Energy Efficient Tax Rebates 2024 What Is the Heat Pump Tax Credit How to Qualify for the Heat Pump Tax Credit Related Tax Credits Heat Pump Tax Rebate State Heat Pump Installation Incentives How to Apply for Heat Pump

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

Energy Efficient Tax Rebates 2024

Energy Efficient Tax Rebates 2024

https://www.rscheatingandair.com/wp-content/uploads/2022/08/2019-06-24-RSC-Heating-164-scaled.jpg

Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives

https://capstantax.com/wp-content/uploads/2022/09/energy-efficient.jpg

25C Tax Credit Fact Sheet Building Performance Association

https://building-performance.org/wp-content/uploads/2023/07/BPA_25C_TaxCredit.jpg

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings Formerly called the nonbusiness energy property credit the energy efficient home improvement credit now provides taxpayers 30 back with limits for the installation of certain Energy

Here s how making energy efficiency part of your 2024 New Year s Resolutions could help you lower your energy costs and save our planet Resolution 1 Save Money Thanks to the Department of Energy s Savings Hub you can easily help determine what clean energy and energy efficiency incentives for home upgrades and appliances are best for you These energy efficiency and electrification rebates are expected to be rolled out in late 2024 and early 2025 and run through September 30 2031 Who qualifies for energy efficiency rebates Not all households will qualify for HEEHRA rebates

Download Energy Efficient Tax Rebates 2024

More picture related to Energy Efficient Tax Rebates 2024

Update Your Home With Energy Efficient Tax Credits In 2023 Toulmin Kitchen Bath Custom

http://static1.squarespace.com/static/5a0d88b3d55b415e4b725ff8/t/639cd02432db9430b25f4531/1671221284280/DSC02604.jpg?format=1500w

Energy Efficient Tax Credits Set To Expire

https://imageio.forbes.com/blogs-images/janetberryjohnson/files/2016/09/tesla-1200x800.jpg?format=jpg&width=1200

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 The Inflation Reduction Act IRA enacted in Aug 2022 provides wide ranging incentives supporting the clean energy transition for the U S economy This included both the creation of new tax credits and significant modifications to existing tax credits and incentives One of the significant changes involves the Section 45L New Energy Efficient Home Credit

How do you claim energy efficient tax credits on your tax return Previously the credit was set to expire in 2024 The Residential Clean Energy Credit will be 30 from 2022 through 2032 when it falls to 26 for 2033 and 22 for 2034 The credit will then expire after 2034 There is no limit on the amount of credit for qualified purchases The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

Inflation Reduction Act 179D Energy Efficient Tax Deduction Explained Radius

https://radiusplus.com/static/img/ira-regulation.jpeg

Tax Credits For Energy Efficient Home Improvements

https://financialsolutionadvisors.com/wp-content/uploads/elementor/thumbs/FSA-Blog-Images-2-2022-12-01T181746.930-pyjoc27rm63svr9fif7s2udrrhpvjmbyvfmw5zjvk8.png

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

What Is the Heat Pump Tax Credit How to Qualify for the Heat Pump Tax Credit Related Tax Credits Heat Pump Tax Rebate State Heat Pump Installation Incentives How to Apply for Heat Pump

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

Energy Efficient Doors Are There Tax Deductions Or Rebates Attainable Home

Inflation Reduction Act 179D Energy Efficient Tax Deduction Explained Radius

Expired Energy Efficiency Tax Credits Renewed Under Inflation Reduction Act Of 2022 National

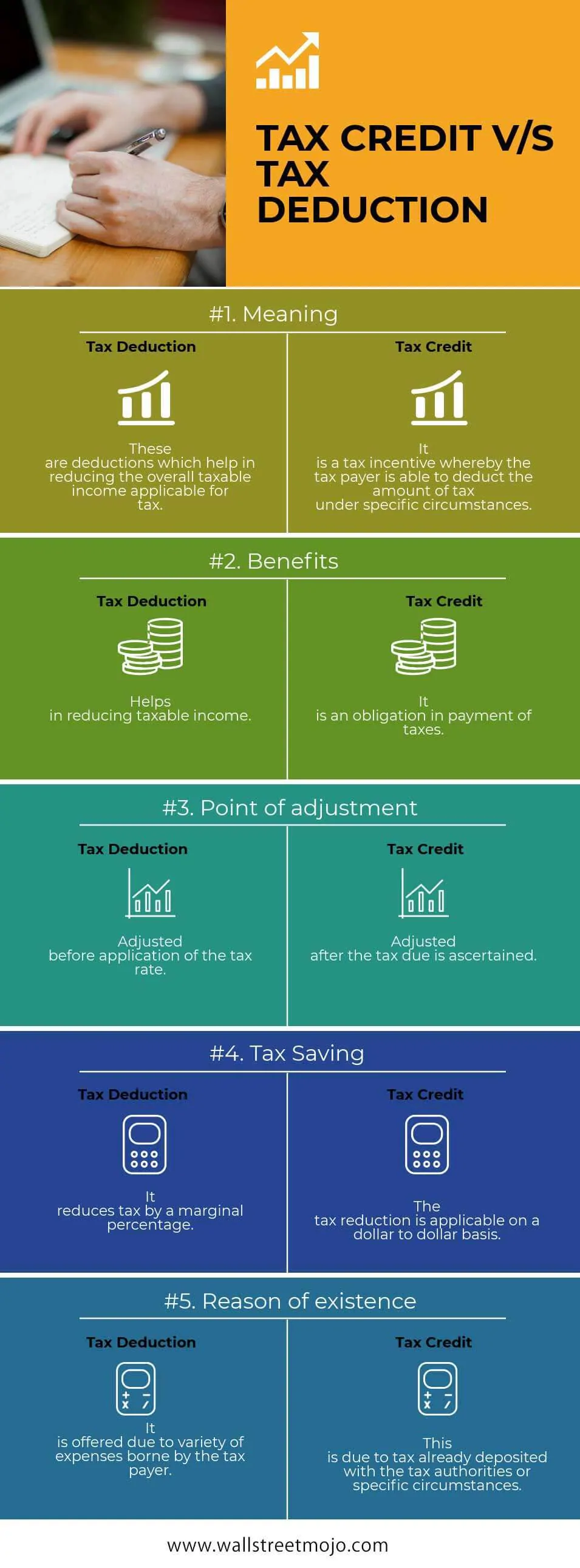

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

Energy Efficiency Rebates And Tax Credits 2023 New Incentives For Home Electrification Solar

45L Energy Efficient Tax Credits Engineered Tax Services

45L Energy Efficient Tax Credits Engineered Tax Services

Energy Efficient Doors Are There Tax Deductions Or Rebates Attainable Home

EV Tax Credit Changes Mean Low income Buyers Can Soon Get Full 7 500 Electrek

179D INTERNAL REVENUE CODE TAX DEDUCTION ENERGY EFFICIENT COMMERCIAL BUILDING DEDUCTION

Energy Efficient Tax Rebates 2024 - Tax law Features Save More with Tax Credits for Energy Efficient Home Improvements Tax credits for energy efficient home improvements are extended and expanded because of the