Energy Efficient Furnace Tax Credit The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified

Energy Efficient Furnace Tax Credit

Energy Efficient Furnace Tax Credit

https://i.pinimg.com/originals/6e/56/30/6e56307f8960a33c02a26bd9ada6a98a.jpg

Is Your Furnace Efficient Energy Efficient Furnace Energy Efficient

https://i.pinimg.com/originals/f4/09/7e/f4097e2f5cad0d4b50750909e4e2c318.jpg

What You Need To Know About Energy Efficient Property Credits

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2022/11/AdobeStock_440097569-scaled.jpeg

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses How to apply Gas Propane or Oil Furnaces and Fans Gas furnaces that are ENERGY STAR certified except those for U S South only meet the requirements for the furnace tax credit Gas and oil furnaces that have earned the ENERGY STAR

Other energy efficiency upgrades Oil furnaces or hot water boilers if they meet or exceed 2021 Energy Star efficiency criteria and are rated by the manufacturer for use with fuel blends at least 20 of the volume of which consists of an eligible fuel See OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are

Download Energy Efficient Furnace Tax Credit

More picture related to Energy Efficient Furnace Tax Credit

Rheem High Efficiency Furnace Comfort Craft LLC

http://comfortcraftllc.com/wp-content/uploads/2019/02/20181120_140852-12.jpg

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

https://static1.squarespace.com/static/55b78a58e4b0e36966db31f9/t/56c73587cf80a157221137e4/1455896001786/

Heat Pump Tax Credits And Rebates Continue In 2024 Moneywise

https://media1.moneywise.com/a/23311/heat-pump-tax-credit-rebate_facebook_thumb_1200x628_v20220927160351.jpg

Oil furnaces or hot water boilers if they meet or exceed 2021 Energy Star efficiency criteria and are rated by the manufacturer for use with fuel blends at least 20 of the volume of which consists of an eligible fuel On August 16th 2022 the Inflation Reduction Act of 2022 was passed naming CEE tiers as the basis for federal tax credits across several product categories through 2032 The Act cites products which meet or exceed the highest efficiency tier not including any

Under the Energy Efficient Home Improvement Credit a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an addition to or renovation of an existing home and not for a newly constructed home Learn about the federal government s tax credit program for high efficiency heating and cooling equipment and review regional programs for qualifying HVAC systems

2023 Energy Efficient Home Credits Tax Benefits Tips

https://accountants.sva.com/hubfs/sva-certified-public-accountants-biz-tip-energy-efficient-home-improvement-credit-more-opportuniities-in-2023-01.png

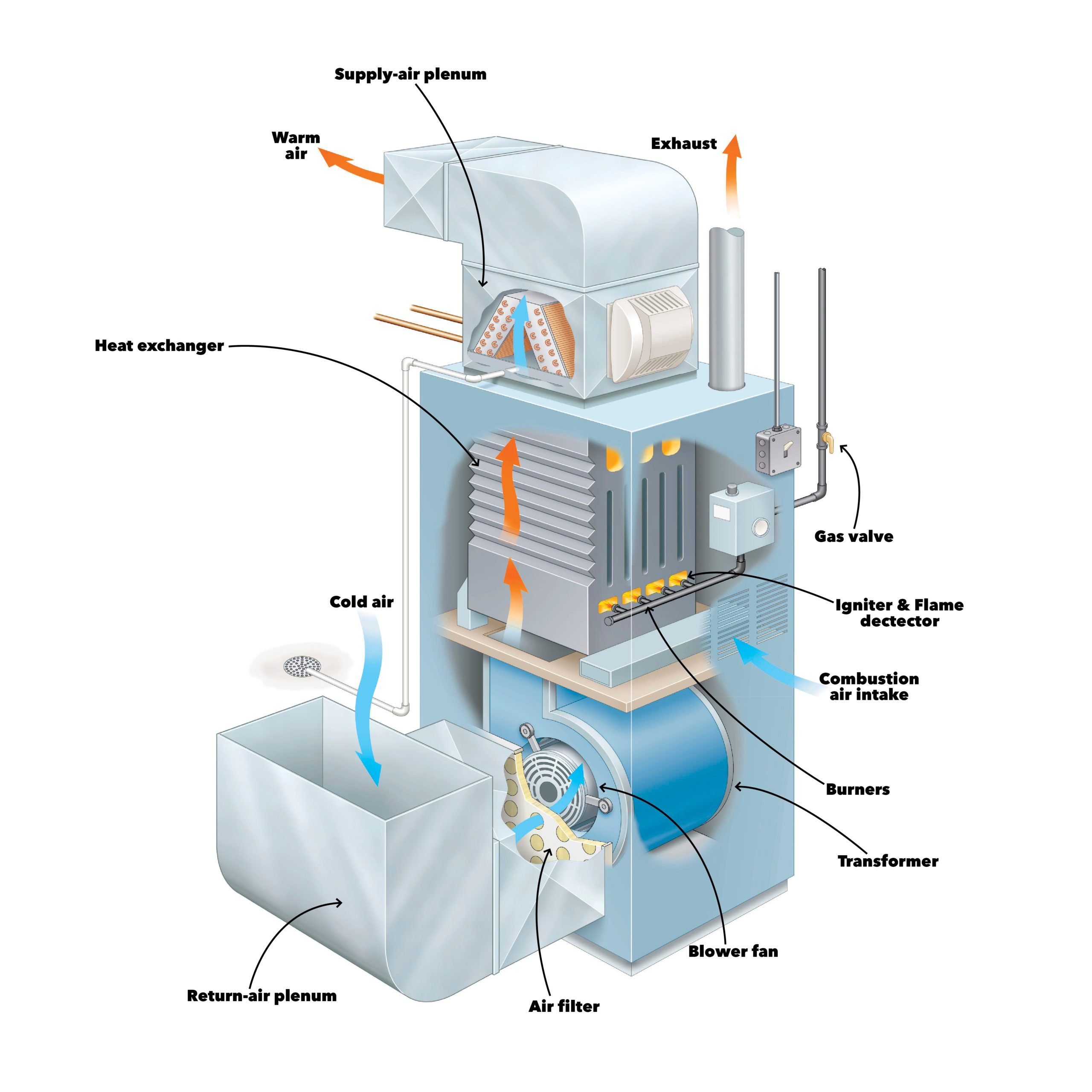

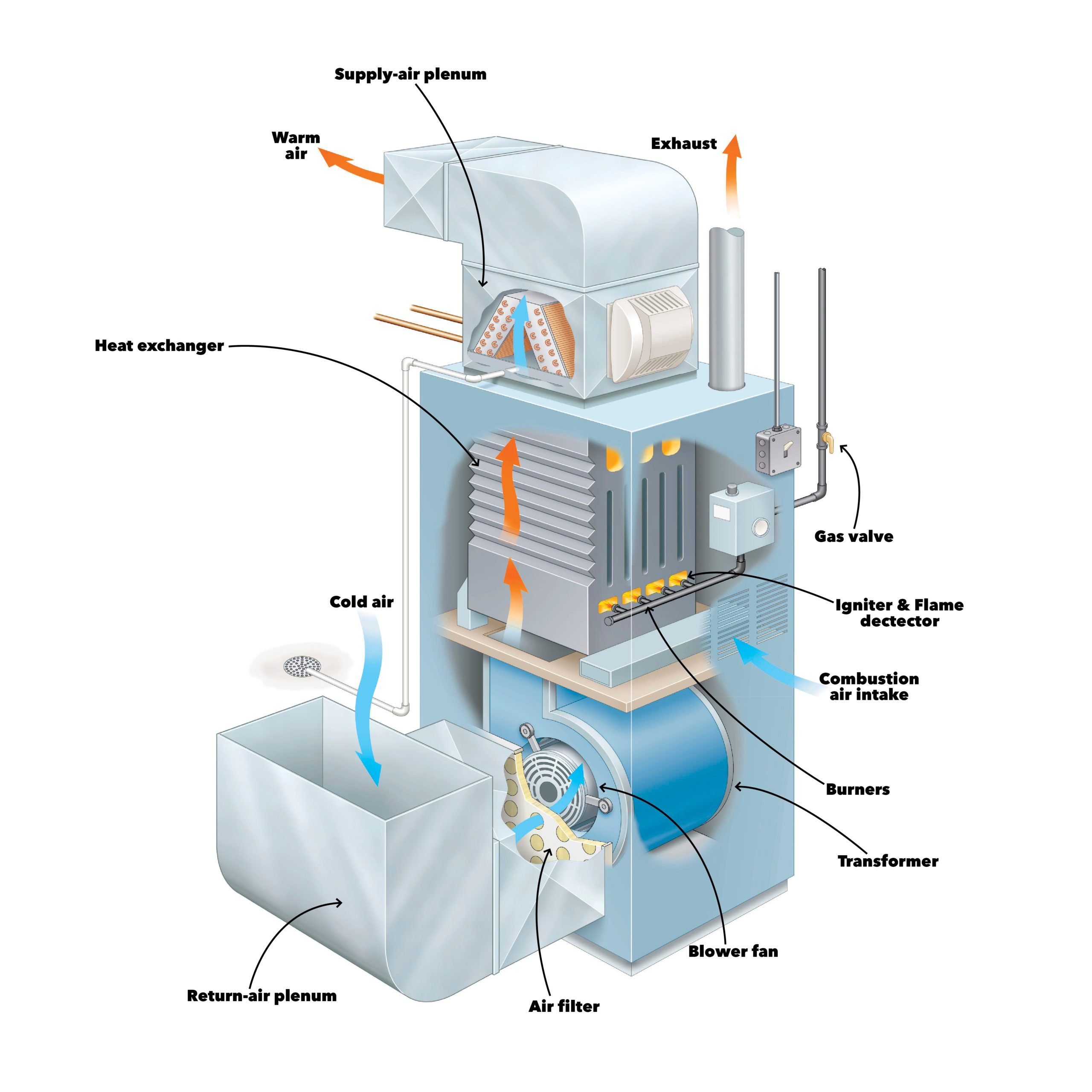

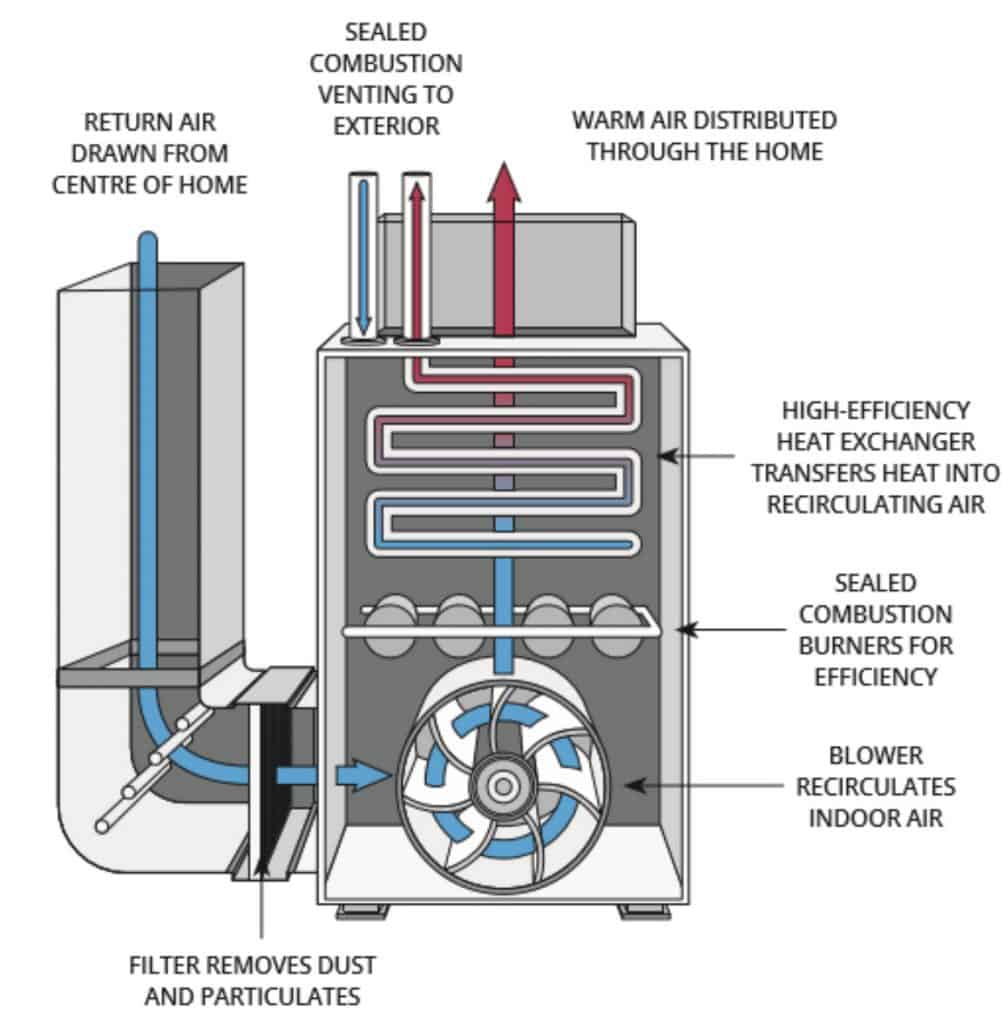

How Does A Furnace Work

https://irp-cdn.multiscreensite.com/8ecf6514/dms3rep/multi/Depositphotos_8707708_l-2015.jpg

https://www.energystar.gov/about/federal-tax...

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

What Qualifies For Energy Efficient Tax Credit

2023 Energy Efficient Home Credits Tax Benefits Tips

Furnace Exhaust Pipe Guide How To Find The Right One HVAC Solvers

Most Energy Efficient Gas Furnaces 2020 WebHVAC

Buy A New Energy Efficient Furnace GTA Furnace

How Does A Gas Furnace Work The Family Handyman

How Does A Gas Furnace Work The Family Handyman

High efficiency Furnaces Can Save You Money Provide Tax Credit Mlive

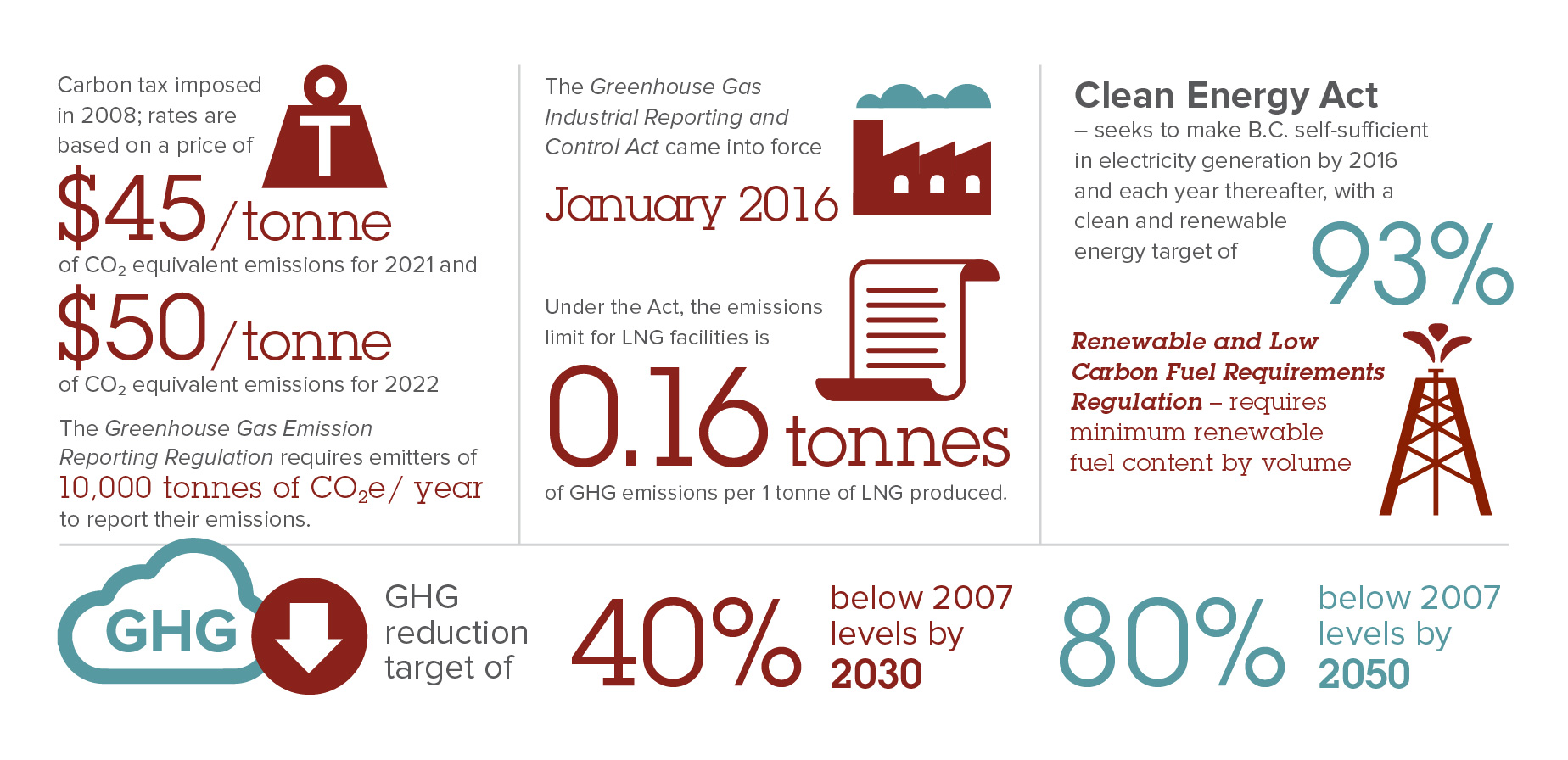

B C s Carbon And Greenhouse Gas Legislation

High Efficiency Furnace Shop Authentic Save 67 Jlcatj gob mx

Energy Efficient Furnace Tax Credit - Other energy efficiency upgrades Oil furnaces or hot water boilers if they meet or exceed 2021 Energy Star efficiency criteria and are rated by the manufacturer for use with fuel blends at least 20 of the volume of which consists of an eligible fuel See