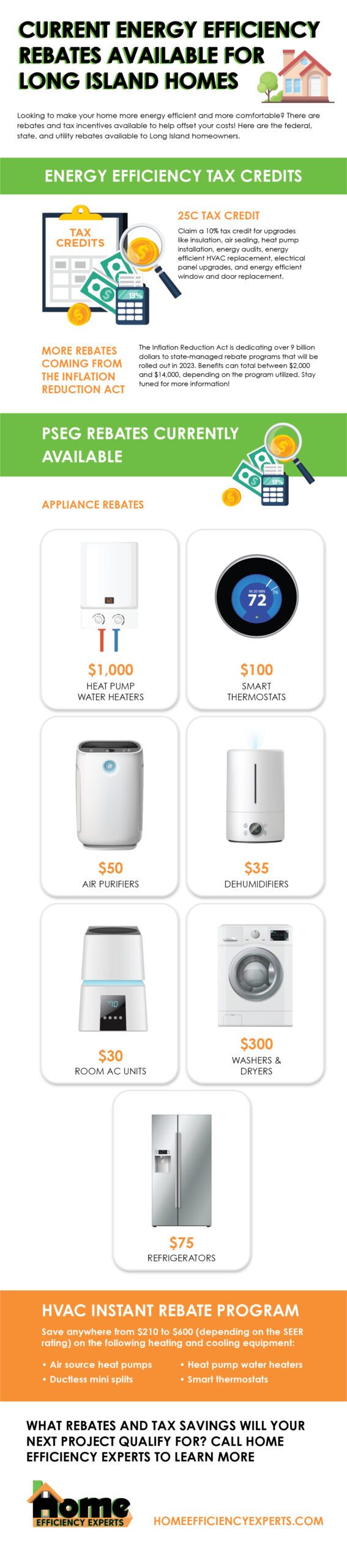

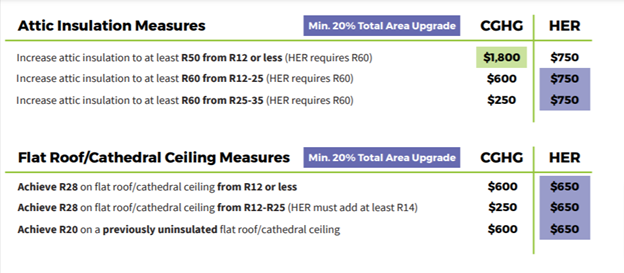

Energy Efficiency Rebates Taxable Web 14 avr 2023 nbsp 0183 32 Homeowners and multifamily building owners can get rebates by making energy efficiency upgrades the amount of money you can claim depends on how much

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Energy Efficiency Rebates Taxable

Energy Efficiency Rebates Taxable

https://www.homeefficiencyexperts.com/wp-content/uploads/2023/01/EnergyEfficiencyRebates_R2-03-1-scaled.jpg

Energy Efficient Rebates Tax Incentives For MA Homeowners

http://www.myenergymonster.com/ma/wp-content/uploads/sites/2/2012/08/energy-efficient-rebates-ma.png

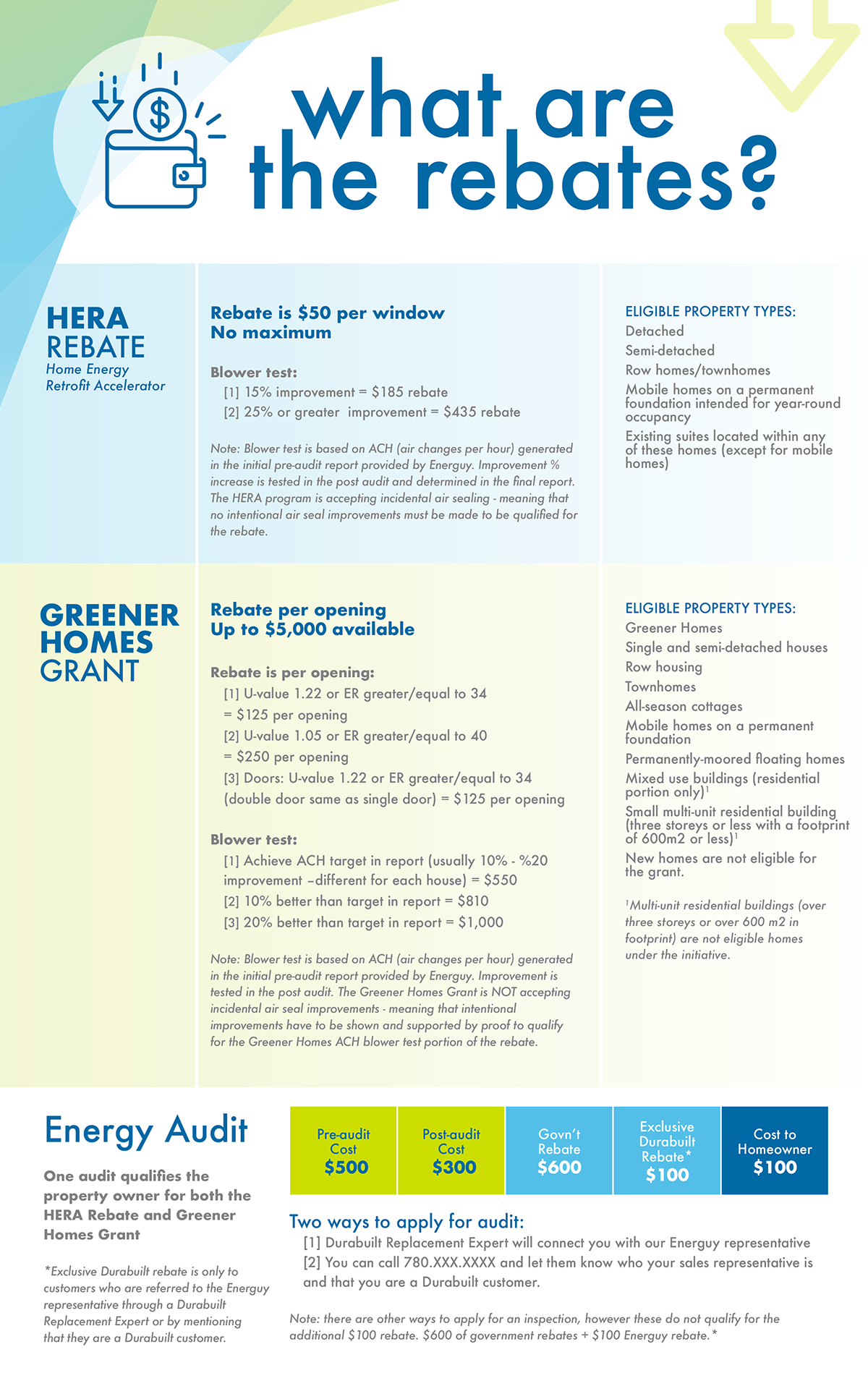

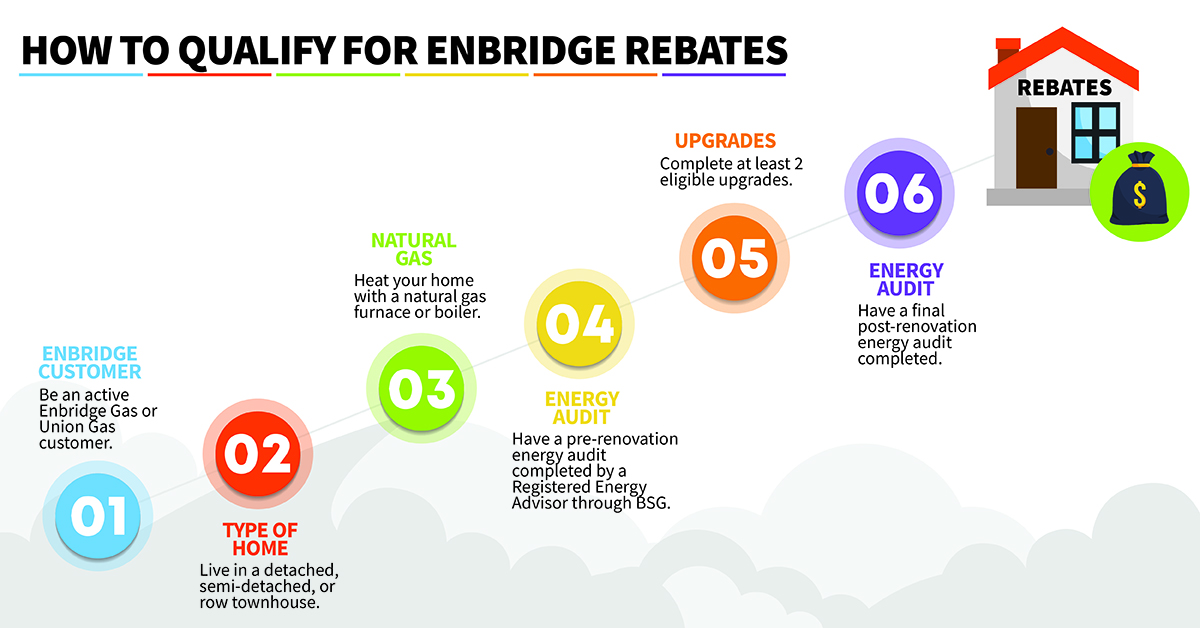

Energy Efficiency Rebates 2 Durabuilt Windows Doors Edmonton

https://durabuiltwindows.com/wp-content/uploads/2021/06/Firstnew.png

Web 22 d 233 c 2022 nbsp 0183 32 Beginning January 1 2023 the amount of the credit is equal to 30 of the sum of amounts paid by the taxpayer for certain qualified expenditures including 1 Web 26 juil 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on

Web The following energy efficient home improvements are eligible for the Energy Efficient Home Improvement Credit o insulation materials or systems and air sealing materials or Web 30 d 233 c 2022 nbsp 0183 32 Energy efficiency tax credits for improvements made in 2022 The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act of 2022 So if you made any qualifying home

Download Energy Efficiency Rebates Taxable

More picture related to Energy Efficiency Rebates Taxable

Extra Tax Benefits For Installing Energy Efficient Lighting

https://retrofitcompanies.com/wp-content/uploads/2021/01/Xcel-Energy-Rebates-2021.png

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

https://weaverexterior.ca/wp-content/uploads/2022/01/Weaver-Ontario-Energy-Rebate.jpg

Home Energy Rebates NRGwise Home Energy Assessments Ontario

https://nrgwise.ca/wp-content/uploads/2021/07/NRGwise-Rebate-Flyer-July-2021-1.jpg

Web The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide a 30 percent credit for qualifying investments in wind solar energy storage and Web 13 ao 251 t 2022 nbsp 0183 32 The rebates are double up to 4 000 and 8 000 respectively for lower income households Their income must be 80 or less of an area s median

Web 20 juin 2023 nbsp 0183 32 Households making between 80 150 can use the rebates to cover 50 of the equipment and installation costs Use this calculator from Rewiring America to find Web Tax Credits Rebates amp Savings Department of Energy Energy gov Tax Credits Rebates amp Savings Please visit the Database of State Incentives for Renewables amp Efficiency

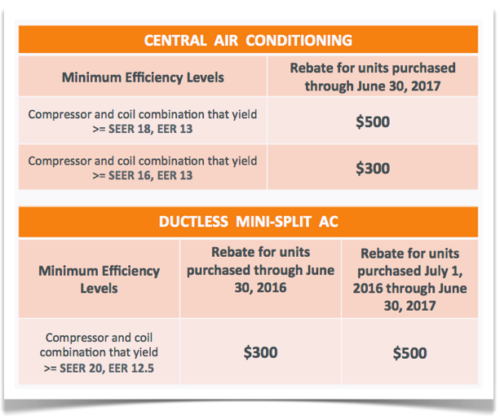

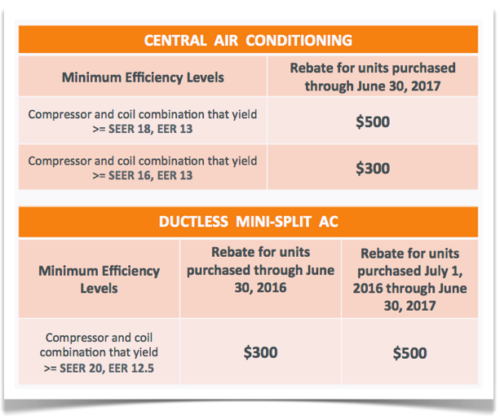

High Efficiency Air Conditioning New Jersey Rebates Skylands Energy

https://www.skylandsenergy.com/wp-content/uploads/2017/04/Rebates-table-2017-500x420.png

Stacking Energy Efficiency Rebates

https://www.barriersciences.com/user_files/upload/Picture1.png

https://time.com/6271460/ev-tax-credits-inflation-reduction-act

Web 14 avr 2023 nbsp 0183 32 Homeowners and multifamily building owners can get rebates by making energy efficiency upgrades the amount of money you can claim depends on how much

https://www.irs.gov/newsroom/energy-incentives-for-individuals...

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

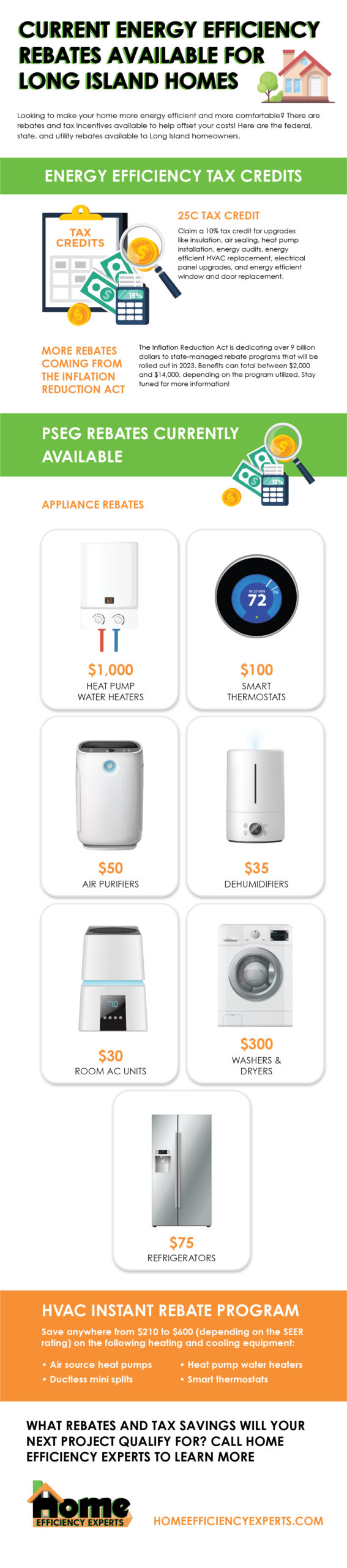

What Are The Enbridge Rebates Home Efficiency Rebates

High Efficiency Air Conditioning New Jersey Rebates Skylands Energy

Mesa First Municipality To Max Out SRP Energy efficiency Rebates The

The Enbridge Gas Home Efficiency Rebate Opportunity BSG

New LADWP Program Offers 225 Rebate On Energy efficient AC Units For

Vectren Gas Rebates For Energy Efficient Furnace Control Tech

Vectren Gas Rebates For Energy Efficient Furnace Control Tech

Energy Efficiency Rebate Program Manitou Springs CO

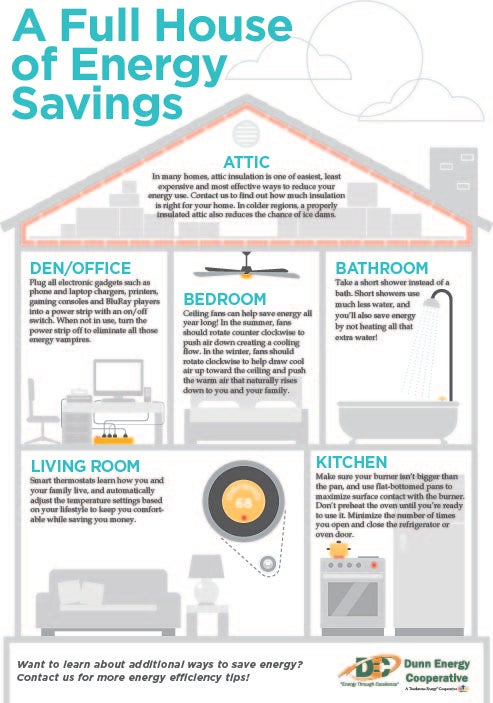

Home Performance Rebates Dunn Energy Cooperative

New Energy Rebates In Ontario For Furnaces And Water Heaters

Energy Efficiency Rebates Taxable - Web What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME