Employer Nps Under Section 80ccd2 Web 22 Sept 2022 nbsp 0183 32 Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this

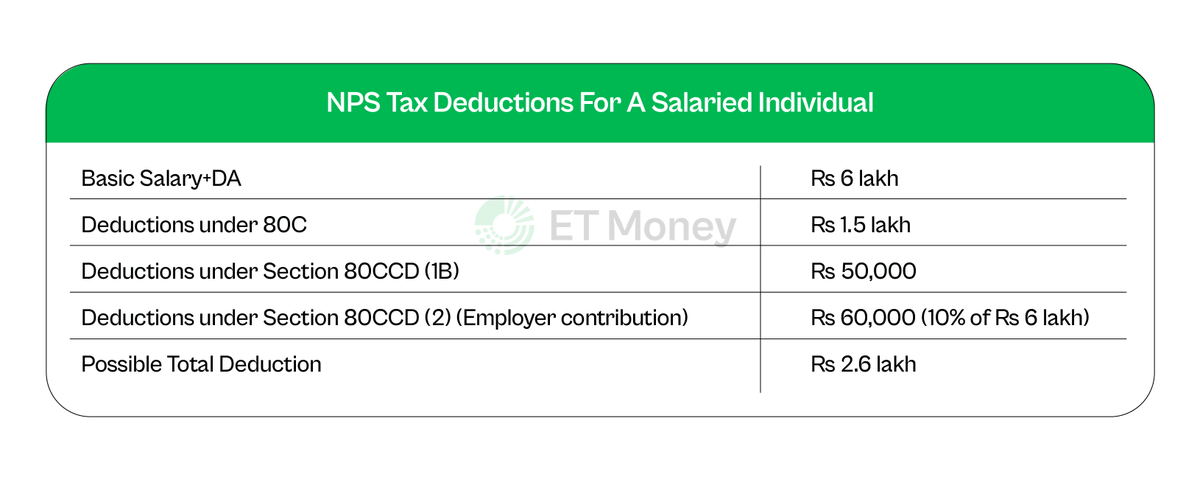

Web If your employer contributes to your NPS account your employer gets a tax benefit under section 80CCD 2 This tax benefit is limited to 20 of the total income of the employer Web 21 Sept 2022 nbsp 0183 32 Tax Benefits under Section 80CCD 2 Contributions by the employer to NPS can also be claimed by salaried individuals under this NPS deduction section For government employees the cap is at 14

Employer Nps Under Section 80ccd2

Employer Nps Under Section 80ccd2

https://www.aihr.com/wp-content/uploads/candidate-nps-social.png

Employer s NPS Contribution Of 14 For State And Central Government

https://www.financialexpress.com/wp-content/uploads/2022/02/nps.jpg

NPS Govt Share 80CCD2 14 10

https://i.ytimg.com/vi/67rR8CGFwGU/maxresdefault.jpg

Web 25 Feb 2016 nbsp 0183 32 FAQ on Tax Benefits in NPS under sections 80CCD 1 80CCD 2 and 80CCD 1B A Govt employee Corporate employee can claim a deduction of your employer s contribution towards NPS under Web Section 80CCD 2 Deduction to NPS Scheme for Contribution by the Employer In case any employer contributes to the NPS Scheme on behalf of the employee and the

Web 18 Feb 2023 nbsp 0183 32 Tax Deduction The employer can claim a tax deduction on their contributions towards the employee s NPS account under Section 80CCD 2 The Web Under the corporate model of NPS an employer may also make contributions to the pension funds of its employees This allowable deduction goes above what is permitted

Download Employer Nps Under Section 80ccd2

More picture related to Employer Nps Under Section 80ccd2

NPS Tax Benefits 2020 Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2018/12/NPS-Tax-Benefits-2019-Sec.80CCD1-80CCD2-and-80CCD1B.jpg

NPS By NSDL E Gov APK Android

https://images.sftcdn.net/images/t_app-cover-l,f_auto/p/d6dcd4ba-a2e9-4882-adda-a4747081ab13/173957727/nps-by-nsdl-e-gov-screenshot.png

NPS Take off pressed ETS NORD

https://www.etsnord.fi/content/uploads/NPS-3.png

Web 3 Mai 2019 nbsp 0183 32 NPS Tax Benefits under Sec 80CCD 2 The limit is least of 3 conditions 1 Amount contributed by an employer 2 10 of Basic DA For Central Government Employees it is now 14 of Basic DA and 3 Web What is Section 80CCD Let us understand the Section 80CCD of the Income Tax Act 1961 in the following way The tax benefits are available to the following categories of

Web There is no specific ceiling on this deduction Provisions under this section come into effect when an employer contributes towards the employee s NPS The contributions towards Web 17 Juli 2019 nbsp 0183 32 The employer contribution to NPS is eligible for additional tax benefit under Section 80CCD 2 And there is no absolute cap on the tax benefit you can get for the

NPS Tax Benefit U s 80ccd1 80ccd2 And 80ccd 1b NPS Tax Benefits

https://i.ytimg.com/vi/TNPR3oHyhIE/maxresdefault.jpg

NLRB Restores Sanity To Its Rules On Employee Handbooks And Joint

https://2.bp.blogspot.com/-z7v4ePsoz8E/WjO_kVArtNI/AAAAAAAAhjQ/NISDEuryD2MWWZG0CPSm_5F3IrTYewecQCLcBGAs/s1600/pexels-photo-433452%2B%25281%2529.jpeg

https://www.etmoney.com/learn/income-tax/section-80ccd-deductions

Web 22 Sept 2022 nbsp 0183 32 Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this

https://groww.in/p/tax/section-80ccd

Web If your employer contributes to your NPS account your employer gets a tax benefit under section 80CCD 2 This tax benefit is limited to 20 of the total income of the employer

Invest Rs 50 000 Annually In NPS And You Can Create A Retirement

NPS Tax Benefit U s 80ccd1 80ccd2 And 80ccd 1b NPS Tax Benefits

Creating Employer s NPS Contribution Pay Head

TDS On Benefits Or Perquisites Under Section 194R By Srinivasan Anand G

3 4 NPT Male X 1 2 NPS Female Reducing Bush Fluid Air Components

Milestone 5 Building Your Employer Network

Milestone 5 Building Your Employer Network

Section 80CCD 2 Employer s Contribution To NPS NPS In New Tax

Deduction Under Section 80CCD 2 For Employer s Contribution To

NPS Results Strategic Actions For NPS Success Next4biz

Employer Nps Under Section 80ccd2 - Web 5 Okt 2022 nbsp 0183 32 In respect of employer s contribution toward NPS account of an employee deduction under Section 80CCD 2 is available to an employee Effectively an