not In New Tax Regime

Employer Contribution To Nps Is Taxable Or Not In New Tax Regime

https://www.alankit.com/blog/blogimage/NPS Tax Benefits NPS Rebate in New Tax Regime.jpg

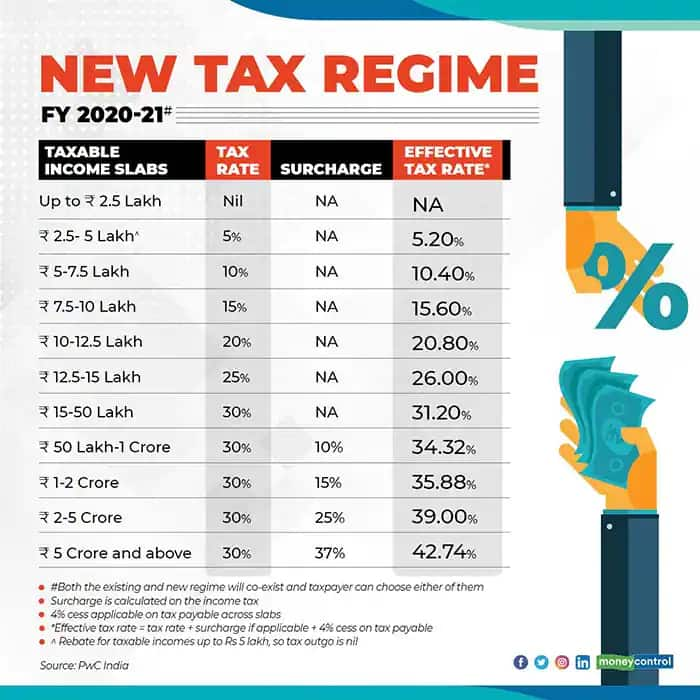

Why The New Income Tax Regime Has Few Takers

https://images.moneycontrol.com/static-mcnews/2022/01/New-tax-regime-1.jpeg

Whether Gratuity Taxable Or Not Income Tax Calculation On Gratuity

https://i.ytimg.com/vi/KvJ8p70qv7U/maxresdefault.jpg

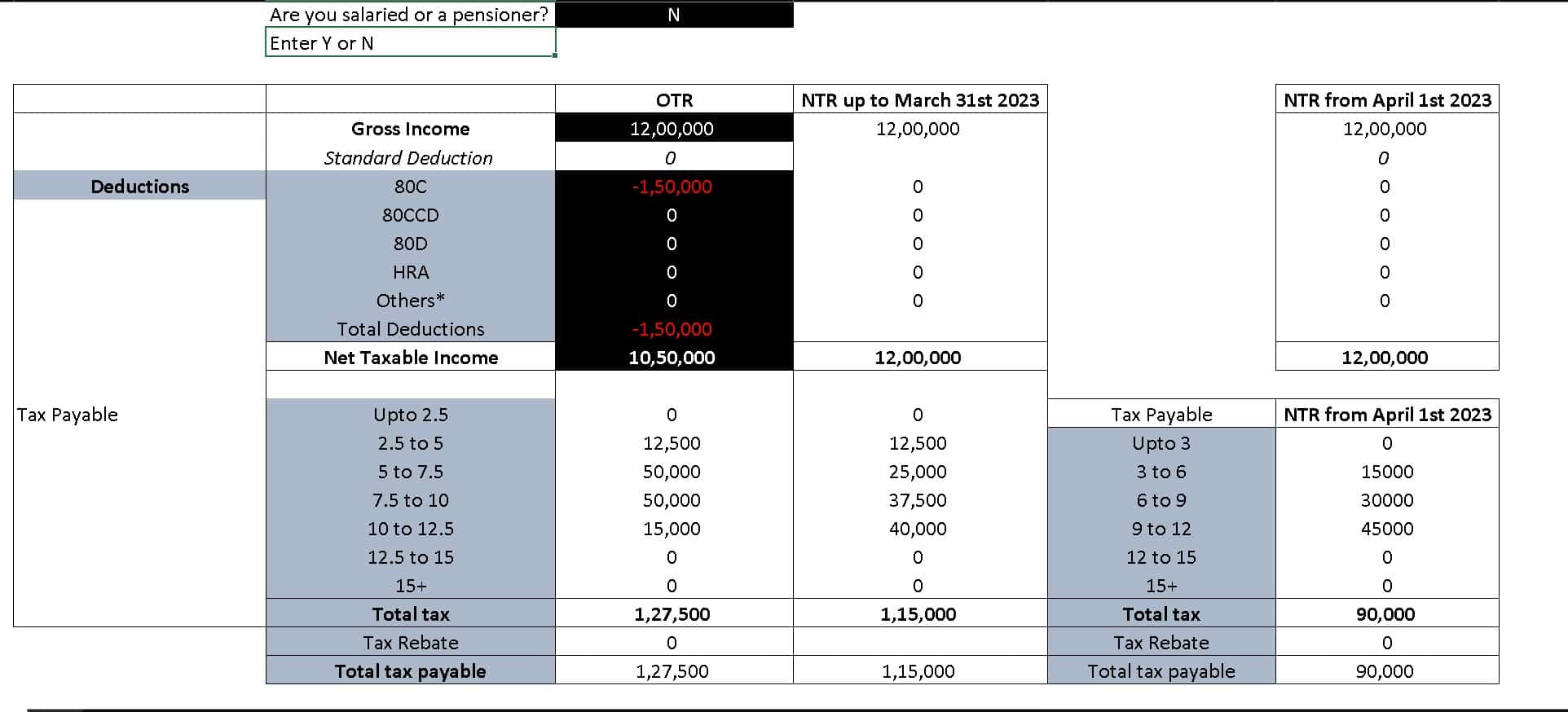

New Tax Regime 2024 Check out here all the frequently asked questions about the new income tax regime for FY 2024 25 slabs calculator and deductions for salaried Individuals opting for the new tax regime in the current financial year can get a deduction under Section 80CCD 2 of the Income Tax Act by investing in NPS This

If your employer is contributing to your NPS account then as a salaried employee you are eligible to claim a deduction for the contribution made from gross income This deduction is claimed under Under the new tax regime the contribution made by employer towards Tier 1 NPS account is eligible for tax deduction under section 80CCD 2 of Income Tax Act

Download Employer Contribution To Nps Is Taxable Or Not In New Tax Regime

More picture related to Employer Contribution To Nps Is Taxable Or Not In New Tax Regime

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

12 Non Taxable Compensation Of Government Employees 12 Non taxable

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8def460a118dbf58656d6da484651792/thumb_1200_1553.png

Is EPF Employer Contribution Taxable In The Revised New Tax Regime

https://freefincal.com/wp-content/uploads/2023/02/Is-EPF-employer-contribution-taxable-in-the-revised-New-Tax-Regime.jpg

However there s still hope for individuals in the new tax regime You can claim a tax deduction if your employer is also contributing to your NPS But do An employer can also contributes to NPS scheme The contribution amount made by the employer can be claimed as tax deduction u s 80CCD 2 subject to the

Section 80CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary for Central Government made Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1

How To Make Online Contributions To NPS Tier I And Tier II Accounts

https://freefincal.com/wp-content/uploads/2015/12/Online-contribution-NPS.jpg

New Income Tax Regime Vs Old Key Things To Consider Budget 2023 Regimes

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

https://timesofindia.indiatimes.com/business/india...

Latest NPS benefits under new tax regime after Budget 2024 If your basic salary is Rs 1 lakh your employer can contribute Rs 10 000 10 of basic pay to the

https://www.valueresearchonline.com/stories/52395

The third deduction is in the form of employer s contribution of up to 10 per cent of salary basic component dearness allowance to the NPS Tier I account It is

Nps Contribution By Employee Werohmedia

How To Make Online Contributions To NPS Tier I And Tier II Accounts

Additional Benefit In New Tax Regime For Those With Net Taxable Income

NPS Investment Proof How To Claim Income Tax Deduction Mint

Helpful Resources For Calculating Canadian Employee Taxable Benefits

Calculate My Income Tax SuellenGiorgio

Calculate My Income Tax SuellenGiorgio

What Is Taxable Income Explanation Importance Calculation Bizness

Budget 2023 Old Tax Regime And New Tax Regime Explained In 3 Scenarios

Opting For New Income Tax Regime 2023 Know 3 Tax Deductions That You

Employer Contribution To Nps Is Taxable Or Not In New Tax Regime - Under the new tax regime the contribution made by employer towards Tier 1 NPS account is eligible for tax deduction under section 80CCD 2 of Income Tax Act